Can I Use My Sezzle Card Anywhere

Imagine strolling through a bustling marketplace, the aroma of freshly baked bread mingling with the vibrant colors of handcrafted goods. You spot the perfect gift for a loved one, or perhaps that long-desired item for yourself. Your wallet feels a little light, but then you remember your Sezzle card. A wave of relief washes over you – but then a question pops up: Can I use this here?

This is a common question among Sezzle users. This article dives deep into the world of Sezzle, exploring its usage, limitations, and where you can (and can’t) use your Sezzle card to make purchases. We'll uncover the ins and outs of this popular Buy Now, Pay Later (BNPL) service.

What is Sezzle?

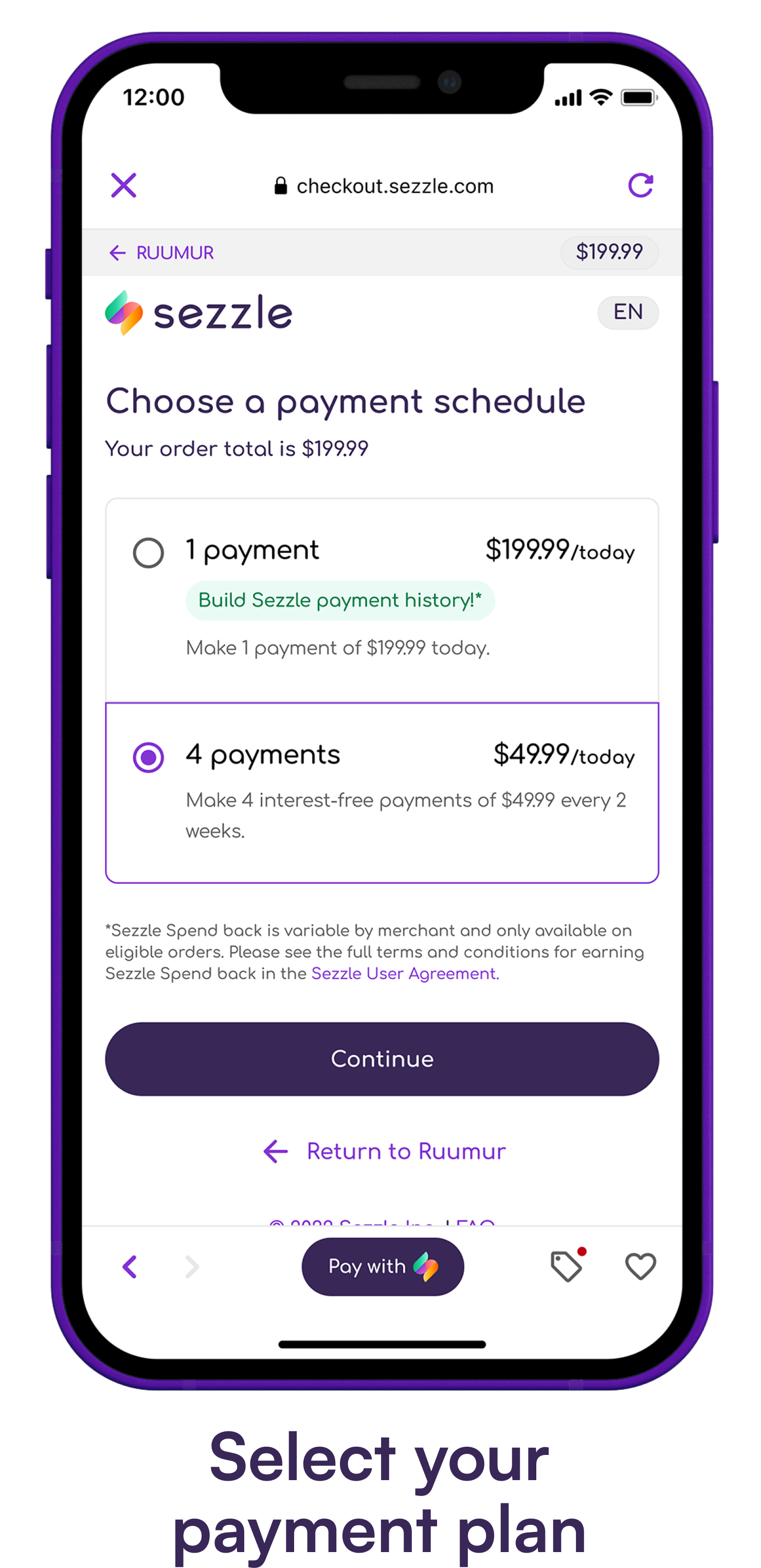

Sezzle is a Buy Now, Pay Later (BNPL) service that allows you to split your online and in-store purchases into four interest-free payments over six weeks. Unlike traditional credit cards, Sezzle doesn't charge interest. They rely on merchant fees and late payment fees to generate revenue.

Founded in 2016, Sezzle has quickly gained popularity. It is especially among younger shoppers who appreciate its flexible payment options. The platform aims to provide a more responsible and transparent alternative to traditional credit.

Where Can You Use Sezzle? The Merchant Network

The primary way to use Sezzle is through its extensive network of participating merchants. Sezzle has partnered with thousands of online and brick-and-mortar stores. This allows customers to use Sezzle at checkout.

These partnerships mean a seamless integration at the point of sale. It is just like any other payment method. You'll often see the Sezzle logo displayed prominently on participating merchant's websites and at their physical locations.

Finding Participating Merchants

Sezzle provides several tools to help you find merchants that accept its payment option. The Sezzle app and website feature a directory where you can search for stores. You can search by category, name, or location.

Many merchants also display the Sezzle logo on their website or in-store signage to indicate that they accept Sezzle. Checking for the Sezzle logo before making a purchase can save you time and frustration.

The Sezzle Virtual Card: Expanding Possibilities

Sezzle offers a virtual card. This allows you to use Sezzle even at merchants that don't have a direct partnership. This expands the utility of Sezzle beyond its established merchant network.

The Sezzle virtual card functions much like a standard credit card, but with the BNPL twist. When you make a purchase, Sezzle pays the merchant in full. You then repay Sezzle in four installments.

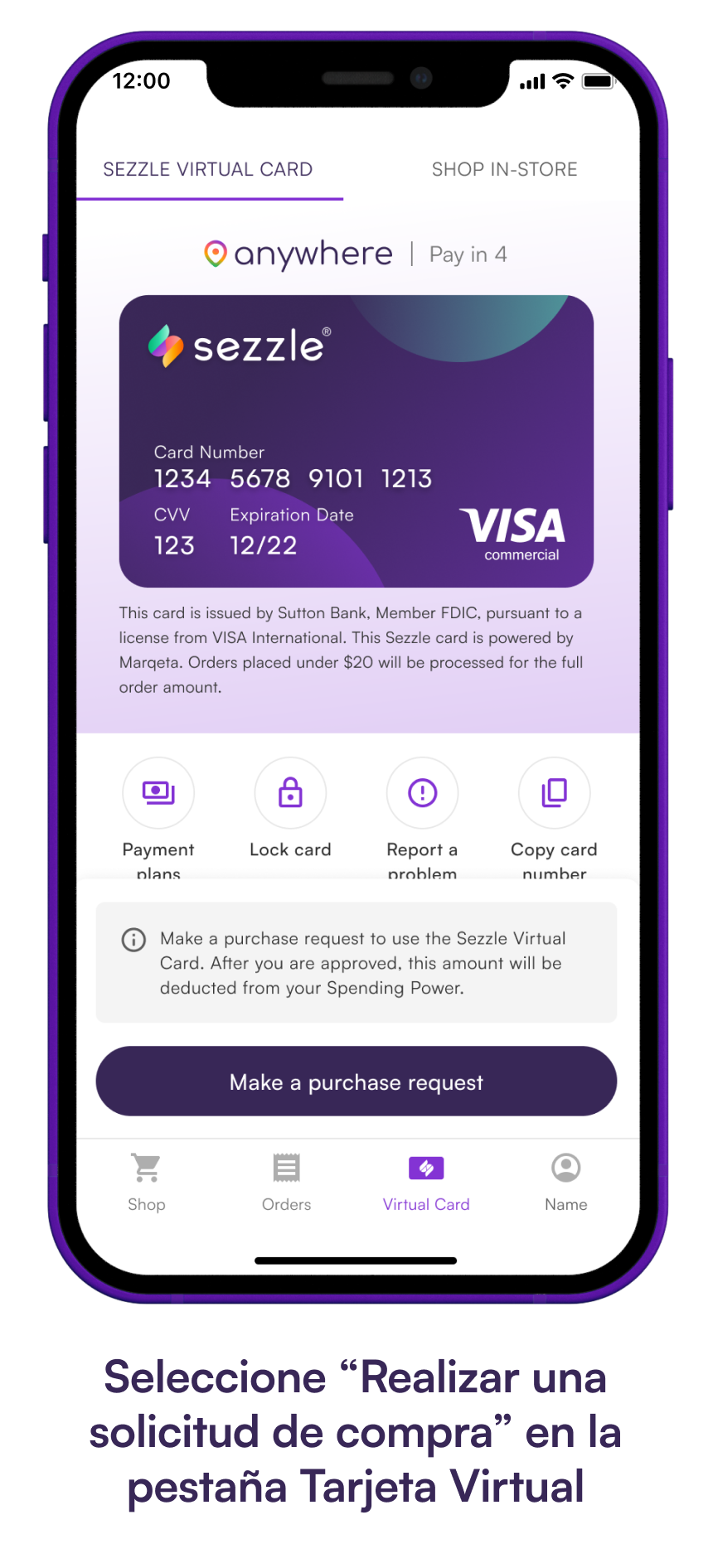

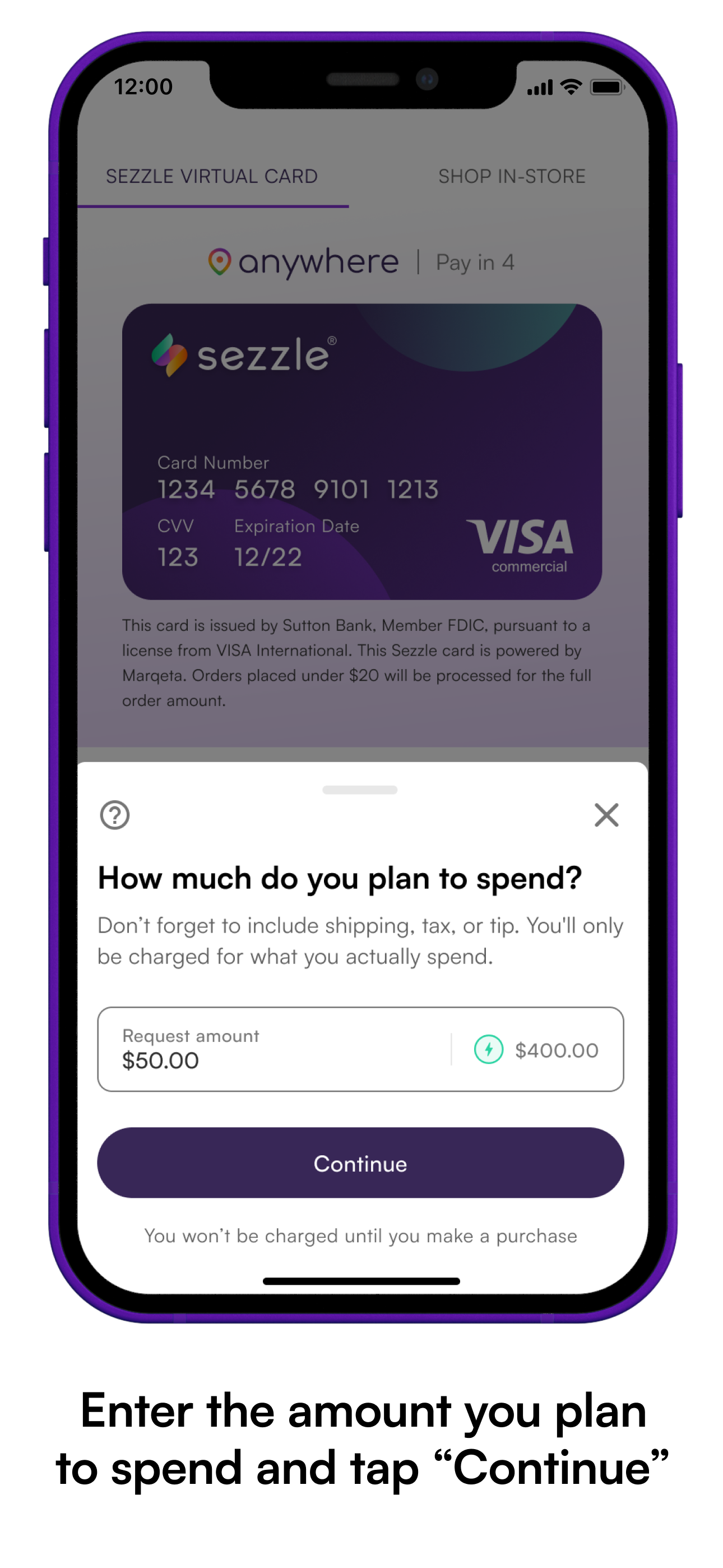

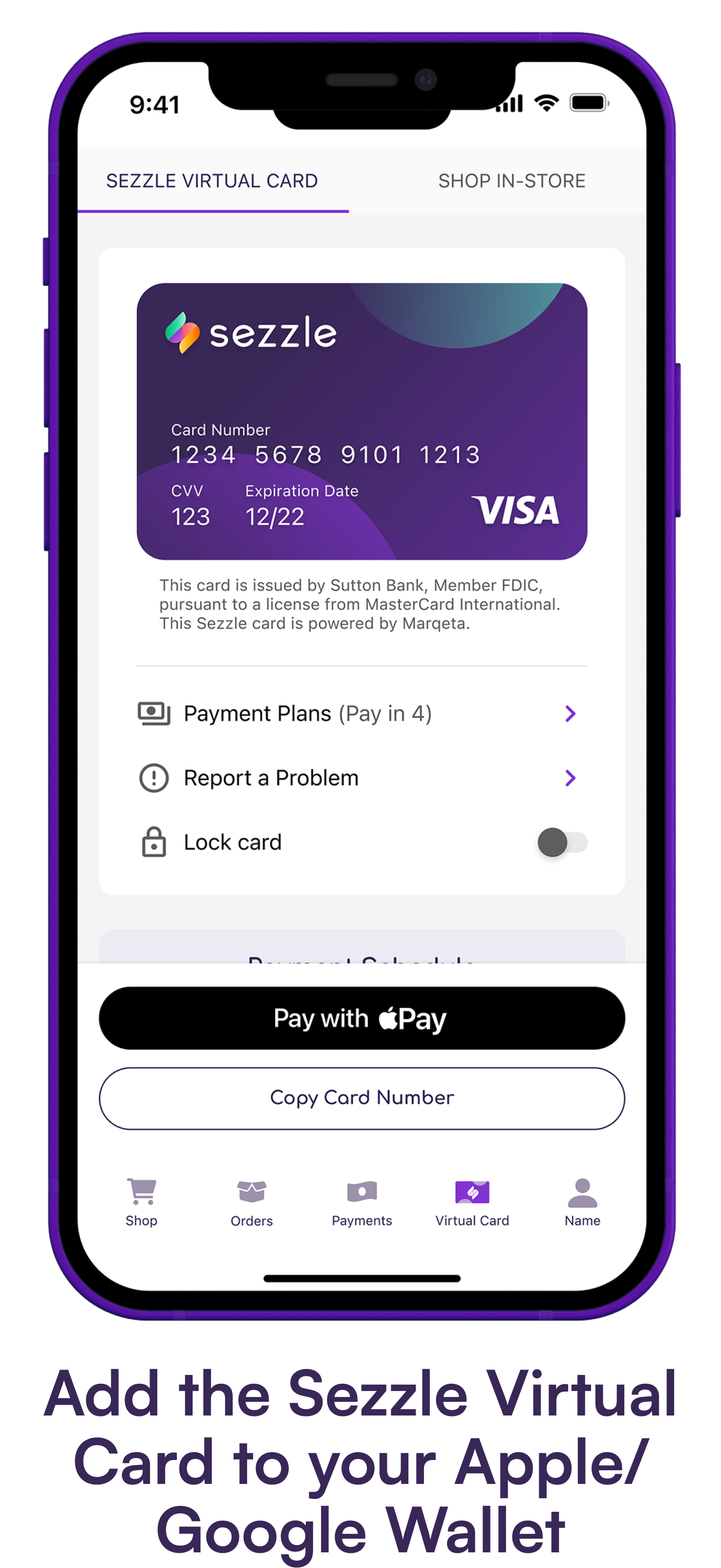

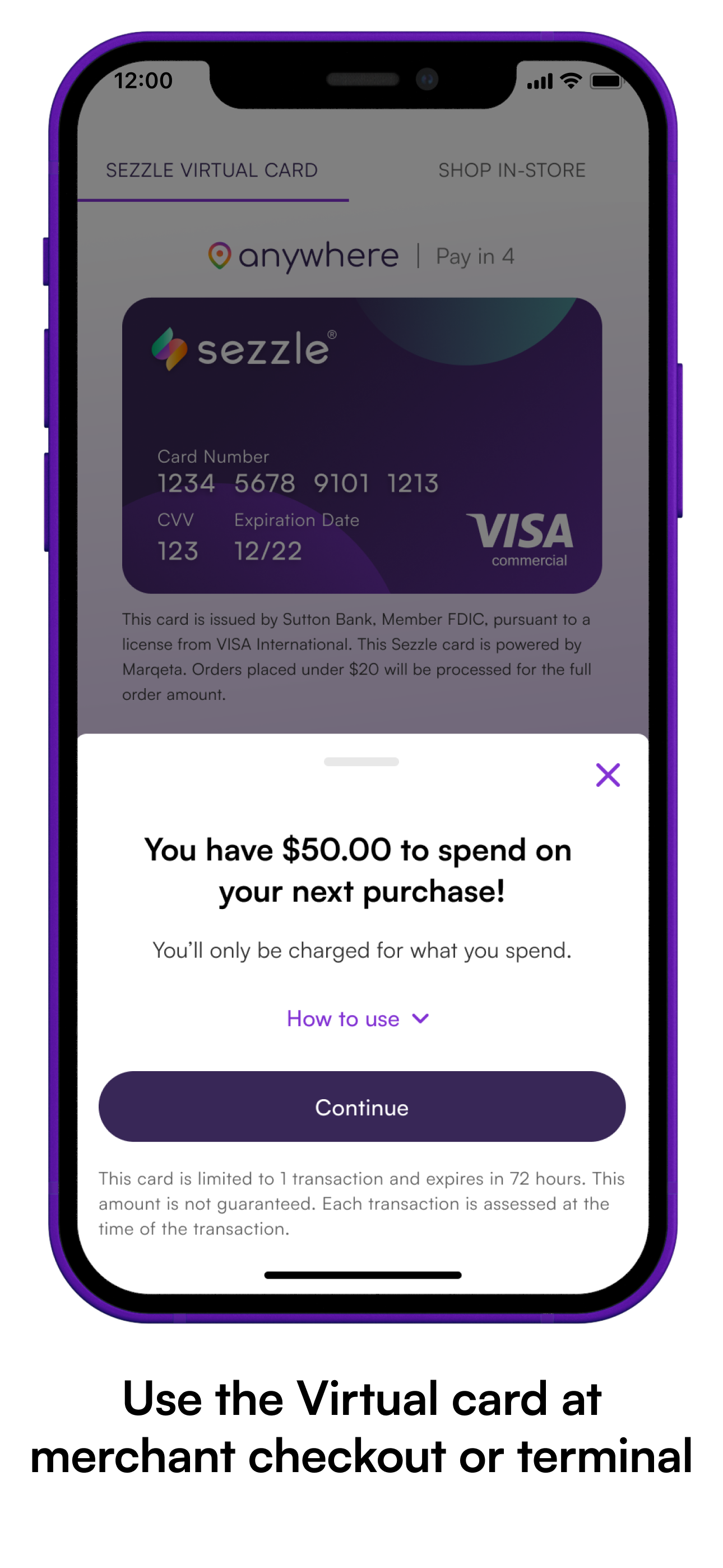

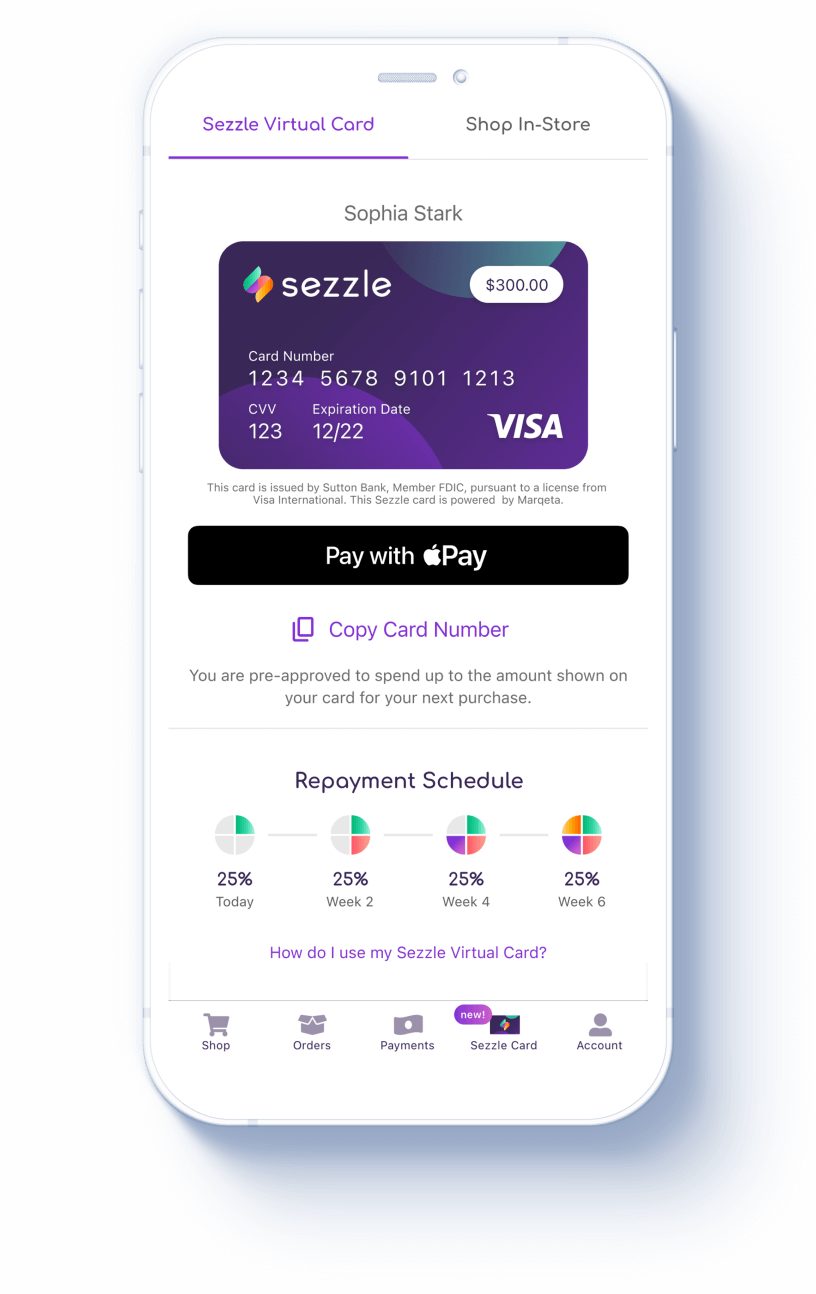

How the Virtual Card Works

To use the Sezzle virtual card, you need to activate it within the Sezzle app. Once activated, you'll receive a virtual card number, expiration date, and CVV code. You can use these details to complete your purchase online or in-store (where contactless payments are accepted).

The virtual card is linked to your Sezzle account. Purchases made with the card are subject to the same repayment schedule as purchases made directly through partnered merchants.

Limitations and Restrictions

Despite its convenience, Sezzle does have certain limitations. Understanding these limitations is crucial to avoid any surprises at checkout.

Merchant Acceptance: While the virtual card broadens acceptance, some merchants still don't accept Sezzle. This could be due to various reasons, including their own payment processing agreements or business policies.

Transaction Limits: Sezzle imposes spending limits based on your account history and creditworthiness. These limits may vary from user to user.

Ineligible Purchases: Certain types of purchases are generally ineligible for Sezzle, such as gift cards, prepaid cards, and some subscription services. Check Sezzle's terms of service for a complete list.

Sezzle vs. Other BNPL Services

The BNPL market is becoming increasingly crowded. Sezzle competes with other popular services like Afterpay, Klarna, and Affirm. Each platform has its own unique features, fees, and merchant networks.

Afterpay, for instance, also offers a four-installment payment plan. Klarna provides a wider range of payment options, including pay-in-30-days and financing. Affirm often focuses on larger purchases with longer repayment terms.

Choosing the right BNPL service depends on your individual needs and spending habits. Consider factors like merchant acceptance, fees, credit limits, and repayment terms.

Responsible Use of Sezzle

While Sezzle can be a convenient way to manage your finances, it's crucial to use it responsibly. BNPL services can encourage overspending if not used carefully.

Always ensure you can comfortably afford the scheduled payments before making a purchase. Late payments can incur fees and potentially impact your credit score. While Sezzle doesn't directly report to major credit bureaus, delinquent accounts may be sent to collections, which can affect your credit.

Budgeting and financial awareness are key to using Sezzle and other BNPL services effectively. Treat it as a tool, not a solution to financial difficulties.

The Future of Buy Now, Pay Later

The Buy Now, Pay Later industry is rapidly evolving. As BNPL services gain mainstream adoption, they are facing increased scrutiny from regulators and consumer advocates.

There are growing calls for greater transparency and consumer protection in the BNPL space. This includes standardizing fee structures, improving disclosure practices, and ensuring responsible lending practices.

The future of BNPL will likely involve tighter regulations and a greater focus on consumer financial well-being. As the industry matures, it will be interesting to see how Sezzle and its competitors adapt to these changes.

Conclusion: Navigating the Sezzle Landscape

So, can you use your Sezzle card anywhere? The answer is nuanced. You can certainly use it at all partnered merchants and wherever the Sezzle virtual card is accepted.

The key is to be informed, plan ahead, and use Sezzle responsibly. With a little due diligence, you can leverage Sezzle to manage your purchases and enjoy the flexibility of Buy Now, Pay Later without falling into debt traps.

Ultimately, Sezzle offers a valuable service when used thoughtfully. Understanding its capabilities and limitations empowers you to make smart financial decisions. Embrace the convenience, but always prioritize responsible spending habits.