Recording Depreciation Each Period Is Necessary In Accordance With The

The relentless ticking of time erodes value, a silent truth that businesses must confront head-on. Failing to acknowledge this decline, through the consistent and accurate recording of depreciation, exposes companies to a cascade of financial misrepresentations and potential regulatory scrutiny.

At its core, the necessity of recording depreciation each period stems from fundamental accounting principles. This practice ensures that a company's financial statements offer a true and fair view of its financial position and performance, aligning with standards like Generally Accepted Accounting Principles (GAAP) and International Financial Reporting Standards (IFRS).

The Foundation: Matching Principle and Accurate Valuation

The matching principle is a cornerstone of accrual accounting. It dictates that expenses should be recognized in the same period as the revenues they help generate.

Depreciation, in essence, allocates the cost of an asset over its useful life, reflecting the economic benefit it provides each period. Ignoring this allocation would inflate profits in early years and deflate them later, creating a distorted picture of profitability.

Furthermore, accurate asset valuation is paramount for balance sheet integrity. Failing to depreciate assets leads to an overstatement of their worth, potentially misleading investors and creditors about the company's financial health.

GAAP, IFRS, and Regulatory Mandates

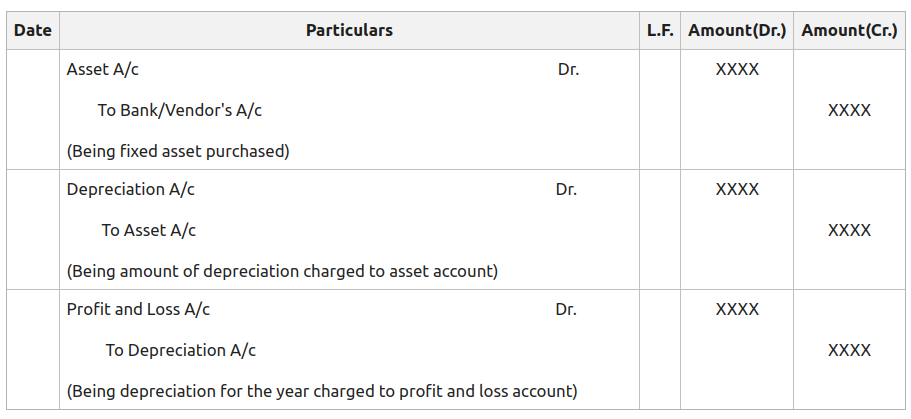

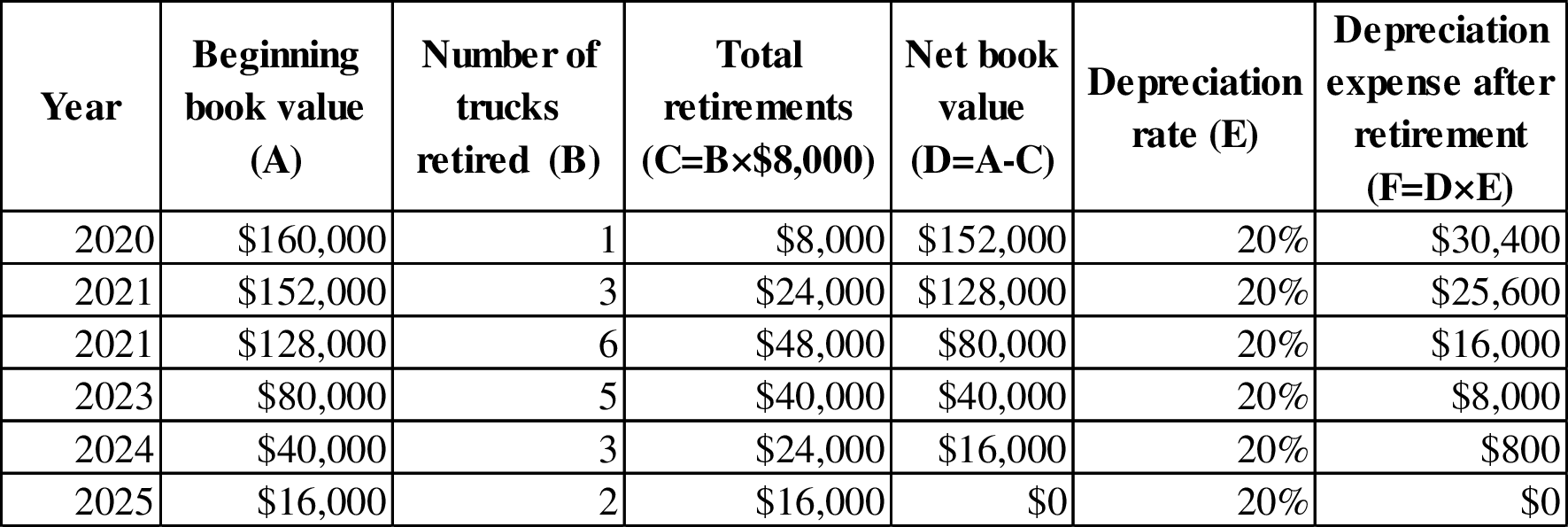

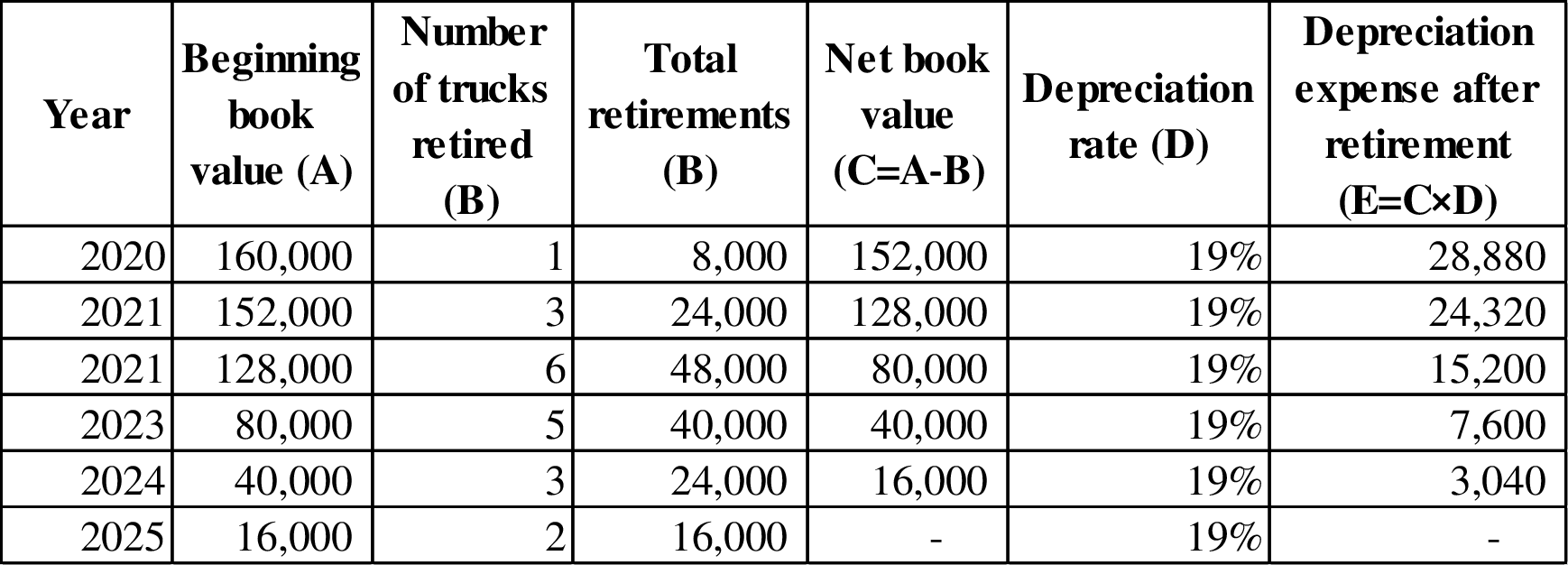

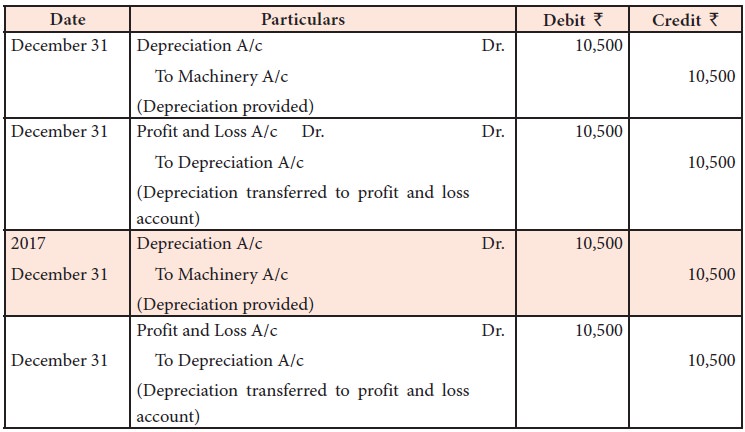

Both GAAP and IFRS explicitly require the systematic and rational allocation of asset costs through depreciation. These standards provide frameworks for calculating depreciation using various methods, such as straight-line, declining balance, and units of production.

Non-compliance with these standards can trigger regulatory action. The Securities and Exchange Commission (SEC), for instance, closely monitors companies' financial reporting and can impose penalties for material misstatements, including those related to depreciation.

Accurate depreciation reporting is not merely a suggestion, but a legal and ethical obligation for publicly traded companies.

Impact on Financial Statements and Key Ratios

The omission or miscalculation of depreciation ripples through various financial statements. It directly affects the income statement, balance sheet, and statement of cash flows.

On the income statement, understating depreciation inflates net income, potentially leading to inflated earnings per share (EPS). This can mislead investors seeking accurate indicators of profitability.

The balance sheet suffers from an overstated asset value, impacting key ratios like return on assets (ROA). Creditors and investors rely on these ratios to assess a company's efficiency in utilizing its assets to generate profits.

Ignoring depreciation also distorts the statement of cash flows by affecting the calculation of net income used in the indirect method of determining cash flow from operations.

Diverse Perspectives and Practical Challenges

While the necessity of recording depreciation is widely accepted, debates arise regarding the most appropriate depreciation method. Factors such as the asset's nature, usage pattern, and industry practices influence this decision.

Some businesses, particularly small enterprises, may face challenges in accurately tracking asset usage and calculating depreciation. They may lack the resources or expertise to implement sophisticated depreciation systems.

However, the availability of accounting software and professional services has made accurate depreciation recording more accessible to businesses of all sizes.

Expert Opinions and Industry Insights

"Depreciation is not about setting aside cash; it's about systematically recognizing the cost of using an asset over its life," states Dr. Anya Sharma, a professor of accounting at the University of Pennsylvania's Wharton School.

According to a report by the American Institute of Certified Public Accountants (AICPA), consistent and accurate depreciation practices enhance the credibility of financial reporting and foster investor confidence.

Many CFOs highlight the importance of aligning depreciation methods with business strategy. For example, accelerated depreciation methods may be favored by companies seeking to reduce taxable income in the early years of an asset's life.

The Future of Depreciation Accounting

The increasing adoption of cloud-based accounting solutions is streamlining depreciation management. These platforms automate calculations, track asset lifecycles, and generate accurate depreciation reports.

Furthermore, ongoing discussions about the recognition of intangible assets and their amortization are shaping the future of depreciation accounting. There is a growing push for greater transparency and consistency in the treatment of intangible assets.

As businesses become increasingly reliant on technology and intellectual property, the accurate accounting for depreciation and amortization will become even more critical for financial reporting integrity.

In conclusion, recording depreciation each period is not merely a procedural formality, but a fundamental principle that underpins sound financial reporting. By adhering to this principle, companies can ensure the accuracy, reliability, and transparency of their financial statements, fostering trust among investors, creditors, and other stakeholders.

:max_bytes(150000):strip_icc()/dotdash_Final_Why_is_Accumulated_Depreciation_a_Credit_Balance_Jul_2020-01-34c67ae5f6a54883ba5a5947ba50f139.jpg)