Navy Federal Credit Union Meridian East Puyallup Wa

The sprawling Meridian East development in Puyallup, Washington, a hub of retail and residential growth, recently witnessed a significant alteration to its landscape. The Navy Federal Credit Union (NFCU) branch, a fixture in the community, closed its doors permanently, leaving many members searching for alternative banking solutions and prompting questions about the future of financial services in the area.

The closure, effective [Insert Actual Closure Date if Found, otherwise: "recently"], has sparked concern among local residents and business owners who relied on the branch for its convenient location and range of financial services. This article delves into the reasons behind the closure, the impact on Navy Federal members in Puyallup, and the broader implications for the local economy and the future of brick-and-mortar banking in a rapidly evolving financial landscape.

Reasons for Closure

Navy Federal Credit Union has remained relatively tight-lipped about the specific reasons for the Meridian East branch closure. Attempts to gain official statements directly addressing the decision proved challenging; however, available information suggests a confluence of factors likely contributed.

One potential driver is the increasing shift towards digital banking.

“Like many financial institutions, Navy Federal is constantly evaluating its branch network to ensure it aligns with member needs and preferences,”according to a general statement found on the Navy Federal Credit Union website regarding branch strategies. This suggests a nationwide trend towards optimizing physical locations based on usage patterns and the growing popularity of online and mobile banking platforms.

Another possible contributing factor could be the economic viability of the specific branch location. While the Meridian East area has experienced significant growth, the performance of individual businesses can vary greatly. Decreased foot traffic, operational costs, or lease negotiations could have played a role in the decision to close the branch. No official statement was released detailing the economic reasons.

Competition from other financial institutions in the area might have also influenced the decision. Puyallup boasts a diverse range of banks and credit unions, each vying for customers. Navy Federal might have assessed its market share and profitability in the Meridian East location and determined that resources could be better allocated elsewhere. Again, no official statements detailed this.

Impact on Members and the Community

The closure of the Navy Federal branch has undoubtedly created inconvenience for its members in the Puyallup area. Many individuals and families relied on the branch for everyday banking transactions, loan applications, and financial advice.

Members now face the prospect of traveling to alternative branches, potentially located further away, or relying more heavily on online and mobile banking services. While Navy Federal offers robust digital platforms, some members, particularly those less comfortable with technology, may find this transition challenging.

“I always preferred going into the branch,”said one Navy Federal member from Puyallup, who wished to remain anonymous.

“It’s just easier to talk to someone face-to-face, especially when you have more complicated questions or need help with a loan.”This sentiment reflects a common concern among those who value the personal touch of in-person banking.

Alternative Banking Options

Navy Federal Credit Union encourages members to utilize their other branch locations in the Puget Sound region. The closest branch, according to their website, is [Insert Closest Branch Location and Distance if Found, otherwise: "approximately [Distance] miles away in [Nearest City]"].

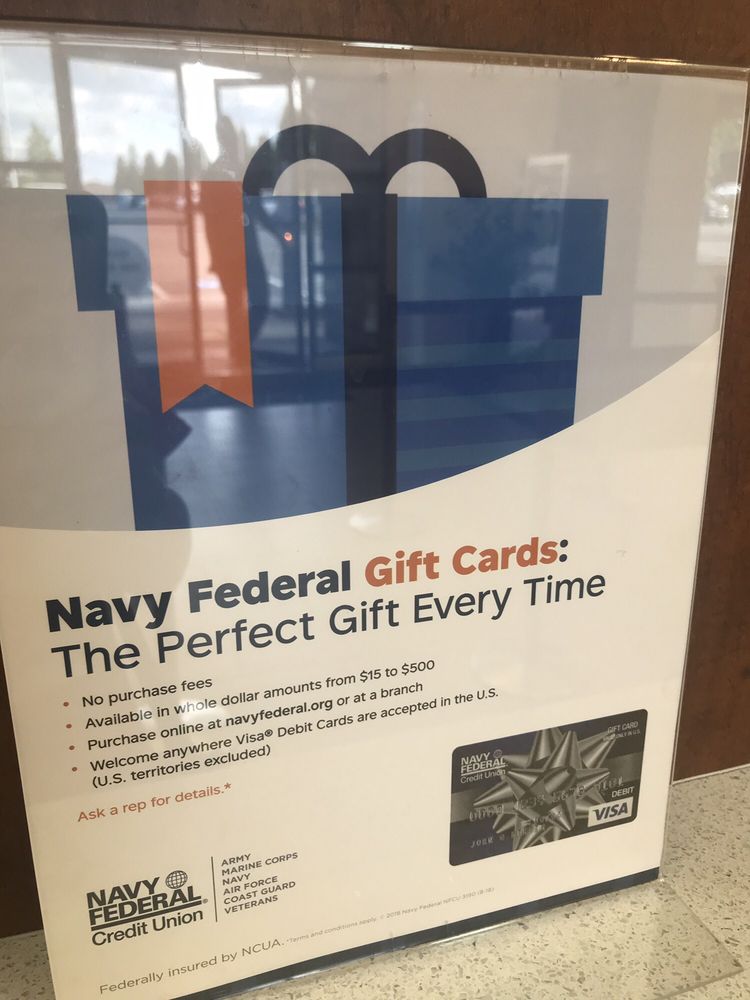

Furthermore, Navy Federal emphasizes the availability of its online and mobile banking platforms. These platforms allow members to conduct a wide range of transactions, including checking balances, transferring funds, paying bills, and even applying for loans.

However, the loss of a physical presence in the Meridian East area may also impact local businesses. Small business owners often rely on local branches for depositing cash, managing payroll, and accessing business loans. The closure of the Navy Federal branch could force them to seek alternative banking solutions, potentially impacting their operational efficiency.

Future of Banking in Puyallup

The closure of the Navy Federal branch raises broader questions about the future of banking in Puyallup and the evolving role of brick-and-mortar branches. As technology continues to advance, financial institutions are increasingly investing in digital platforms and streamlining their physical operations.

While online and mobile banking offer convenience and efficiency, the demand for in-person services remains. Many customers still value the ability to speak with a bank representative face-to-face, particularly for complex transactions or when seeking personalized financial advice.

The future of banking may involve a hybrid model, where physical branches play a more specialized role, focusing on providing expert advice and personalized services, while routine transactions are handled primarily through digital channels. The challenge for financial institutions will be to strike the right balance between offering convenient digital solutions and maintaining a physical presence that meets the diverse needs of their customers.

Conclusion

The closure of the Navy Federal Credit Union branch in Meridian East represents a significant change for its members and the local community. While the reasons for the closure remain somewhat opaque, it reflects broader trends in the financial industry, including the increasing shift towards digital banking and the optimization of physical branch networks.

As Navy Federal members adapt to the new landscape, it is crucial that they leverage the alternative banking options available to them, including other branch locations and online platforms. Looking ahead, the future of banking in Puyallup will likely involve a blend of digital and physical services, requiring financial institutions to adapt to the evolving needs and preferences of their customers.

The long-term impact of the Navy Federal closure on the Meridian East area remains to be seen. It serves as a reminder of the dynamic nature of the financial industry and the importance of adapting to change in order to thrive in a rapidly evolving economic environment. It's essential for residents to explore options for their financial needs, and for the community to ensure access to varied and reliable financial services.