How Long Does It Take To Get Your Credit Card

In today's fast-paced world, obtaining a credit card has become a common step towards managing finances and building credit. But after submitting that application, a burning question often arises: how long will it actually take to get the card in hand?

The timeframe for receiving a credit card after approval varies, influenced by several factors including the issuer, application method, and delivery speed. Understanding these elements can help manage expectations and plan accordingly. Let's delve into the typical timeline and the variables that affect it.

Application Processing Time

The initial phase involves the credit card issuer processing your application. This usually takes between 24 hours to a few business days. Many issuers now offer instant approval for eligible applicants, providing immediate access to a virtual card.

However, some applications may require further review, particularly if there are discrepancies or insufficient information. This can extend the processing time to a week or longer. Keep an eye on your email to make sure the issuer has not requested more information or documents from you.

Card Production and Mailing

Once approved, the card itself needs to be produced and mailed. Standard delivery via the United States Postal Service (USPS) typically takes 7 to 10 business days.

Some issuers offer expedited shipping, usually for a fee, which can shorten the delivery time to 2 to 3 business days. If you need the card urgently, consider requesting expedited shipping during the application process, if this option is available.

Factors Influencing Delivery Times

Several factors can impact how long it takes to receive your credit card. Online applications are generally processed faster than paper applications. The time of year can also play a role, with potential delays during peak mailing seasons like the holidays.

Your geographical location can also affect delivery times. Rural areas may experience longer delivery periods compared to urban centers. In cases when applicants have just moved into their new residents, it may also take longer to receive the credit card via mail.

Common Causes for Delays

Incorrect address information is a frequent culprit behind delayed or undeliverable cards. It’s crucial to double-check all details on your application. Postal service disruptions or processing backlogs at the issuing bank can also cause delays.

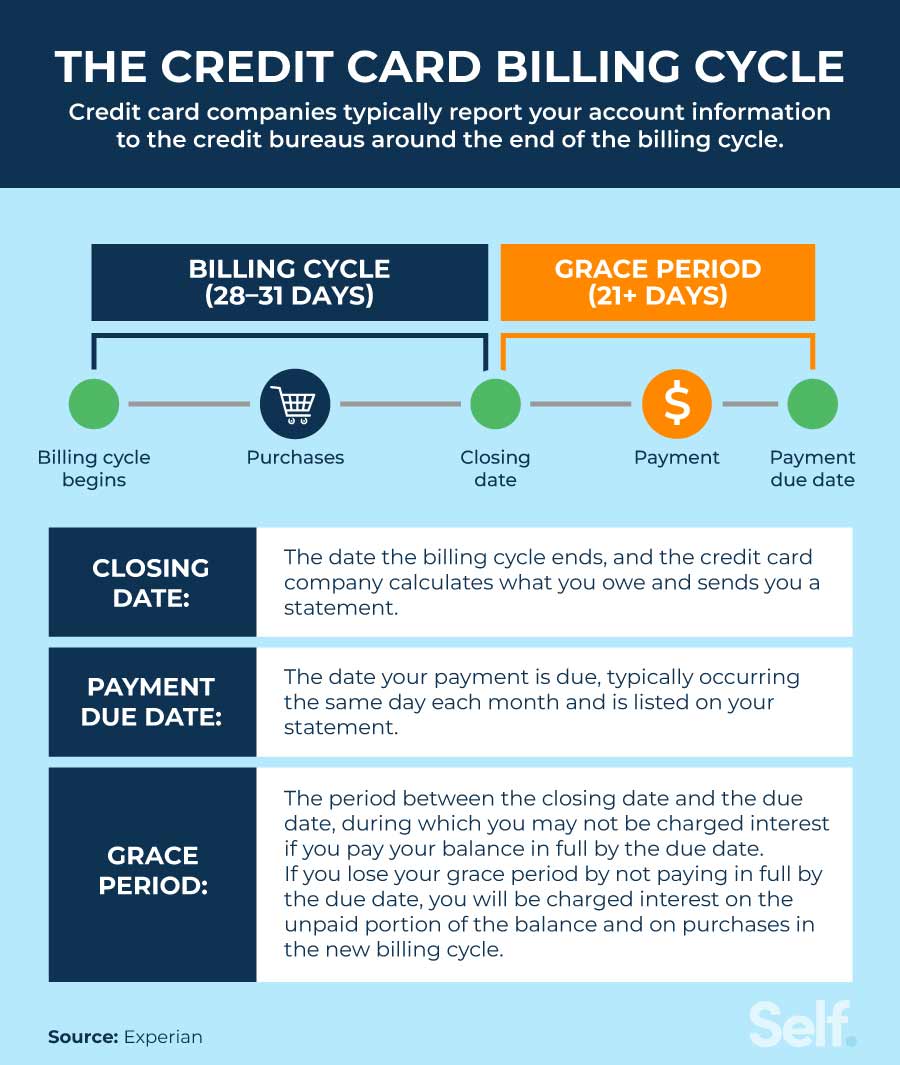

Applicants can proactively check the status of their application online or by calling the credit card company's customer service line. According to Experian, monitoring your application status can provide insights into any potential delays.

Impact and Considerations

The time it takes to receive a credit card can significantly impact financial planning, especially if the card is needed for an immediate purchase. Knowing the potential timelines allows individuals to make informed decisions. Some retail and gas credit cards often allow cardholders to use the cards online, but it is rare.

For example, if you are planning a trip, apply for the credit card well in advance to ensure it arrives before your departure date. Otherwise you need to prepare an alternate form of payment.

Ultimately, the wait time for a credit card is usually somewhere around 2-3 weeks, but may be subject to change. By understanding the various factors involved, consumers can better manage their expectations and ensure a smoother experience.