A Convertible Term Policy Offers Which Of The Following Advantages

Time is running out for those seeking flexible life insurance options. A convertible term life insurance policy offers a crucial advantage: the ability to transition to permanent coverage without requalification.

This feature provides peace of mind amidst changing life circumstances. Convertibility allows policyholders to secure lifelong protection regardless of future health developments.

Understanding Convertible Term Life Insurance

What is it? Convertible term life insurance provides coverage for a specific period (the "term"). It carries the invaluable option to convert to a permanent life insurance policy, such as whole life or universal life, before the term expires.

The conversion privilege is the key advantage. It eliminates the need for a new medical exam or underwriting process at the time of conversion.

The Advantages in Detail

Advantage #1: Guaranteed Insurability. The primary benefit is the guarantee that you can obtain permanent coverage. You don't have to prove your insurability later in life, even if your health declines.

This is crucial if you develop a health condition during the term. It allows you to secure lifelong coverage that might otherwise be unattainable or prohibitively expensive.

Advantage #2: Flexibility and Control. Convertible term offers flexibility to adapt your insurance coverage. You can respond to changing financial situations or long-term security goals.

As you progress in your career and wealth accumulation, you may desire the benefits of a permanent policy.

Advantage #3: Building Cash Value. Permanent life insurance policies often accumulate cash value over time. Convertible terms allow you to eventually benefit from this feature.

Cash value can be accessed through policy loans or withdrawals. It provides a source of funds for future financial needs or opportunities.

Who Benefits the Most?

Young adults starting families are ideal candidates. They often seek affordable term coverage initially.

Individuals with uncertain future health are also prime beneficiaries. This feature provides coverage if a health concern arises.

Furthermore, those anticipating increased future income find convertibility valuable. This lets them acquire permanent coverage as their financial means grow.

Conversion Mechanics: What to Expect

When can you convert? Typically, conversion options are available for a specified period. This occurs during the term policy, often within the first few years or up to a certain age.

How does it work? The process usually involves contacting your insurance company. Complete an application for the permanent policy and choosing the type of permanent coverage you want.

What are the costs? Converting will increase your premium payments. Permanent policies are more expensive than term policies due to their lifelong coverage and cash value components.

Carefully assess your budget and financial goals before converting. Compare the costs and benefits of different permanent policy options.

Real-World Examples

Consider a 30-year-old professional purchasing a convertible term policy. After 10 years, they develop a chronic illness. They exercise their conversion option to secure permanent coverage.

Another example involves a couple with young children. They initially opt for term coverage to manage expenses. As their income grows, they convert to a whole life policy to provide long-term financial security for their children.

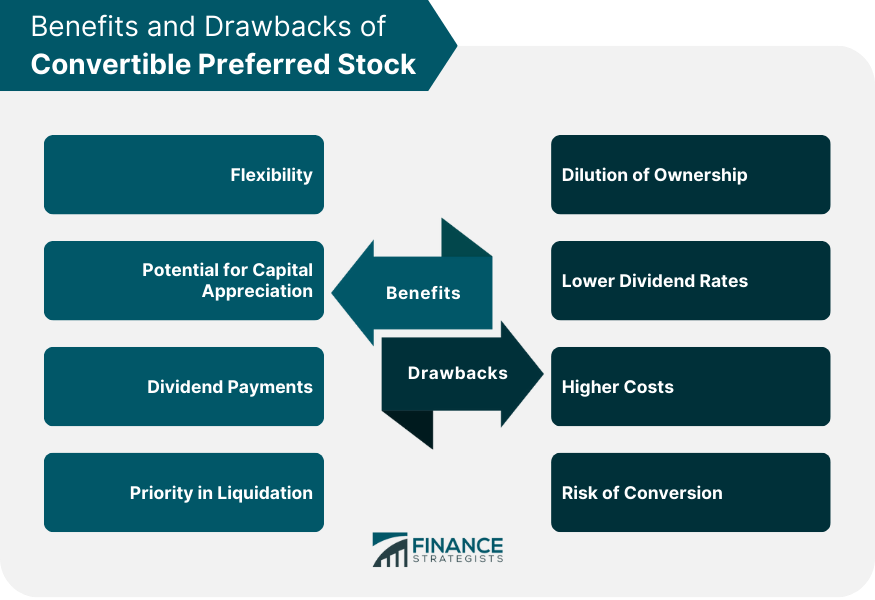

Beware of Potential Drawbacks

Conversion options aren't without their considerations. Understand the limitations and potential drawbacks before making a decision.

Limited Conversion Period. The option to convert doesn't last for the entire term. Miss the deadline, and you lose the conversion privilege.

Higher Premiums. Permanent life insurance is invariably more expensive than term. Be prepared for the increased financial commitment upon conversion.

Policy Restrictions. Some policies may impose restrictions on the type of permanent policy you can convert to. This can limit your flexibility.

Take Action Now

Determine if a convertible term life insurance policy is right for you. Contact your insurance provider or a qualified financial advisor today.

Evaluate your insurance needs and explore your options. Don't delay securing your financial future.

The ongoing developments include continuous refinement of product offerings. Insurers constantly adapt convertible term policies to meet evolving customer needs.

:max_bytes(150000):strip_icc()/dotdash-term-life-vs-whole-life-5075430-Final-60fb4e8f7bae43e0a65a3fac2431479c.jpg)