A Firm's Cash Flow From Investing Activities Includes

:max_bytes(150000):strip_icc()/AppleCFJune2019-7034d23092e14723b39c1c22f5e170b3.jpg)

Imagine a bustling city skyline, its gleaming towers representing thriving businesses. Each building pulses with activity, money flowing in and out, a constant dance of investments and returns. Think of it as the lifeblood of the economy, and at the heart of it all lies a critical element: the cash flow from investing activities.

This article explores the concept of cash flow from investing activities, a vital component of a company's financial health. It examines what it entails, its significance, and how it provides valuable insights into a company's strategic direction and long-term prospects.

Understanding Cash Flow

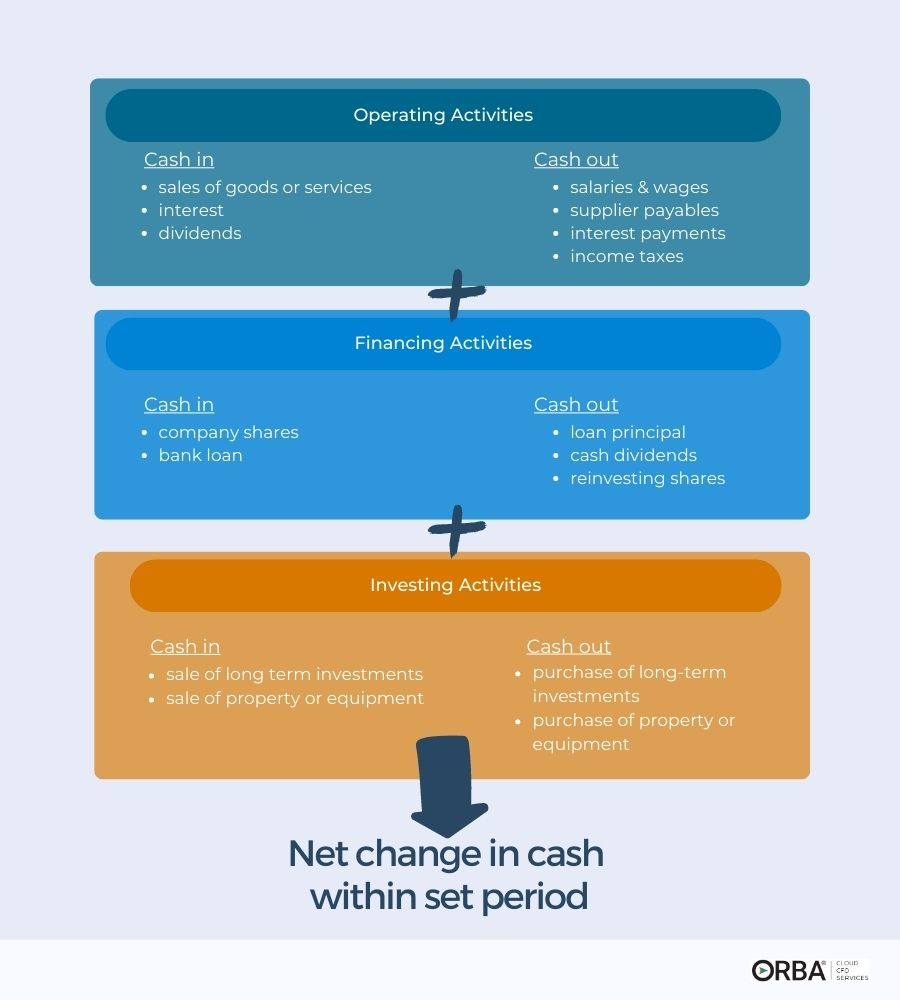

Before diving into the specifics of investing activities, it’s crucial to understand the broader picture of cash flow. Cash flow represents the net amount of cash and cash equivalents moving into and out of a company.

It's categorized into three main areas: operating activities, investing activities, and financing activities. Each provides a unique perspective on the company's financial performance.

The Three Pillars of Cash Flow

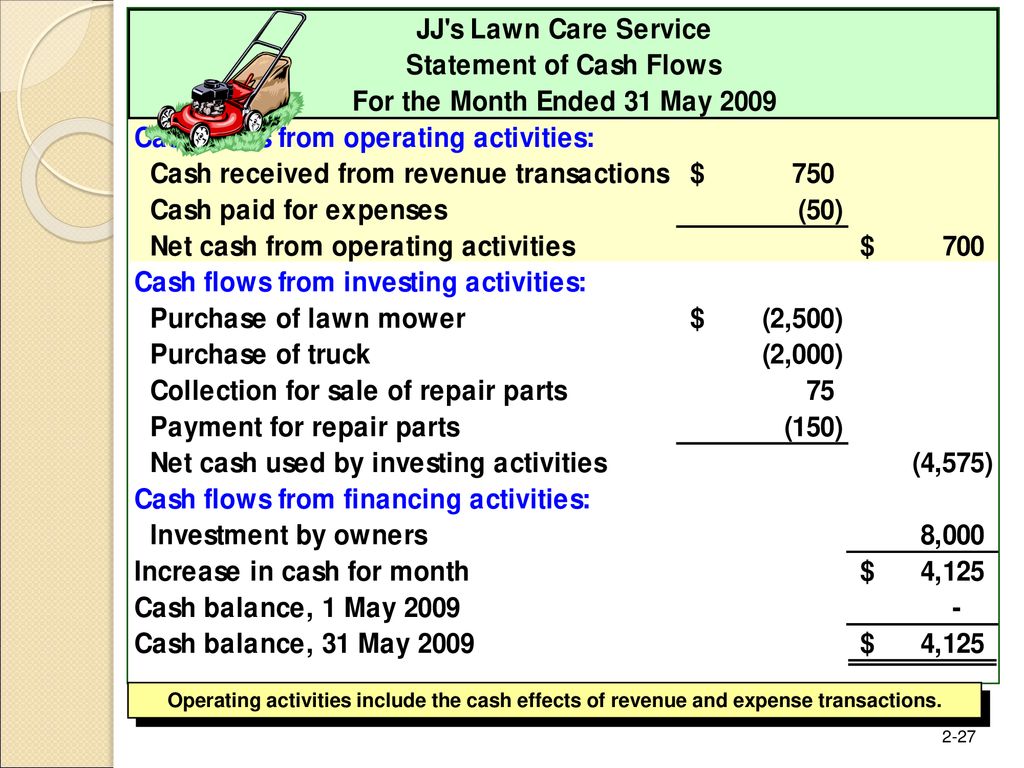

Cash flow from operating activities reflects the cash generated from a company's core business operations. This includes revenue from sales, payments to suppliers, and salaries.

Cash flow from financing activities encompasses cash inflows and outflows related to debt, equity, and dividends. This provides insights into how a company raises and manages capital.

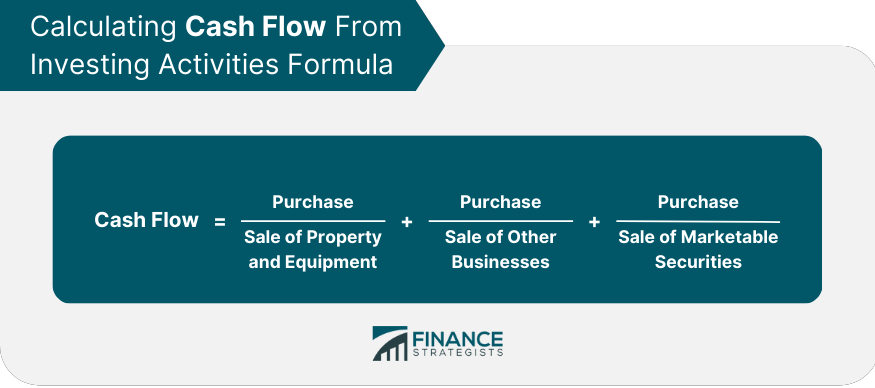

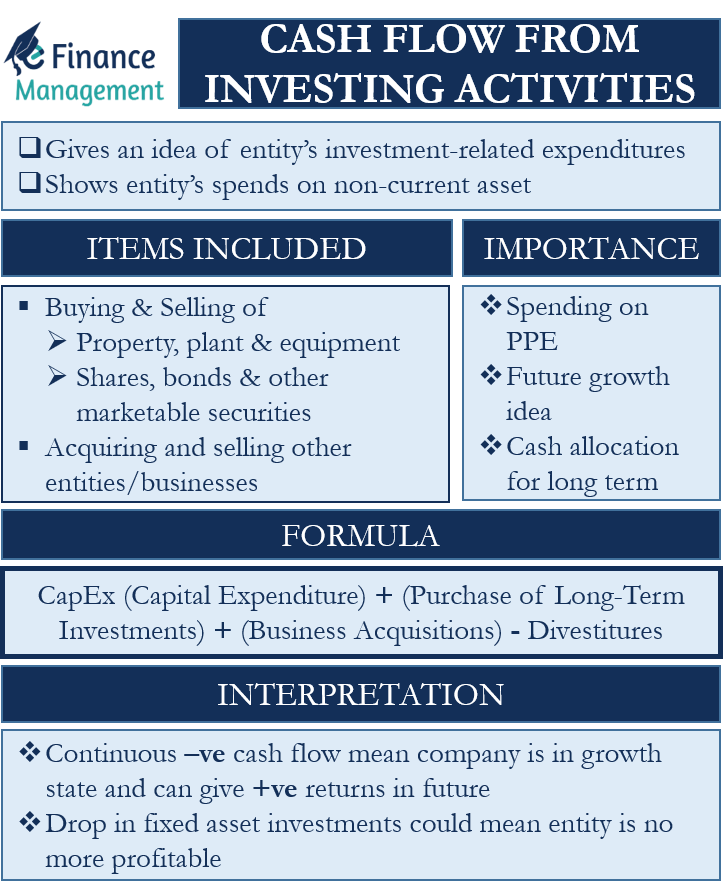

Which brings us to our main topic: Cash flow from investing activities. This focuses on the purchase and sale of long-term assets, such as property, plant, and equipment (PP&E), as well as investments in other companies.

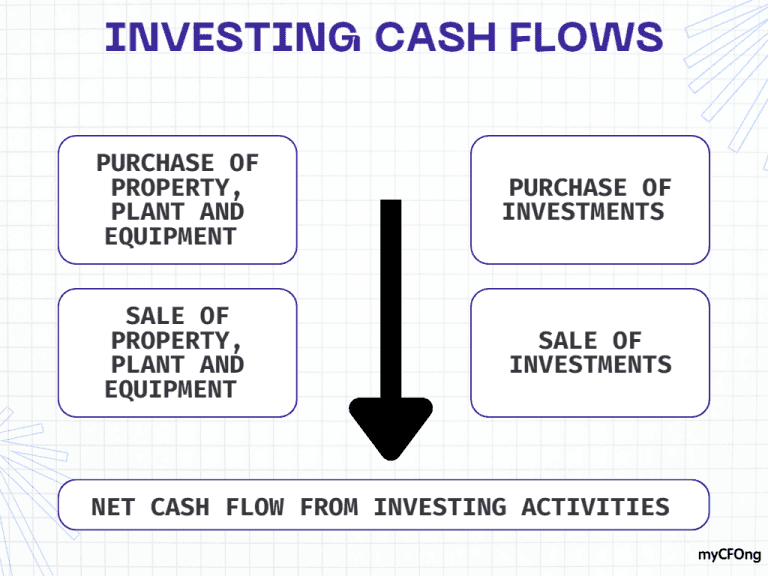

Decoding Cash Flow From Investing Activities

Cash flow from investing activities showcases the cash used for or generated from long-term investments. These are investments that are expected to benefit the company over several years. It provides insights into a company's capital expenditures and strategic investments.

A positive cash flow in this section often indicates a company is selling assets or investments. Conversely, a negative cash flow typically signals that the company is investing heavily in its future.

Let’s break down the specific items that typically fall under this category.

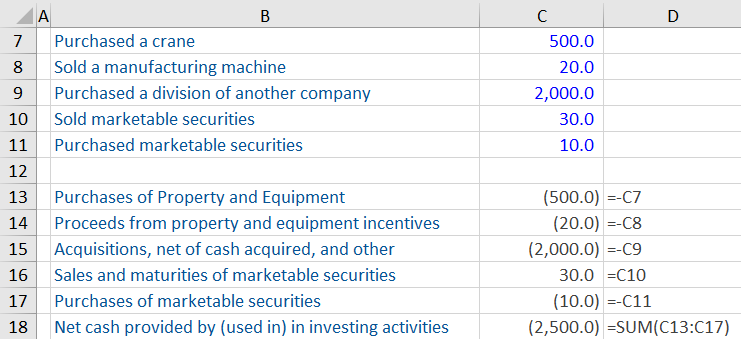

Key Components of Investing Activities

1. Purchase of Property, Plant, and Equipment (PP&E): This includes investments in tangible assets like land, buildings, machinery, and equipment.

Acquiring PP&E is crucial for expanding production capacity, improving efficiency, and maintaining a competitive edge. These acquisitions result in a cash outflow, recorded as a negative value.

2. Sale of Property, Plant, and Equipment (PP&E): When a company disposes of assets like land, buildings, or equipment, it generates cash inflow.

This often occurs when assets are outdated, no longer needed, or when the company is restructuring its operations. The sale of PP&E leads to a positive cash flow.

3. Purchase of Investments (e.g., Stocks, Bonds, Securities): Companies invest in other businesses, government securities, or financial instruments to generate returns.

These investments can range from short-term marketable securities to long-term strategic holdings. Purchasing these investments represents a cash outflow.

4. Sale of Investments (e.g., Stocks, Bonds, Securities): Selling investments held by the company generates cash inflow. This may occur when the company needs to raise capital or rebalance its portfolio.

It could also be a result of strategic decisions to divest from certain sectors or assets. The sale of investments leads to a positive cash flow.

5. Lending Money and Collecting Loans: If a company provides loans to other entities, the initial disbursement of funds is a cash outflow.

When the loan is repaid, including interest, it results in a cash inflow. This activity is more common for financial institutions but can also occur in other industries.

6. Acquisition and Disposal of Subsidiaries: When a company acquires another business (subsidiary), it typically involves a significant cash outflow.

Conversely, selling a subsidiary generates a cash inflow. These activities reflect the company's strategic growth and restructuring efforts.

Why Investing Activities Matter

Understanding cash flow from investing activities is crucial for investors, analysts, and management. It provides insights into a company's long-term strategy and capital allocation decisions.

A company consistently investing in new equipment or acquisitions may be positioned for growth. On the other hand, consistently selling off assets might signal financial distress or a shift in strategy.

For example, a tech company heavily investing in research and development (R&D) might show a significant cash outflow in investing activities. This would indicate a commitment to innovation and future growth.

Alternatively, a manufacturing company selling off factories and equipment might be streamlining operations or facing declining demand. Analyzing these trends over time provides valuable context.

Furthermore, it allows stakeholders to assess whether a company is making prudent investment decisions. Are they investing in assets that will generate future returns?

Are they strategically managing their investment portfolio? It also helps identify potential risks. Are they over-investing in certain areas or neglecting necessary maintenance?

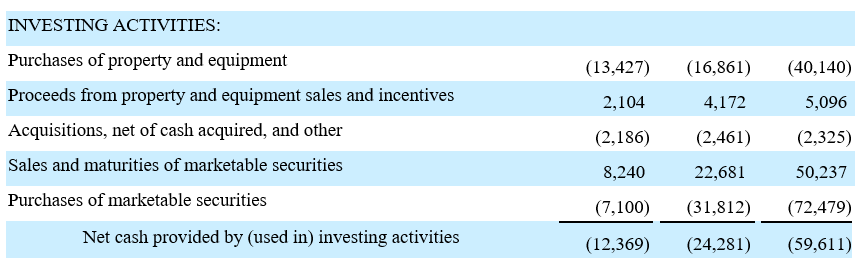

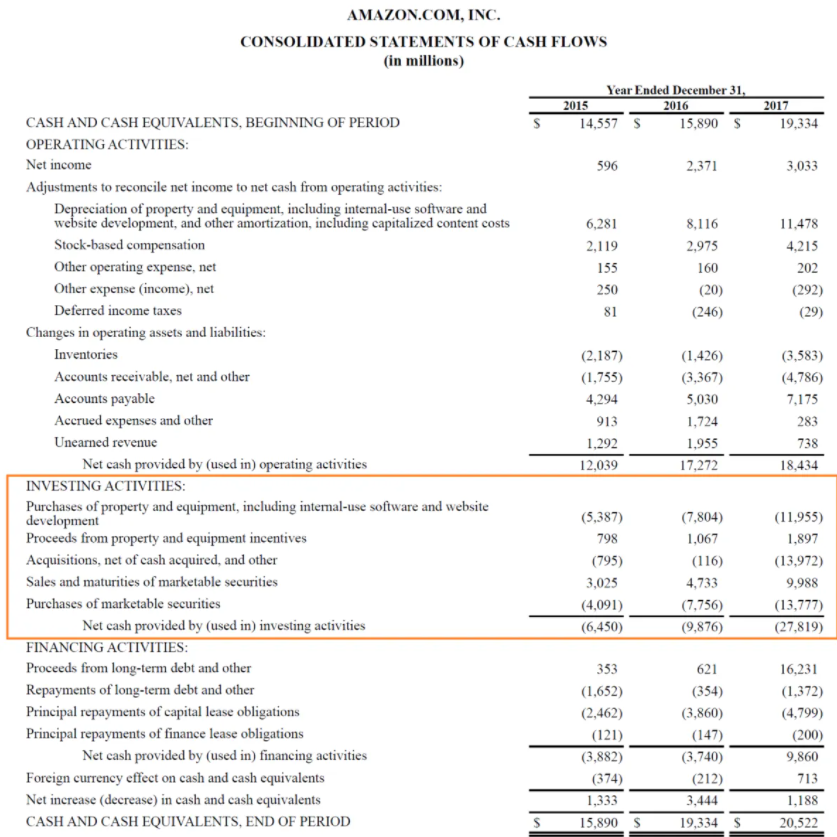

Interpreting the Numbers

It's important to analyze cash flow from investing activities in conjunction with other financial statements. This includes the income statement and balance sheet, to gain a comprehensive understanding of a company's financial health.

Looking at trends over several years provides a more accurate picture than a single year's data. Comparison with industry peers helps benchmark the company's performance and strategy.

For instance, a company with a negative cash flow from investing activities but positive cash flow from operating activities might be funding its investments through its core business. This is generally viewed as a healthy sign.

However, a company with negative cash flow from both operating and investing activities might be relying on debt to finance its investments, which could be a cause for concern.

"The key to successful investing is to understand not only a company's financial statements but also the underlying business and its competitive landscape," - Warren Buffett.

Conclusion

Cash flow from investing activities is a critical indicator of a company's investment strategies and long-term prospects. It reflects the decisions made about acquiring and disposing of assets, which shapes the company's future growth and profitability.

By carefully analyzing these activities, investors and analysts can gain valuable insights into a company's strategic direction and its ability to create value.

Ultimately, understanding cash flow from investing activities empowers informed decision-making and contributes to a more comprehensive assessment of a company's overall financial health and future potential.

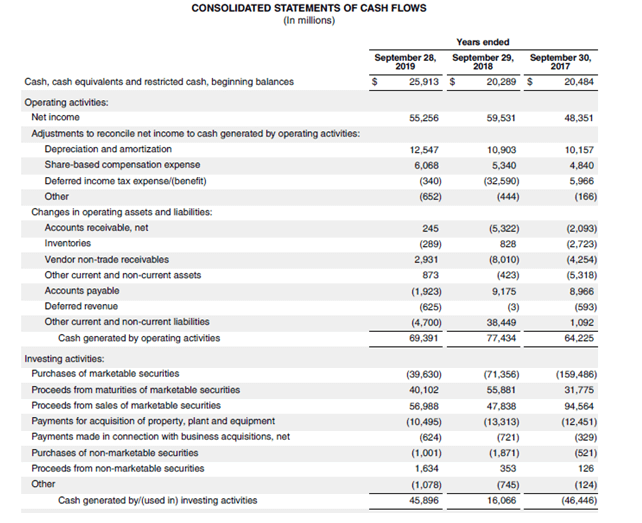

:max_bytes(150000):strip_icc()/dotdash_Final_Cash_Flow_Statement_Analyzing_Cash_Flow_From_Investing_Activities_Jul_2020-01-5297a0ec347e4dd8996f307b3d9d61ad.jpg)

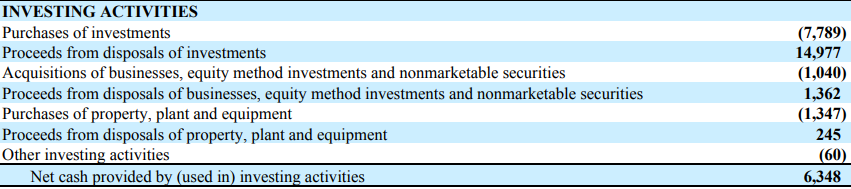

:max_bytes(150000):strip_icc()/cashflowfinvestingactivities-recirc-8787bbde413f4036b2f8cfad5c4c6a99.png)