A Group Owned Insurance Company That Is Formed

The insurance landscape is undergoing a significant shift as a consortium of small business owners across the Midwest announces the formation of a group-owned insurance company, "Midwest Mutual Assurance Cooperative" (MMAC). This innovative venture aims to address rising insurance costs and limited coverage options that have long plagued small and medium-sized enterprises (SMEs) in the region.

This move signifies a growing trend of businesses taking control of their risk management by creating captive insurance solutions, challenging the traditional insurance market dynamics. It is a bold initiative driven by a collective need for greater control, transparency, and affordability in an increasingly volatile economic climate.

The Genesis of Midwest Mutual Assurance Cooperative

The impetus behind MMAC stems from a widespread dissatisfaction among business owners with the existing insurance market. Skyrocketing premiums, coupled with increasingly restrictive coverage terms, have made it difficult for many SMEs to adequately protect their assets and operations.

“We were tired of feeling like we were at the mercy of large insurance corporations that didn’t understand our specific needs,” stated Sarah Miller, a founding member of MMAC and owner of a local manufacturing firm. “We needed a solution that put us, the business owners, in the driver's seat.”

The idea for a group-owned insurance company emerged from a series of informal discussions among business owners at regional industry events. These discussions quickly evolved into a formal working group that spent months researching the feasibility and legal requirements of forming a captive insurance company.

According to the National Risk Retention Association (NRRA), the number of captive insurance companies has grown steadily over the past decade, reflecting a growing interest in alternative risk financing solutions. MMAC leveraged resources from NRRA to understand the landscape of forming the co-op.

Structure and Operation

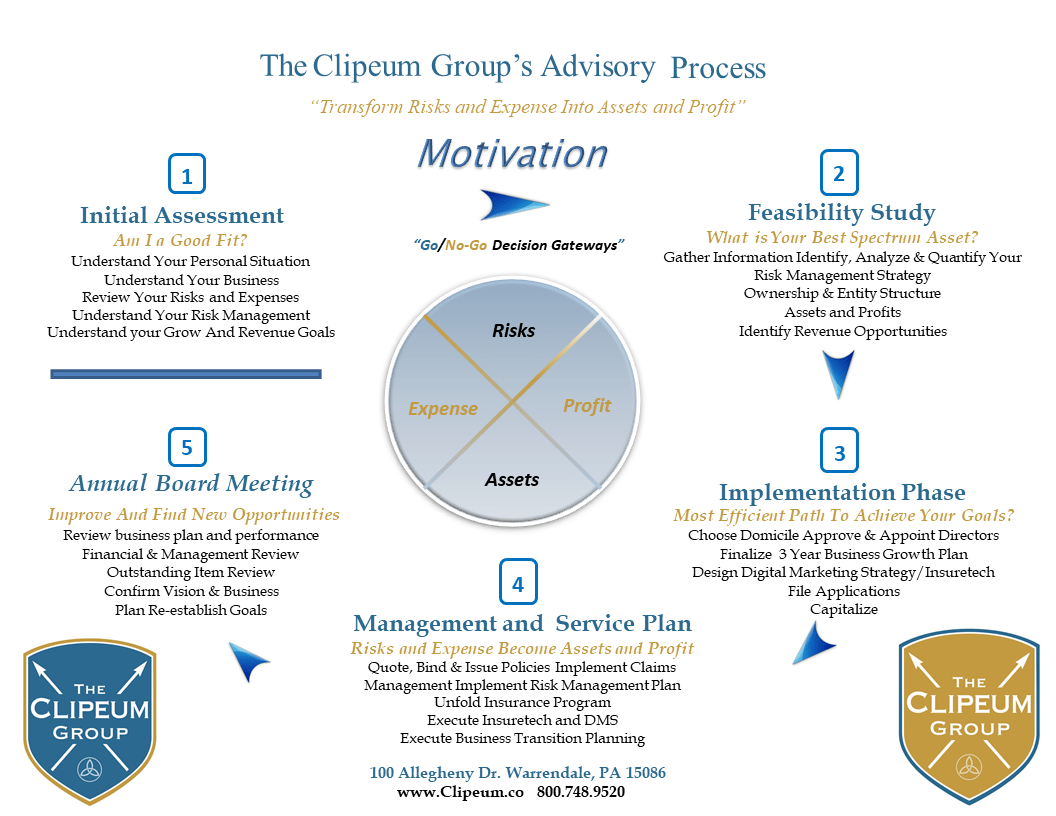

Midwest Mutual Assurance Cooperative is structured as a risk retention group (RRG), a type of captive insurance company authorized under the federal Liability Risk Retention Act. This structure allows businesses with similar or related liability exposures to pool their risks and form their own insurance company.

The cooperative is governed by a board of directors elected from among its members, ensuring that the company's policies and operations align with the needs of its policyholders. The initial focus of MMAC will be on providing general liability, property, and workers' compensation insurance to its members.

The underwriting process will be based on a thorough assessment of each member's risk profile, taking into account factors such as industry, safety record, and risk management practices. This approach aims to provide fairer and more accurate pricing compared to traditional insurance models that often rely on broad industry averages.

Key Benefits for Members

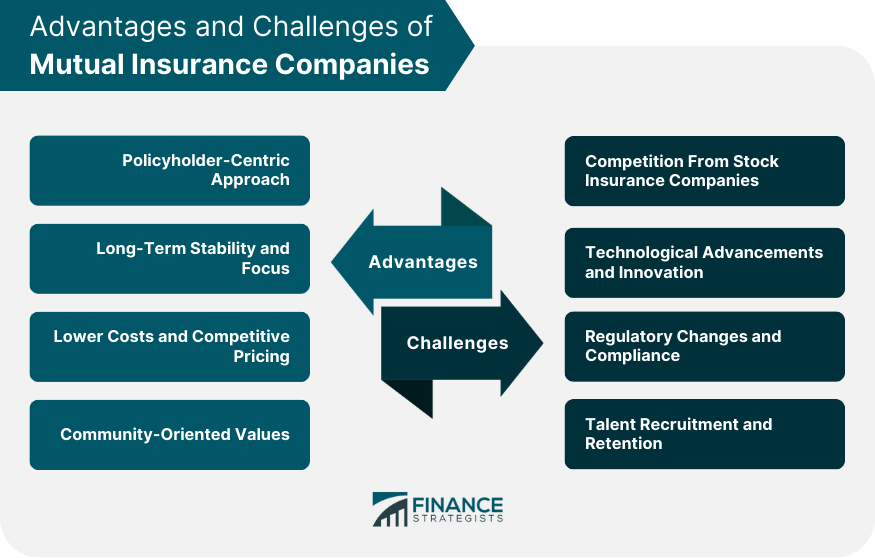

The primary benefit for members of MMAC is greater control over their insurance costs. By pooling their risks and eliminating the profit motive of traditional insurance companies, members can potentially achieve significant savings on their premiums.

Another key advantage is the ability to tailor coverage to the specific needs of their businesses. MMAC will work with its members to develop customized insurance policies that address their unique risks and exposures.

Increased transparency is also a significant benefit. Members will have access to detailed information about the company's financial performance and claims experience, allowing them to better understand how their premiums are being used.

Challenges and Opportunities

The formation of a group-owned insurance company is not without its challenges. One of the biggest hurdles is raising the initial capital required to establish the company and meet regulatory requirements. MMAC is currently in the process of securing funding from its members and through a combination of debt and equity financing.

Another challenge is attracting and retaining experienced insurance professionals to manage the company's operations. MMAC has assembled a team of seasoned underwriters, claims adjusters, and risk managers to ensure the company operates efficiently and effectively.

Despite these challenges, MMAC presents a significant opportunity for small businesses in the Midwest. By taking control of their insurance, they can reduce costs, improve coverage, and gain greater peace of mind.

"We believe that Midwest Mutual Assurance Cooperative has the potential to transform the insurance landscape for small businesses in the region," said John Davis, a risk management consultant who advised MMAC during its formation. "This is a model that could be replicated in other industries and regions across the country."

Expert Opinions and Market Reactions

Industry analysts are closely watching the development of Midwest Mutual Assurance Cooperative. Some experts believe that this trend of businesses forming their own insurance companies will continue to gain momentum as traditional insurance costs continue to rise.

“Group-owned insurance companies can be a viable option for businesses that are willing to take on more risk and responsibility for managing their own insurance programs," said Dr. Emily Carter, a professor of risk management at a leading business school. "However, it's important to carefully assess the risks and rewards before making a decision."

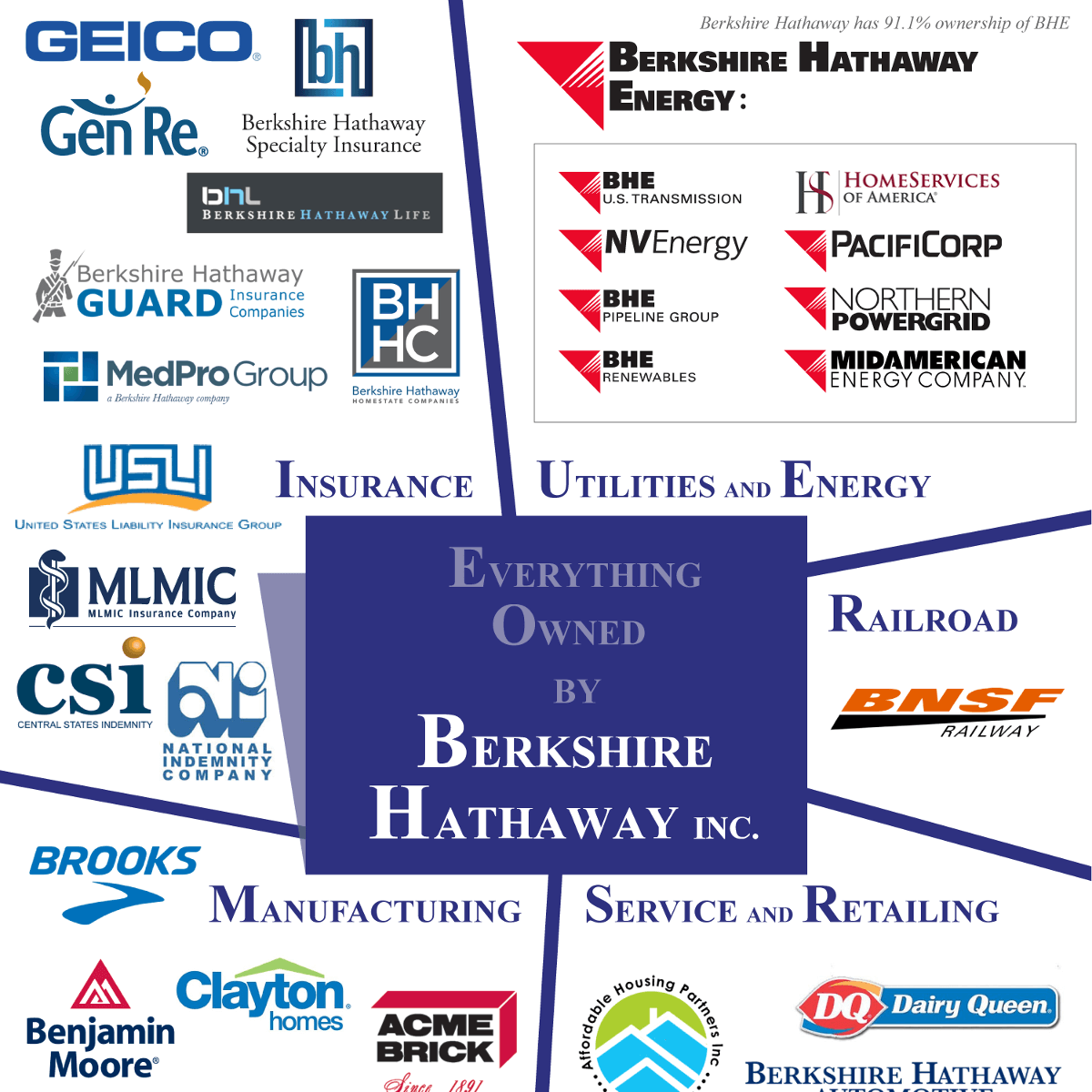

The traditional insurance industry has taken note of the emergence of MMAC. While some insurers see it as a potential threat, others view it as an opportunity to partner with the cooperative to provide specialized services and reinsurance.

Looking Ahead

Midwest Mutual Assurance Cooperative is expected to begin writing policies in the first quarter of next year. The company plans to initially focus on serving businesses in the manufacturing, construction, and transportation industries, but it hopes to expand its offerings to other sectors in the future.

The success of MMAC will depend on its ability to effectively manage risk, control costs, and provide value to its members. If it can achieve these goals, it has the potential to become a leading provider of insurance solutions for small businesses in the Midwest.

The formation of Midwest Mutual Assurance Cooperative represents a significant development in the insurance industry, signaling a growing trend of businesses taking control of their risk management. As the company moves forward, it will be closely watched by businesses, insurers, and regulators alike.

.jpg)

.jpg)