Which Of The Following Describes Accrued Revenue

Imagine you're a freelance graphic designer. You've just poured your heart and soul into creating a stunning new logo for a local bakery. The client is thrilled, but the final payment isn't due until next month. The aroma of freshly baked bread seems to mingle with the satisfaction of a job well done, but a question lingers: how does this income get recorded now, before the cash hits your account?

This scenario highlights the core concept of accrued revenue, a fundamental element of accrual accounting. Accrued revenue represents income that has been earned but for which cash has not yet been received. Understanding this concept is crucial for accurate financial reporting and provides a clearer picture of a company’s or individual’s financial performance.

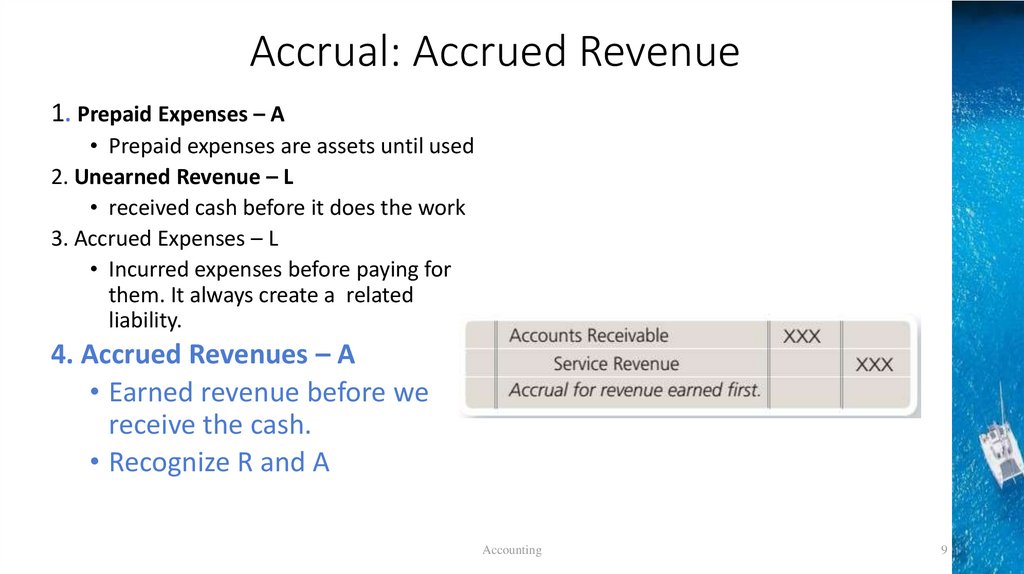

Understanding Accrued Revenue

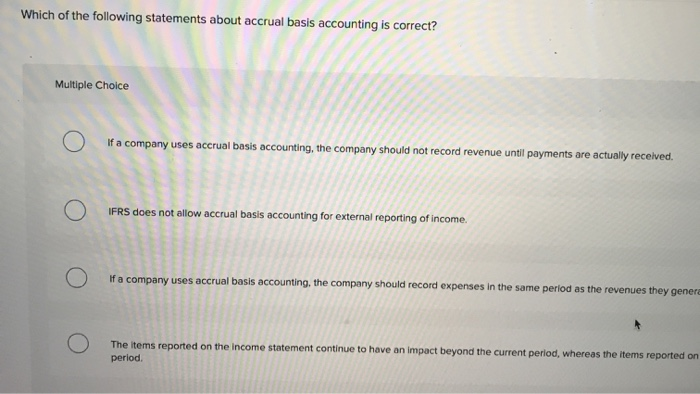

Accrued revenue, also known as accrued assets or unbilled revenue, is a critical component of the accrual accounting method. This method, in accordance with Generally Accepted Accounting Principles (GAAP), recognizes revenue when it is earned, regardless of when the cash is received. It is a way to accurately reflect the financial performance of a business during a specific period.

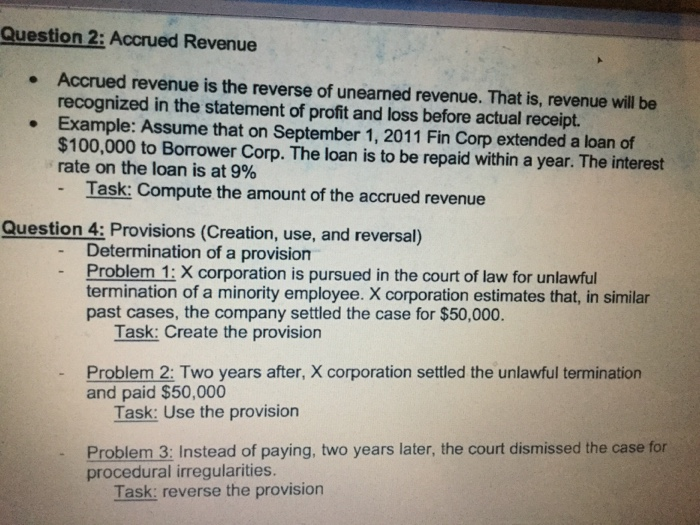

The opposite of accrued revenue is deferred revenue (also known as unearned revenue), where cash is received before the service is performed or the product is delivered. Accrual accounting provides a more comprehensive view of a business’s financial health compared to cash accounting, which only recognizes revenue when cash is received.

Key Characteristics of Accrued Revenue

Accrued revenue possesses several key characteristics that distinguish it from other types of revenue. First and foremost, the service or product must have been delivered or substantially completed. This means the earning process is largely finished.

Secondly, a reasonable expectation of payment must exist. Although the cash hasn’t been received, there should be a high probability that the client or customer will fulfill their financial obligation. The amount of the revenue must also be reliably measurable.

Finally, the revenue must be recognized in the accounting period in which it was earned, not necessarily when the cash is received. This adherence to the matching principle is a cornerstone of accrual accounting.

Illustrative Examples of Accrued Revenue

Consider a law firm that provides legal services throughout December but bills its client at the beginning of January. Although the invoice is issued in the new year, the revenue is considered earned in December when the services were rendered. This revenue will be recognized in December as accrued revenue.

Similarly, imagine a construction company nearing completion on a large project. They’ve finished 90% of the work by the end of the year but won’t receive the final payment until the project is fully completed in January. The 90% of work completed needs to be accounted as revenue.

Another example could be an interest on a savings account. Interest earned at the end of the month but not credited to the account until the following month would also be considered accrued revenue.

Accounting for Accrued Revenue

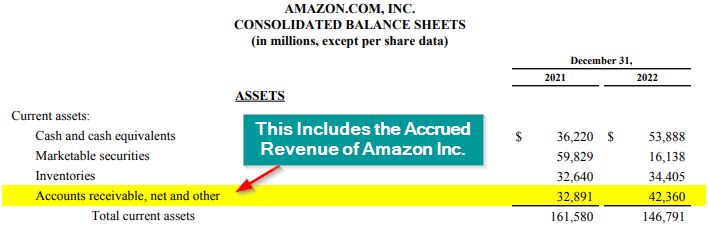

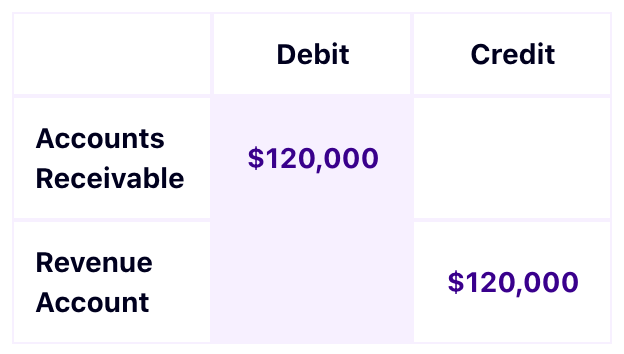

The accounting treatment for accrued revenue involves creating a journal entry to recognize the revenue and the corresponding asset. This entry typically involves debiting (increasing) an asset account, such as Accounts Receivable, and crediting (increasing) a revenue account, such as Service Revenue.

For instance, if the law firm from the previous example earned $10,000 in services during December, the journal entry would debit Accounts Receivable for $10,000 and credit Service Revenue for $10,000. This reflects the firm’s right to receive the payment and the recognition of the earned revenue.

When the cash is eventually received, a subsequent journal entry will debit (increase) the Cash account and credit (decrease) the Accounts Receivable account. This removes the accrued revenue from the balance sheet as the actual cash has been collected.

Significance of Accrued Revenue

Accrued revenue plays a vital role in providing a comprehensive and accurate picture of a company’s financial performance. It ensures that revenue is recognized in the period it is earned, regardless of cash flow. This helps avoid misleading investors and stakeholders by providing a more transparent view of the company’s financial health.

For example, consistently reporting accrued revenue can help businesses secure loans or attract investors. By showing a steady stream of earnings, even before cash is in hand, companies can demonstrate their profitability and stability. This allows lenders to feel more confident in providing financing.

Furthermore, understanding accrued revenue can help businesses make informed decisions about pricing and resource allocation. By tracking revenue earned but not yet received, businesses can better manage their cash flow and forecast future earnings.

Common Pitfalls and Considerations

Despite its importance, accounting for accrued revenue can be challenging. Estimating the amount of revenue earned can be subjective, especially for long-term projects. Careful documentation and reliable measurement methods are essential.

Another challenge lies in the risk of non-payment. If a customer or client fails to pay, the accrued revenue may need to be written off as a bad debt expense, which can negatively impact the company's financial statements. Performing due diligence on customers' creditworthiness can mitigate these risks.

Proper internal controls and thorough audits are crucial to ensure the accuracy and reliability of accrued revenue accounting. This includes implementing robust processes for tracking services rendered, issuing invoices promptly, and monitoring accounts receivable closely.

The Broader Context of Accrual Accounting

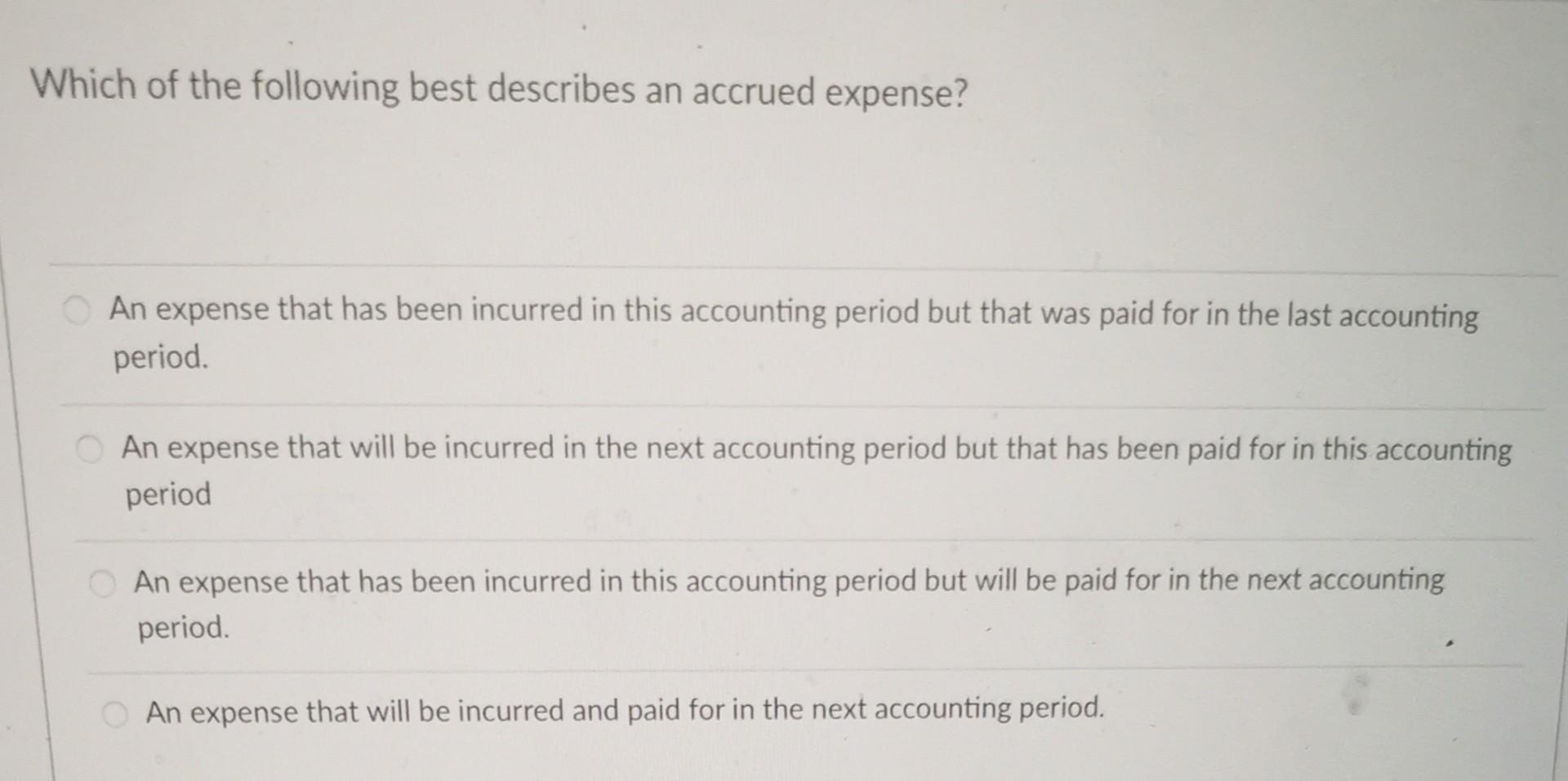

Accrued revenue is just one aspect of accrual accounting, a method that provides a more holistic view of a company's financial performance than cash accounting. Accrual accounting also recognizes expenses when they are incurred, regardless of when the cash is paid.

This comprehensive approach provides a more accurate reflection of a company’s profitability and financial position. Many companies especially those listed on the stock exchange are required to use accrual accounting.

By understanding the principles of accrual accounting and the specific nuances of accrued revenue, businesses can gain a deeper insight into their financial health. This enables better decision-making and fosters greater transparency and accountability.

In Conclusion

In the grand symphony of financial accounting, accrued revenue plays a vital, if often understated, role. It ensures that the financial picture painted for stakeholders is both accurate and complete. It bridges the gap between services rendered and cash received.

Just as the aroma of that bakery lingers in the air, the impact of accrued revenue persists in the financial statements, contributing to a more realistic view of a business's success. By understanding and correctly accounting for accrued revenue, companies can unlock a greater level of financial clarity and pave the way for sustainable growth.

Ultimately, mastering accrued revenue is not just about compliance; it's about empowering businesses to make informed decisions and build a solid financial foundation for the future. It is a testament to the importance of accurate financial reporting, which ensures a healthier and more transparent marketplace for all.