Can A Mexican Timeshare Ruin Your Credit

Mexican timeshares are increasingly linked to unexpected credit score damage for unsuspecting American consumers. Reports surge of aggressive sales tactics and hidden clauses leading to debt collection efforts impacting US credit reports.

The allure of affordable vacations south of the border can quickly turn into a financial nightmare. Consumers are finding their credit scores plummeting due to debts tied to Mexican timeshare contracts, a problem exacerbated by aggressive collection agencies and a lack of clear legal recourse.

The Bait and Switch: How it Happens

Many consumers report being lured in with promises of luxury accommodations and hassle-free vacation ownership.

However, the reality often involves high-pressure sales presentations. These presentations lead to complex contracts with hidden fees and difficult cancellation policies.

Profeco, Mexico's consumer protection agency, receives thousands of complaints annually related to timeshare sales, yet resolving these issues from the US remains challenging.

Credit Score Casualties: The Aftermath

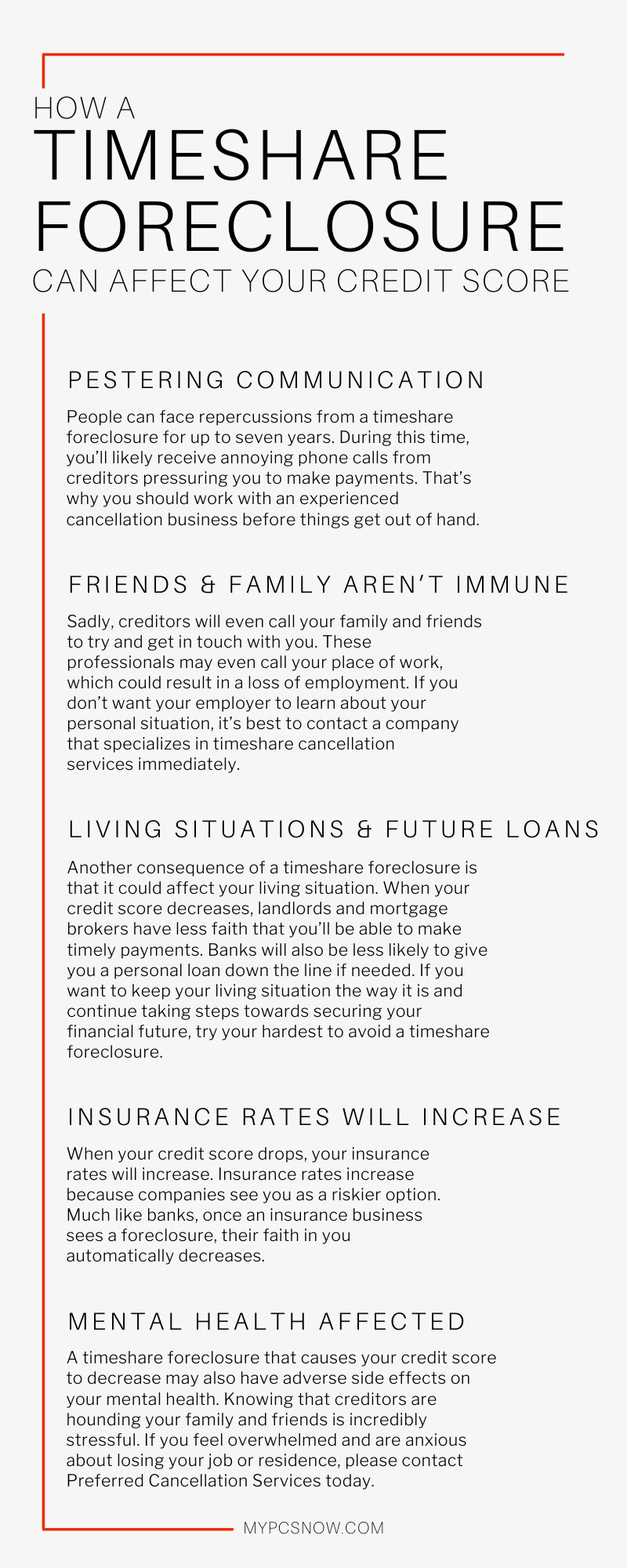

When owners struggle to keep up with maintenance fees or try to exit their contracts, they risk facing collection agencies. Some of these agencies operate across borders.

These agencies aggressively pursue debts. The debts, if unpaid, appear on US credit reports, severely impacting credit scores.

According to the Federal Trade Commission (FTC), consumers should carefully review contracts. The FTC stresses consumers should understand all terms before signing any agreement involving international purchases.

Who is Affected?

The victims span all demographics, but retirees and families are particularly vulnerable.

They are often targeted with promises of fixed vacation costs. Fixed cost vacation can prove untrue.

The American Resort Development Association (ARDA) acknowledges the existence of fraudulent actors. ARDA advocates for ethical sales practices within the timeshare industry.

Where and When is this Happening?

The problem is concentrated in popular Mexican tourist destinations like Cancun, Puerto Vallarta, and Cabo San Lucas.

The uptick in reported credit score impacts coincides with a surge in timeshare sales. The surge followed the post-pandemic travel rebound.

The Better Business Bureau (BBB) receives frequent complaints. Complaints are filed against Mexican timeshare companies and associated collection agencies.

The Legal Labyrinth: No Easy Way Out

US laws offer limited protection when dealing with contracts signed in Mexico.

Mexican law governs these agreements, making legal recourse complex and expensive.

Many consumers find themselves trapped, facing legal fees. They face fees that outweigh the cost of simply paying the debt, regardless of its legitimacy.

Protect Your Credit: What to Do Now

If you're considering a Mexican timeshare, exercise extreme caution.

Carefully review all contract terms. Get legal advice from an attorney experienced in international property law before signing anything.

If you're already facing collection efforts related to a Mexican timeshare, document everything. Dispute the debt with the credit bureaus and seek legal counsel.

Report suspected fraudulent activity to the FTC and your state's attorney general.

Ongoing efforts include increased consumer awareness campaigns. Campaigns will warn travelers about the risks associated with Mexican timeshares.

.jpg)