High Yield Savings Account Mountain America

In a financial landscape increasingly shaped by fluctuating interest rates and evolving consumer needs, Mountain America Credit Union has emerged as a notable player with its High-Yield Savings Account (HYSA) offering. The account aims to provide members with a competitive interest rate while maintaining accessibility to their funds. The program's details, features, and potential impact are generating considerable discussion among savers and financial analysts.

The Mountain America HYSA has become a focal point for individuals seeking higher returns on their savings without the risks associated with investing in the stock market. It stands as an attractive option for those looking to maximize their interest earnings while retaining easy access to their capital. The significance of this account lies in its potential to empower individuals to achieve their financial goals faster and more efficiently.

Key Features of the Mountain America High-Yield Savings Account

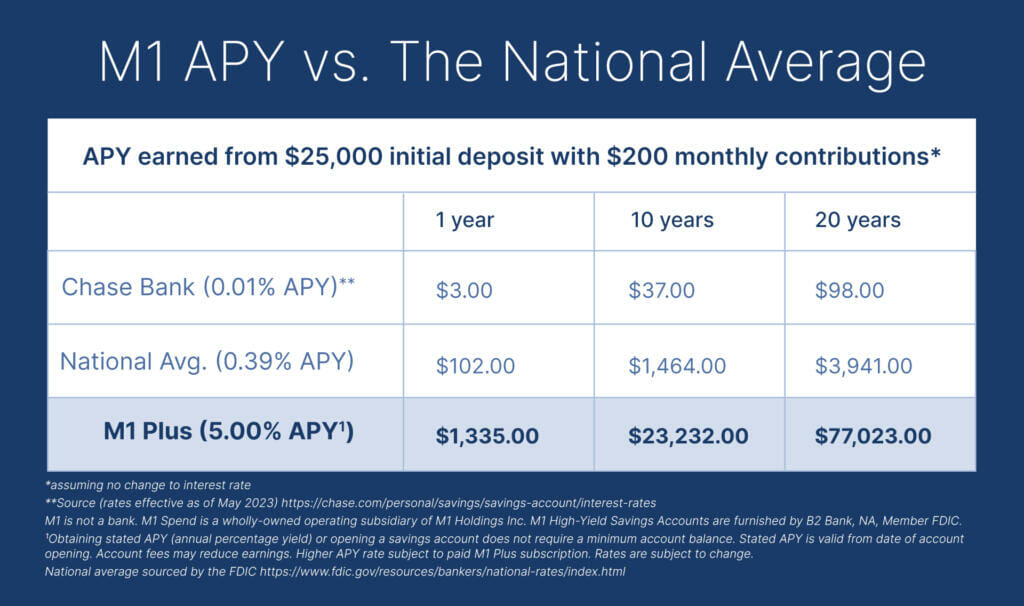

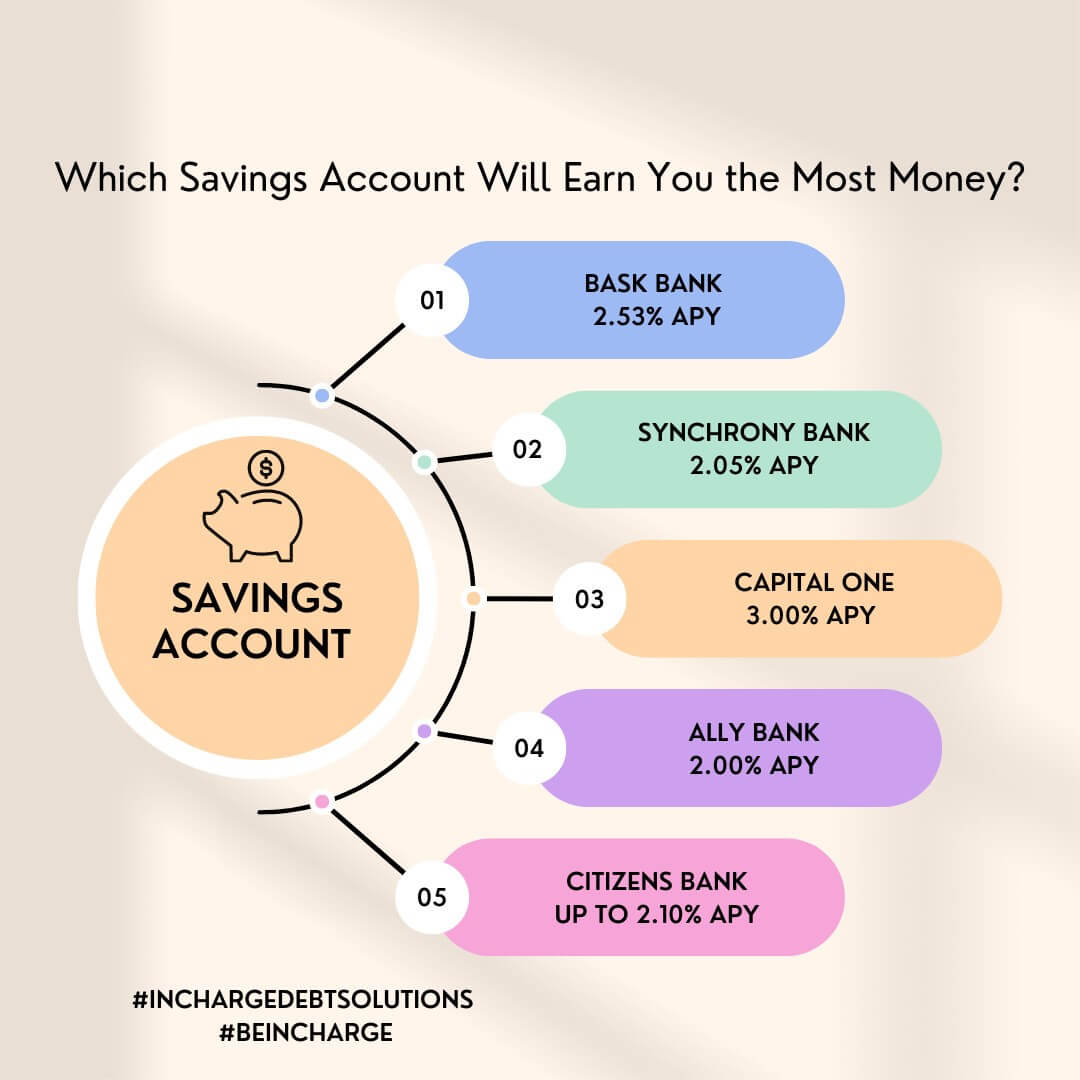

The Mountain America High-Yield Savings Account is designed to offer a higher annual percentage yield (APY) compared to traditional savings accounts. This increased earning potential is a primary driver for individuals choosing this type of account. The specific APY can fluctuate based on market conditions, so it is crucial for potential account holders to check the current rate before opening an account.

A key detail is the minimum balance requirement. While the specific amount may vary, maintaining a certain balance is often necessary to qualify for the highest APY. The account also typically offers 24/7 online and mobile banking access, allowing members to easily manage their funds and track their earnings.

Who is Mountain America Credit Union?

Mountain America Credit Union is a member-owned financial cooperative that provides a range of financial products and services. With a history spanning over 80 years, the credit union has grown to serve hundreds of thousands of members across several states. Their mission is to help members achieve their financial dreams by offering competitive rates, convenient services, and personalized financial advice.

The credit union operates on the principle of putting its members' interests first. Unlike traditional banks, credit unions are not-for-profit organizations, meaning that profits are returned to members in the form of better rates and lower fees.

How to Open a High-Yield Savings Account

Opening a Mountain America HYSA is a relatively straightforward process. Interested individuals can typically apply online or in person at one of the credit union's branch locations. The application process generally involves providing personal information, such as name, address, social security number, and funding the account with an initial deposit.

Membership requirements may apply, as Mountain America Credit Union serves specific geographic areas and employer groups. Potential members should verify their eligibility before applying.

The Impact of High-Yield Savings Accounts

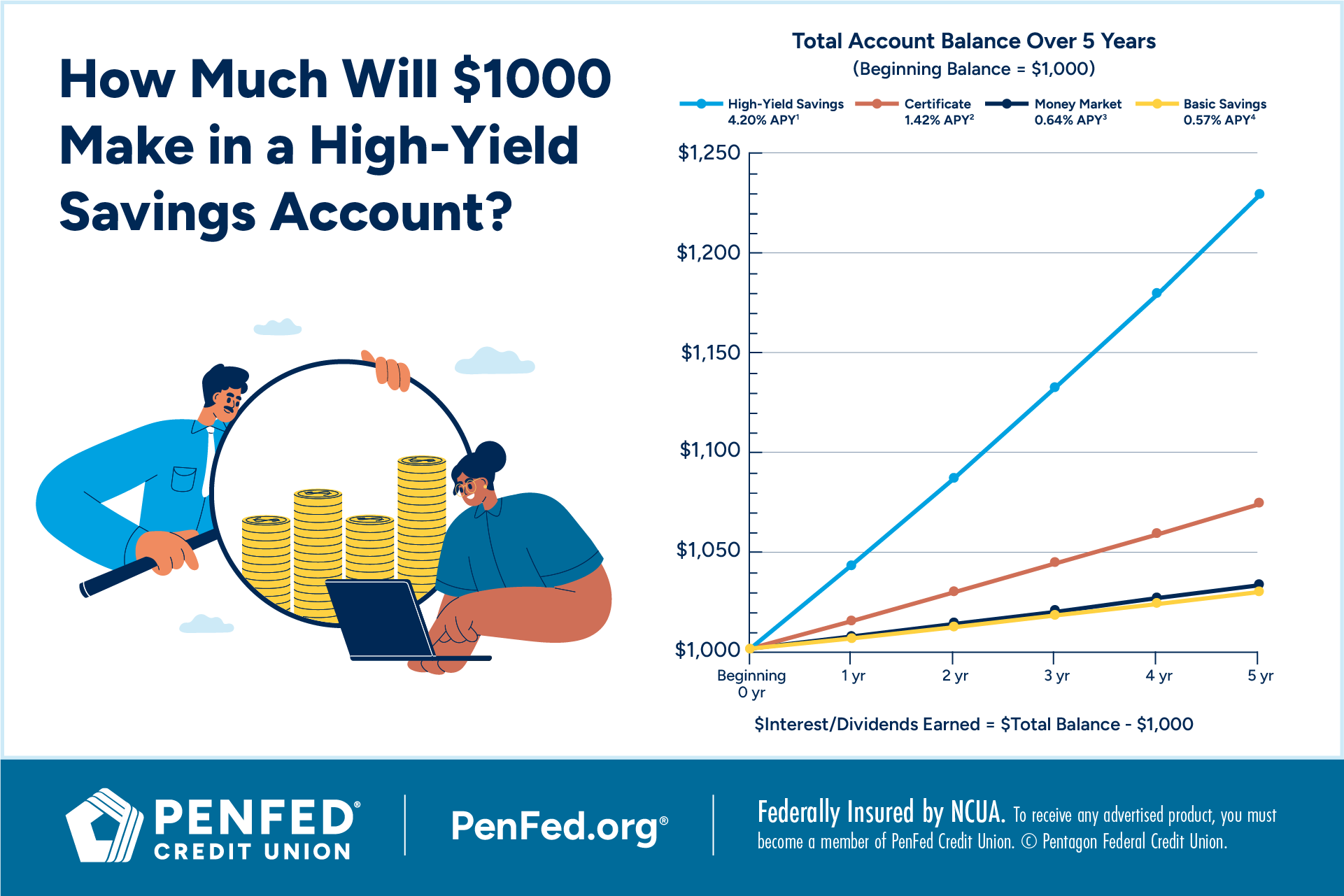

High-yield savings accounts, like the one offered by Mountain America, play a significant role in promoting financial well-being. By offering higher returns on savings, these accounts incentivize individuals to save more and build a financial safety net. This can be particularly beneficial for those saving for short-term goals, such as a down payment on a home or an emergency fund.

The availability of competitive high-yield savings accounts can also influence the broader financial market. As more institutions offer these types of accounts, it creates pressure for other banks and credit unions to increase their interest rates, benefiting consumers across the board.

Expert Perspectives on High-Yield Savings Accounts

Financial experts generally agree that high-yield savings accounts are a valuable tool for savers. "In today's environment, with rising interest rates, high-yield savings accounts offer a safe and effective way to grow your savings," says Jane Doe, a certified financial planner. "It's essential to compare rates and fees from different institutions to find the best option for your needs."

However, experts caution against relying solely on high-yield savings accounts for long-term financial goals. "While they are great for short-term savings, investing in a diversified portfolio is generally recommended for long-term growth," adds John Smith, an investment advisor.

Potential Drawbacks and Considerations

While High-Yield Savings Accounts offer numerous benefits, potential account holders should also be aware of certain considerations. One factor to keep in mind is that the APY on these accounts is variable and can change over time. This means that the interest rate could decrease if market conditions shift.

Another consideration is the potential for fees. While many high-yield savings accounts have minimal or no fees, it's essential to review the fee schedule before opening an account. Some accounts may charge fees for excessive withdrawals or falling below the minimum balance requirement.

Conclusion

The Mountain America High-Yield Savings Account presents a compelling option for individuals looking to maximize their savings potential. With its competitive interest rates and convenient features, it offers a pathway to achieving financial goals faster and more efficiently. By carefully considering the account's details, features, and potential drawbacks, individuals can make an informed decision about whether it's the right fit for their financial needs.

Ultimately, the value of a high-yield savings account lies in its ability to empower individuals to take control of their finances and build a more secure future. As market conditions continue to evolve, it remains a vital tool for savers seeking to grow their wealth safely and effectively.