How To Set Up Epay In Quickbooks Desktop

For small business owners, streamlining financial operations is paramount. QuickBooks Desktop, a popular accounting software, offers integration with ePay, a service facilitating electronic payments. This article provides a detailed guide on setting up ePay within QuickBooks Desktop, enabling users to efficiently manage vendor payments and employee payroll.

Understanding the Significance of ePay Integration

Integrating ePay with QuickBooks Desktop offers significant advantages. It reduces manual payment processing time, minimizes errors, and provides a secure platform for electronic transactions. This integration can improve cash flow management and streamline reconciliation processes.

Step-by-Step Guide to Setting Up ePay in QuickBooks Desktop

Before initiating the setup, ensure you have a valid ePay account. Contact Intuit or an authorized reseller to establish an account. Gather all necessary banking information, including your routing and account numbers.

Step 1: Accessing the Payment Setup

Open QuickBooks Desktop and navigate to the "Vendors" menu. Select "Pay Bills Electronically" and then choose "Setup Accounts." This action opens the ePay Setup wizard.

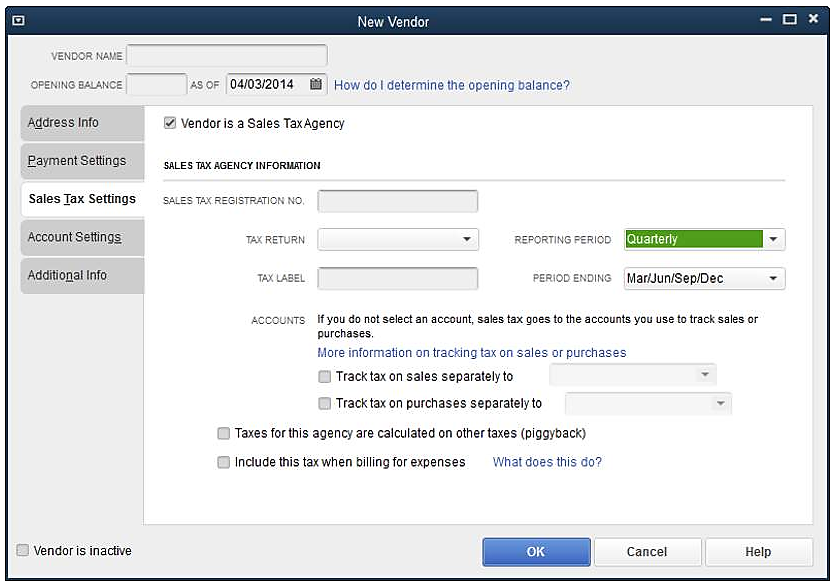

Step 2: Entering Account Information

The setup wizard prompts you to enter your ePay account information. This includes your ePay account number, company name, and contact details. Verify that all information is accurate to avoid payment processing errors.

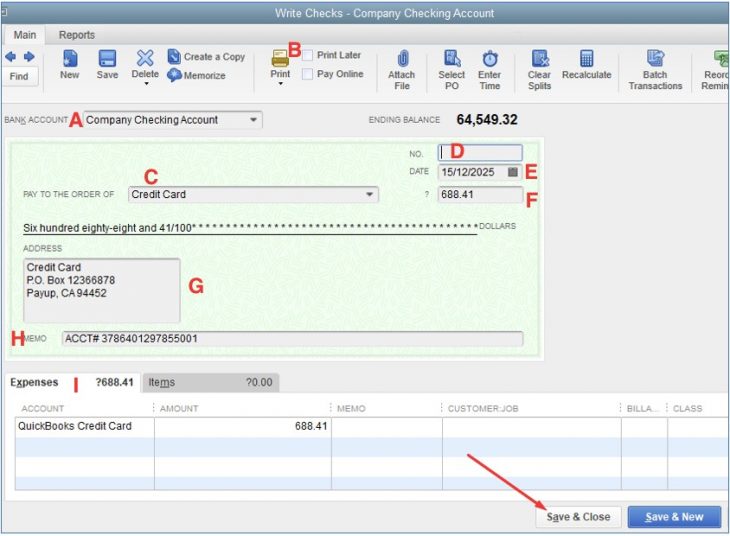

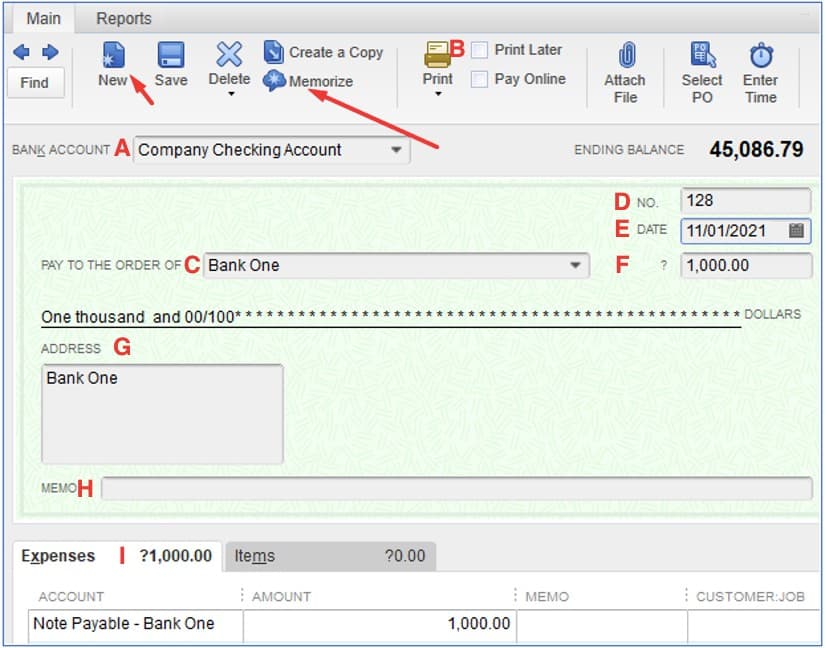

Step 3: Linking Bank Accounts

Link your bank account to your ePay account. This step requires entering your bank routing number and account number. Intuit may require a verification process, such as micro-deposits, to confirm the bank account's validity.

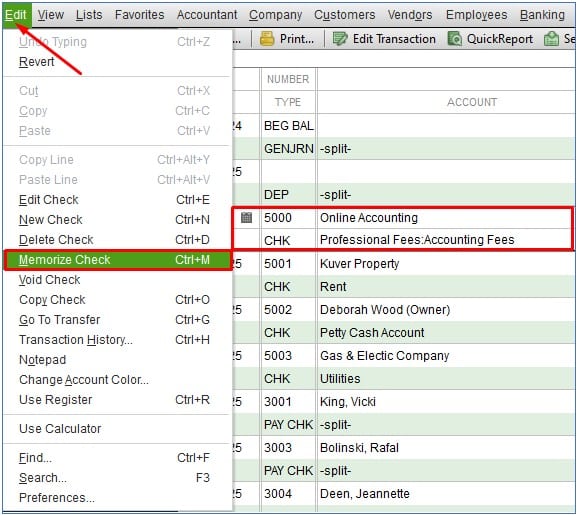

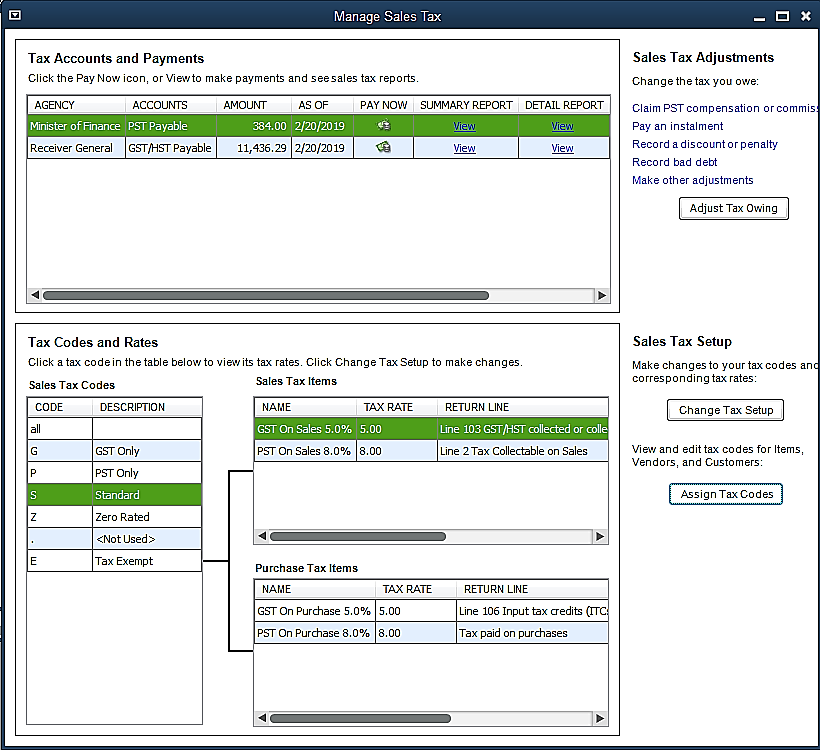

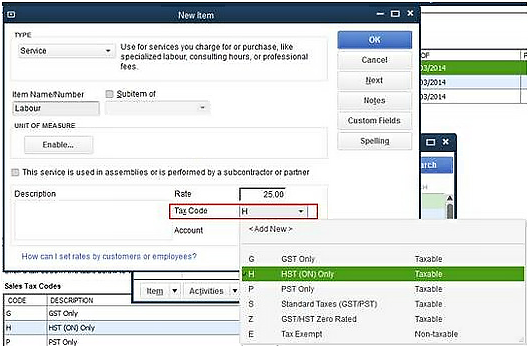

Step 4: Configuring Payment Preferences

Configure your payment preferences within QuickBooks Desktop. Define default payment methods, payment approval workflows, and notification settings. These settings help tailor the ePay system to your specific business needs.

Step 5: Verifying and Activating the Service

Once you have completed the setup, review all entered information for accuracy. Activate the ePay service within QuickBooks Desktop. You may need to agree to the terms and conditions of the ePay service.

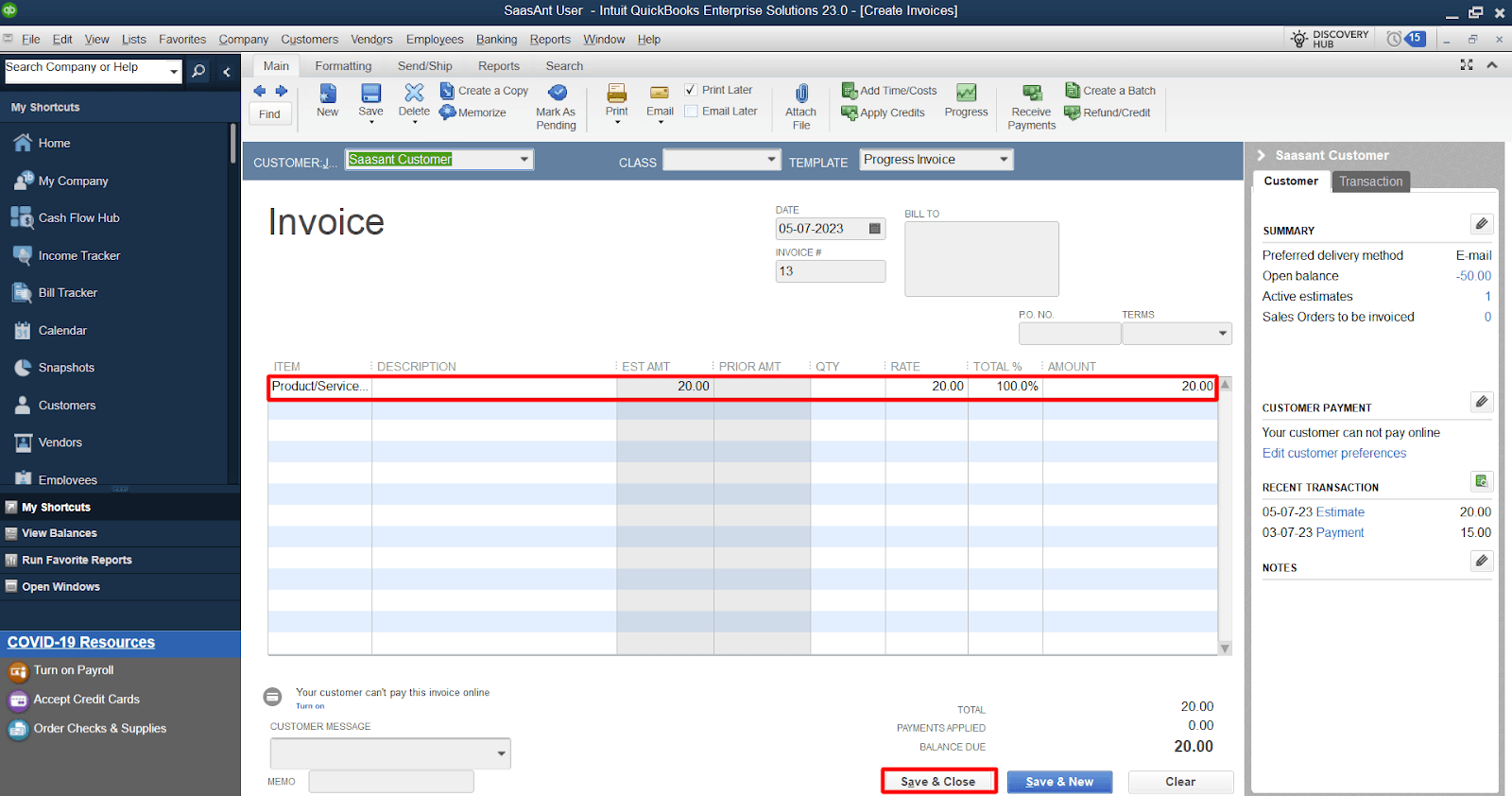

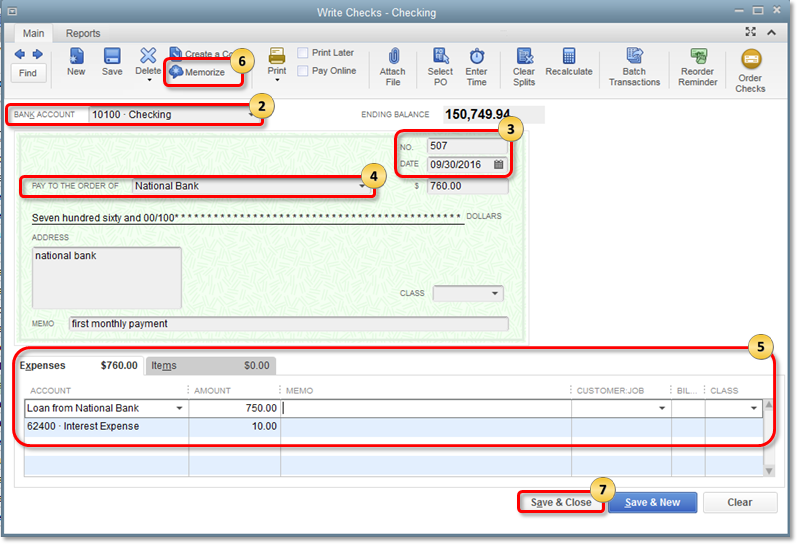

Using ePay for Vendor Payments

After the setup is complete, you can begin using ePay to pay your vendors. When entering bills in QuickBooks Desktop, mark them for electronic payment. When the bill is due, process the payment through the "Pay Bills Electronically" option.

QuickBooks Desktop will then transmit the payment information to ePay. ePay processes the payment and sends the funds to your vendor's bank account. You'll receive confirmation of the payment within QuickBooks Desktop and ePay.

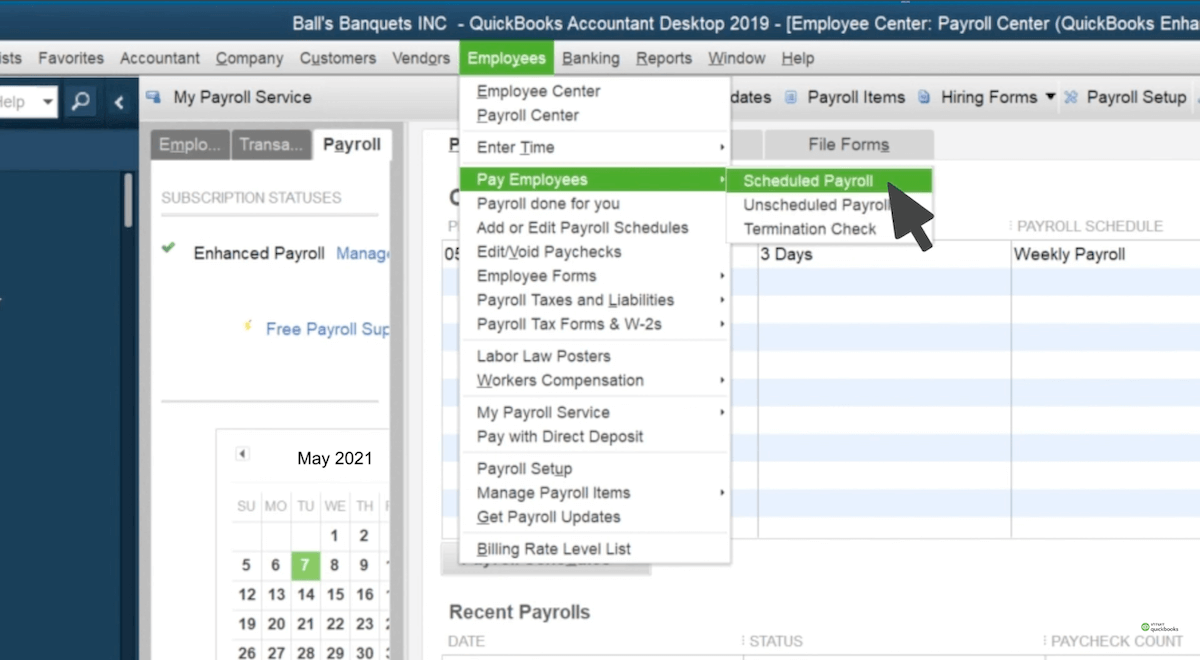

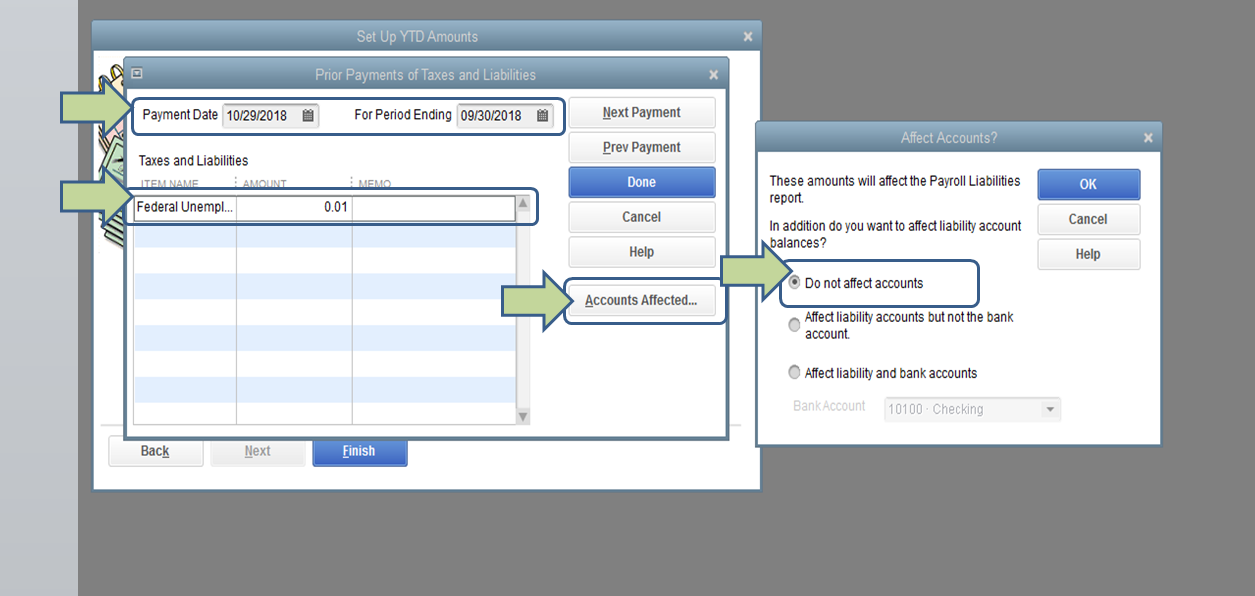

Using ePay for Payroll

ePay can also be used to process payroll electronically. Configure your payroll settings within QuickBooks Desktop to use ePay for direct deposit. Ensure that all employee bank account information is accurately entered.

When you process payroll, QuickBooks Desktop transmits the direct deposit information to ePay. ePay processes the payroll and deposits the funds into your employees' bank accounts. Employees receive pay stubs electronically.

Troubleshooting Common Issues

Encountering issues during the setup or payment process is possible. Check your internet connection and ensure that QuickBooks Desktop is up-to-date. Verify your bank account information and ePay account details.

If problems persist, contact Intuit's support team for assistance. They can provide troubleshooting guidance and resolve any technical issues. Consulting the ePay and QuickBooks Desktop documentation can also provide helpful solutions.

Potential Impact and Benefits

Implementing ePay within QuickBooks Desktop can transform a business's financial operations. It reduces manual labor, minimizes errors, and accelerates payment cycles. Businesses can improve cash flow management and reduce the risk of late payments.

Moreover, ePay offers enhanced security features, protecting sensitive financial information. It provides a streamlined and efficient way to manage both vendor payments and employee payroll. This can contribute to increased profitability and improved business operations.

By following this guide, businesses can seamlessly integrate ePay into their QuickBooks Desktop workflow. This enables them to leverage the benefits of electronic payments for enhanced financial management. Embrace the digital transformation to streamline your processes and gain a competitive edge.