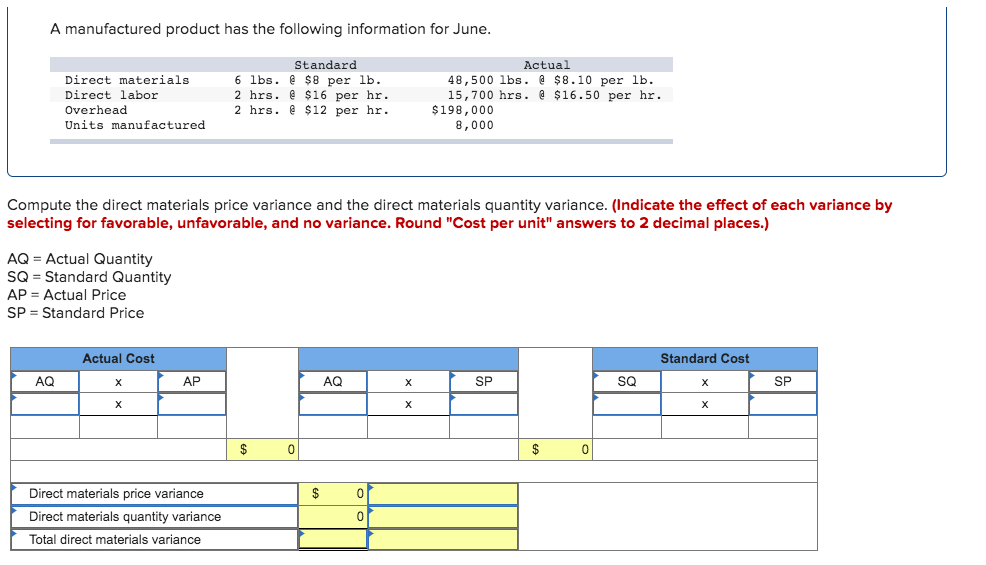

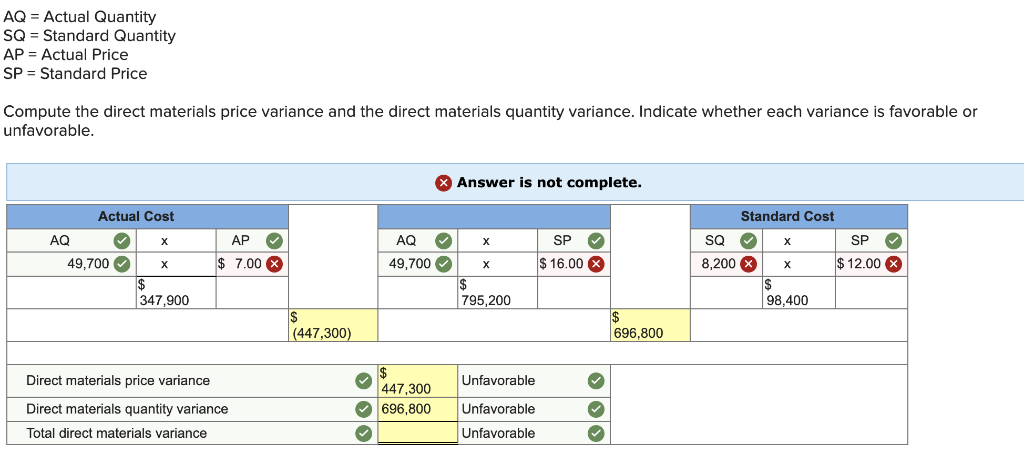

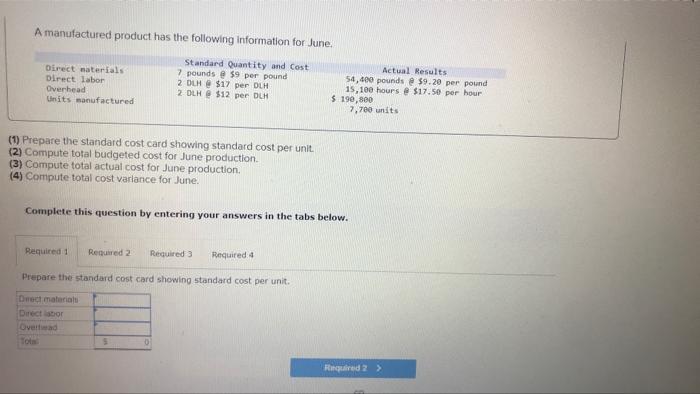

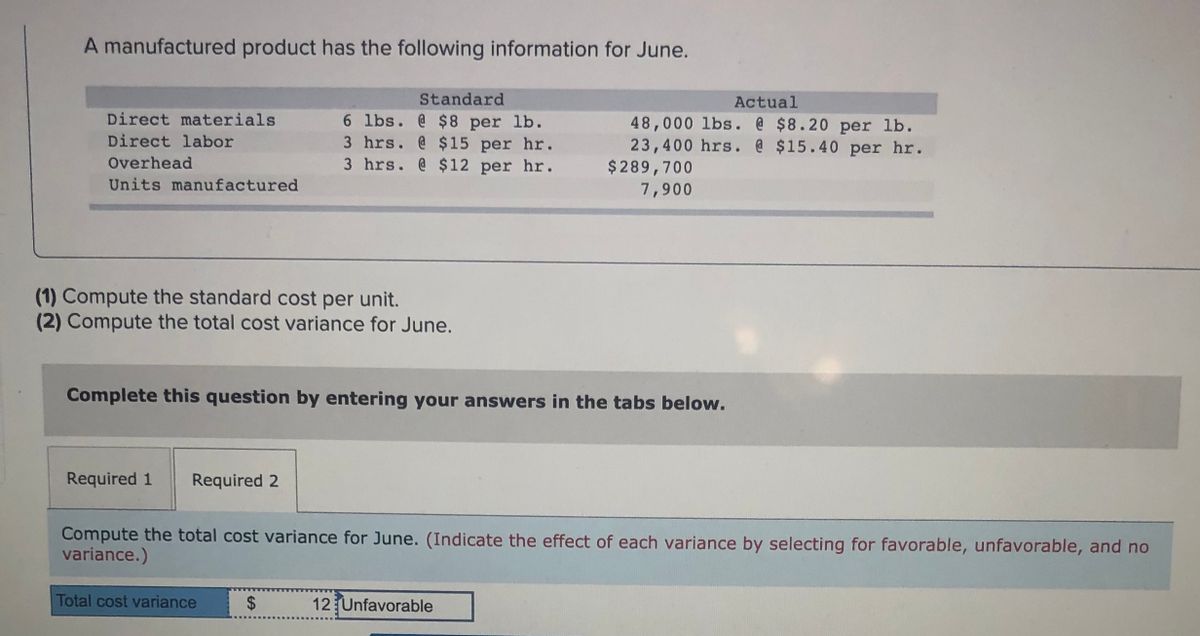

A Manufactured Product Has The Following Information For June

The global widget market is facing a turbulent period, marked by fluctuating demand, supply chain bottlenecks, and rising production costs. June's data paints a complex picture of the challenges and opportunities facing manufacturers in this crucial sector.

This report delves into the key indicators from June's widget manufacturing data, analyzing production volumes, sales figures, inventory levels, and pricing trends. We'll explore the factors driving these changes, including raw material costs, labor shortages, geopolitical instability, and shifting consumer preferences. Furthermore, we will examine the potential implications for the wider economy and future market stability.

Production Volumes: A Mixed Bag

Widget production experienced a slight contraction in June, according to data released by the International Widget Manufacturing Association (IWMA). The overall production volume dipped by 2.3% compared to May. This marginal decline reflects persistent supply chain disruptions impacting access to critical components.

However, the data reveals regional variations. North American manufacturers saw a more significant decrease in output, while Asian factories experienced a slight increase, suggesting a shift in production dynamics.

Reasons Behind the Production Dip

The primary factor behind the production slowdown is the ongoing shortage of semiconductors. Many advanced widgets rely on these chips. The IWMA cited this shortage as a critical constraint, hindering the ability of manufacturers to meet existing orders.

Rising energy costs also played a significant role. Energy-intensive manufacturing processes have become more expensive, forcing some companies to reduce their production output.

Sales Figures: Demand Remains Strong

Despite the production challenges, widget sales remained relatively robust in June. Data from the Global Widget Sales Tracker (GWST) indicates only a minor 0.8% decrease compared to May.

This resilience suggests continued strong underlying demand for widgets across various sectors. The report notes increased demand from the construction and automotive industries, offsetting some of the declines in consumer electronics.

Impact of Inflation on Sales

While sales volume remained steady, the GWST report acknowledges the impact of inflation on purchase decisions. Consumers are becoming more price-sensitive.

Many manufacturers are absorbing some of the increased production costs to maintain competitive pricing. However, this strategy is unsustainable in the long term.

Inventory Levels: A Growing Concern

With production lagging behind sales, widget inventory levels are dwindling. Data reveals a 7.5% decrease in total inventory held by manufacturers and retailers compared to May.

This depletion of inventory raises concerns about potential stockouts and delays in fulfilling orders. The IWMA warns that the low inventory levels could exacerbate supply chain vulnerabilities.

The "Just-in-Case" Shift

Many companies are reconsidering their reliance on "just-in-time" inventory management. They are moving towards a "just-in-case" approach.

This shift requires increased investment in warehousing and storage facilities. It also leads to higher carrying costs for businesses.

Pricing Trends: Upward Pressure

As production costs rise and inventory tightens, widget prices are under increasing upward pressure. The average widget price increased by 3.2% in June, according to the Widget Price Index (WPI).

This price inflation is likely to continue in the coming months. Manufacturers pass on the increased cost to consumers. This could dampen demand and potentially trigger a period of stagflation in the widget market.

Consumer Response to Price Hikes

The long-term impact of these price increases is uncertain. Consumers might delay purchases or seek alternative products. They might also opt for cheaper, lower-quality widgets.

Dr. Anya Sharma, a leading economist specializing in the widget market, noted that "consumer behavior will be a crucial factor in determining the future trajectory of the widget industry."

Regional Analysis: Asia Holds Strong

While the global widget market faces headwinds, Asian manufacturers have shown greater resilience. They have benefited from relatively lower labor costs and more stable supply chains.

China remains the world's largest widget producer. Countries like Vietnam and India are rapidly expanding their widget manufacturing capabilities.

The Impact of Geopolitical Instability

Geopolitical tensions in Europe and elsewhere are disrupting global trade flows. They are also impacting the widget market.

The war in Ukraine has created significant uncertainty. It has disrupted supply chains for raw materials used in widget production.

Looking Ahead: Uncertainty Prevails

The widget market faces a complex and uncertain future. The continuation of supply chain disruptions, rising inflation, and geopolitical instability will continue to challenge manufacturers.

Investments in technology, diversification of supply chains, and adaptation to changing consumer preferences will be crucial for success. The industry must strive for greater efficiency and sustainability.

The IWMA predicts that the widget market will experience modest growth in the second half of the year, but warns that the outlook remains highly dependent on macroeconomic conditions and geopolitical stability. Continuous monitoring and flexible strategies will be essential for navigating these turbulent times.

![A Manufactured Product Has The Following Information For June [Solved] A manufactured product has the following | SolutionInn](https://dsd5zvtm8ll6.cloudfront.net/si.experts.images/questions/2023/03/64253f7d93a79_1680162684993.jpg)

![A Manufactured Product Has The Following Information For June [Solved] A manufactured product has the following | SolutionInn](https://dsd5zvtm8ll6.cloudfront.net/questions/2024/05/663b1eadec0fb_663b1e5f21efaphpIBavRj.png)

![A Manufactured Product Has The Following Information For June [Solved] A manufactured product has the following | SolutionInn](https://dsd5zvtm8ll6.cloudfront.net/si.experts.images/questions/2022/04/624beaed6f7d4_1649142509477.jpg)

![A Manufactured Product Has The Following Information For June [Solved] A manufactured product has the following | SolutionInn](https://dsd5zvtm8ll6.cloudfront.net/si.experts.images/questions/2022/04/624c02e4eb0c8_644624c02e4c8d09.jpg)

![A Manufactured Product Has The Following Information For June [Solved] A manufactured product has the following | SolutionInn](https://dsd5zvtm8ll6.cloudfront.net/si.experts.images/questions/2022/04/624c02e43cfde_644624c02e41921f.jpg)