A Market Is Most Efficient When

Imagine a bustling farmer's market on a Saturday morning. The air is thick with the aroma of freshly baked bread, ripe fruits, and blooming flowers. Vendors call out their wares, each eager to make a sale. Customers weave through the stalls, comparing prices, examining produce, and engaging in lively negotiations.

But amidst this vibrant scene, a crucial question lurks: How do we know if this market, or any market for that matter, is working as well as it possibly can? This article delves into the concept of market efficiency, exploring the conditions under which a market allocates resources optimally, benefiting both buyers and sellers.

Understanding Market Efficiency

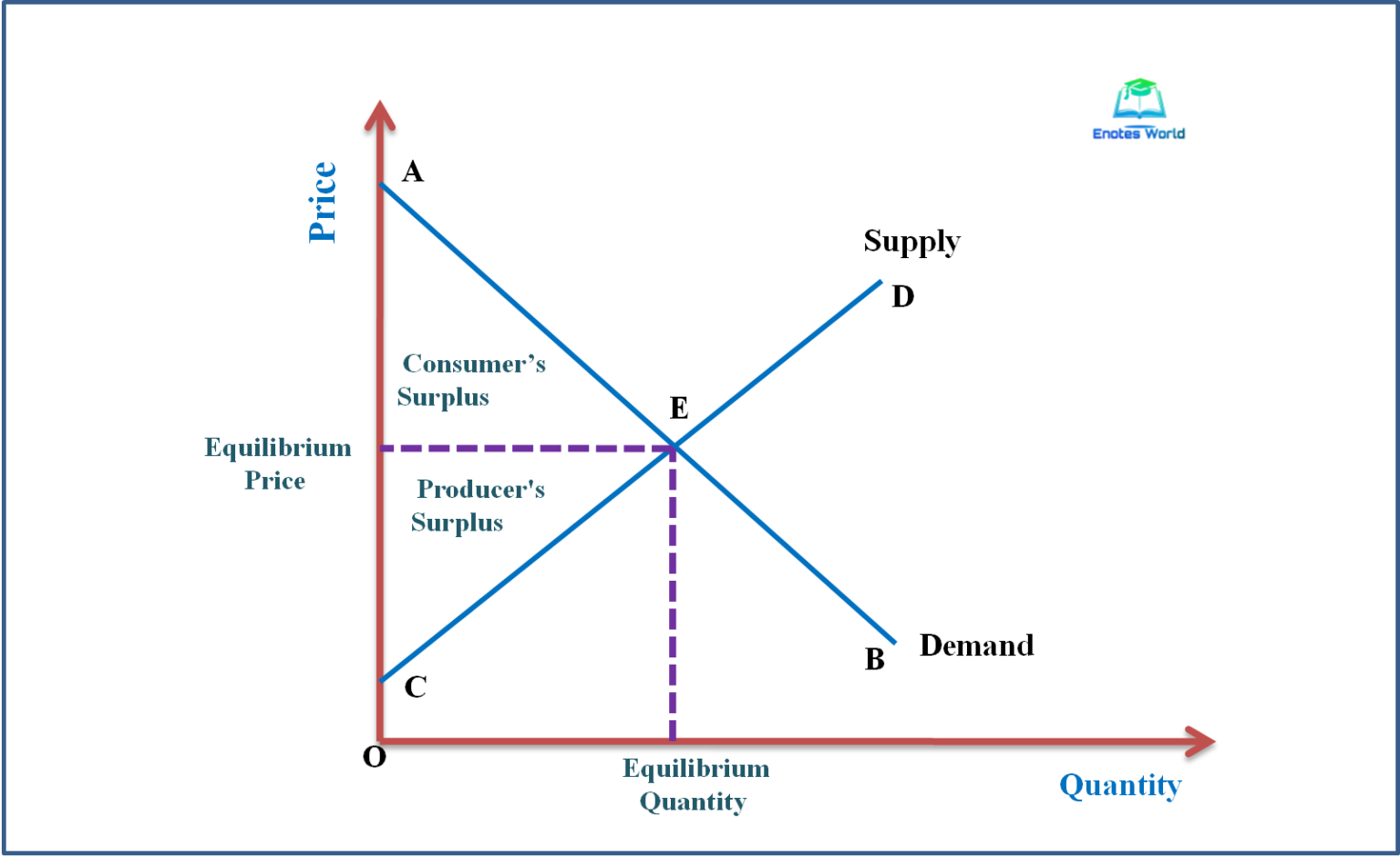

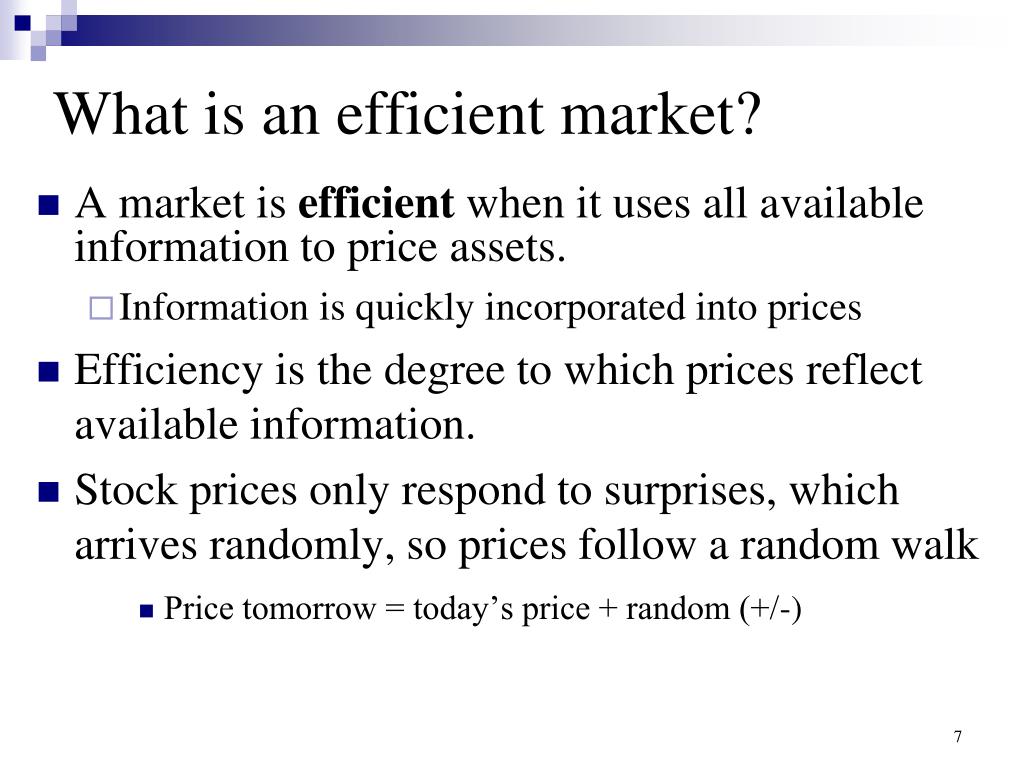

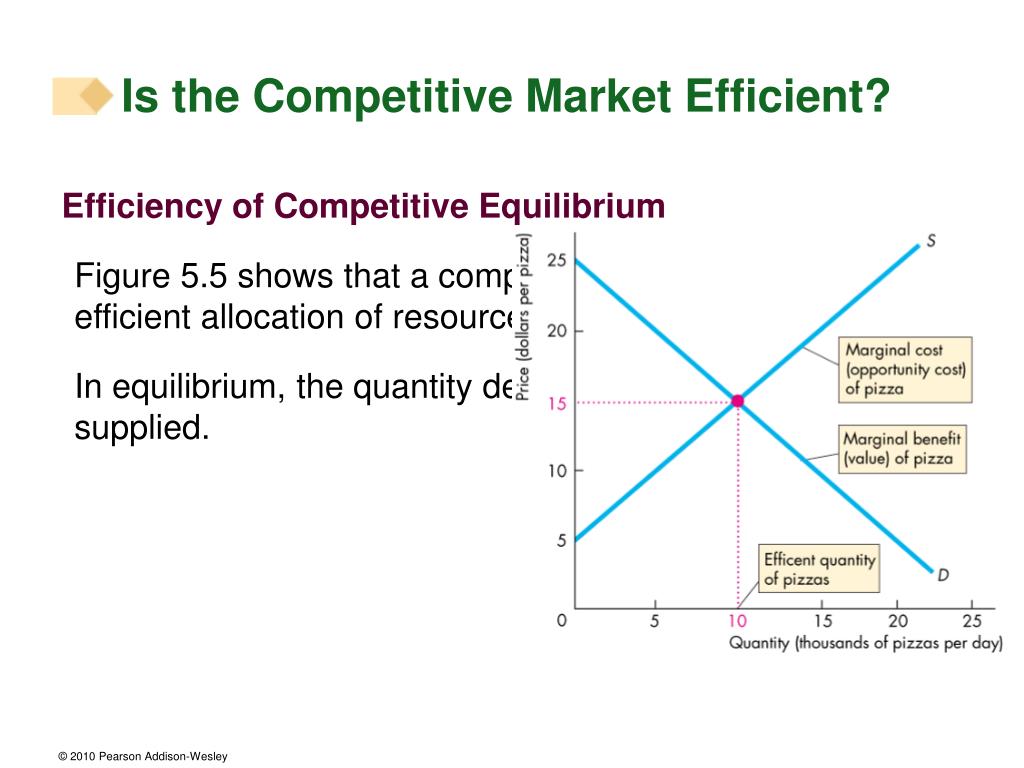

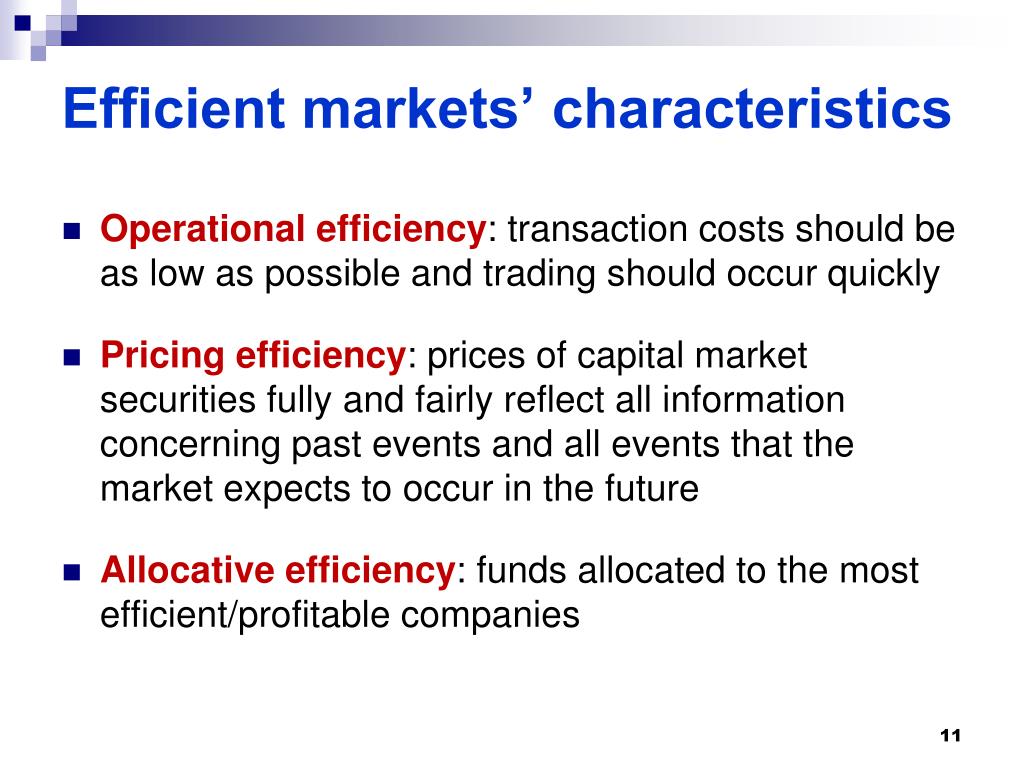

At its core, market efficiency refers to the extent to which market prices reflect all available information. In an efficient market, resources are allocated to their most valued uses, leading to maximum overall welfare. This doesn't mean everyone is happy or that there's no inequality, but rather that it's impossible to reallocate resources in a way that makes some people better off without making others worse off—a state known as Pareto efficiency.

The concept of market efficiency is central to economics. It provides a benchmark against which to evaluate real-world markets and informs policy decisions aimed at improving market performance.

The Ideal Conditions for Efficiency

Several key conditions contribute to a market's efficiency. The presence of these factors significantly enhances a market’s ability to allocate resources effectively.

Perfect Competition

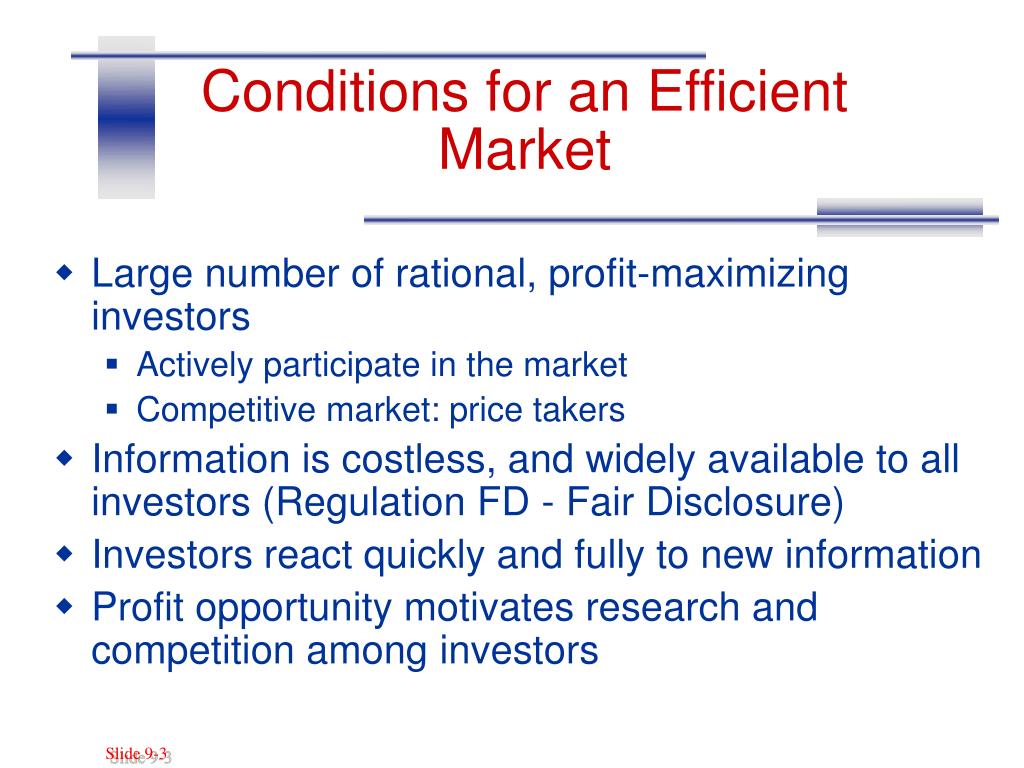

Perhaps the most fundamental requirement is perfect competition. This implies a market structure characterized by numerous buyers and sellers, none of whom have the power to individually influence prices. Each participant is a price taker, accepting the market price as given.

This situation ensures that prices accurately reflect supply and demand. No single entity can distort the market to their advantage.

Perfect Information

Another critical element is perfect information. All participants have access to the same, complete, and accurate information about the goods or services being traded. This includes information about prices, quality, availability, and future prospects.

With perfect information, buyers and sellers can make informed decisions, preventing information asymmetries that could lead to market failures. This ensures that decisions are based on the true value of the good or service.

No Externalities

Externalities, whether positive or negative, can disrupt market efficiency. A negative externality occurs when the production or consumption of a good imposes costs on third parties who are not involved in the transaction (e.g., pollution from a factory). Conversely, a positive externality arises when the production or consumption of a good benefits third parties (e.g., the benefits of education for society as a whole).

When externalities are present, the market price does not reflect the true social costs or benefits. This leads to either overproduction or underproduction of the good or service in question.

Well-Defined Property Rights

Clear and enforceable property rights are essential for market efficiency. These rights define who owns what and what they are allowed to do with their property.

Without well-defined property rights, there is uncertainty and the potential for disputes. This reduces the incentive for individuals to invest and engage in market transactions.

Rational Actors

Classical economic theory often assumes that market participants are rational actors. That they make decisions based on their own self-interest and seek to maximize their utility or profits.

While this assumption is often debated, it underpins many models of market efficiency. Deviations from rationality, such as behavioral biases, can lead to suboptimal outcomes.

The Role of Government

While the ideal market is often considered self-regulating, governments play a vital role in promoting market efficiency. This involves addressing market failures and ensuring that the conditions for efficiency are met.

Governments can implement policies to correct externalities, such as taxes on pollution or subsidies for education. They can also enforce property rights and promote competition by preventing monopolies and anti-competitive behavior.

Regulations designed to ensure transparency and prevent fraud are also crucial. These regulations help to level the playing field and ensure that participants have access to reliable information.

The Real World: Imperfect but striving

In reality, few, if any, markets perfectly meet all the conditions for efficiency. Information is often imperfect, externalities are common, and participants are not always perfectly rational. However, this does not mean that the concept of market efficiency is irrelevant.

It provides a useful framework for understanding how markets work and identifying areas for improvement. By understanding the factors that contribute to efficiency, we can develop policies and strategies to make markets work better for everyone.

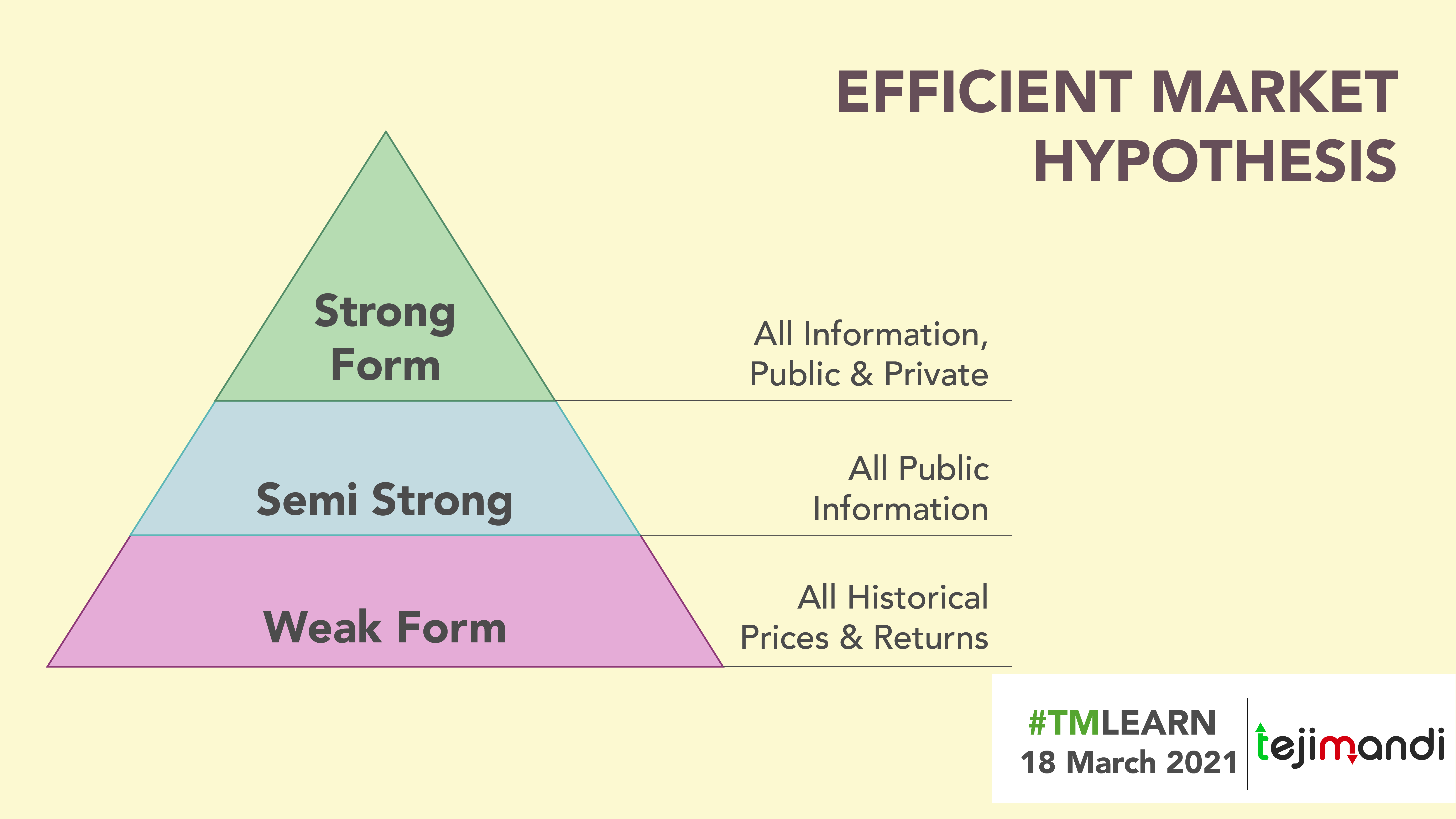

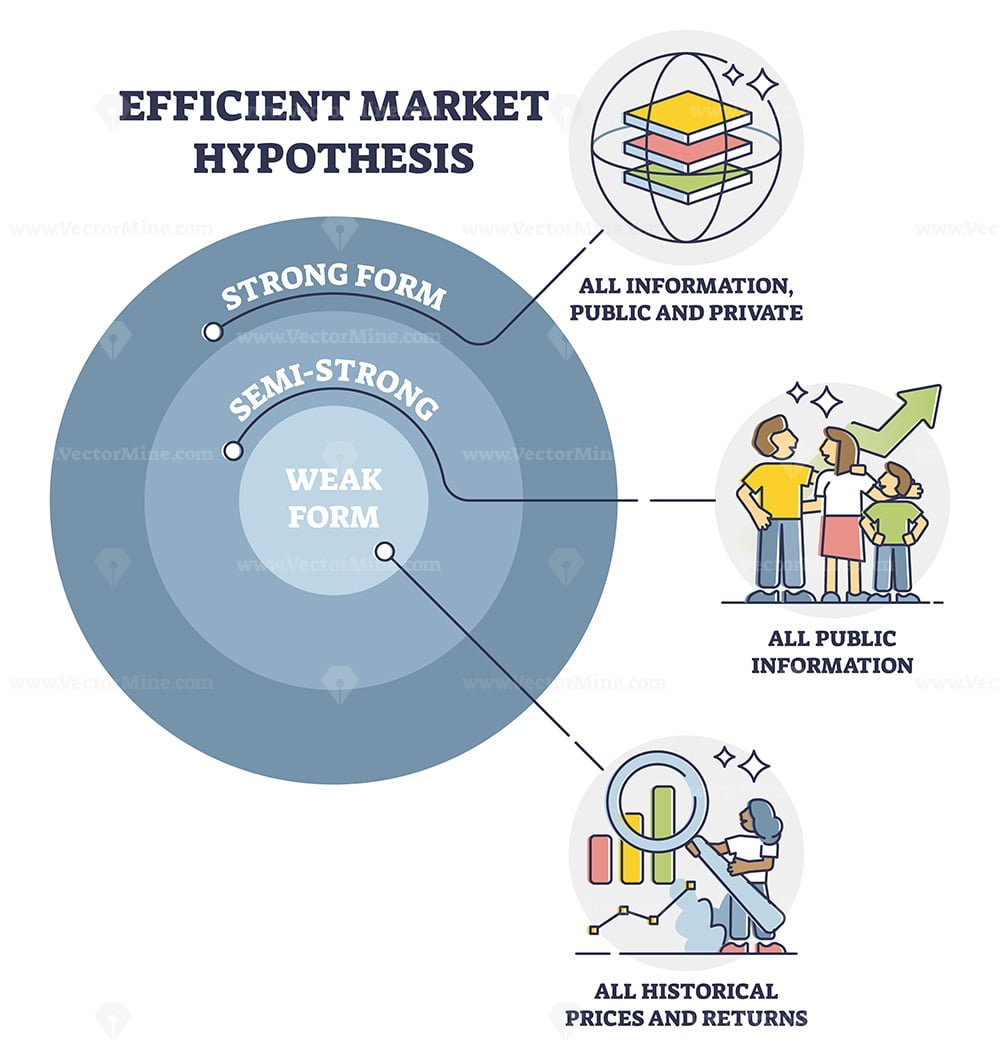

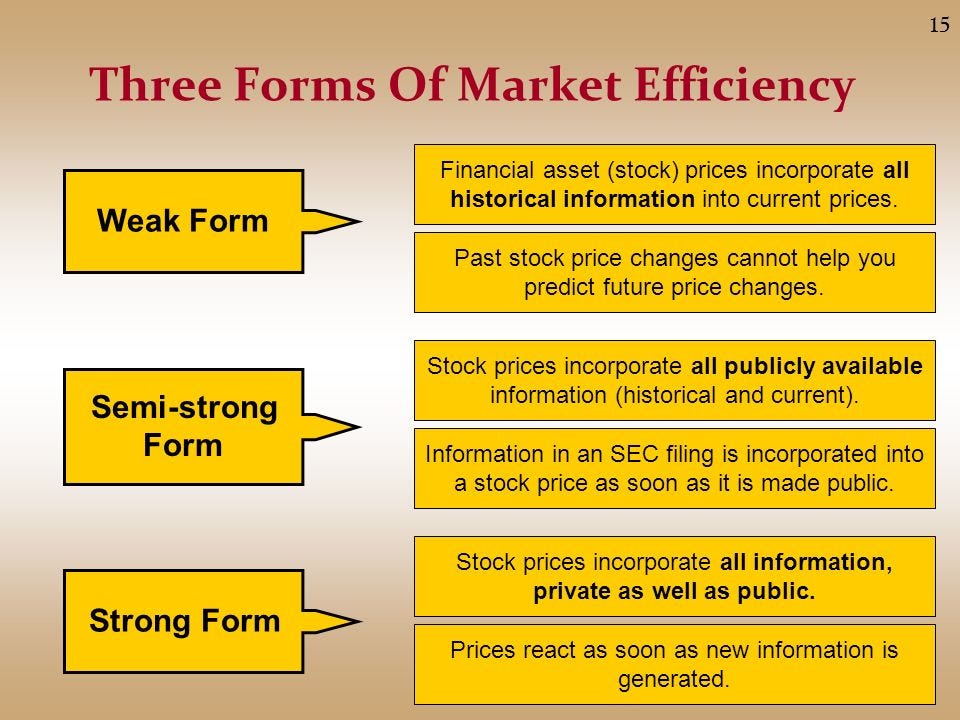

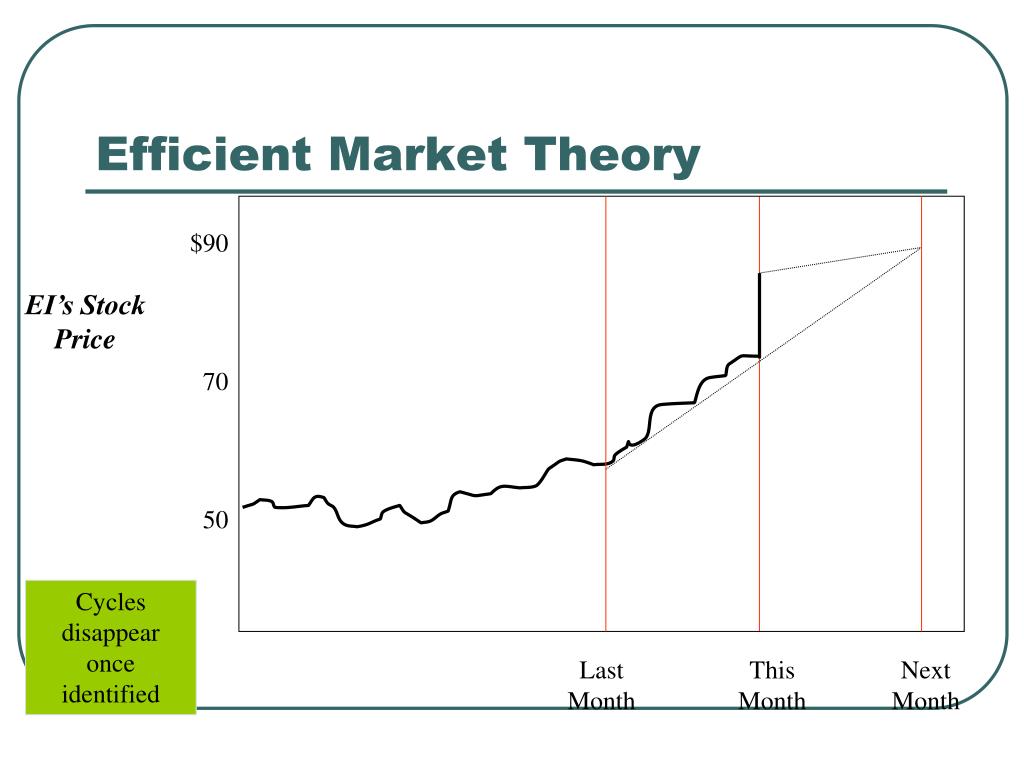

The Efficient Market Hypothesis (EMH), particularly in its strongest form, suggests that it is impossible to consistently "beat the market" because prices already reflect all available information. While controversial, it highlights the power of markets to quickly incorporate new information.

The Pursuit of Efficiency: A Continuous Journey

The pursuit of market efficiency is an ongoing process. As technology evolves, consumer preferences shift, and new challenges emerge, markets must adapt and innovate to remain efficient.

This requires a continuous effort to improve information flows, address externalities, and promote competition. It also calls for a willingness to experiment with new approaches and to learn from past mistakes.

Think back to that bustling farmer's market. While it may not perfectly embody the theoretical ideal of market efficiency, it exemplifies the power of voluntary exchange and decentralized decision-making. It embodies the essence of what a market can be.

By striving to create environments where information is readily available, competition flourishes, and individual choices are respected, we can move closer to that ideal. This, in turn, will lead to a more prosperous and equitable society for all.

:max_bytes(150000):strip_icc()/terms_m_marketefficiency.asp-Final-edeca29099ff42f0984dce267ed4c883.jpg)