Steps In Buying An Existing Business

Imagine stepping into a bustling bakery, the aroma of warm bread and sweet pastries filling the air. The ovens hum a gentle tune, a testament to years of perfected recipes and a loyal customer base. Owning a business, like this bakery, might seem like a distant dream. However, acquiring an existing business is a tangible path to entrepreneurship, offering a shortcut through the initial hurdles of building a brand from scratch.

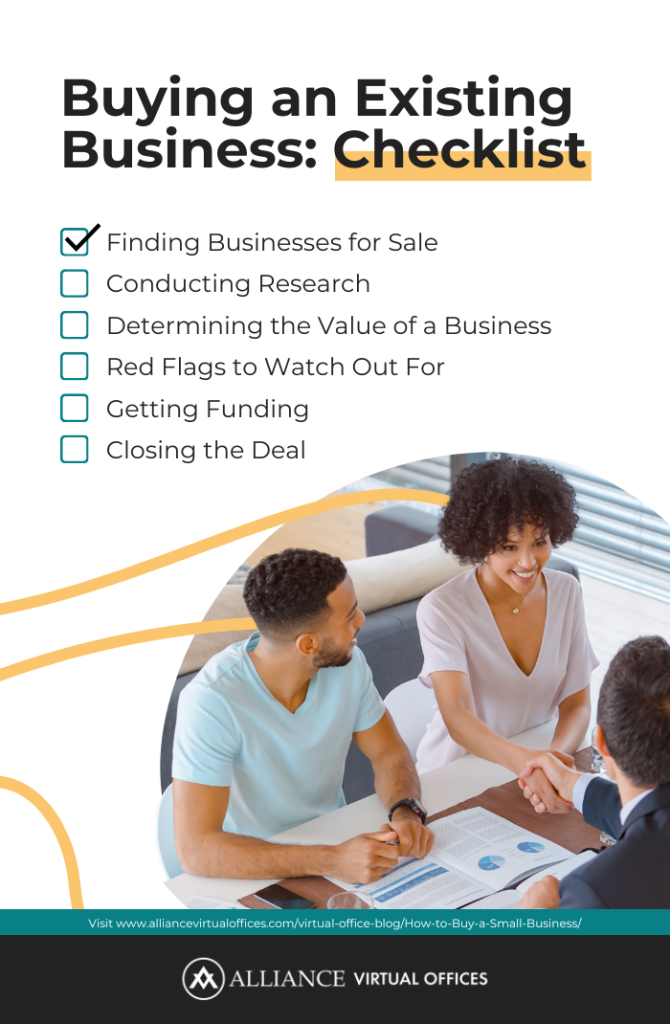

This article explores the key steps involved in buying an existing business, providing a roadmap for aspiring entrepreneurs to navigate this exciting, but often complex, journey. From initial research to final negotiations, we'll unpack the essential elements for a successful acquisition.

Laying the Foundation: Research and Self-Assessment

Before diving into the market, self-assessment is crucial. What are your skills, interests, and financial capabilities? What kind of business are you passionate about, and where do you see yourself contributing the most value?

Consider your risk tolerance and lifestyle preferences. This introspection will guide your search towards opportunities that align with your personal and professional goals. Researching different industries and market trends is the next critical step.

Websites like the Small Business Administration (SBA) and industry-specific publications offer valuable insights. Understanding the competitive landscape, potential growth areas, and emerging technologies will help you make informed decisions.

Finding the Right Fit: Sourcing and Evaluating Opportunities

Several avenues can lead you to potential acquisition targets. Online business marketplaces like BizBuySell and BusinessesForSale list thousands of businesses for sale across various sectors and geographies. Brokers specializing in business acquisitions can also provide access to exclusive listings and expert guidance.

Networking within your industry and contacting business owners directly can uncover hidden gems. Once you've identified a promising business, due diligence is paramount.

This involves a thorough examination of the business's financial records, legal compliance, customer base, and operational processes. Engage professionals such as accountants, lawyers, and industry consultants to conduct independent audits and assessments.

Their expertise will help you uncover any red flags and determine the true value of the business. Pay close attention to the business's financial performance over the past several years. Analyze revenue trends, profit margins, and cash flow to assess its stability and growth potential.

Digging Deeper: Financials and Legal Considerations

Scrutinize the assets and liabilities of the business, including inventory, equipment, and outstanding debts. Understand the terms of existing contracts with suppliers, customers, and employees.

A comprehensive legal review is essential to identify any potential liabilities or legal disputes. This should include examining the business's compliance with regulations, permits, and licenses. Ensure that the lease agreement for the business premises is favorable and transferable.

You'll also want to understand the terms of existing contracts with suppliers, customers, and employees. Don't overlook the importance of intellectual property, such as trademarks, patents, or copyrights. Make sure these assets are properly protected and transferable to the new owner.

Sealing the Deal: Negotiation and Closing

With a clear understanding of the business's value and potential risks, you can begin negotiating the purchase price and terms. Base your offer on the due diligence findings and market comparisons of similar businesses. Be prepared to walk away if the seller is unwilling to negotiate fairly or address any significant concerns.

The purchase agreement should clearly outline all terms and conditions of the sale, including the purchase price, payment schedule, closing date, and any contingencies. It should also address issues such as non-compete agreements, employee retention, and the transfer of intellectual property.

Obtain financing from a bank, credit union, or private investor to fund the acquisition. The SBA offers loan programs specifically designed to support small business acquisitions.

The closing process involves finalizing all legal and financial documents, transferring ownership of the business, and paying the purchase price. Work closely with your legal and financial advisors to ensure a smooth and seamless transition.

Beyond the Purchase: Transition and Growth

Once the deal is closed, the real work begins. Develop a transition plan to ensure a smooth handover of operations from the previous owner. Communicate clearly with employees, customers, and suppliers about the change in ownership and your vision for the future.

Embrace the existing business's strengths while identifying opportunities for improvement and innovation. Invest in marketing, technology, and employee training to drive growth and profitability. Build strong relationships with your customers and become an active member of the local community.

Owning an existing business can be a rewarding and fulfilling experience. By following these steps and seeking expert advice, you can increase your chances of success and build a thriving enterprise.