Western Union Aml Compliance Quiz Answers

The integrity of financial systems hinges on robust anti-money laundering (AML) compliance. Recent concerns surrounding publicly available answers to Western Union's AML compliance quizzes have sparked debate and raised questions about the effectiveness of their training programs.

This situation threatens to undermine the very foundation of AML efforts. It calls into question whether employees are truly internalizing the necessary knowledge to detect and prevent illicit financial activities.

The Core Issue: Compromised Training Integrity

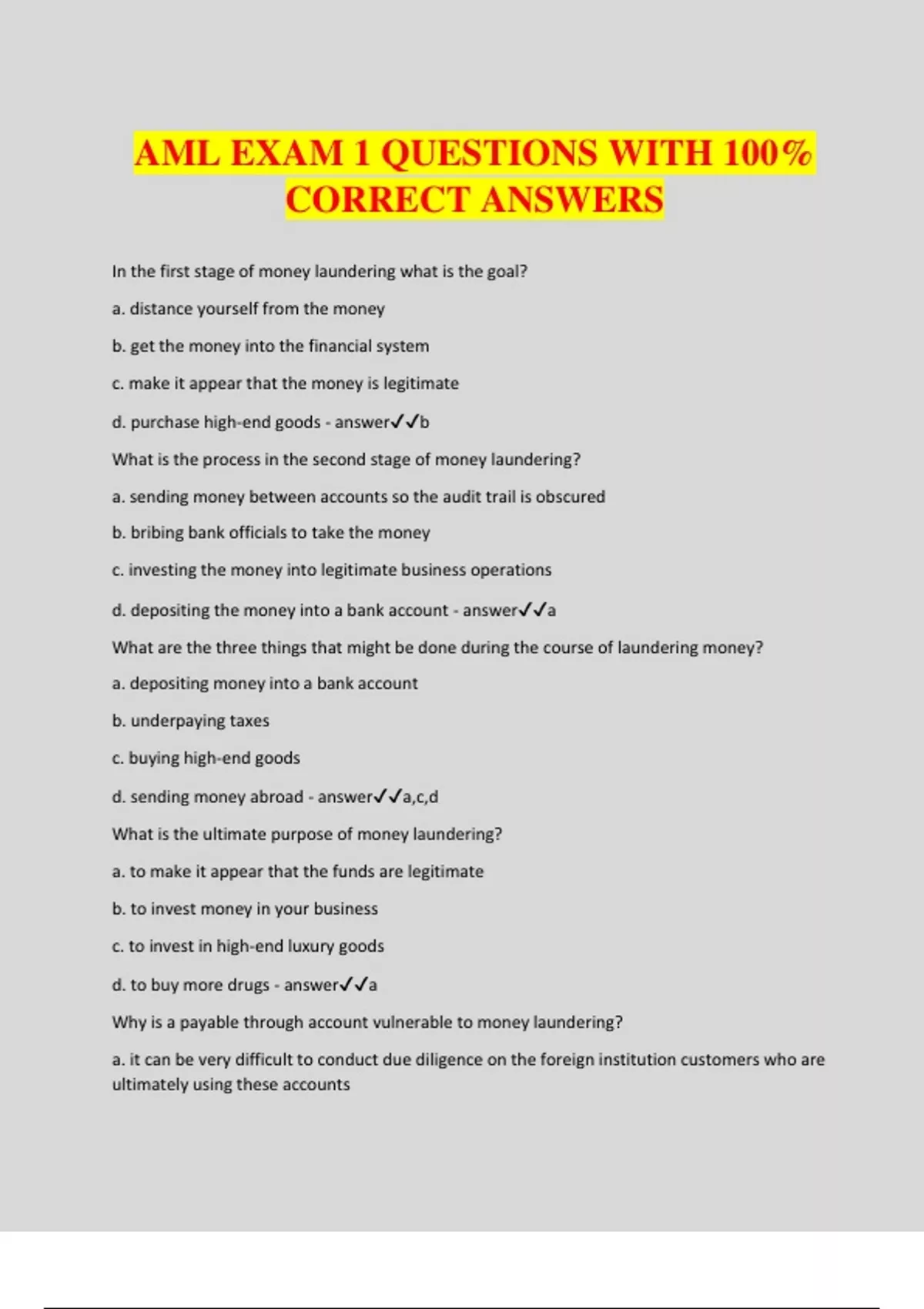

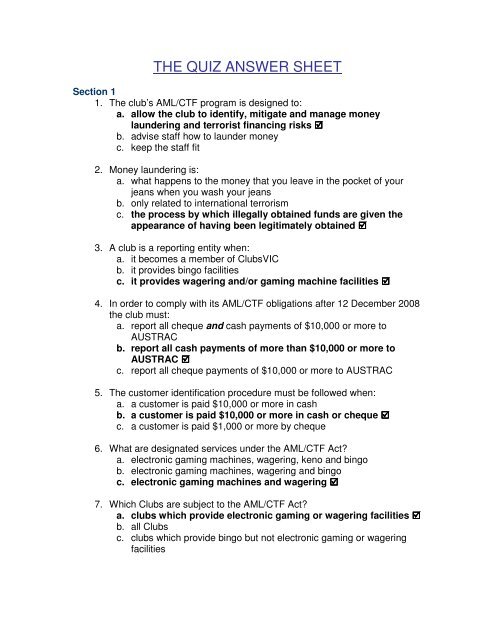

At the heart of the controversy lies the accessibility of Western Union AML compliance quiz answers. These answers, reportedly circulating online, potentially allow employees to pass assessments without genuinely understanding the underlying principles of AML. This poses a significant risk to the company and the global financial system.

A strong AML program is crucial to prevent criminals from exploiting financial services. The program allows them to launder money derived from illegal activities such as drug trafficking, terrorism financing, and fraud.

Compromised training can weaken the first line of defense against financial crime.

Western Union's Response and Remedial Actions

Western Union has acknowledged the issue and stated they are taking steps to address the situation. "Western Union is committed to maintaining the highest standards of AML compliance," a company spokesperson stated. The company has reportedly initiated internal investigations to identify the source of the leaked information.

They are also reviewing and updating their training materials and assessment procedures. These actions aim to prevent future breaches and ensure employees receive proper training.

Western Union is working to reinforce the importance of ethical conduct and knowledge retention. This is being done throughout its global operations.

Expert Perspectives on the Implications

AML experts express serious concerns about the potential consequences of this security lapse. "The circulation of quiz answers renders the training ineffective," notes John Smith, a former AML regulator. He added, "It creates a false sense of security and undermines the entire AML framework."

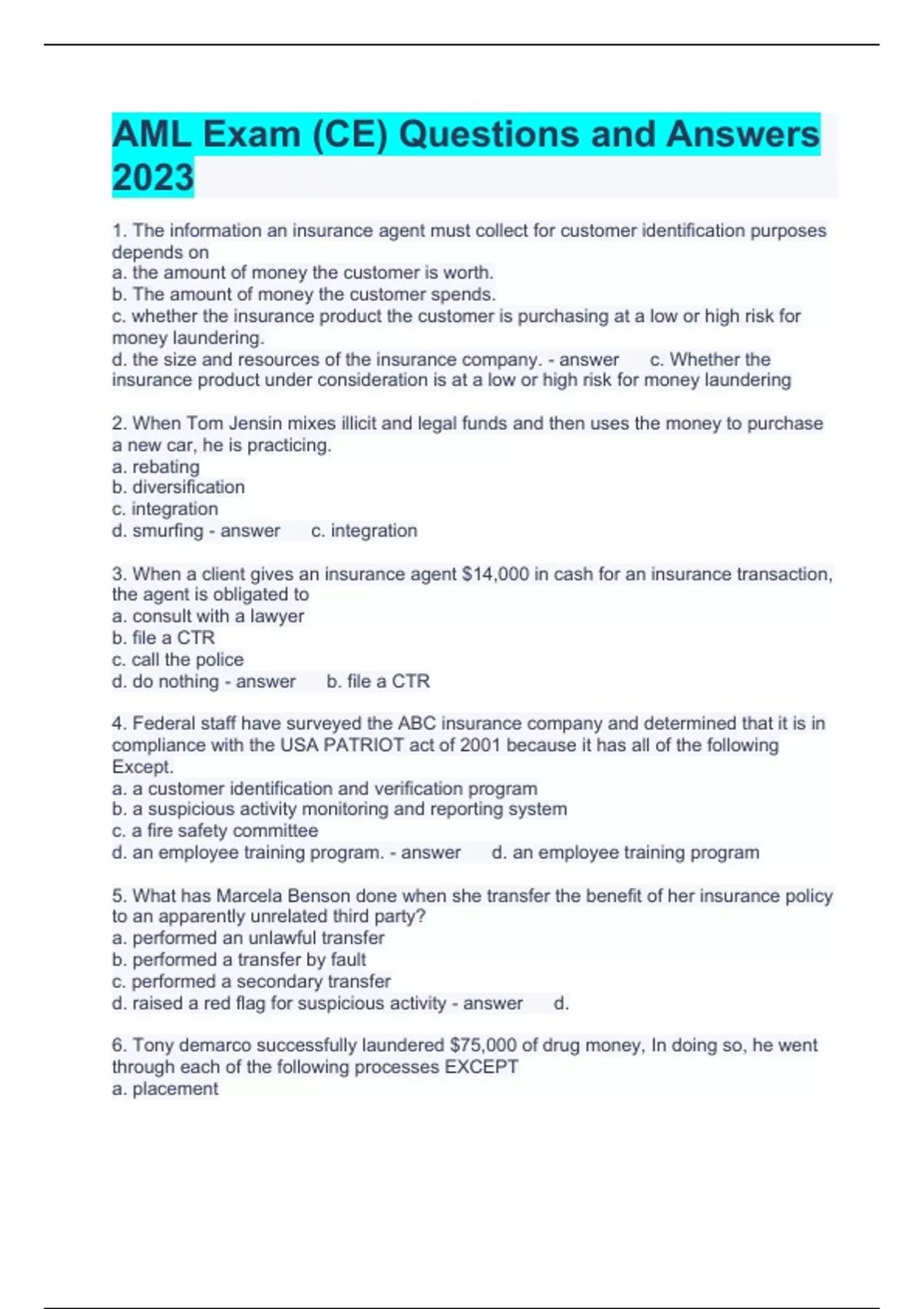

According to financial crime expert Sarah Lee, companies must prioritize robust security measures to protect sensitive training materials. "Regular audits and revisions of training content are also essential to stay ahead of emerging threats," she emphasizes.

The incident raises broader concerns about the security and integrity of online training programs. It highlights the need for stronger measures to prevent cheating and ensure genuine knowledge acquisition.

The Regulatory Landscape and Potential Penalties

AML regulations are stringent and enforced by various regulatory bodies globally. Non-compliance can result in hefty fines, reputational damage, and even criminal charges.

Regulatory agencies like the Financial Crimes Enforcement Network (FinCEN) in the US and similar bodies in other countries hold financial institutions accountable for lapses in their AML programs. These lapses include inadequate training.

The discovery of compromised training materials can trigger regulatory scrutiny. This can lead to investigations and potential enforcement actions against Western Union.

Strengthening AML Defenses: A Path Forward

Addressing the compromised quiz answers requires a multi-faceted approach. This approach should include not only immediate remedial actions but also long-term strategies to strengthen AML defenses.

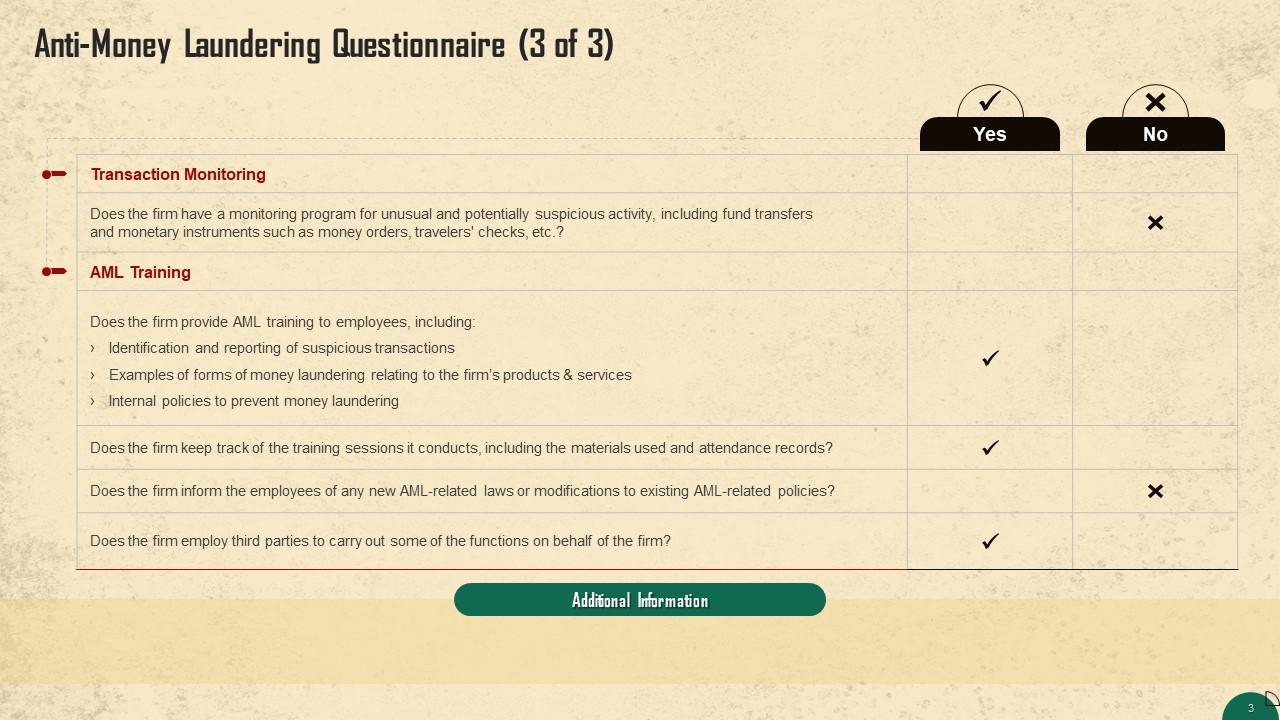

Companies must invest in more secure and interactive training platforms. They should also incorporate regular knowledge checks and simulations to assess employee understanding.

Emphasis should be placed on cultivating a culture of compliance within organizations. Encouraging employees to report suspicious activity is crucial for detecting and preventing financial crime.

Moving Forward: Building a Culture of Compliance

The Western Union incident serves as a stark reminder of the importance of maintaining the integrity of AML training programs. A proactive and vigilant approach is essential to safeguarding the financial system from illicit activities.

By prioritizing security, continuous improvement, and a strong culture of compliance, companies can effectively mitigate the risks associated with money laundering. They can also protect themselves from regulatory penalties and reputational damage.

Ultimately, the strength of the AML framework depends on the knowledge, skills, and ethical commitment of every individual involved in the financial system.