How To Remove A Name From A Business Partnership

Business partnerships can dissolve, demanding swift action. Removing a partner's name requires legal precision and adherence to established procedures.

Navigating this process incorrectly can lead to costly litigation and jeopardize the business's future. Here's what you need to know, immediately.

Understanding the Partnership Agreement

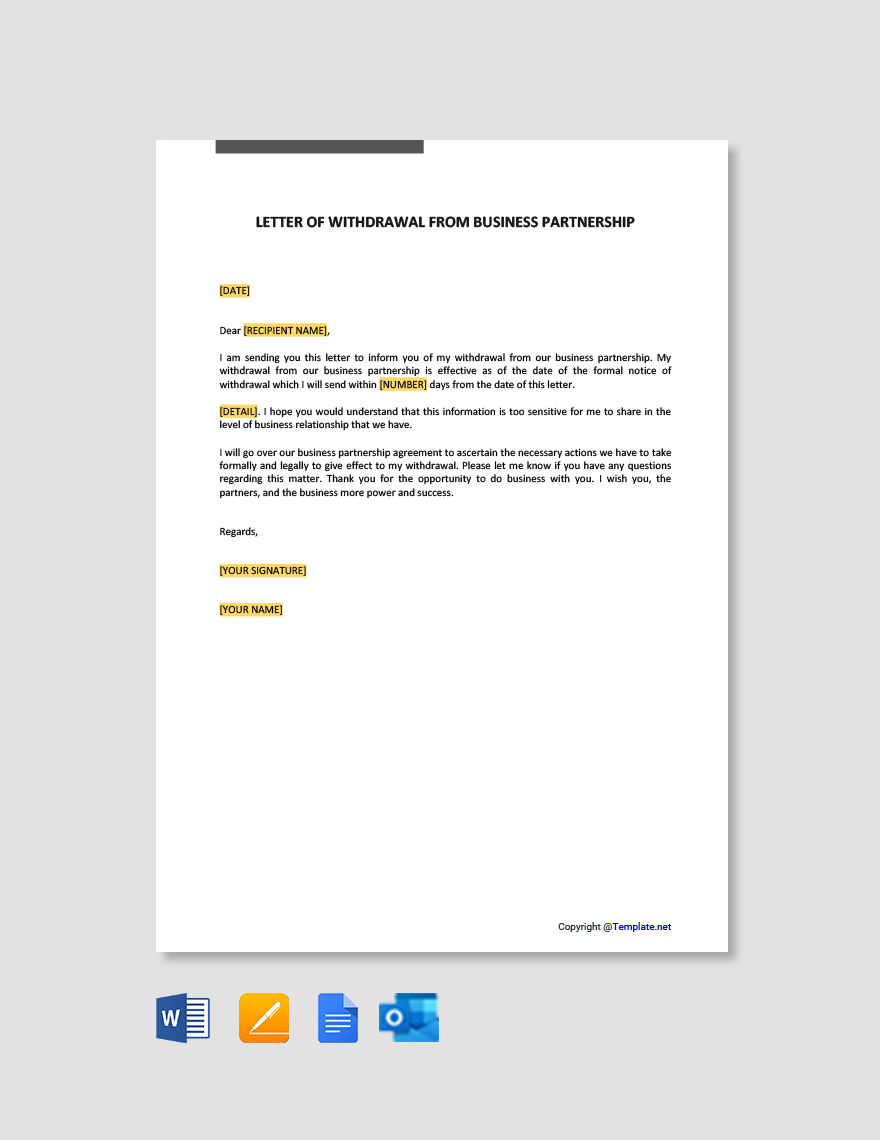

The first step is to meticulously review the existing partnership agreement. This document outlines the terms for partner withdrawal, including procedures for name removal.

Pay close attention to clauses addressing dissolution, buyout options, and transfer of ownership. This agreement dictates everything.

If no agreement exists, state partnership laws govern the dissolution process. This often defaults to a more complex and potentially contentious outcome.

The Buyout Process

Typically, the remaining partners will need to buy out the departing partner's share. This requires a fair valuation of the business.

Consider engaging a qualified appraiser to determine the business's current market value. Disagreements over valuation are a common source of disputes.

Secure financing if needed to fund the buyout. Explore options like loans or investment from new partners.

Legal Documentation and Filings

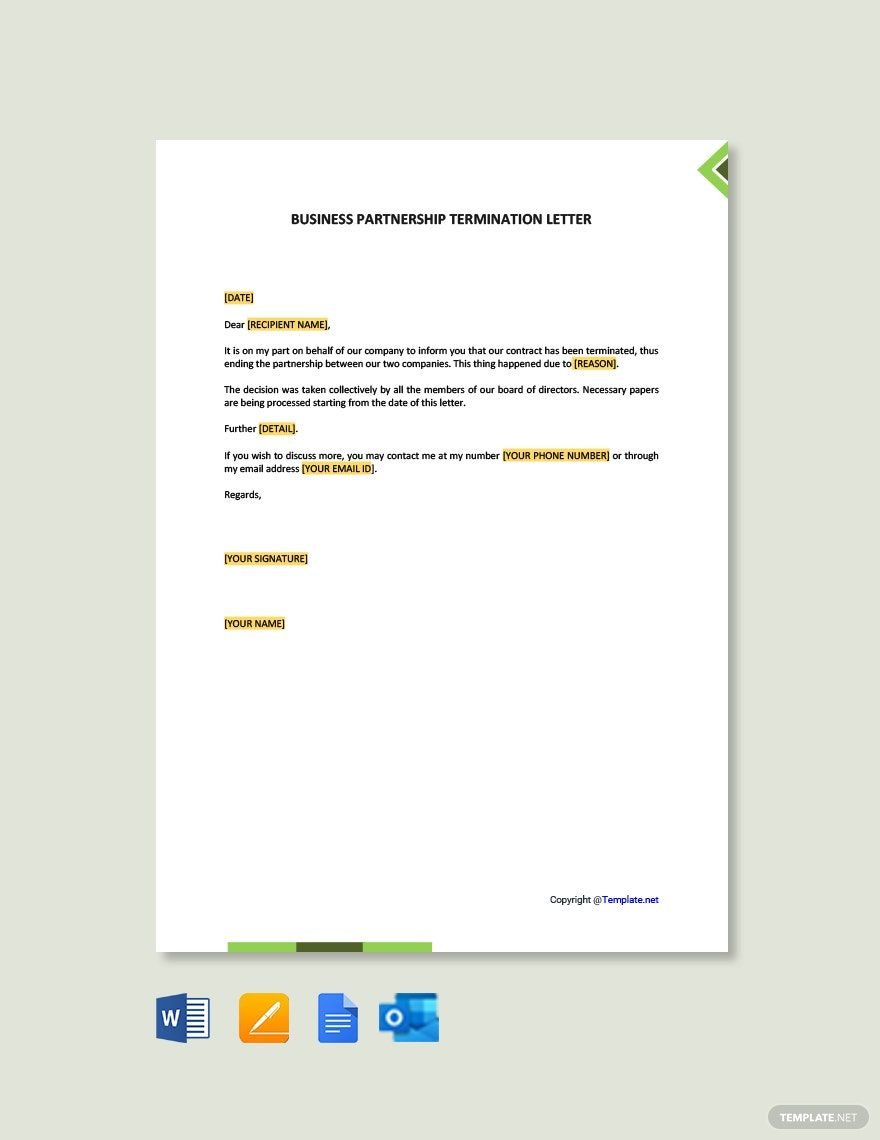

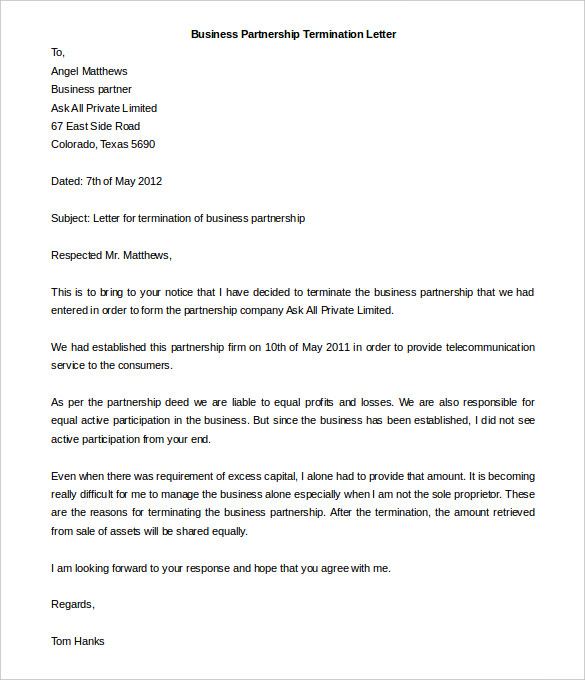

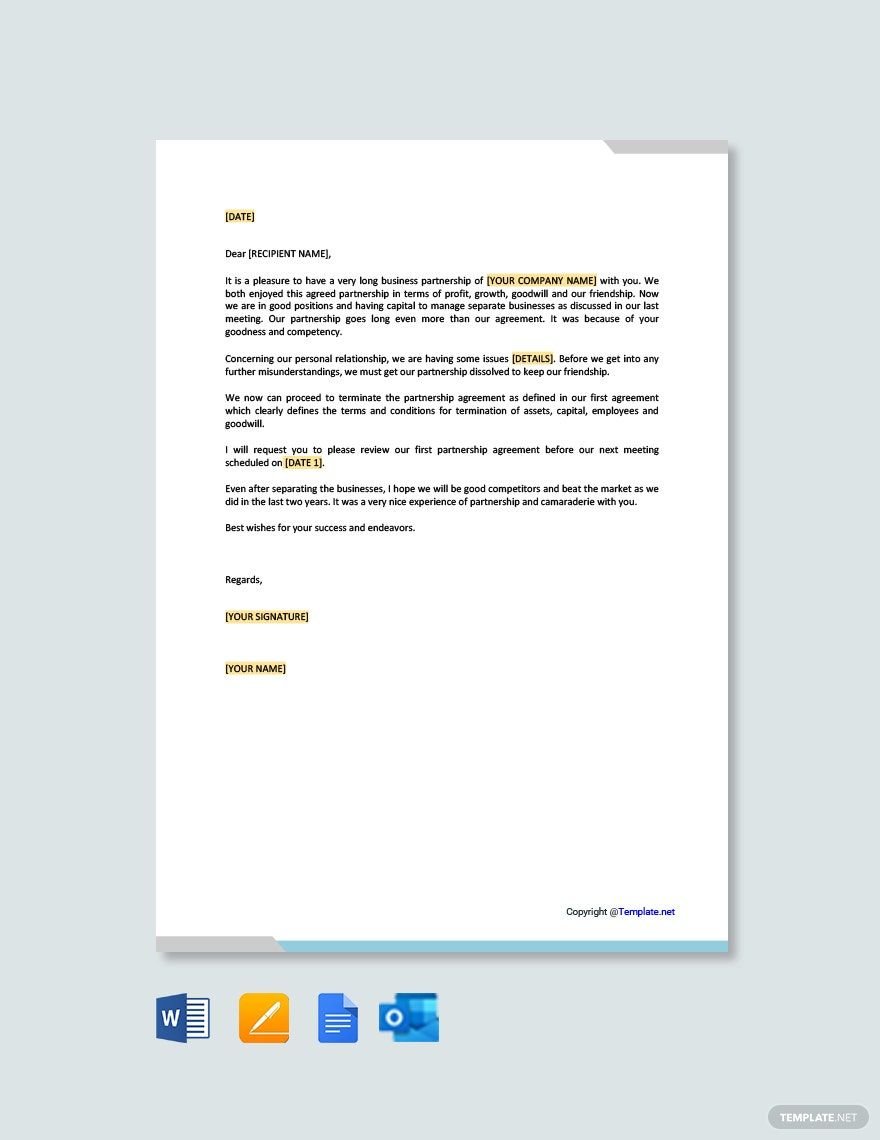

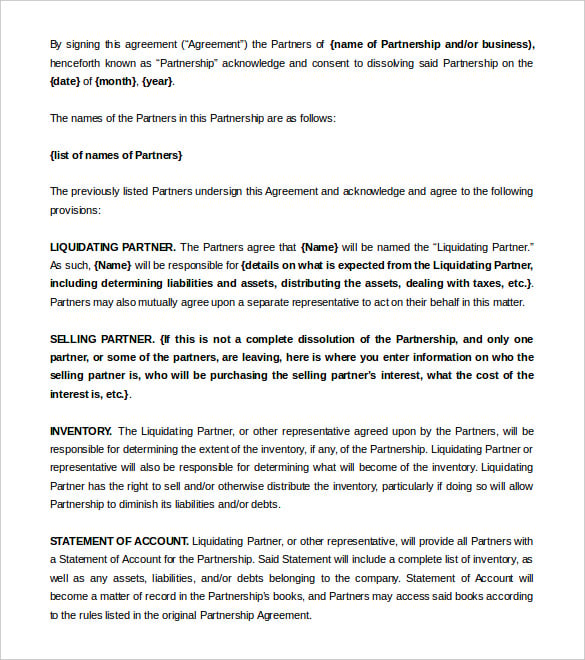

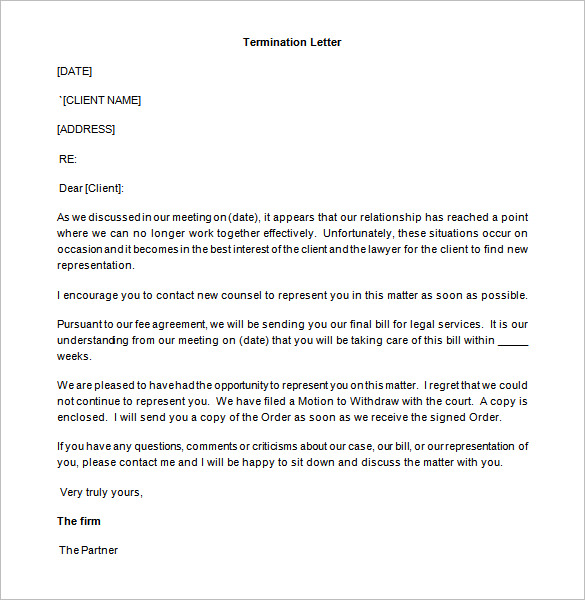

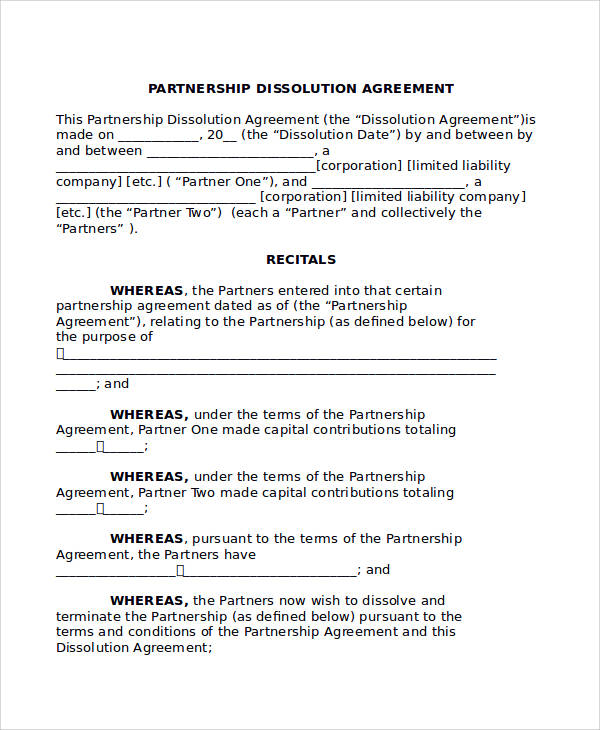

Formalize the partner's departure with a written dissolution agreement. This document should clearly state the terms of the buyout and release all parties from future liabilities.

Consult with an attorney to draft and review the agreement. This is critical to ensure legal compliance and protect the remaining partners' interests.

File the necessary paperwork with the relevant state authorities. This usually involves amending the business's registration and filing a Statement of Dissolution.

Notifying Stakeholders

Inform all relevant stakeholders, including customers, suppliers, and financial institutions. Transparency is vital to maintain trust and ensure a smooth transition.

Update all business documents, including contracts, marketing materials, and online listings. Remove the departing partner's name from all official representations.

Notify the Internal Revenue Service (IRS) of the change in partnership structure. File the appropriate tax forms to reflect the departure.

Potential Complications

Disputes over valuation or the terms of the buyout are common pitfalls. Mediation or arbitration may be necessary to resolve conflicts.

If the departing partner holds significant intellectual property or client relationships, address these issues in the dissolution agreement. Secure necessary transfers.

Failure to comply with legal requirements can result in personal liability for the remaining partners. Seek legal counsel immediately if complications arise.

Next Steps

Consult with an attorney to initiate the formal dissolution process. Gather all relevant documents, including the partnership agreement and financial records.

Begin the valuation process to determine a fair buyout price. Communicate openly with the departing partner to facilitate a smooth transition.

Procrastination is costly; act decisively to protect your business interests. The future of your business depends on it.