Best Place To Buy Gold In Chicago

Chicago residents seeking to invest in gold face a complex market. Navigating the options requires careful consideration of reputation, pricing, and security.

This report identifies top locations for buying gold in Chicago, focusing on transparency, customer service, and competitive rates to guide both novice and experienced investors. Finding a trustworthy dealer is crucial in the current economic climate.

Reputable Gold Dealers in Chicago

Dillon Gage Metals, while not strictly a storefront in Chicago, offers a secure online platform and is a well-established national bullion dealer serving many Chicago investors. They are known for their wide selection and competitive pricing. Investors should compare their offerings carefully with local dealers.

Chicago Gold Gallery located on the Northwest side has a reputation for fair dealings. They are known for buying and selling gold coins, jewelry, and bullion.

Luriya Jewelry & Loan, a pawn shop in the heart of Chicago, also trades in gold. This can be a viable option, but prices may be less favorable than dedicated dealers.

Key Considerations When Buying Gold

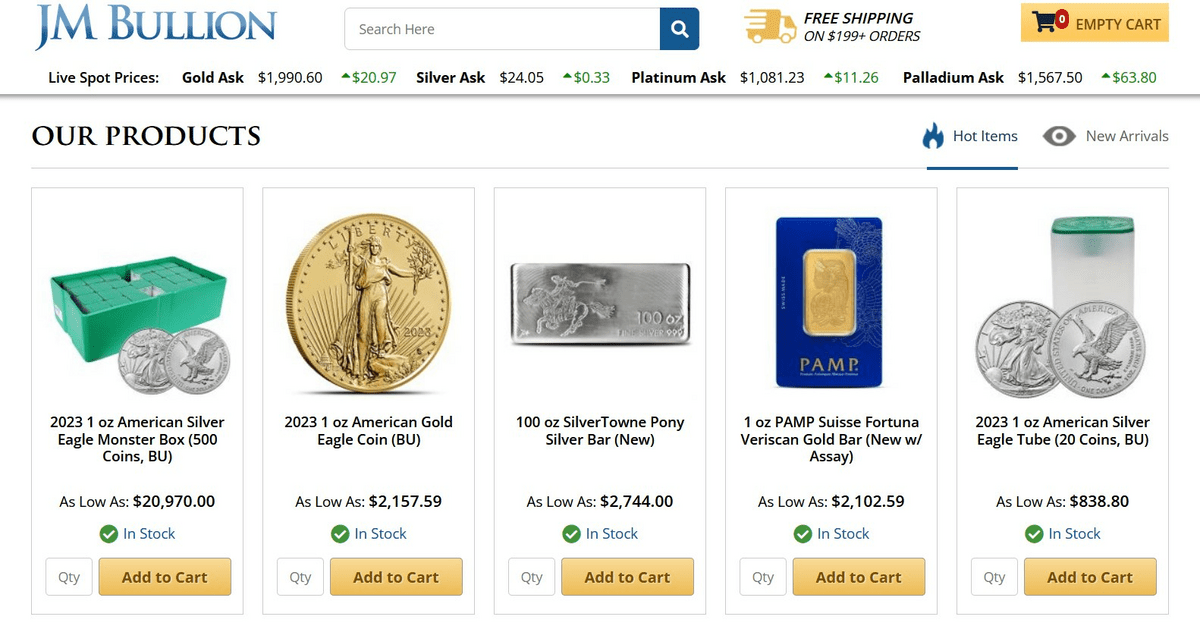

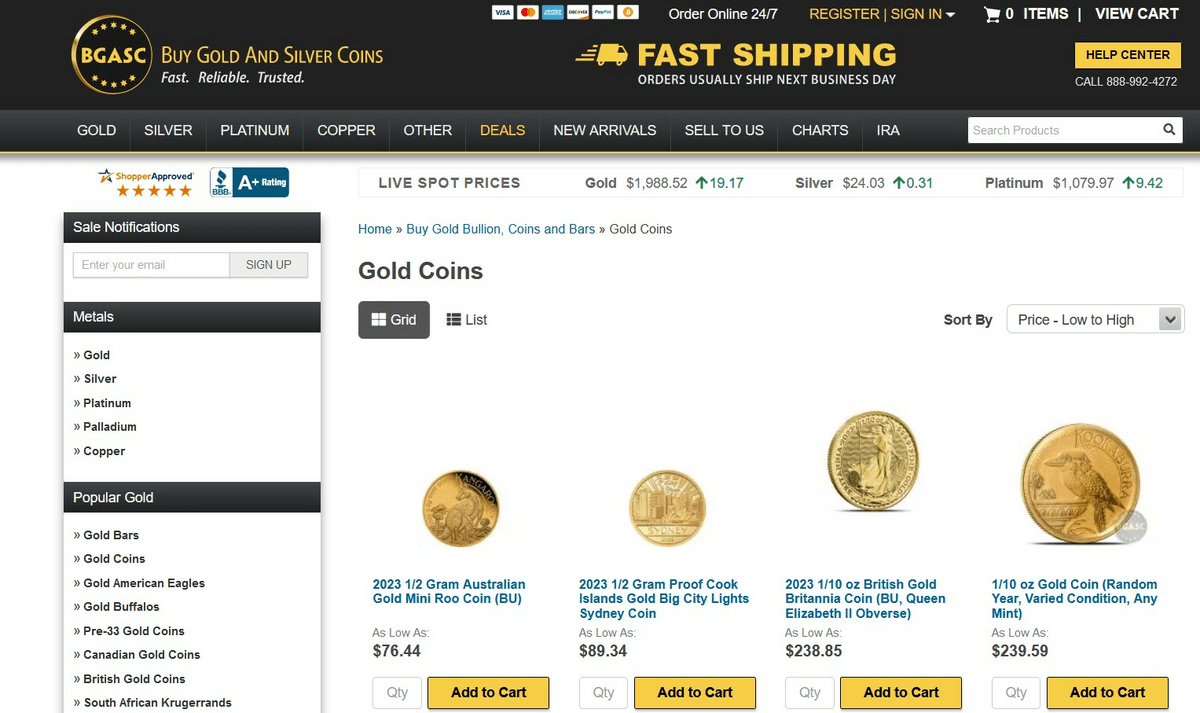

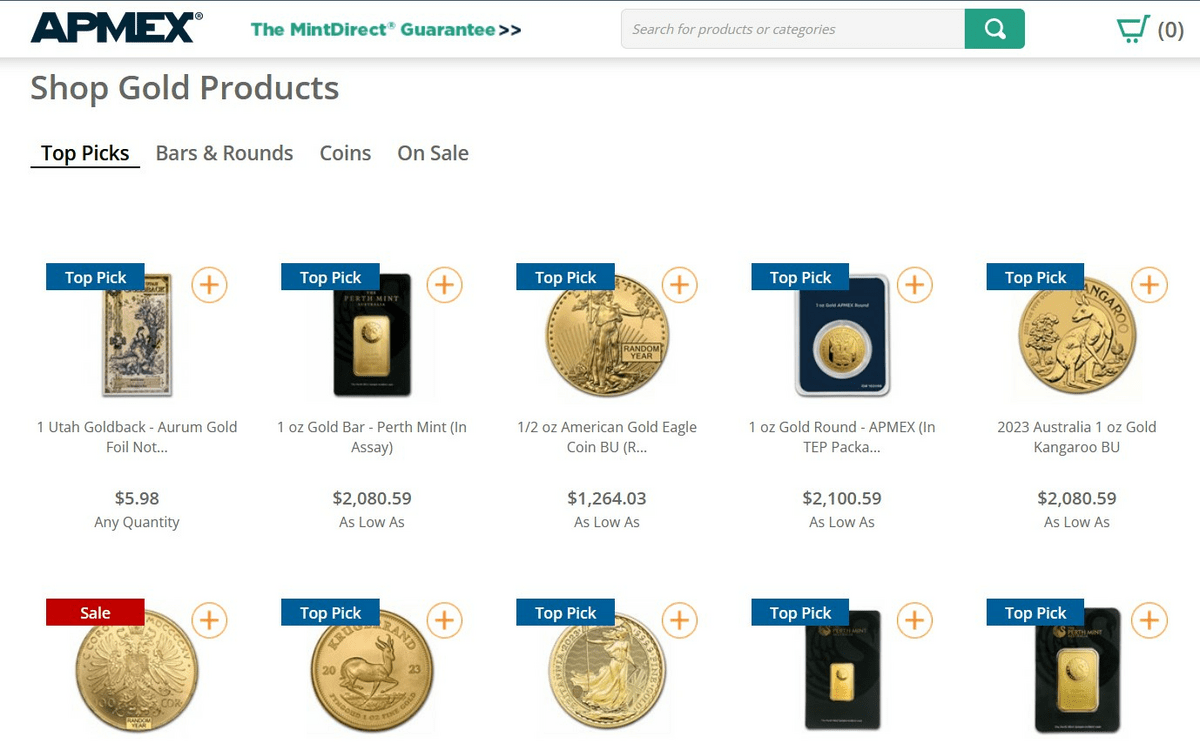

Price Transparency: Always compare prices from multiple dealers before making a purchase. Be wary of dealers who are unwilling to disclose their markup.

Check spot prices for gold. It is important to understand the current gold market value and confirm the rate is reflected in your purchasing price.

Reputation and Reviews: Research a dealer's history through the Better Business Bureau (BBB) and online reviews. Look for consistent patterns of positive or negative feedback.

Storage Options: Consider where you will store your gold after purchase. Banks, private vaults, and home safes are common options, each with its own risks and costs.

Product Authentication: Ensure the gold you are buying is authentic and accurately graded. Reputable dealers use professional authentication methods.

Paper gold is often cheaper, but it carries counterparty risk. Buying the physical gold is safer but needs more storage.

Spotting Potential Scams

High-Pressure Sales Tactics: Be cautious of dealers who pressure you to make immediate decisions or offer "limited-time" deals.

Unrealistic Promises: Avoid dealers who guarantee unusually high returns or claim to have insider information about the gold market.

Lack of Transparency: Question dealers who are unwilling to provide detailed information about their products, fees, or storage arrangements.

Unsolicited Offers: Beware of unsolicited phone calls or emails offering gold investments, as these are often scams.

Due Diligence: Essential Steps Before Buying

Verify Credentials: Check if the dealer is licensed and registered with relevant regulatory bodies.

Get a Written Agreement: Obtain a detailed written contract outlining the terms of the sale, including price, delivery date, and storage fees.

Seek Professional Advice: Consult with a financial advisor before investing in gold, especially if you are new to the market.

Inspect the Gold: Request to examine the gold before purchasing it, and look for any signs of damage or tampering.

The Chicago Gold Market: Factors to Watch

The price of gold is influenced by various factors, including economic uncertainty, inflation, and interest rates. Stay informed about these trends before investing.

Keep an eye on local economic conditions, as they can affect the demand for gold in the Chicago area.

Follow news and analysis from reputable financial sources to stay up-to-date on the gold market.

Current economic conditions show demand for gold as a safe haven asset, but volatility is always present. Carefully consider your risk tolerance and financial goals.

Ongoing Developments and Next Steps

Consumers are urged to conduct thorough research before engaging with any gold dealer. Consult with financial advisors and compare offerings to make informed decisions.

Regulatory bodies continue to monitor the gold market for fraudulent activities. Report any suspected scams to the appropriate authorities.

This report will be updated periodically to reflect changes in the Chicago gold market. The next update is planned for Q1 2025.

![Best Place To Buy Gold In Chicago 7 Best Place to Buy Gold Chains in 2021 [Authentic] - Crystalopedia](https://cdn-0.crystalopedia.com/wp-content/uploads/2021/01/f2-1.png)