Flat Dollar Amount Of Net Pay

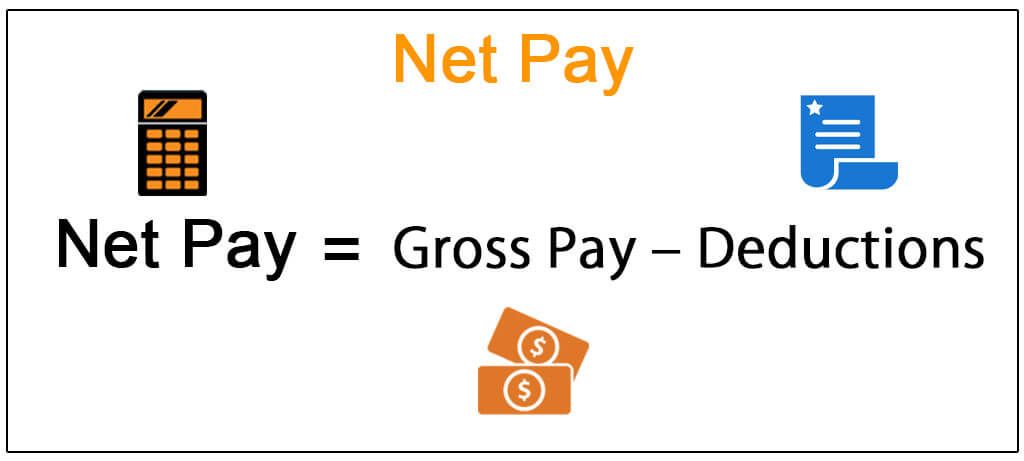

The American workforce is facing a subtle but potentially seismic shift in how paychecks are experienced. While wage growth has been a dominant economic narrative, a growing number of employees are reporting a stagnant or even shrinking net pay, despite nominal increases in their gross earnings. This phenomenon, driven by a complex interplay of factors, is raising concerns about financial well-being and economic stability for households across the income spectrum.

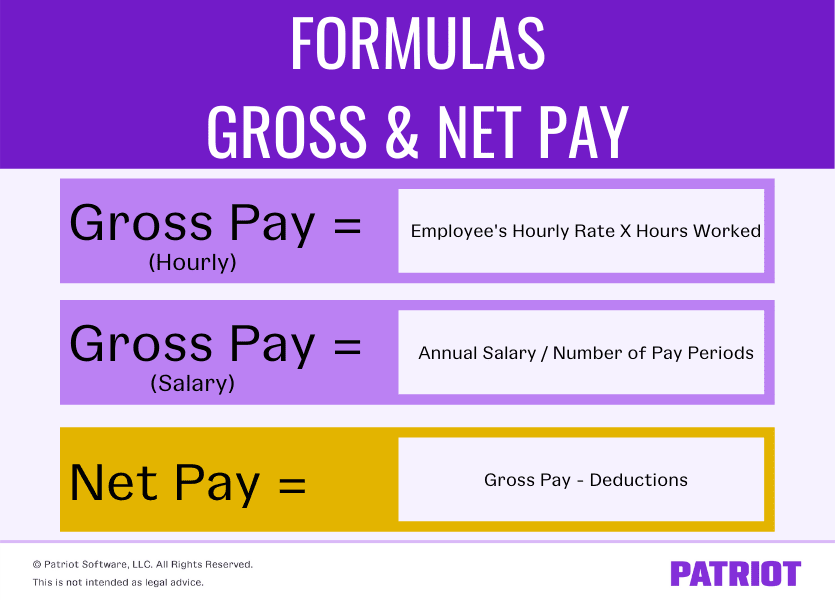

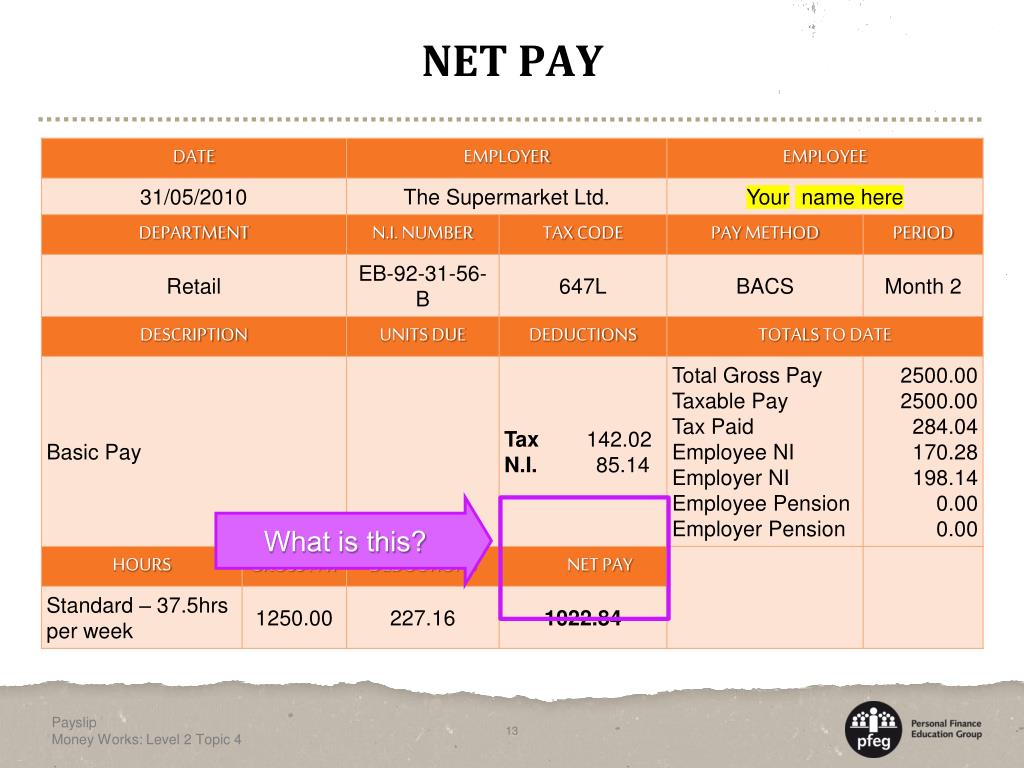

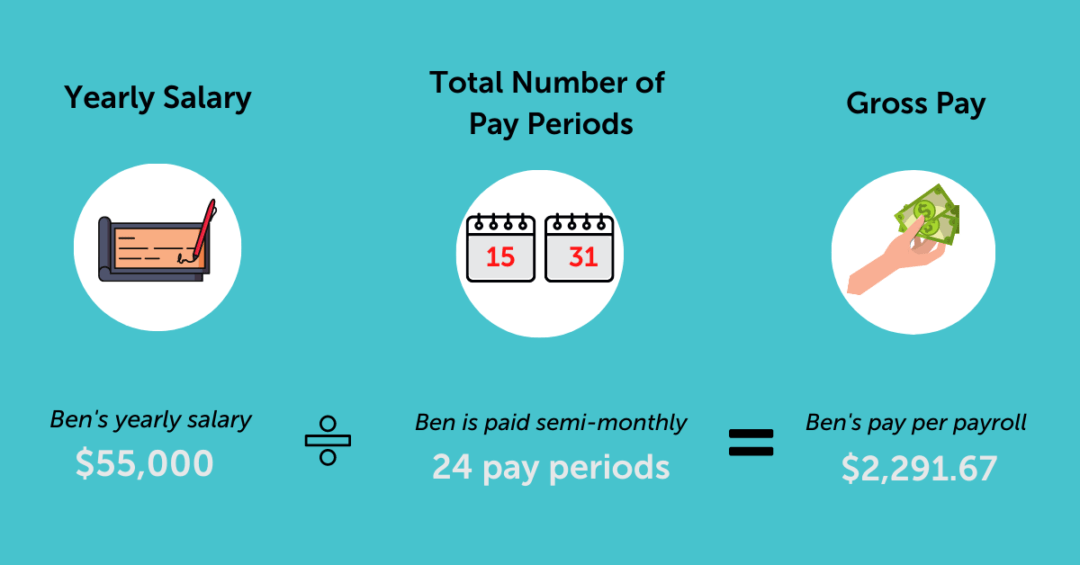

At the heart of this issue lies the discrepancy between gross and net income. The 'nut graf' here: a convergence of rising taxes, escalating benefit costs (particularly healthcare), and stubbornly high inflation are eroding the purchasing power of each paycheck, leaving many workers with a feeling that their raises are disappearing before they even hit the bank account. This article will explore the underlying causes of this trend, its potential consequences, and the various perspectives on how to address it.

The Erosion of Take-Home Pay

Multiple factors contribute to the flattening of net pay. One of the most significant is the rising cost of employer-sponsored benefits, especially healthcare. According to a 2023 study by the Kaiser Family Foundation, the average annual premium for employer-sponsored family health coverage reached over $22,000, with workers contributing a substantial portion. This cost, often deducted directly from paychecks, directly reduces net income.

Furthermore, tax burdens play a crucial role. While federal income tax brackets adjust annually for inflation, state and local taxes can be more volatile, impacting take-home pay disproportionately depending on geographic location. Social Security and Medicare taxes, often overlooked, also represent a significant deduction from gross earnings.

Inflation, the economic elephant in the room, further exacerbates the issue. Even with nominal wage increases, if the cost of goods and services rises faster, the real purchasing power of a paycheck diminishes. The Consumer Price Index (CPI), a key measure of inflation, has remained elevated, putting pressure on household budgets, as reported by the Bureau of Labor Statistics (BLS).

Perspectives on the Impact

The impact of flat or shrinking net pay varies across different income levels. For lower-income workers, even small deductions can have a significant impact on their ability to meet basic needs. "For families living paycheck to paycheck, a $50 decrease can mean the difference between putting food on the table and going hungry," says Dr. Emily Carter, an economist at the Center for American Progress, in a recent interview.

Middle-income earners also feel the squeeze. The rising cost of housing, education, and other essentials, coupled with increasing deductions, leaves less discretionary income for savings, investments, and leisure activities. This can impact long-term financial security and economic mobility.

While higher-income earners are generally less vulnerable to the immediate impact of fluctuating net pay, they are not immune. Increased tax burdens and benefit costs can reduce their ability to invest and save, potentially affecting their retirement plans and overall financial goals.

Employer Strategies and Employee Options

Some employers are exploring strategies to mitigate the impact of rising benefit costs on employees. These include offering different healthcare plan options with varying levels of coverage and cost-sharing, implementing wellness programs to reduce healthcare utilization, and increasing employer contributions to health savings accounts (HSAs).

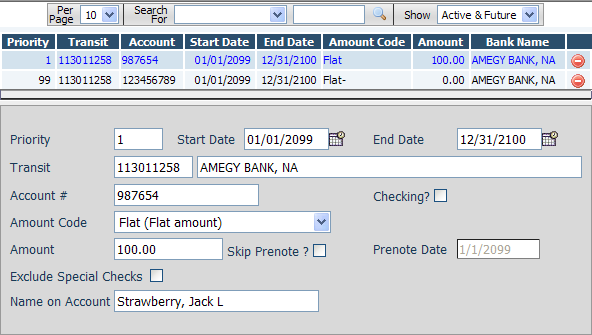

Employees can also take steps to manage their net pay. This includes carefully evaluating their benefit options, contributing to pre-tax retirement accounts to reduce their taxable income, and exploring opportunities to negotiate for higher wages or benefits. Consulting with a financial advisor can provide personalized guidance on managing finances and maximizing take-home pay.

"Financial literacy is key," asserts John Smith, a certified financial planner. "Understanding your paycheck, deductions, and taxes is crucial for making informed financial decisions."

Policy Implications and Potential Solutions

The trend of flat or shrinking net pay raises important policy questions. Some argue for tax reforms that would provide greater relief to working families, such as expanding the Earned Income Tax Credit (EITC) or increasing the standard deduction. Others advocate for policies that would control healthcare costs, such as government regulation of drug prices or expansion of public health insurance options.

Another potential solution involves addressing the root causes of inflation. This could include policies to increase domestic production, reduce trade barriers, or address supply chain bottlenecks. The Federal Reserve's monetary policy decisions also play a crucial role in managing inflation.

"A multi-pronged approach is needed," emphasizes Dr. Carter. "Addressing healthcare costs, tax burdens, and inflation simultaneously is essential for improving the financial well-being of American workers."

Looking Ahead

The future of net pay in the United States remains uncertain. The persistence of inflation, the ongoing debate over healthcare reform, and the potential for further tax changes will all play a significant role. Monitoring these trends and advocating for policies that support working families will be crucial for ensuring that wage growth translates into tangible improvements in living standards.

Ultimately, the flat dollar amount of net pay is a symptom of deeper economic challenges. A concerted effort from policymakers, employers, and individuals is needed to address these challenges and create a more secure and prosperous future for all.

Only time will tell if this trend will reverse, or if Americans must adapt to a new normal where gross pay increases do not always translate to a bigger paycheck.

.jpg)