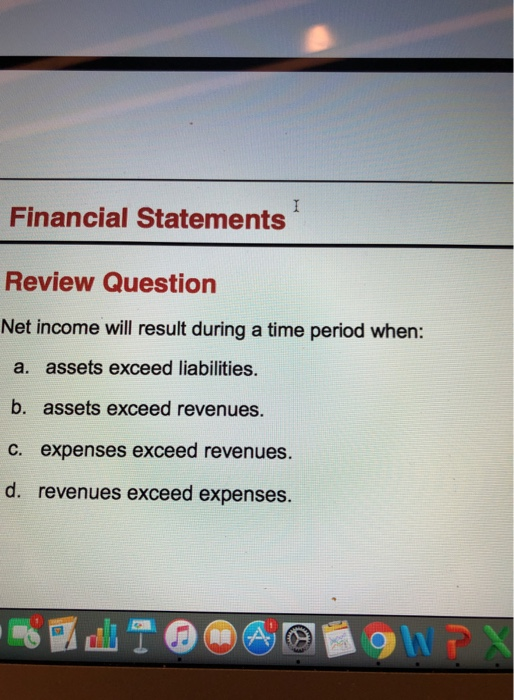

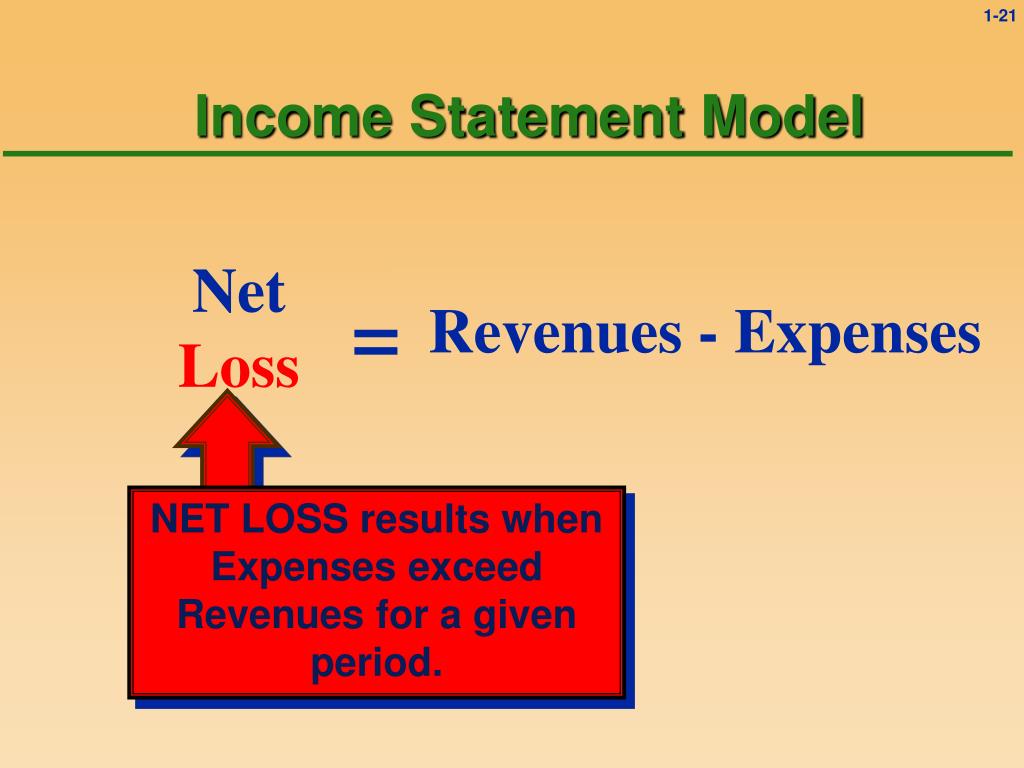

A Net Loss Will Result During A Time Period When

Global shipping giant, Maritime Ventures Inc. (MVI), has announced it anticipates a net loss for the third quarter of 2024, marking a significant downturn after a period of sustained profitability. The announcement, made late Tuesday, sent ripples through the maritime industry and raised concerns about the state of global trade.

The impending loss, projected to be in the range of $150 million to $200 million, contrasts sharply with the $75 million profit recorded in the same period last year. This anticipated net loss during this time period stems from a confluence of factors, including a sharp decline in freight rates, increased operational costs, and ongoing geopolitical instability affecting key trade routes.

Factors Contributing to the Net Loss

According to a press release from MVI, the primary driver of the projected loss is the substantial decrease in global freight rates. The surge in demand for shipping containers witnessed during the pandemic has subsided, leading to an oversupply of vessels and intense price competition.

This oversupply has been exacerbated by the delivery of numerous new ships ordered during the peak of the pandemic, further diluting the market and driving down prices. The company states that average freight rates have fallen by nearly 40% compared to the previous year.

Furthermore, MVI is grappling with escalating operational expenses. Fuel costs, a significant component of shipping expenses, remain elevated despite recent fluctuations in global oil prices.

Labor costs have also increased, driven by inflationary pressures and collective bargaining agreements with maritime unions. Security costs associated with navigating increasingly volatile maritime routes have also contributed to the higher operational expenses.

Geopolitical Instability and Trade Disruptions

The ongoing geopolitical instability in various regions is further compounding MVI's financial woes. The conflict in Ukraine, for example, has disrupted trade flows through the Black Sea, a crucial route for grain and other commodities.

Increased piracy in certain parts of the world requires enhanced security measures and insurance premiums, adding to the overall cost of operations. The company specifically cited increased transit times around the Cape of Good Hope as a result of tensions in the Red Sea.

These disruptions have forced MVI to reroute vessels, leading to longer transit times and higher fuel consumption. This has a direct impact on the company's profitability.

Impact on the Maritime Industry and Beyond

The anticipated net loss by MVI serves as a bellwether for the broader maritime industry. Other shipping companies are likely facing similar challenges, potentially leading to consolidation and restructuring within the sector.

Smaller shipping firms, in particular, may struggle to weather the storm, potentially leading to bankruptcies and job losses. Industry analysts predict a period of increased volatility and uncertainty in the coming months.

The slowdown in the shipping industry also has implications for global trade. Higher shipping costs, even if temporary, can translate into increased prices for consumers and businesses alike. It also affects supply chains.

This could further exacerbate inflationary pressures and dampen economic growth worldwide. The news comes as many countries are already struggling with economic slowdowns and rising prices.

MVI's Response and Future Outlook

In response to the challenging environment, MVI has announced a series of cost-cutting measures. These include streamlining operations, reducing administrative overhead, and renegotiating contracts with suppliers.

"We are taking decisive action to mitigate the impact of these headwinds," said John Smith, CEO of MVI, in a statement. "We are confident that these measures, combined with our strong balance sheet and diversified portfolio of services, will allow us to navigate this challenging period and emerge stronger in the long run."

The company is also exploring new opportunities in emerging markets and investing in technology to improve efficiency and reduce costs. MVI is committed to sustainable shipping practices.

However, the company acknowledges that the near-term outlook remains uncertain. The timing and extent of a potential recovery in freight rates will largely depend on the resolution of geopolitical tensions, the pace of global economic growth, and the overall supply-demand balance in the shipping market. Experts believe this will take 2-3 quarters.

A Human-Interest Angle

Beyond the financial figures, the situation has direct consequences for the thousands of employees of MVI and its related industries. The uncertainty surrounding the company's financial performance creates anxiety among workers and their families.

Seafarers, in particular, who spend extended periods away from home, are facing increased job insecurity. Local communities that rely on the shipping industry for employment and economic activity are also feeling the strain.

The potential ripple effects of MVI's net loss highlight the interconnectedness of the global economy and the human cost of economic downturns.

:max_bytes(150000):strip_icc()/Net_loss-4192311-primary-final-a957c8d046354dab921ad0f31a4ac340.png)

.jpg)

+Losses+result+when+an+entity’s+deductions+for+the+period+exceed+its+income..jpg)