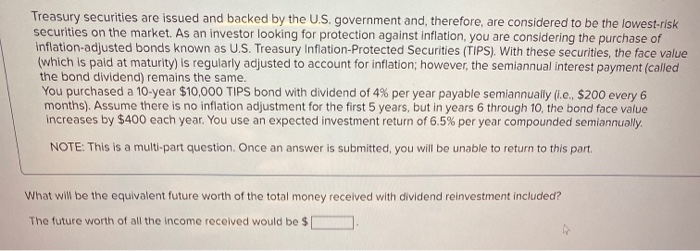

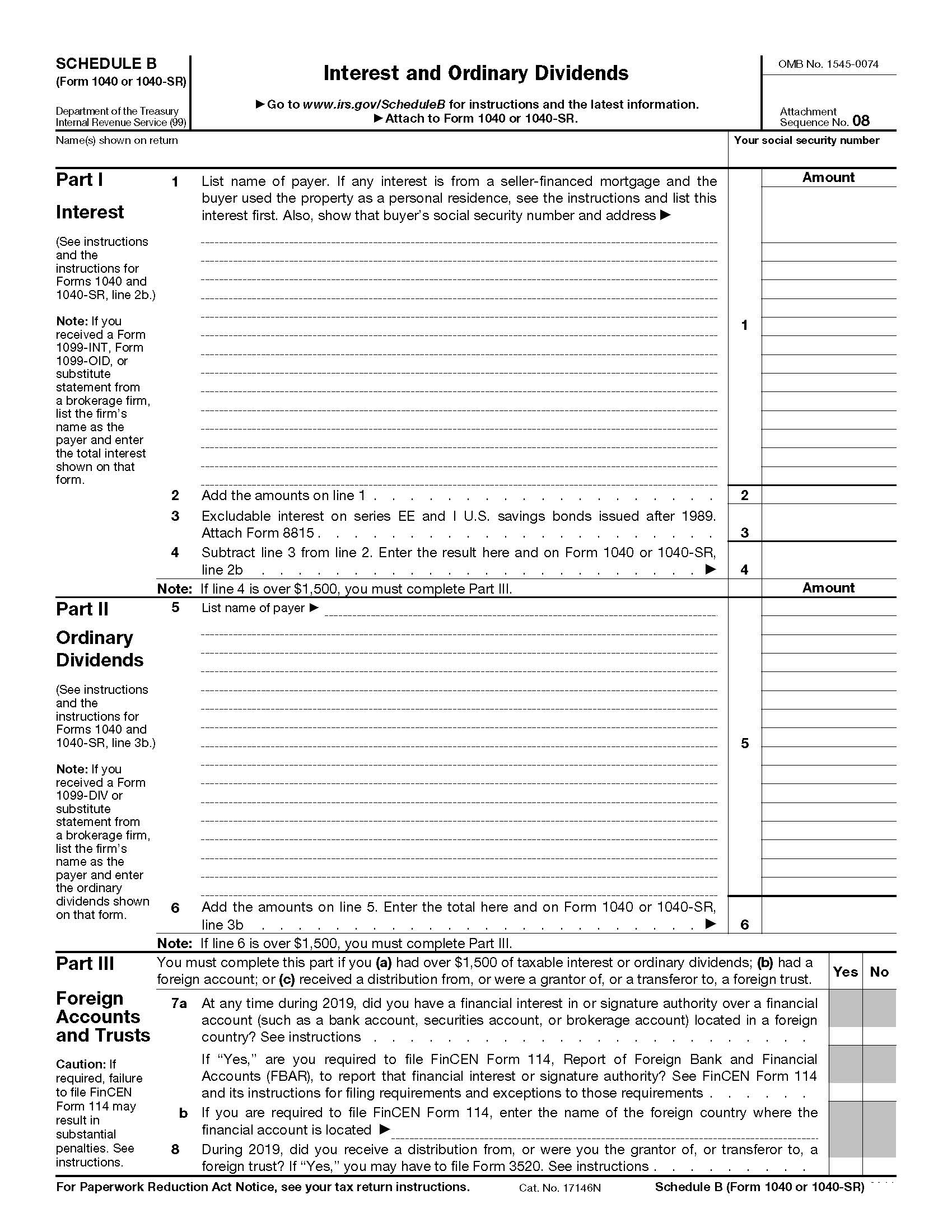

A Portion Of These Dividends Is U.s. Government Interest

In a surprising revelation, a significant portion of dividends paid out by certain companies and investment funds is indirectly linked to interest payments from the U.S. government, prompting scrutiny from financial analysts and raising questions about the underlying mechanisms of federal debt and its impact on investment returns.

This article delves into the intricate web connecting government debt, dividend payouts, and the implications for investors, examining how U.S. Treasury securities held by various entities ultimately contribute to the funds available for dividend distributions. Understanding this connection is crucial for investors seeking to comprehend the full picture of their investment portfolio’s performance.

The Treasury-Dividend Link: How It Works

The relationship stems from the fact that a wide range of institutions, including mutual funds, pension funds, and even some corporations, hold substantial amounts of U.S. Treasury bonds and bills. These securities are considered a safe haven and a stable source of income. The interest earned on these Treasuries flows back into the financial system.

These institutions often reinvest the interest earned, or use it to fund other activities, including dividend payments to their shareholders or beneficiaries. Therefore, a portion of the dividends individuals receive from these entities can be traced back, indirectly, to interest paid by the U.S. government on its debt.

Breaking Down the Chain

Imagine a scenario where a large pension fund holds a significant portfolio of U.S. Treasury bonds. The interest the fund receives from these bonds forms a portion of its overall investment income. This income, in turn, can be used to pay out pensions to retirees.

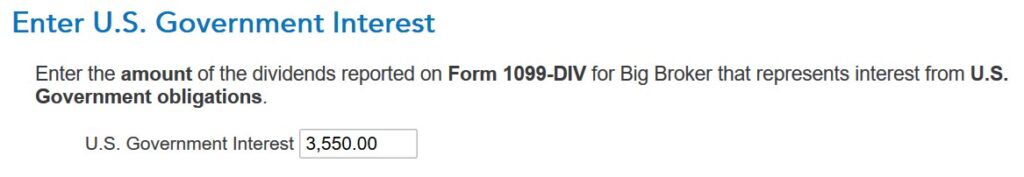

Similarly, a mutual fund might allocate a portion of its investments to Treasury securities for stability and income generation. The dividends paid out to the fund's shareholders are partly derived from the interest earned on those Treasuries.

This highlights how government borrowing can subtly influence investment returns across various sectors of the economy. The reliance on Treasury securities for stable income indirectly ties dividend payouts to the nation's debt obligations.

Impact on Investors

The realization that a portion of dividends is linked to government interest could influence investor sentiment and strategy. Understanding this connection allows investors to better assess the sustainability and risk associated with their dividend income.

Investors might become more aware of the macroeconomic factors that could impact government borrowing rates and, consequently, the yields on Treasury securities. Changes in fiscal policy or economic conditions can ripple through the system, affecting dividend payouts, even if indirectly.

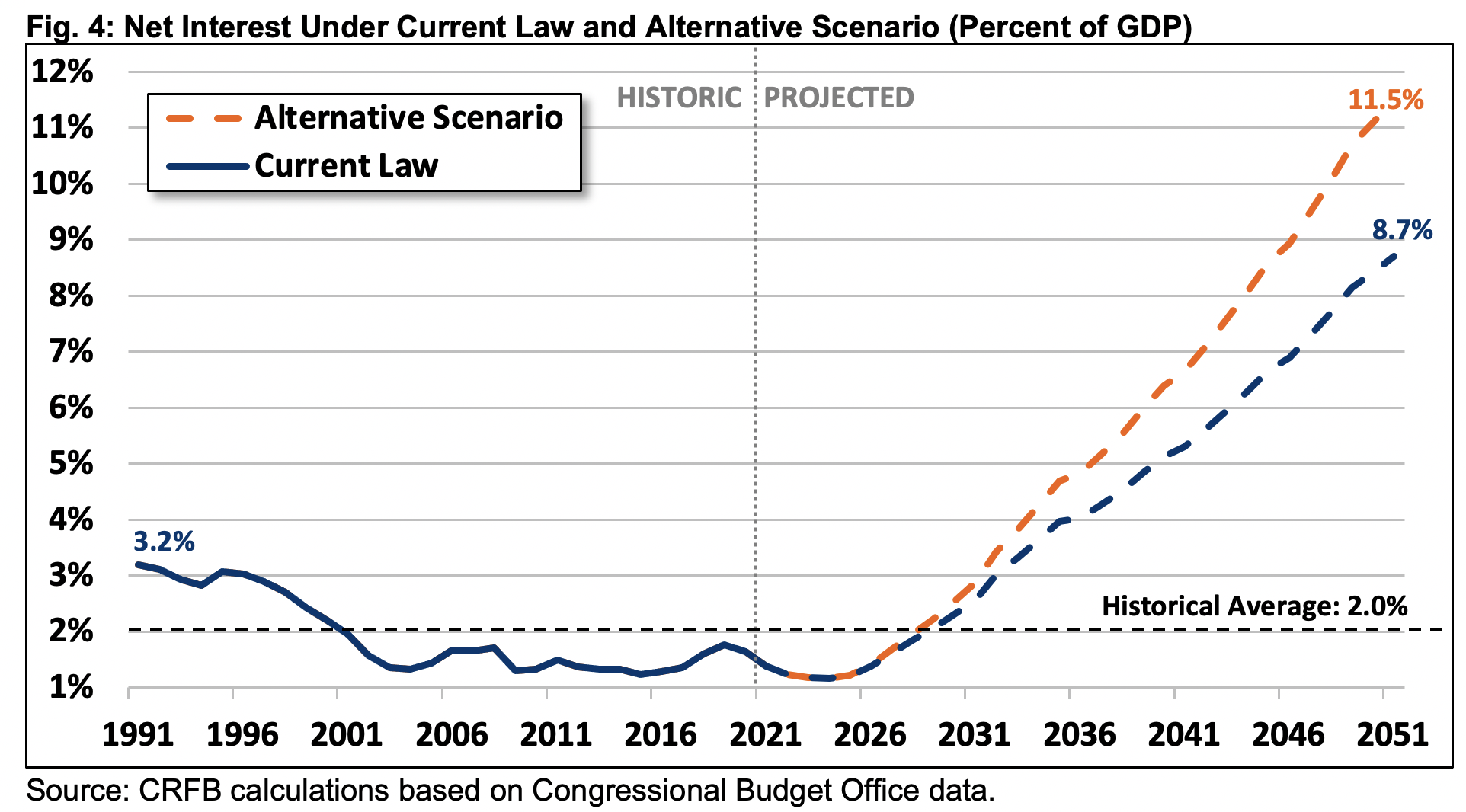

Furthermore, the reliance on government debt for a portion of investment returns raises questions about long-term sustainability. If government debt levels become unsustainable, or if interest rates rise significantly, the impact on dividend payouts could be substantial.

Expert Perspectives

Financial analysts are offering varying perspectives on the significance of this connection. Some argue that it is a natural and expected consequence of the financial system's reliance on government debt as a stable asset class.

Others express concern about the potential risks associated with over-reliance on government debt for investment returns. “While U.S. Treasury securities are generally considered safe, high levels of government debt could create vulnerabilities,” says Dr. Anya Sharma, an economist at the Institute for Financial Research.

Dr. Sharma added, "Investors need to consider the broader economic picture and diversify their portfolios to mitigate potential risks."

Regulatory Scrutiny and Future Outlook

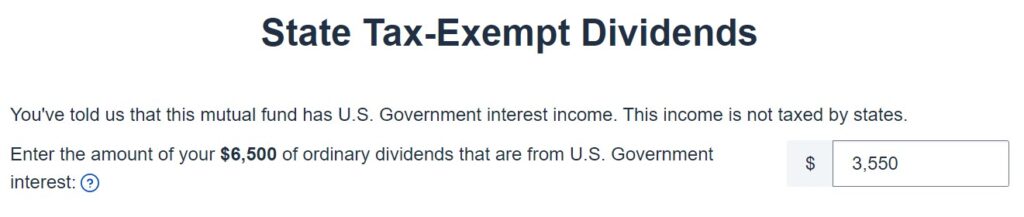

The growing awareness of the link between dividends and government interest is prompting some regulatory scrutiny. Financial regulators are examining whether greater transparency is needed regarding the sources of dividend income.

Discussions are underway regarding potential disclosure requirements for investment funds to reveal the proportion of their dividend payouts that are derived from government interest. Such disclosures could empower investors to make more informed decisions.

The future outlook depends on several factors, including government fiscal policy, interest rate trends, and the overall health of the U.S. economy. Changes in any of these areas could have a significant impact on the flow of government interest into the financial system and, ultimately, on dividend payouts.

The intricate relationship between dividends and U.S. government interest underscores the complex interconnectedness of the modern financial system. While it may seem like a minor detail, it highlights the importance of understanding the underlying mechanisms that drive investment returns.

As investors become more aware of this connection, they can make more informed decisions and better assess the risks and opportunities associated with their investment portfolios. The key takeaway is that even seemingly unrelated financial instruments are often intertwined in unexpected ways.

![A Portion Of These Dividends Is U.s. Government Interest Ultimate Guide to Dividend Tax and Dividend Tax Allowance [2023]](https://global-uploads.webflow.com/5d71eeb2a19ee03e3430f50f/618aaafedc9d457e6e4d614e_Dividend tax rates 2021 2022.jpg)