A Prepaid Application For Individual Disability Income Insurance

Did you know that a person is more likely to experience a long-term disability than death before retirement? Individual Disability Income (IDI) insurance is crucial for protecting your most valuable asset: your ability to earn an income.

Understanding the Need for Disability Income Insurance

Disability income insurance replaces a portion of your income if you become too sick or injured to work. This protection is vital for business owners, executives, and professionals who rely on their earnings to cover living expenses, debts, and other financial obligations.

Why is this important for businesses? Because a key employee's disability can significantly impact operations, productivity, and profitability.

Introducing the Prepaid Application for IDI

The prepaid application offers a streamlined approach to securing IDI coverage. It involves paying a portion of the premium upfront during the application process.

This strategy can provide several key advantages to both the applicant and the insurance company.

Advantages of the Prepaid Application

Faster Underwriting: The initial payment often expedites the underwriting process. It demonstrates a serious intent to purchase the policy.

Potential for Guaranteed Issue: In some cases, a prepaid application can qualify an applicant for guaranteed issue, meaning coverage is approved regardless of pre-existing health conditions (within certain limitations, of course).

Locked-in Rates: Depending on the insurer, prepaying may allow you to lock in the premium rate at the time of application. This can be particularly beneficial if rates are expected to rise.

Increased Acceptance Rates: While not guaranteed, showing commitment via prepayment can sometimes positively influence the underwriting decision, especially in borderline cases.

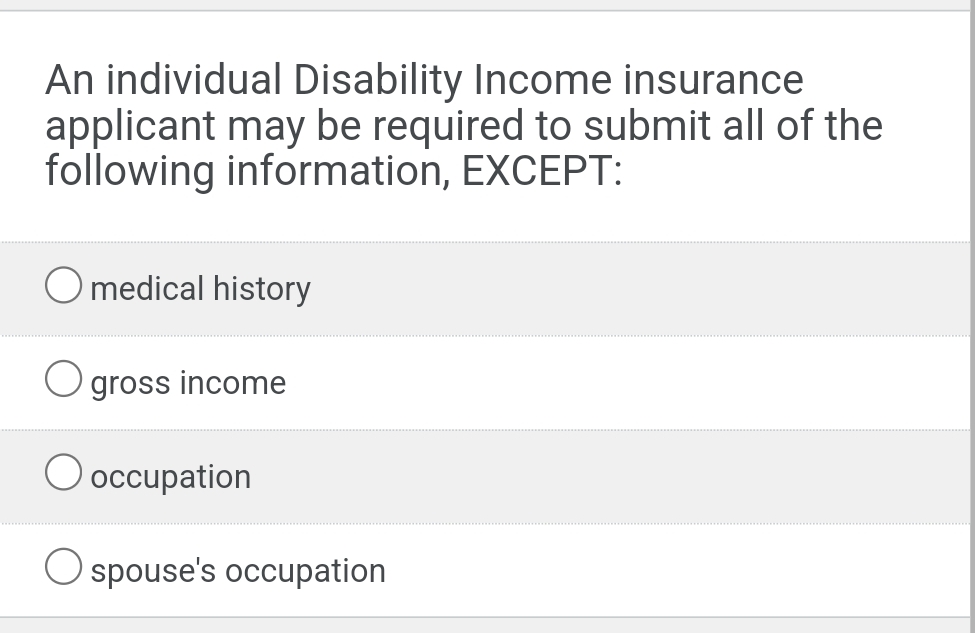

How the Prepaid Application Works

The applicant completes the standard IDI application. However, instead of just submitting the application, they also include a payment – often equivalent to one to three months' premium.

The insurer then begins the underwriting process. During this time, the money is typically held in a separate account.

If the application is approved, the prepaid amount is applied toward the policy premiums. If the application is declined, the prepaid amount is usually refunded.

Considerations and Potential Drawbacks

Refund Policies: Carefully review the insurer's refund policy if the application is declined or if you choose to withdraw it. Ensure the terms are clear and favorable.

Financial Commitment: You're committing to a financial outlay before knowing the final outcome of the underwriting process. Consider your financial situation and risk tolerance.

Not Always Available: Not all insurance companies offer prepaid application options for IDI. Research insurers that provide this feature and align with your coverage needs.

Who Benefits Most from a Prepaid Application?

Individuals with a history of health concerns may benefit from the potential for guaranteed issue or expedited underwriting.

Those anticipating future premium increases might find value in locking in current rates.

Entrepreneurs seeking comprehensive income protection and wishing to demonstrate a strong commitment to securing coverage can benefit as well.

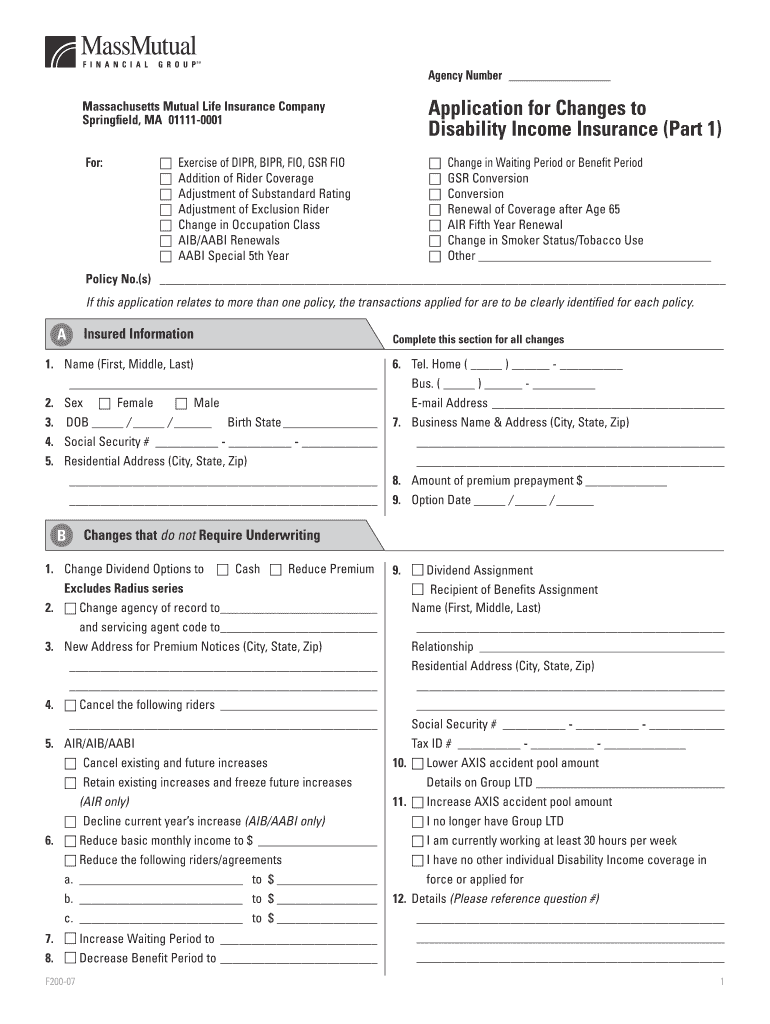

Comparing Traditional vs. Prepaid Applications

A traditional application involves submitting the application without any upfront payment. The premium is paid only upon policy approval.

The prepaid approach can offer advantages in terms of speed and potential coverage guarantees but requires an initial financial commitment. Choose the option that best aligns with your individual circumstances and risk profile.

Integrating IDI into a Business Strategy

For business owners, IDI can be an integral part of a comprehensive business continuity plan. It helps ensure the business can continue operating even if a key employee or owner becomes disabled.

Consider offering IDI as part of your employee benefits package to attract and retain top talent. This shows you care about their financial well-being.

Conclusion

A prepaid application for Individual Disability Income insurance offers a unique pathway to securing vital income protection. Understanding its advantages, drawbacks, and how it compares to traditional applications is essential for making informed decisions.

By proactively addressing the risk of disability, you can protect yourself, your family, and your business from potentially devastating financial consequences. Consult with a qualified insurance professional to determine if a prepaid application is the right strategy for your specific needs.

Source 1: Council for Disability Awareness, "Disability Statistics" (Numerous studies and statistics are cited on their website: https://www.disabilitycanhappen.org/disability-statistic/

Source 2: Investopedia, "Disability Insurance" (Provides general information and definitions related to disability insurance): https://www.investopedia.com/terms/d/disability-insurance.asp

.jpg)

:max_bytes(150000):strip_icc()/diinsurance_v3-bf77d05568264d77a7f79ec956ef3d82.png)