A Profit Maximizing Firm Employs Resources To The Point Where

The relentless pursuit of profit, the cornerstone of capitalist economies, often leads firms to a critical juncture: the optimal allocation of resources. But where exactly is that point, and what are the implications when a company pushes resource utilization to its absolute limit in the name of maximizing profits?

This article delves into the complex dynamics of how profit-maximizing firms allocate resources, specifically exploring the point where marginal revenue equals marginal cost. We will examine the theoretical underpinnings of this principle, analyze real-world examples, and consider the potential societal and ethical consequences when companies prioritize profit maximization above all else.

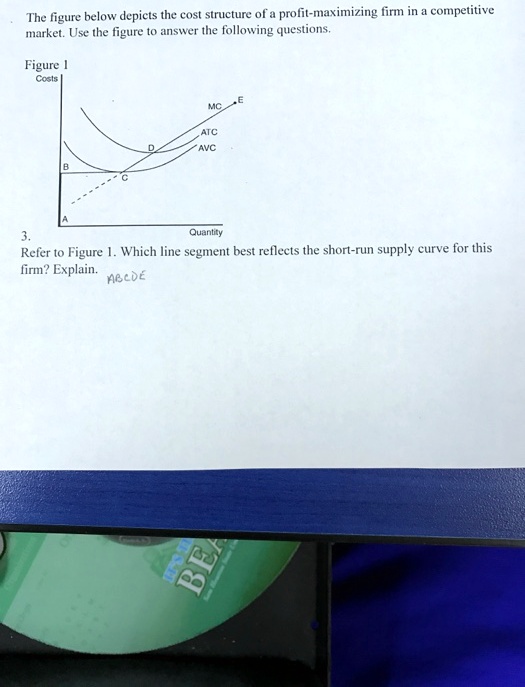

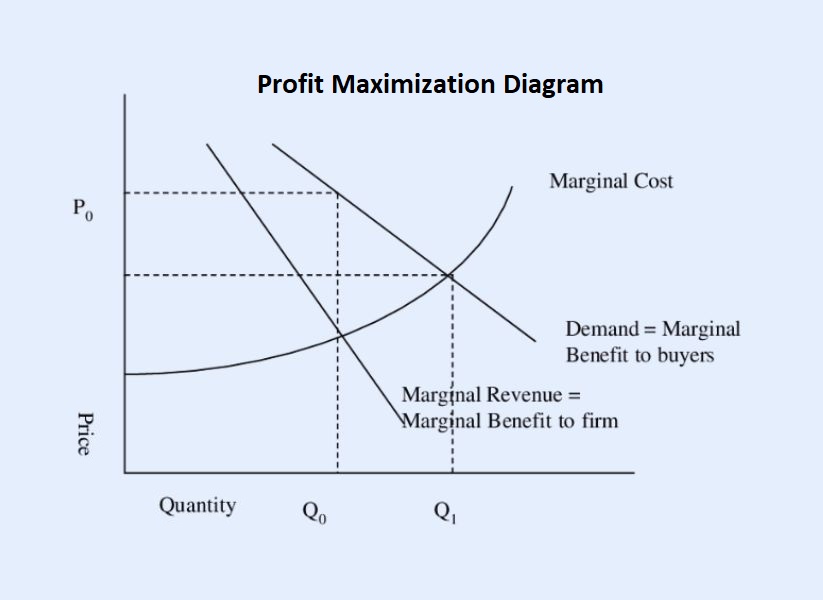

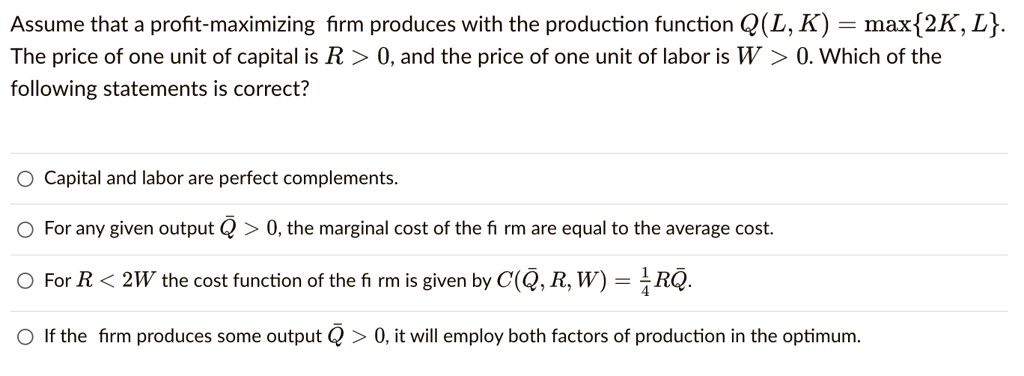

The Theoretical Framework: Marginal Revenue Equals Marginal Cost

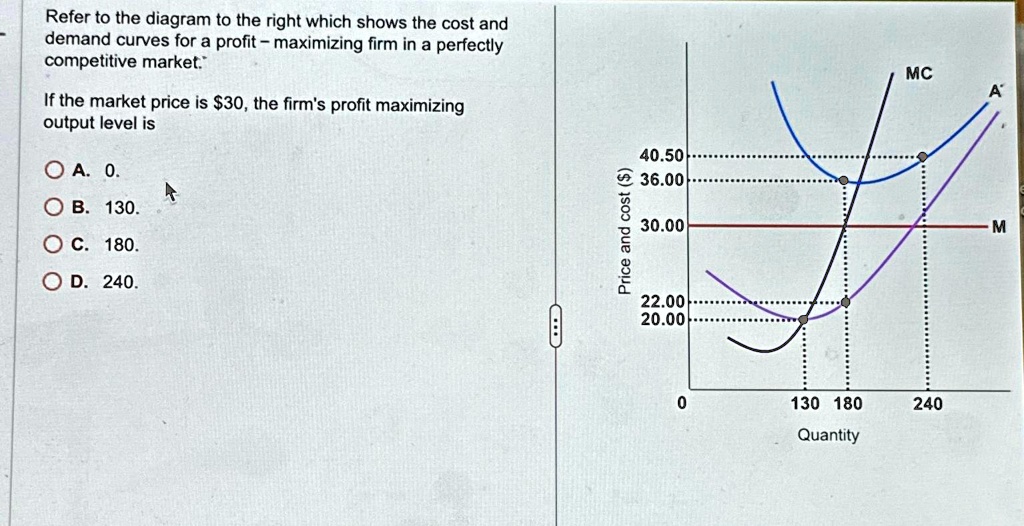

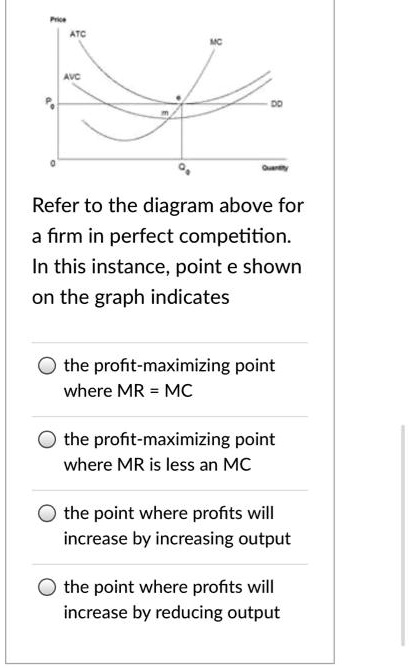

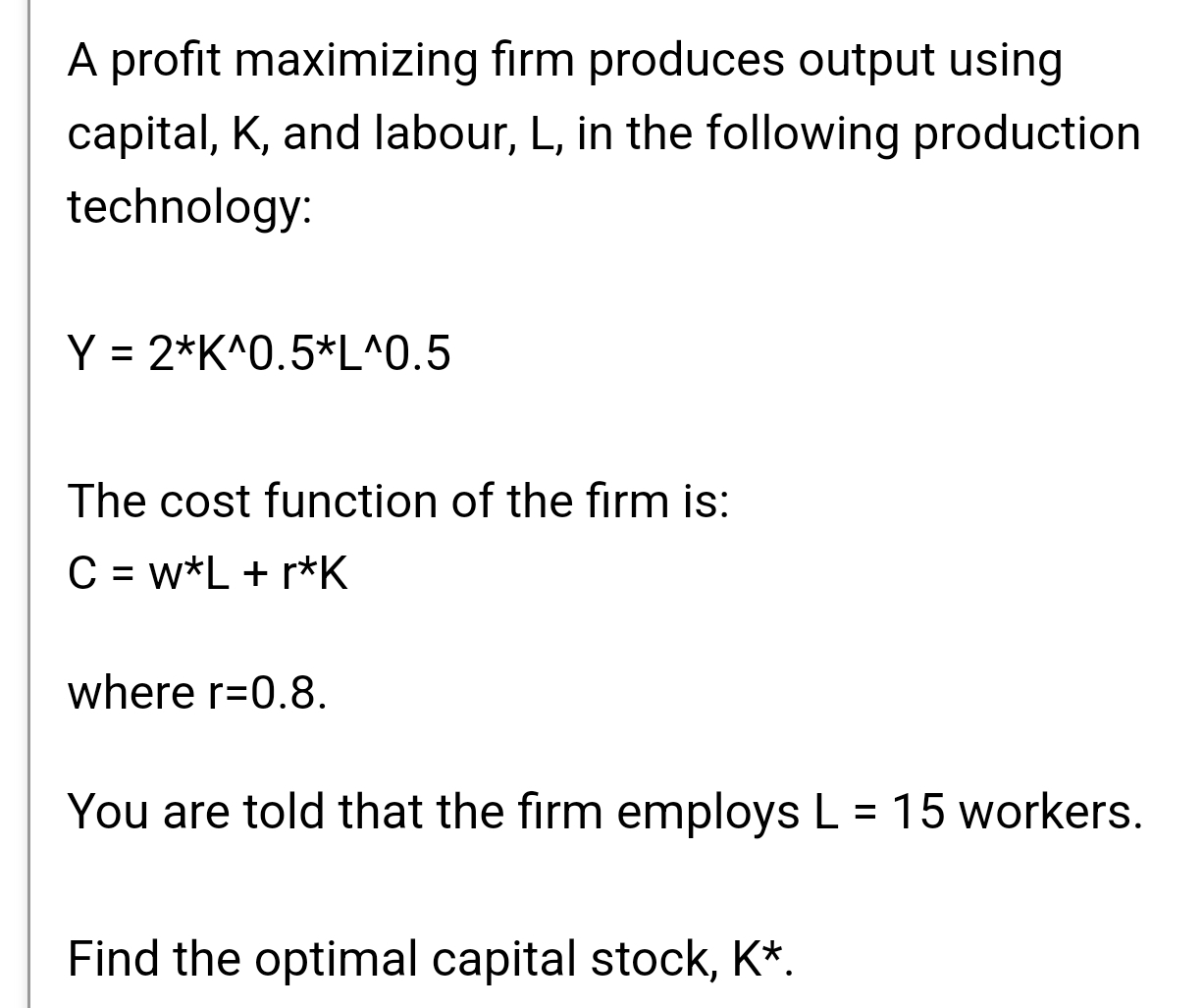

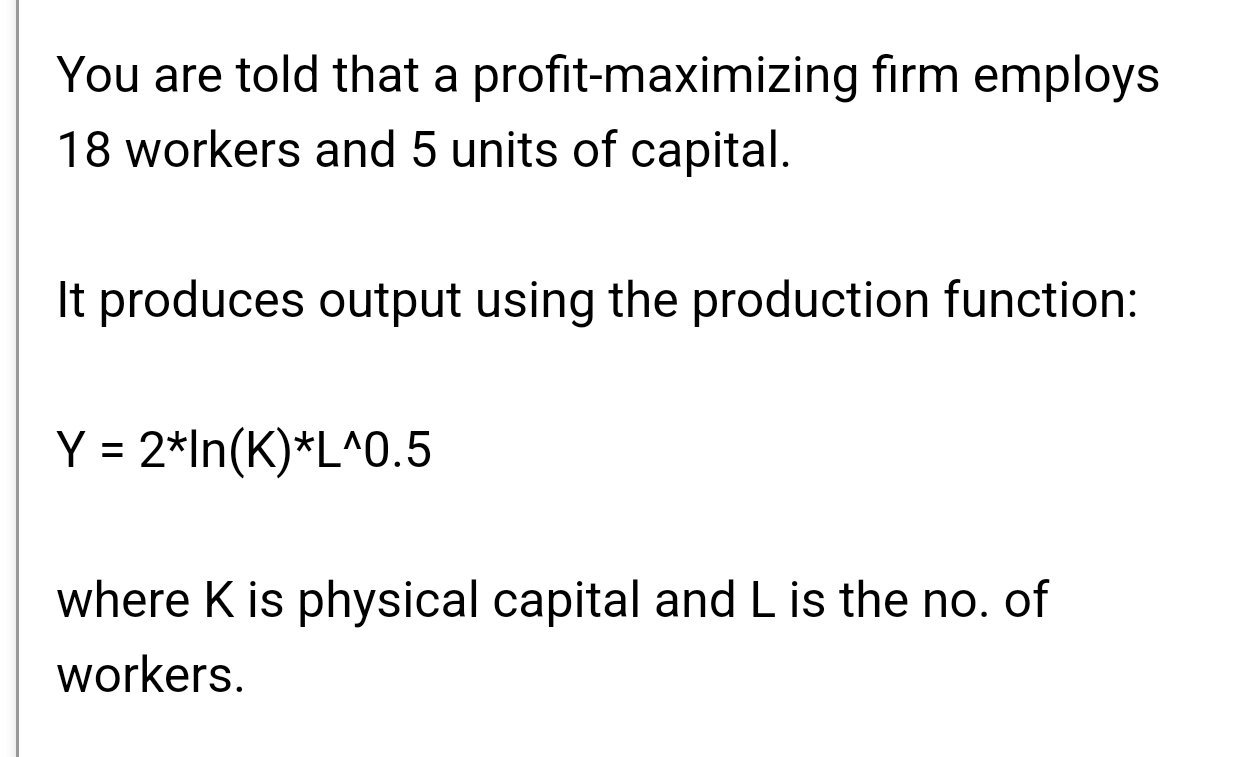

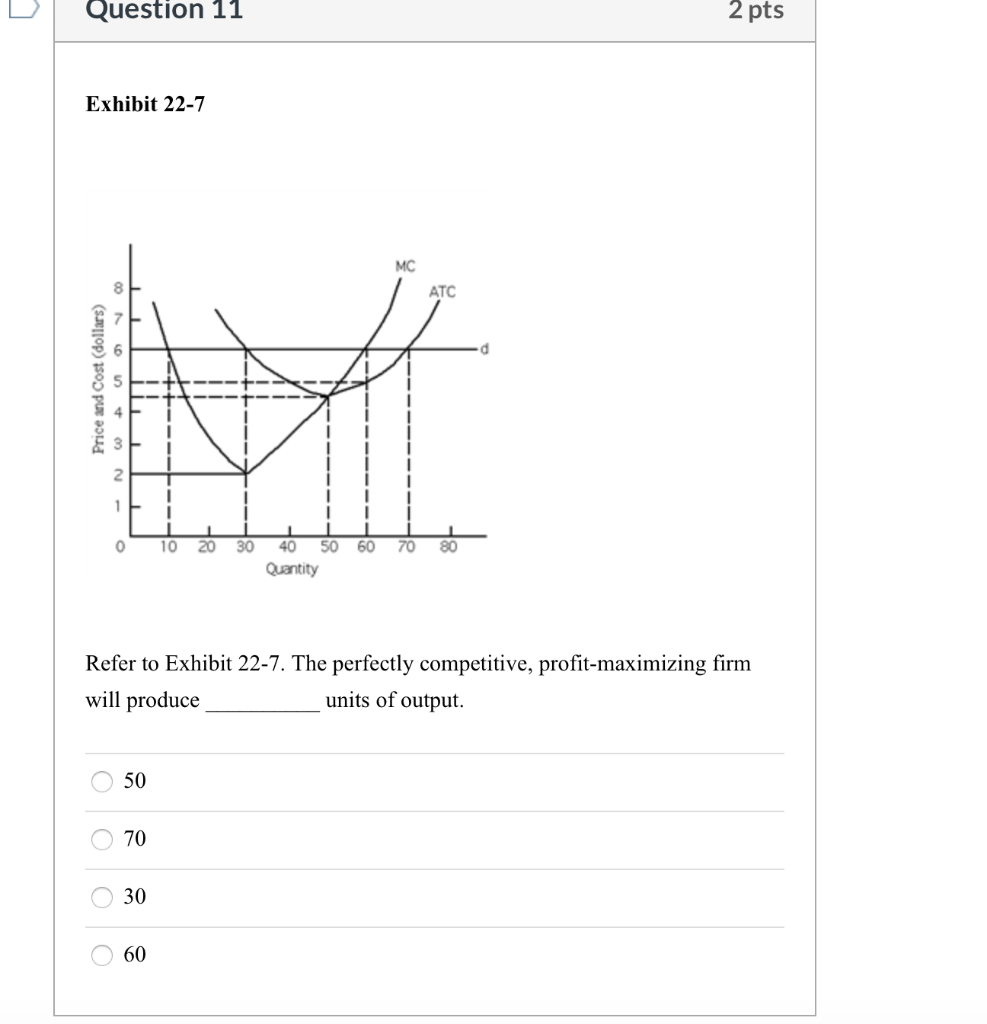

At the heart of profit maximization lies the concept of marginal analysis. A firm strives to produce and sell additional units of a good or service as long as the revenue generated from each additional unit (marginal revenue) exceeds the cost of producing that unit (marginal cost).

This continues until marginal revenue is equal to marginal cost. This is the point beyond which producing more would actually decrease profits, as the cost of each additional unit would outweigh the revenue it generates. According to economic theory, a rational, profit-maximizing firm will always aim to operate at this equilibrium.

However, the application of this principle is not always straightforward in the real world. Factors such as market competition, imperfect information, and internal organizational constraints can complicate decision-making.

Real-World Applications and Examples

Consider a manufacturing company producing smartphones. Initially, increasing production might lead to economies of scale, where the cost of producing each phone decreases due to bulk purchasing of components and efficient use of machinery.

As production scales up, however, the company might start encountering diminishing returns. Overtime pay for workers, increased maintenance costs for heavily used equipment, and rising prices of raw materials due to high demand could all drive up marginal costs.

The ideal production level would be where the revenue earned from selling one more smartphone exactly equals the cost of producing that smartphone. This point represents the company's profit-maximizing output. Beyond this point, profits decrease.

The agricultural industry also offers a prime example. A farmer might initially increase crop yields by applying more fertilizer. However, at some point, adding more fertilizer will not significantly increase yields and could even damage the crops or the environment.

The farmer needs to carefully analyze the marginal revenue from the increased yield against the marginal cost of the additional fertilizer. The profit-maximizing point is where the additional revenue from selling the extra crops equals the cost of the extra fertilizer.

Potential Societal and Ethical Implications

While profit maximization can drive efficiency and innovation, it can also lead to negative consequences if not carefully managed. A relentless focus on maximizing profits can sometimes lead to unethical or socially irresponsible behavior.

For example, a company might choose to cut corners on safety measures or environmental protection to reduce costs and increase profits. This could result in accidents, pollution, and harm to workers or the community.

"The social responsibility of business is to increase its profits," - Milton FriedmanThis famous quote underscores the traditional view, but it's increasingly challenged by the notion of stakeholder capitalism, which prioritizes the interests of all stakeholders, including employees, customers, and the environment, not just shareholders.

Critics argue that focusing solely on short-term profits can be detrimental to long-term sustainability and social well-being. They advocate for a more balanced approach that considers the broader impact of business decisions.

Some companies are adopting corporate social responsibility (CSR) initiatives to address these concerns. These initiatives aim to integrate social and environmental considerations into business operations, demonstrating a commitment to ethical and sustainable practices.

The Role of Regulation and Market Forces

Government regulations play a crucial role in mitigating the potential negative consequences of profit maximization. Environmental regulations, labor laws, and consumer protection laws are all designed to ensure that companies operate in a responsible and ethical manner.

Market forces, such as consumer demand for ethical products and investor pressure for sustainable business practices, can also influence corporate behavior. Companies that prioritize social and environmental responsibility may attract more customers and investors, ultimately leading to long-term profitability.

Ultimately, the point at which a profit-maximizing firm employs resources to the point where marginal revenue equals marginal cost is a dynamic equilibrium. It requires careful analysis of costs, revenues, market conditions, and societal expectations.

Looking Ahead: A Shift Towards Sustainable Profitability?

The future of profit maximization may involve a shift towards a more sustainable and inclusive model. Companies are increasingly recognizing that long-term profitability depends on creating value for all stakeholders, not just shareholders.

This requires a fundamental rethinking of the traditional approach to business, with a greater emphasis on ethical behavior, environmental sustainability, and social responsibility. By embracing these principles, companies can create a more prosperous and equitable future for all.

The challenge lies in finding the right balance between profit maximization and social responsibility. The most successful companies of the future will be those that can navigate this complex landscape and create value for all.