Why Is Big Bear Ai Stock Dropping

Imagine a bustling trading floor, screens flashing red and green, the air thick with anticipation. A collective holding of breath as the ticker for Big Bear AI, a name once synonymous with innovation and market dominance, stutters, dips, and then – alarmingly – plummets. Investors, both seasoned veterans and starry-eyed newcomers, watch in dismay as their portfolios take a hit, prompting a frantic search for answers.

The burning question on everyone's mind: Why is Big Bear AI stock experiencing such a dramatic downturn? The answer, as always, is multifaceted, involving a complex interplay of market trends, company-specific challenges, and the ever-fickle sentiment of investors.

The Rise and Reign of Big Bear AI

To understand the current situation, it’s crucial to appreciate the meteoric rise of Big Bear AI. Founded just a decade ago by visionary entrepreneur Anya Sharma, the company quickly established itself as a leader in artificial intelligence solutions for the logistics and supply chain industries.

Their flagship product, 'BearTrack,' a sophisticated AI-powered logistics optimization platform, revolutionized warehouse management and delivery routing. This lead to significant cost savings and efficiency gains for its clients. This disruptive technology propelled Big Bear AI to the forefront of the AI revolution, attracting substantial investment and garnering widespread acclaim.

For years, Big Bear AI enjoyed an impressive growth trajectory, consistently exceeding market expectations and solidifying its position as a Wall Street darling. Investors were captivated by Sharma's bold vision and the company's ability to translate cutting-edge research into tangible business solutions.

The Shifting Tides

However, the landscape of the AI industry is constantly evolving, and no company, no matter how dominant, is immune to market forces. The recent stock drop appears to be the culmination of several converging factors, each contributing to the erosion of investor confidence.

Increased Competition

One of the most significant challenges facing Big Bear AI is the rise of formidable competitors. Several startups, backed by venture capital firms, are entering the market with innovative AI solutions targeted at specific niches within the logistics sector.

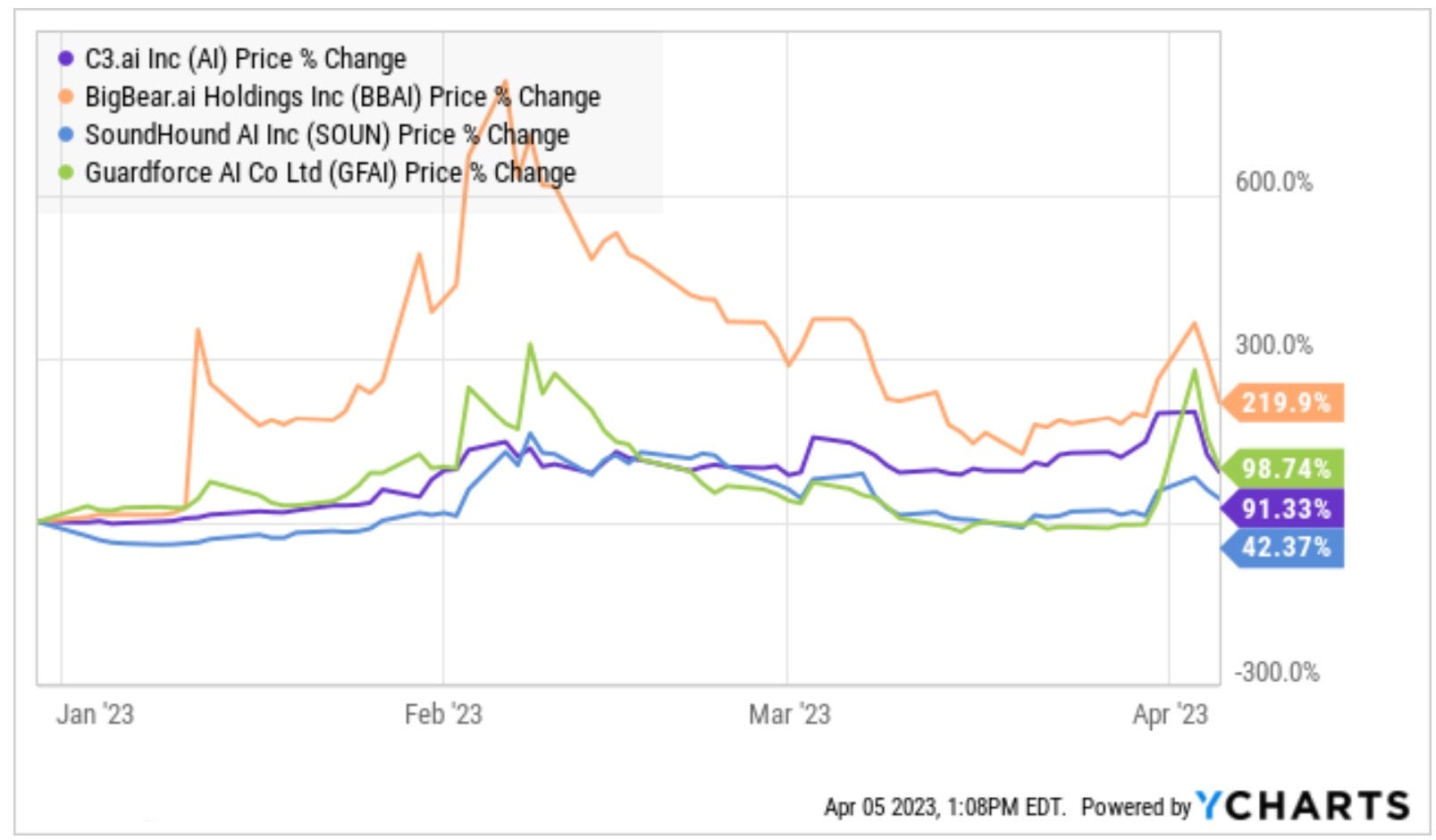

These newcomers, often agile and adaptable, are aggressively undercutting Big Bear AI on price and offering specialized features. This is putting pressure on the company's market share and profitability. A recent report by Gartner indicated a measurable shift in market share away from Big Bear AI towards these emerging players.

Slowing Growth

After years of hyper-growth, Big Bear AI has begun to experience a slowdown in revenue. While the company is still growing, the rate of expansion has decelerated, raising concerns among investors about its long-term prospects.

This slowing growth can be attributed to several factors, including market saturation and the increasing difficulty of acquiring new customers. Many companies have already adopted AI solutions and the pool of potential clients is shrinking.

Furthermore, some analysts suggest that Big Bear AI may have become complacent, failing to innovate quickly enough to maintain its competitive edge. "They rested on their laurels," commented industry analyst David Lee in a recent interview. "And the competition caught up."

Regulatory Scrutiny

Like many tech companies operating in the AI space, Big Bear AI is facing increasing regulatory scrutiny. Governments around the world are grappling with the ethical and societal implications of AI, and new regulations are being introduced to address issues such as data privacy and algorithmic bias.

These regulations could increase the cost of doing business for Big Bear AI and potentially limit the scope of its operations. This has created uncertainty among investors, who are wary of the potential impact of regulatory changes on the company's future earnings.

Leadership Changes

The unexpected departure of CFO, Mark Olsen, earlier this year added another layer of uncertainty. While the company cited "personal reasons" for Olsen's departure, the timing raised eyebrows and fueled speculation about internal disagreements or financial improprieties.

The lack of a permanent replacement for Olsen has further exacerbated the situation. It left investors feeling uneasy about the company's financial management and strategic direction. The company recently appointed Sarah Chen as interim CFO.

The Investor Perspective

Ultimately, the stock market is driven by investor sentiment. The combination of increased competition, slowing growth, regulatory scrutiny, and leadership changes has created a climate of fear and uncertainty surrounding Big Bear AI.

Many investors have chosen to sell their shares, contributing to the downward spiral of the stock price. This sell-off has been further amplified by algorithmic trading, which automatically executes trades based on pre-programmed criteria.

When the stock price falls below a certain threshold, algorithmic trading systems automatically trigger sell orders, further accelerating the decline. This creates a self-fulfilling prophecy, where fear and uncertainty drive the stock price down, which in turn fuels more fear and uncertainty.

Looking Ahead

Despite the current challenges, Big Bear AI remains a company with significant potential. They posses a strong brand, a loyal customer base, and a talented team of engineers and researchers.

To regain investor confidence, Big Bear AI needs to address the underlying issues that are weighing down its stock price. This includes investing in new product development, streamlining its operations, and engaging proactively with regulators.

Furthermore, the company needs to rebuild trust with investors by providing greater transparency and clarity about its future strategy. In a recent press release, Anya Sharma emphasized the commitment to innovation and long-term value creation. She noted the company is "aggressively pursuing new market opportunities and investing in cutting-edge research."

The Future of AI Investments

The story of Big Bear AI serves as a cautionary tale about the risks and rewards of investing in the AI sector. While AI has the potential to transform industries and create immense value, it is also a rapidly evolving field with intense competition and regulatory uncertainty.

Investors need to be diligent in their research and carefully assess the long-term prospects of any company before investing. Diversification is key, as is a willingness to weather short-term volatility. As for Big Bear AI, only time will tell if they can turn the ship around and reclaim their position as a leader in the AI revolution. But one thing is certain: the company's journey will be closely watched by investors and industry observers alike.