According To Gaap When Is Income Reported

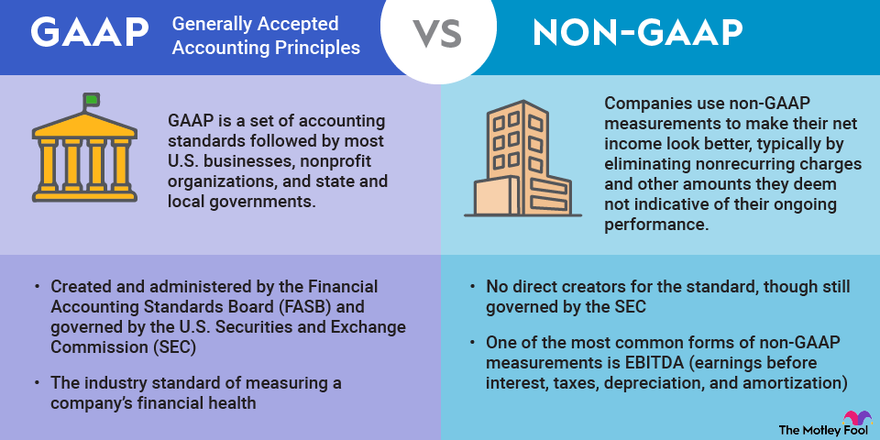

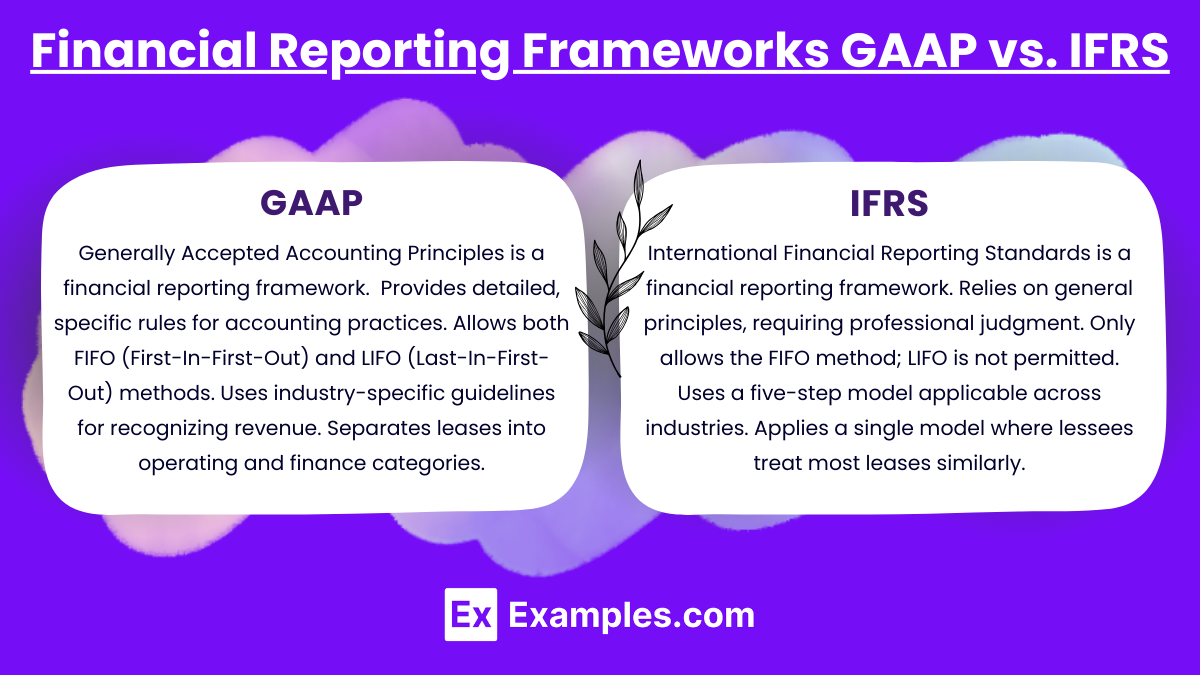

For businesses, understanding when to report income is paramount for accurate financial reporting and compliance. Generally Accepted Accounting Principles (GAAP) provide the framework for these standards in the United States. These guidelines dictate when revenue and expenses are recognized on a company's financial statements.

At the core of GAAP's income reporting rules is the revenue recognition principle, which states that revenue should be recognized when it is earned and realized or realizable. This is not necessarily when cash is received. Understanding the nuances of this principle is crucial for businesses to maintain accurate financial records and avoid potential legal or financial repercussions.

The Revenue Recognition Principle Explained

The revenue recognition principle is based on the idea that revenue should be recorded when a company has substantially performed its obligations to a customer, regardless of when payment is received. This means a business can't simply book revenue when it gets paid. Instead, they must consider the underlying transaction and the timing of the actual service or delivery of goods.

Consider a software company selling a subscription. Under GAAP, the revenue is not recognized upfront when the customer signs the contract and pays. The revenue is recognized ratably over the subscription period as the service is provided to the customer.

Key Criteria for Revenue Recognition Under GAAP

Several criteria must be met before revenue can be recognized under GAAP. These criteria are detailed in Accounting Standards Codification (ASC) 606, Revenue from Contracts with Customers. This is the primary source of guidance on revenue recognition under GAAP.

First, there must be a contract with a customer. The contract defines the terms of the agreement, including the goods or services being provided. Second, the performance obligations in the contract must be identified.

These performance obligations are the promises to transfer goods or services to the customer. Third, the transaction price must be determined. This is the amount of consideration the company expects to receive in exchange for transferring the goods or services to the customer.

Fourth, the transaction price must be allocated to the performance obligations in the contract. Finally, revenue is recognized when (or as) the company satisfies a performance obligation by transferring control of the goods or services to the customer.

Specific Scenarios and GAAP Compliance

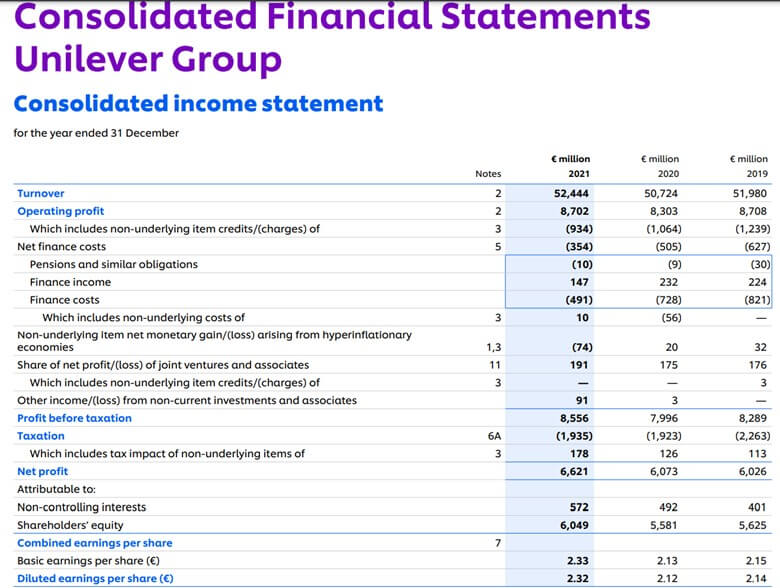

The application of GAAP can vary depending on the specific industry and transaction. For instance, construction companies often use the percentage-of-completion method to recognize revenue over time as a project progresses.

This method allows them to recognize revenue based on the proportion of the project that has been completed. However, this requires careful estimation of costs and progress, which can be subject to judgment.

Another example is in the retail industry. Revenue from a sale is typically recognized when the customer takes possession of the goods. However, if a customer has a right of return, the company must estimate the amount of returns and reduce the revenue recognized accordingly.

Companies must ensure that their accounting policies are consistent with GAAP. Moreover, these policies are properly disclosed in their financial statements. Failure to comply with GAAP can lead to regulatory scrutiny and potential penalties.

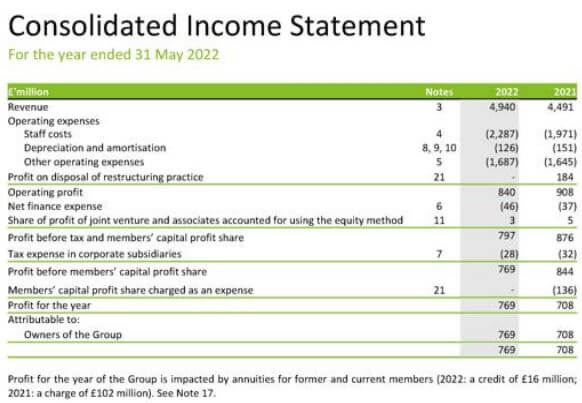

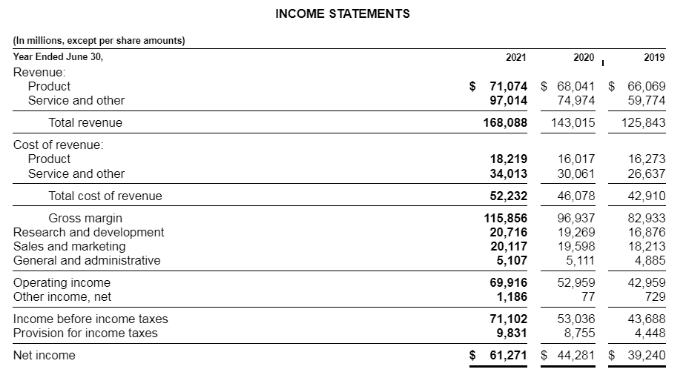

The Impact of Income Reporting on Financial Statements

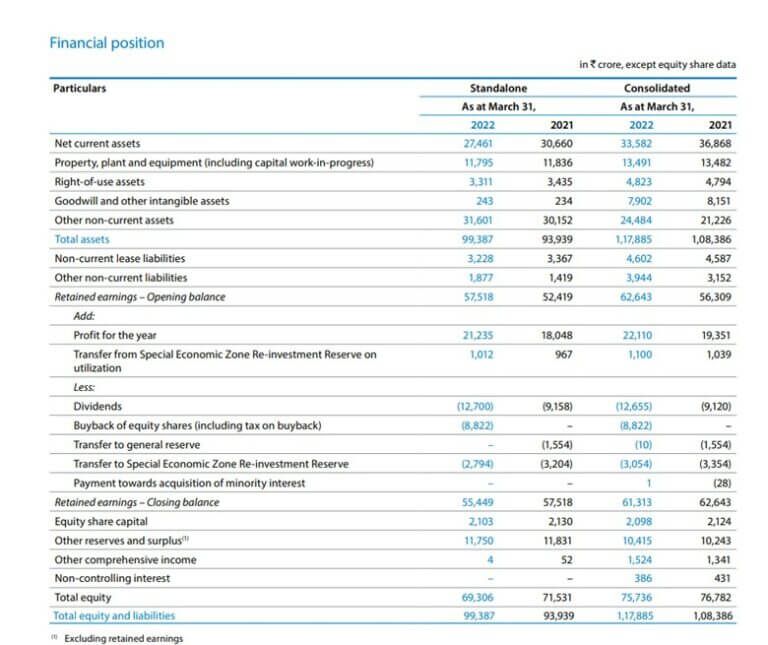

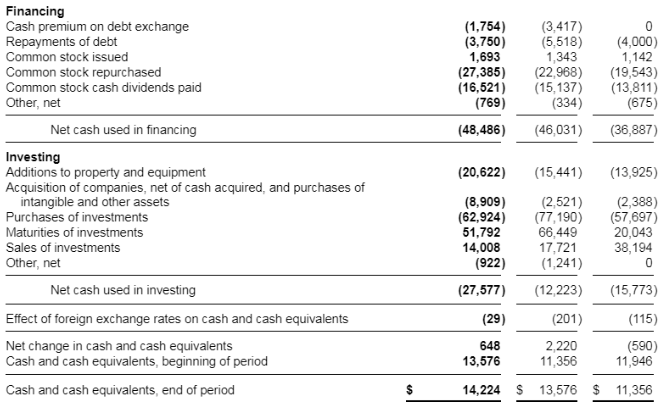

The timing of income reporting has a direct impact on a company's financial statements. Specifically, the income statement and the balance sheet are affected. Incorrectly recognizing revenue can distort a company's profitability and financial position.

For example, if a company prematurely recognizes revenue, it may overstate its profits in the current period and understate them in future periods. This can mislead investors and other stakeholders about the company's true performance.

On the balance sheet, improper revenue recognition can affect the accounts receivable balance and the deferred revenue balance. Deferred revenue represents payments received from customers for goods or services that have not yet been delivered or performed.

Navigating GAAP and Seeking Professional Advice

Given the complexity of GAAP, many companies seek professional advice from accountants or consultants. This is particularly true for small and medium-sized businesses (SMBs). These companies may lack the internal expertise to navigate the intricacies of revenue recognition.

Accountants can help companies develop and implement appropriate accounting policies. They can also ensure that their financial statements are compliant with GAAP. This can save companies time and money in the long run.

Furthermore, staying updated with the latest developments in accounting standards is crucial. The Financial Accounting Standards Board (FASB) regularly issues new guidance and interpretations of GAAP. Keeping abreast of these changes is essential for maintaining accurate financial reporting.

In conclusion, understanding the GAAP principles for income reporting, particularly the revenue recognition principle, is critical for companies of all sizes. By adhering to these standards, businesses can ensure the accuracy and reliability of their financial statements. Ultimately, this fosters trust with investors, creditors, and other stakeholders.