Account Software For Small Business

The financial health of small businesses, the lifeblood of the global economy, is often precarious. A missed payment, a miscalculated tax, or a lack of clear financial visibility can spell disaster, leading to crippling debt or even closure. In an increasingly complex financial landscape, small business owners are turning to accounting software as a crucial tool for survival and growth.

This article delves into the rapidly evolving world of accounting software tailored for small businesses. It will examine the benefits, challenges, and emerging trends, providing a comprehensive overview of how these digital tools are transforming financial management for entrepreneurs.

The Core Benefits of Accounting Software

Accounting software offers a multitude of advantages over traditional manual bookkeeping methods.

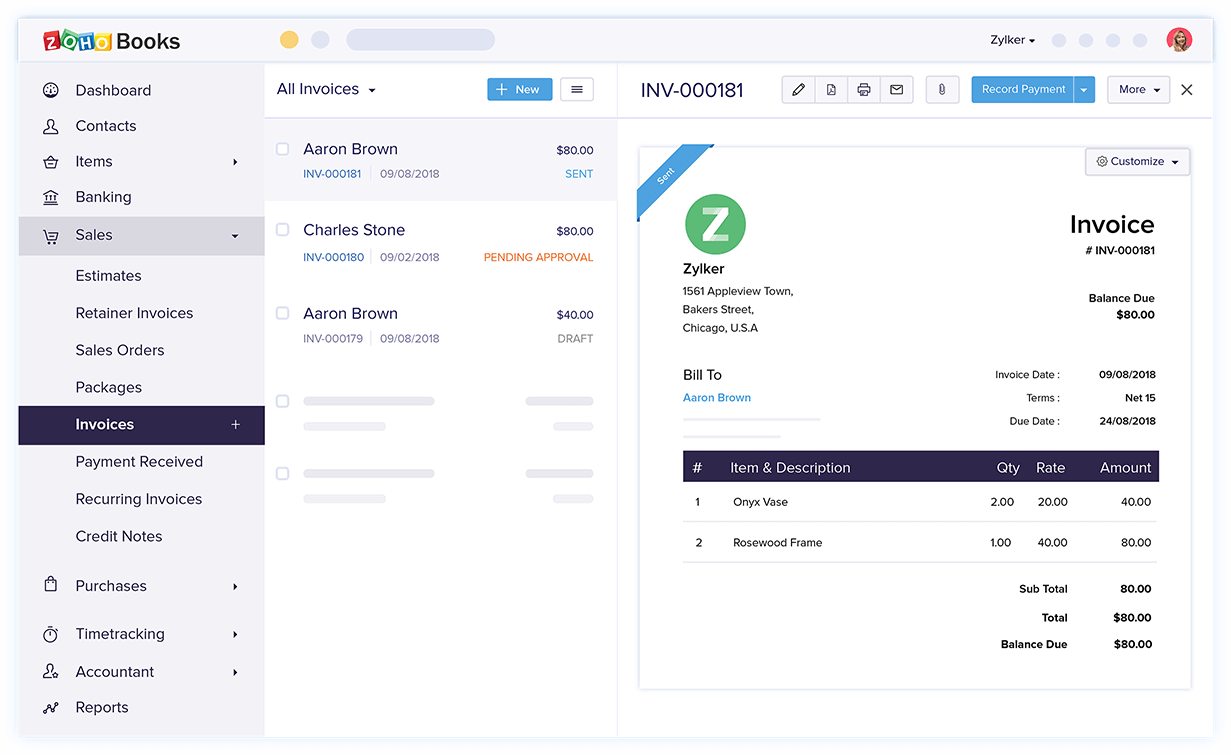

Firstly, it automates many routine tasks, such as invoicing, expense tracking, and bank reconciliation, significantly reducing the time and effort required for financial administration. This automation frees up valuable time for business owners to focus on core business activities like sales, marketing, and product development.

Secondly, accounting software enhances accuracy and minimizes the risk of human error. Automated calculations and real-time data updates ensure that financial reports are reliable and up-to-date, providing a clear and accurate picture of the company's financial position.

Improved Financial Visibility and Decision-Making

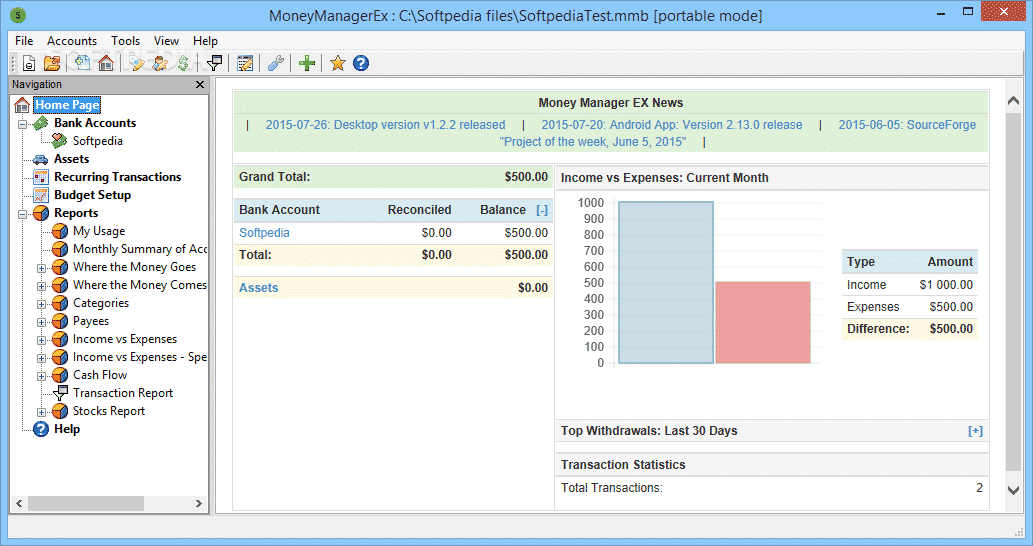

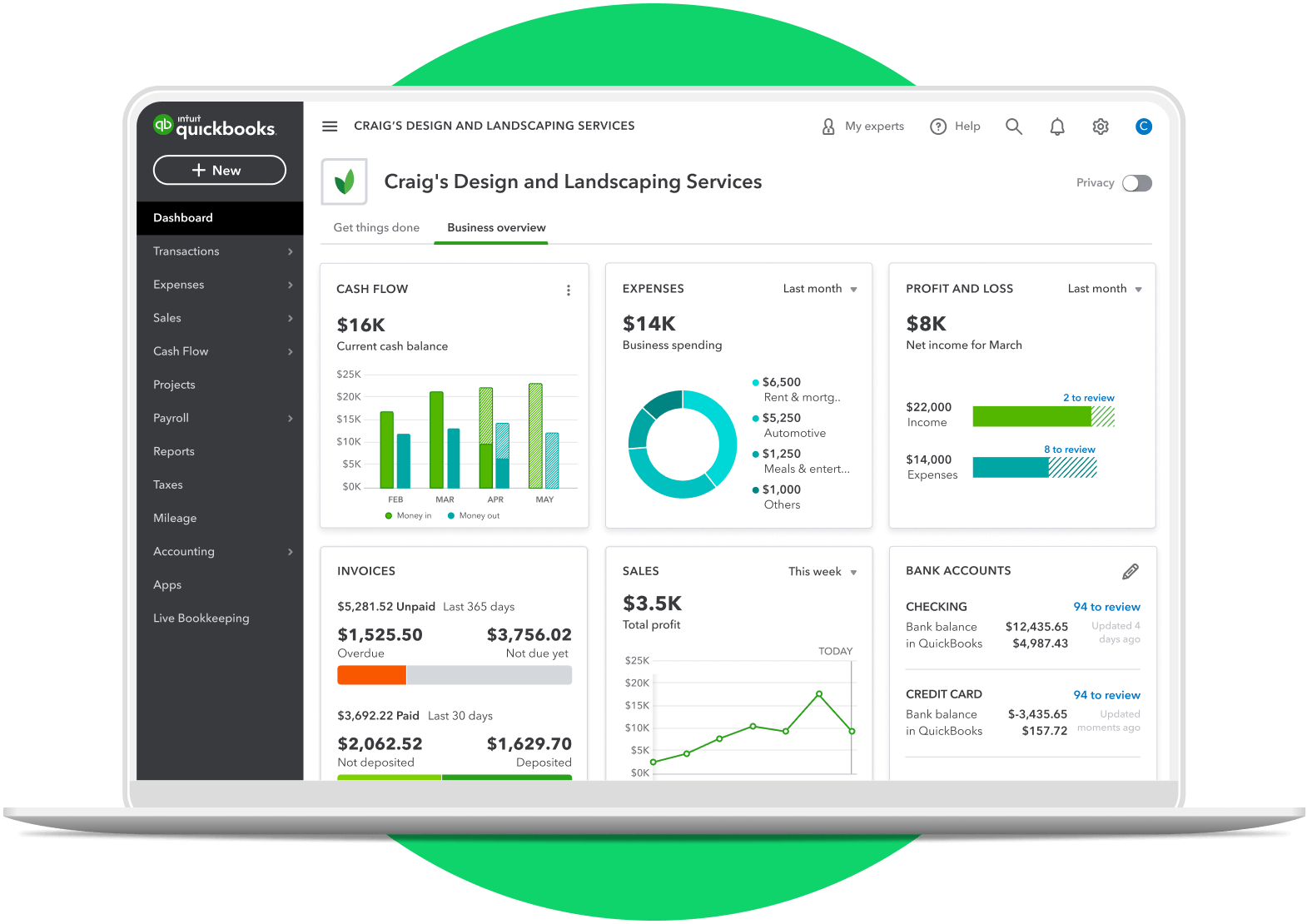

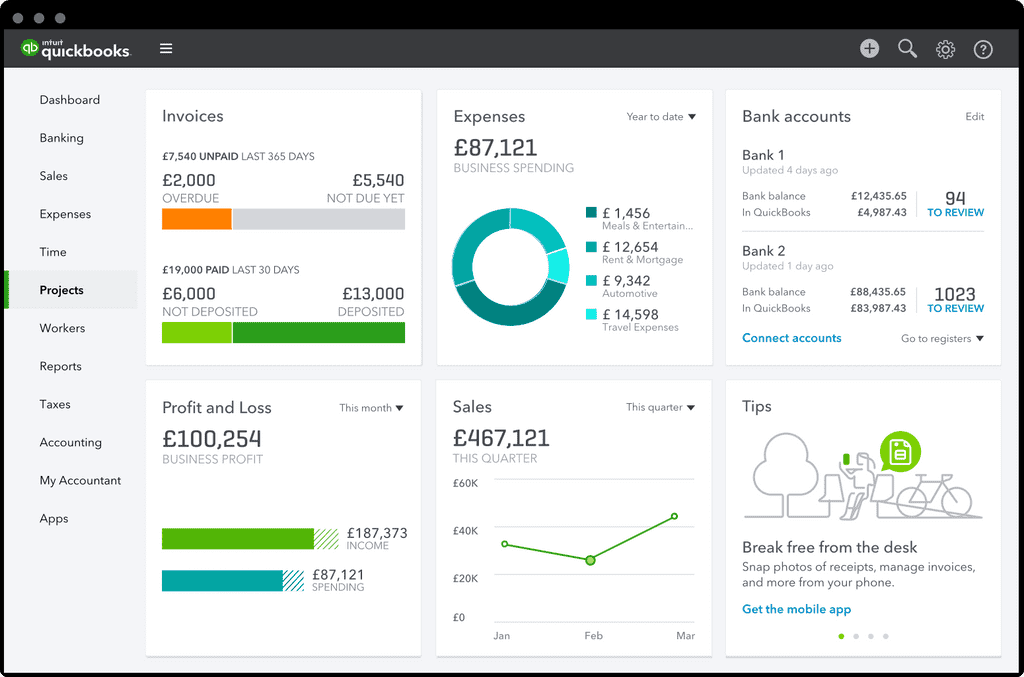

Perhaps the most significant benefit is improved financial visibility. Accounting software provides a centralized platform for tracking income, expenses, assets, and liabilities.

This allows business owners to quickly and easily generate insightful reports, such as profit and loss statements, balance sheets, and cash flow statements, empowering them to make informed decisions about pricing, investments, and resource allocation.

"Having access to real-time financial data has been a game-changer for my business," says Sarah Chen, owner of a local bakery. "I can now track my expenses meticulously, identify areas where I can cut costs, and make better decisions about inventory management."

Key Features and Functionality

Modern accounting software offers a wide range of features designed to meet the specific needs of small businesses.

These features include invoicing and billing, expense tracking, bank reconciliation, payroll management, inventory management, financial reporting, and tax preparation. Many platforms also offer integrations with other business tools, such as CRM systems and e-commerce platforms, streamlining workflows and enhancing data accuracy.

Cloud-based accounting software is becoming increasingly popular due to its accessibility, scalability, and security benefits. Cloud solutions allow business owners to access their financial data from anywhere with an internet connection, facilitating remote work and collaboration. Security features like data encryption and multi-factor authentication protect sensitive financial information from cyber threats.

Choosing the Right Software

Selecting the right accounting software can be a daunting task, given the wide array of options available. Factors to consider include the size and complexity of the business, the specific accounting needs, the budget, and the level of technical expertise of the user.

Some popular accounting software options for small businesses include QuickBooks, Xero, and FreshBooks. Each platform offers a unique set of features and pricing plans, so it's essential to compare options and choose the one that best meets the business's specific requirements.

Challenges and Considerations

While accounting software offers numerous benefits, there are also some challenges and considerations to keep in mind.

One challenge is the learning curve associated with adopting new software. Business owners and employees may need training and support to effectively use the software's features and functionalities. Some software can be expensive, particularly for businesses with limited budgets.

Data security is another important concern. It is crucial to choose a reputable software provider that implements robust security measures to protect sensitive financial data from unauthorized access and cyberattacks.

The Role of Accountants

Despite the increasing sophistication of accounting software, the role of accountants remains crucial. Accountants can provide expert guidance on financial planning, tax compliance, and business strategy. They can also help businesses interpret financial reports and make informed decisions based on the data.

Accountants can also assist with the setup and configuration of accounting software, ensuring that it is properly integrated with other business systems. The American Institute of Certified Public Accountants (AICPA) offers resources and training for accountants to stay up-to-date on the latest accounting software technologies.

Future Trends

The future of accounting software for small businesses is likely to be shaped by several key trends.

Artificial intelligence (AI) and machine learning are expected to play an increasingly important role in automating tasks, such as fraud detection and forecasting. Blockchain technology could enhance the security and transparency of financial transactions. Mobile accounting apps will continue to gain popularity, allowing business owners to manage their finances on the go.

As the digital landscape continues to evolve, accounting software will become even more essential for small businesses to thrive. By embracing these technologies and working closely with accounting professionals, entrepreneurs can unlock the full potential of their businesses and achieve long-term financial success.

![Account Software For Small Business Free accounting software for small businesses [consultants] | Free](https://i.pinimg.com/originals/3c/5b/62/3c5b6243c0b4829e61206921e49c8529.png)