Accounting Software With Payroll Software

Imagine Sarah, a small business owner, juggling invoices, chasing payments, and wrestling with payroll calculations late into the night. The spreadsheets seemed to multiply, and the fear of a miscalculation loomed large. But what if there was a way to lift this burden, to transform those late nights into evenings spent with family?

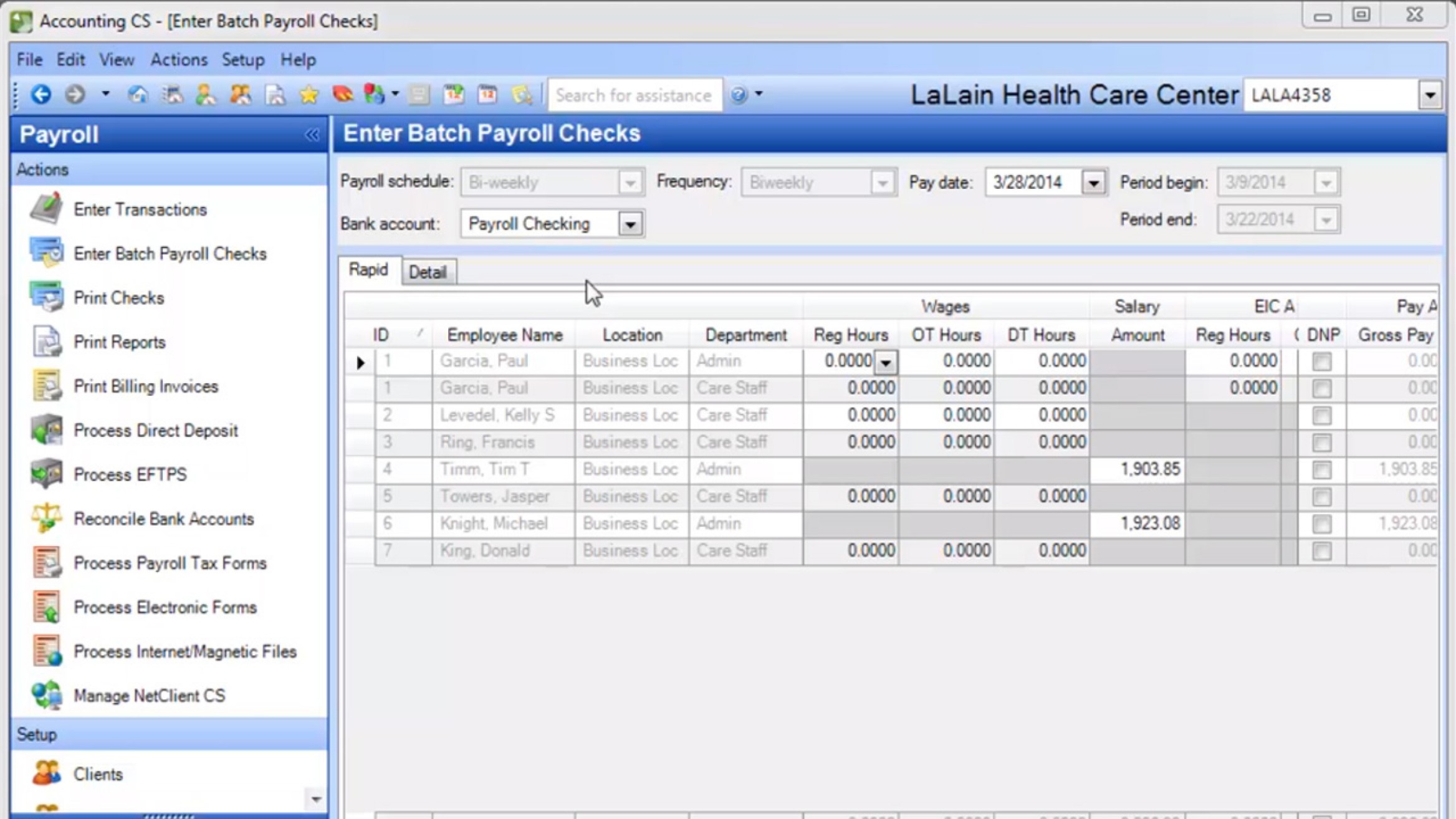

At the heart of this potential transformation lies the integration of accounting and payroll software. This powerful combination streamlines financial management, reduces errors, and frees up valuable time for business owners to focus on growth. This is more than just a convenience; it's a strategic advantage for navigating the complexities of modern business.

The Rise of Integrated Solutions

Historically, accounting and payroll were often handled separately, with data manually transferred between systems. This approach was prone to errors and inefficiencies. According to a 2023 report by Gartner, businesses using integrated systems saw a 25% reduction in administrative overhead.

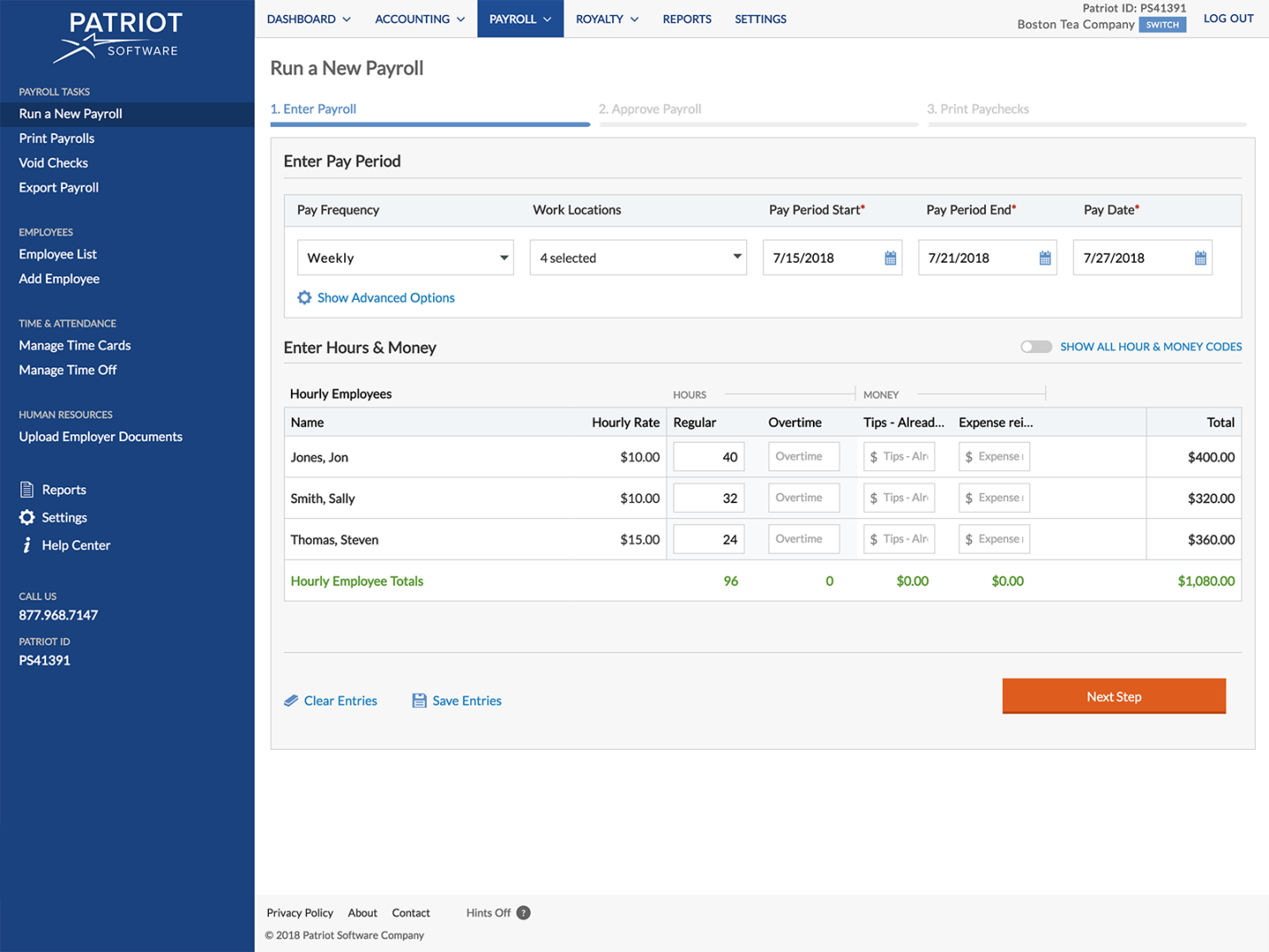

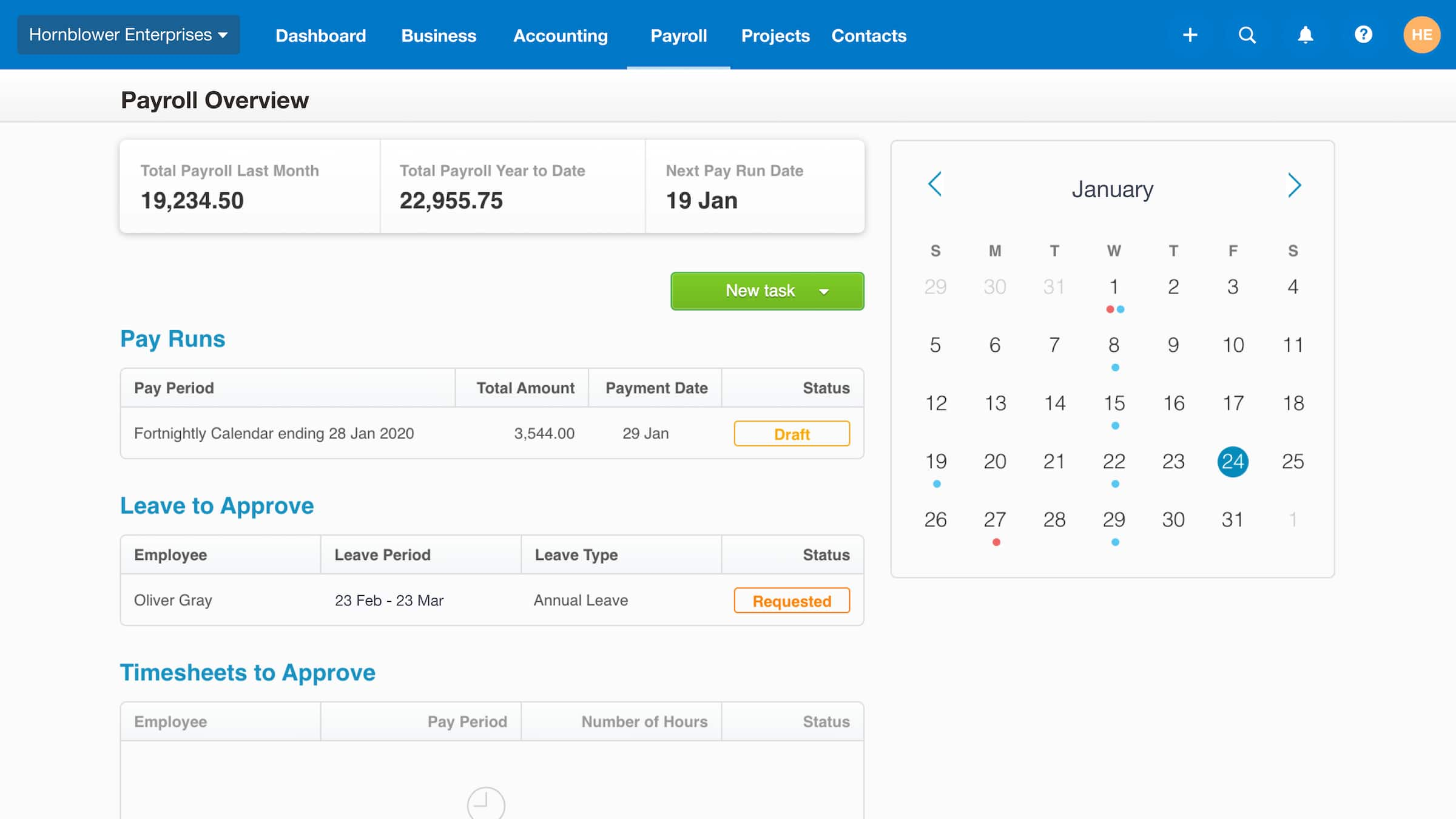

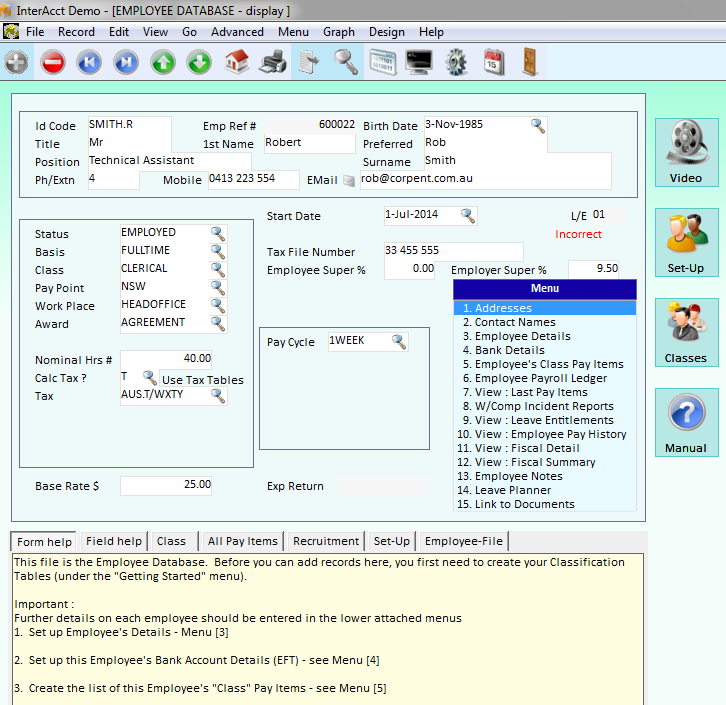

The advent of cloud-based solutions has revolutionized this landscape. Now, accounting and payroll can seamlessly integrate, creating a unified platform for financial management. This integration provides real-time insights into cash flow, expenses, and employee compensation, offering a comprehensive view of the business's financial health.

Benefits Beyond Efficiency

The benefits of integrated accounting and payroll software extend far beyond simple efficiency gains. Accuracy is paramount, especially when dealing with employee paychecks and tax filings. Integrated systems minimize the risk of errors by automating calculations and ensuring data consistency across all platforms.

Compliance is another critical area where integrated solutions excel. Tax laws and regulations are constantly evolving, and staying compliant can be a significant challenge for small businesses. Payroll software automatically calculates and withholds the correct taxes, reducing the risk of penalties and audits. The IRS emphasizes the importance of accurate and timely tax filings, and these integrated systems play a vital role in achieving that.

Furthermore, integrated systems provide enhanced security. By centralizing financial data in a secure environment, businesses can protect sensitive information from unauthorized access. Cloud-based solutions often include features like multi-factor authentication and data encryption, adding an extra layer of security.

Choosing the Right Solution

Selecting the right accounting and payroll software is a crucial decision. Factors to consider include the size and complexity of the business, the number of employees, and the specific features required. Small businesses might find a simple, user-friendly solution sufficient, while larger organizations may need more robust capabilities.

Cost is another important consideration. Many software providers offer different pricing plans based on the features and number of users. It's essential to compare the costs and benefits of different options to find the best fit for your budget. Read online reviews and seek recommendations from other business owners to make an informed decision.

Implementation and training are also key to successful adoption. Ensure that the software provider offers adequate support and training resources to help you get started. A smooth implementation process will minimize disruption to your business operations and ensure that you can quickly realize the benefits of the integrated system.

"Integrating accounting and payroll software has transformed the way we manage our finances," says John Miller, owner of a local bakery. "We've saved countless hours on administrative tasks and gained a much clearer picture of our business's financial performance."

Looking Ahead

The future of accounting and payroll software is bright. Artificial intelligence (AI) and machine learning are being integrated into these systems to automate tasks, predict trends, and provide personalized insights. AI-powered solutions can analyze financial data to identify potential risks and opportunities, helping businesses make more informed decisions.

As technology continues to evolve, accounting and payroll software will become even more sophisticated and user-friendly. These solutions will empower businesses of all sizes to streamline their financial operations, improve accuracy, and gain a competitive edge. The days of late-night spreadsheet struggles are fading, replaced by a future of efficient, data-driven financial management.

Ultimately, the integration of accounting and payroll software represents a significant step forward for business owners. It's a tool that not only simplifies complex tasks but also empowers them to take control of their finances and build a more sustainable and successful future. It's about reclaiming time, reducing stress, and focusing on what truly matters: growing their business and pursuing their passions.