How To Deposit Check To Paypal

In an increasingly digital financial landscape, PayPal continues to evolve, offering users diverse methods for managing their funds. One often overlooked feature is the ability to deposit checks directly into a PayPal account, providing a convenient alternative to traditional banking procedures.

This article delves into the process of depositing checks to PayPal, outlining the necessary steps, requirements, and potential benefits for users seeking a streamlined digital banking experience.

The Nuts and Bolts of Mobile Check Deposit with PayPal

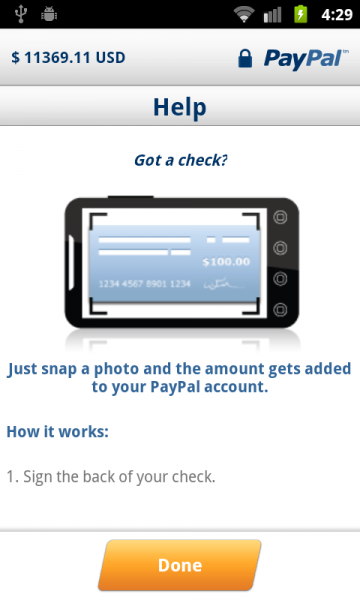

Depositing a check to PayPal relies on the service's mobile check capture feature within the PayPal app. This function essentially turns a smartphone into a mobile deposit scanner.

The service leverages the phone's camera to capture images of the front and back of the check, transmitting them securely to PayPal for processing. This eliminates the need to physically visit a bank or credit union.

Eligibility and Requirements

Not all PayPal users are automatically eligible for mobile check deposit. PayPal assesses eligibility based on factors like account history, activity, and overall standing.

Users can typically check their eligibility within the PayPal app, often found under the "Finance" or "More" sections. Meeting certain requirements, such as having a verified account and a good transaction history, may be necessary to gain access to this feature.

Step-by-Step Guide to Depositing a Check

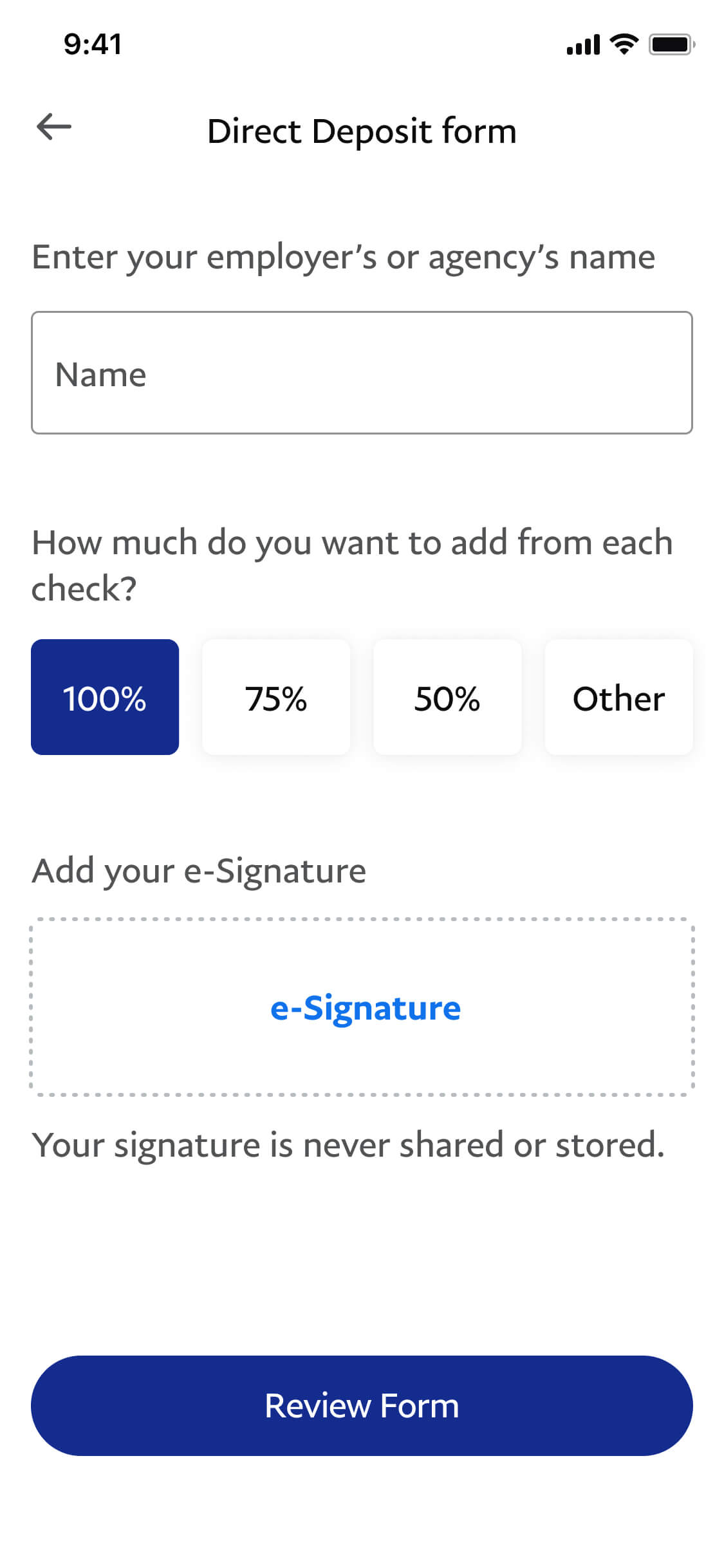

Once eligibility is confirmed, the check deposit process is relatively straightforward. It begins with opening the PayPal app on a smartphone or tablet.

Navigate to the section dedicated to check deposits, often labeled as "Cash a Check," "Mobile Check Deposit," or similar phrasing. The app will then prompt the user to enter the check amount.

The next step involves capturing images of the check. Users are instructed to photograph the front and back of the check, ensuring that all information is clearly visible and within the designated frame.

The back of the check needs to be endorsed with the phrase "For Mobile Deposit Only" followed by the signature of the payee. This endorsement is a crucial security measure to prevent fraudulent duplicate deposits.

After capturing the images, the PayPal app will typically ask the user to review the details and confirm the deposit. It is essential to verify the check amount and ensure the images are clear and legible before submitting.

Once submitted, PayPal will review the deposit. This review process can take anywhere from a few minutes to a few days, depending on the amount of the check and the user's account history.

Fees and Limits

While PayPal offers mobile check deposit, it's crucial to be aware of any associated fees and limitations. In some cases, PayPal may charge a fee for expedited processing, allowing funds to be available sooner than the standard timeframe.

Deposit limits also apply, restricting the maximum amount that can be deposited via mobile check capture within a specific timeframe (e.g., daily or monthly). These limits vary depending on the user's account and risk profile.

Potential Benefits and Considerations

The primary benefit of depositing checks to PayPal is convenience. It eliminates the need to physically visit a bank or use a traditional ATM.

This can be particularly useful for individuals who lack easy access to banking services or prefer to manage their finances entirely online. Funds deposited into a PayPal account can then be used for online purchases, sent to other users, or transferred to a linked bank account.

However, users should also consider potential drawbacks. Processing times can sometimes be longer than traditional bank deposits.

Also, funds are subject to PayPal's terms and conditions, including potential holds or restrictions. Keeping track of deposit limits and associated fees is essential for effective financial management.

An Evolving Landscape

PayPal's mobile check deposit feature is part of a broader trend towards digital financial services. As technology advances and consumer preferences shift, we can expect to see further innovations in how people manage their money.

Staying informed about these developments is crucial for making informed financial decisions and maximizing the benefits of the digital economy.

This option makes PayPal an attractive tool for various users, offering a blend of traditional and modern financial services.