What Is Penalty For 401k Early Withdrawal

Facing unexpected financial hardship? The temptation to tap into your 401(k) early might seem appealing, but understanding the potential penalties is crucial. This article breaks down the financial ramifications of early 401(k) withdrawals, helping you make informed decisions about your retirement savings.

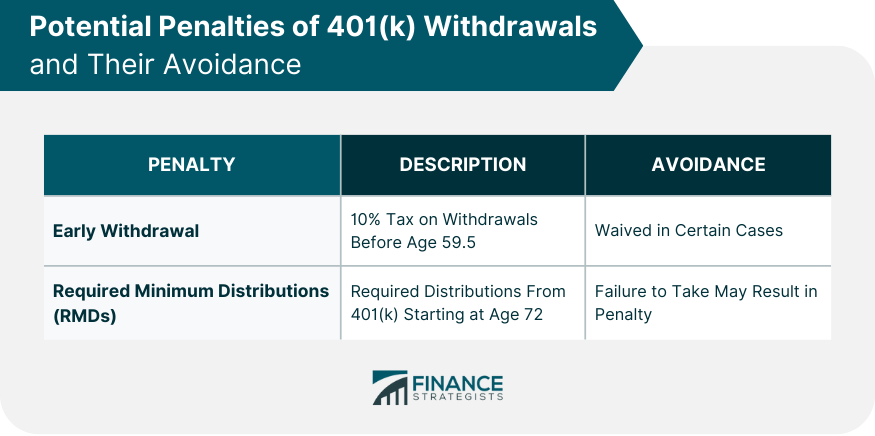

The primary penalty for withdrawing from a 401(k) before age 59 ½ is a 10% early withdrawal penalty imposed by the Internal Revenue Service (IRS). This is on top of any applicable federal and state income taxes. Therefore, accessing your retirement funds prematurely can significantly deplete your savings.

The 10% Early Withdrawal Penalty

Generally, if you withdraw money from your 401(k) before you reach age 59 ½, you'll be hit with the 10% penalty. This penalty is calculated on the taxable amount of the withdrawal. So, understanding how that penalty works is very important.

For example, if you withdraw $10,000, you could owe $1,000 just in penalty fees. That is before considering the money you will owe in income tax.

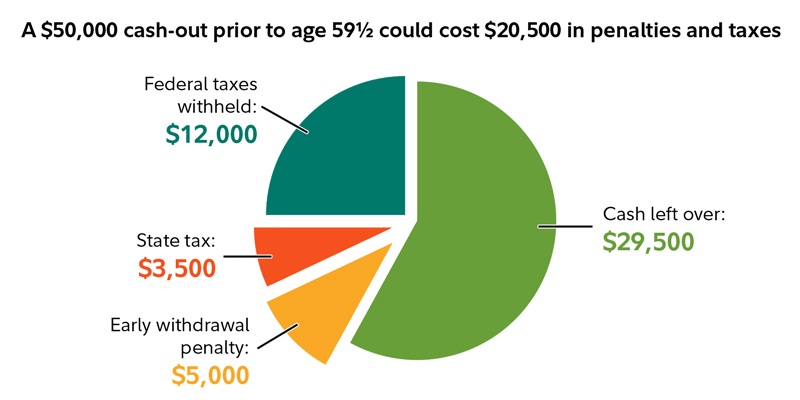

Income Tax Implications

Beyond the 10% penalty, early 401(k) withdrawals are also subject to federal and potentially state income taxes. Since 401(k) contributions are typically made on a pre-tax basis, withdrawals are taxed as ordinary income in the year they are taken.

This means the withdrawn amount will be added to your gross income for the year. As a result, it could potentially push you into a higher tax bracket.

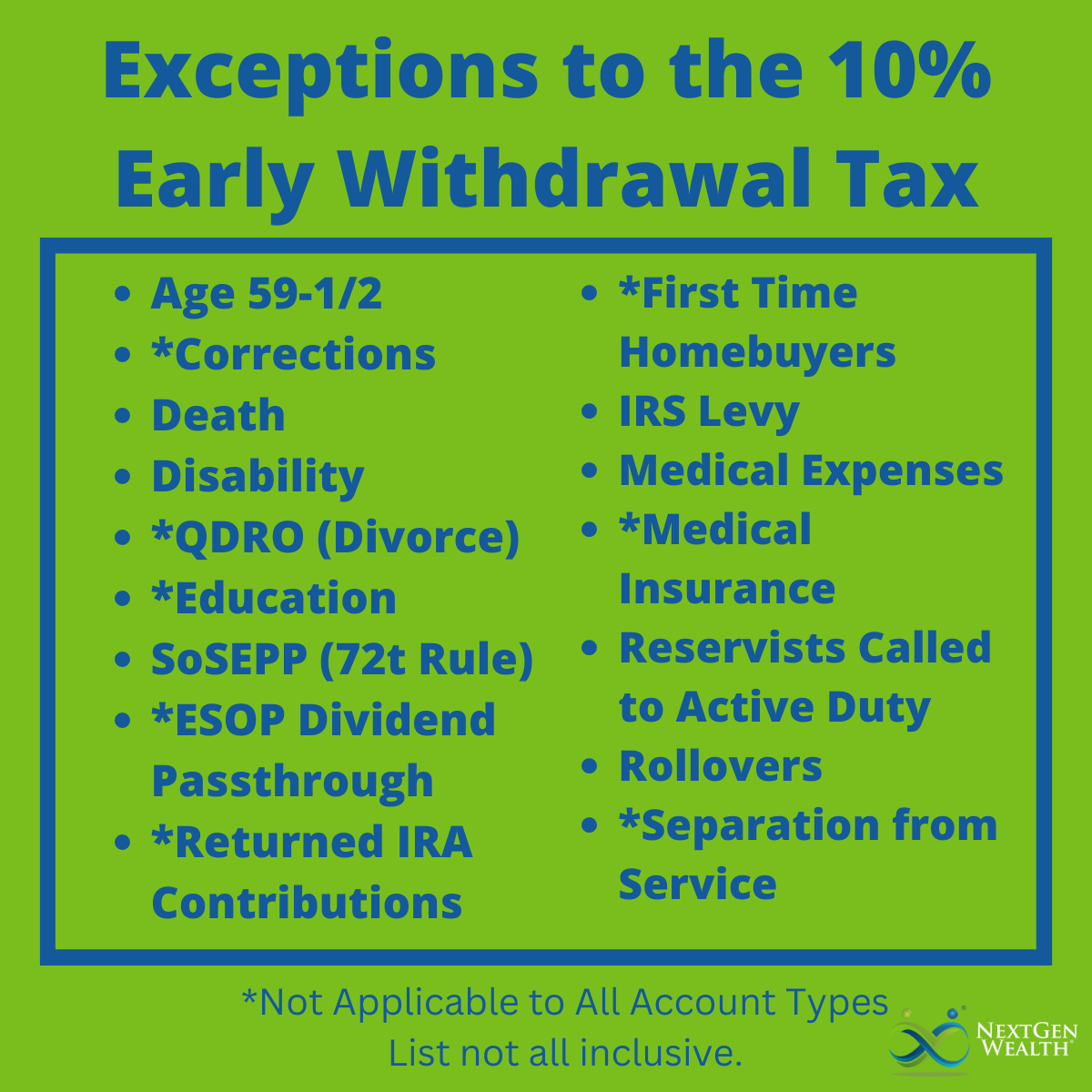

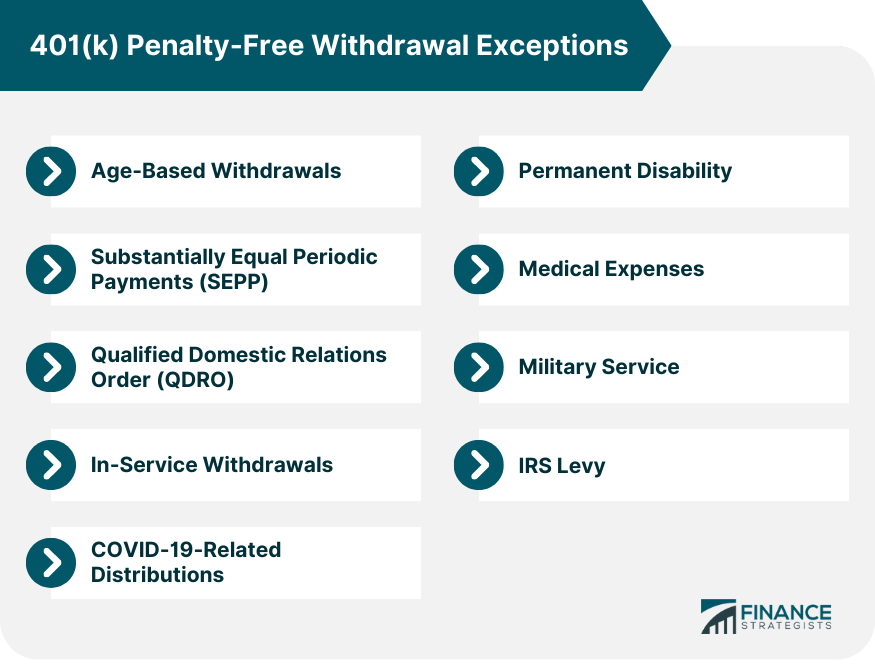

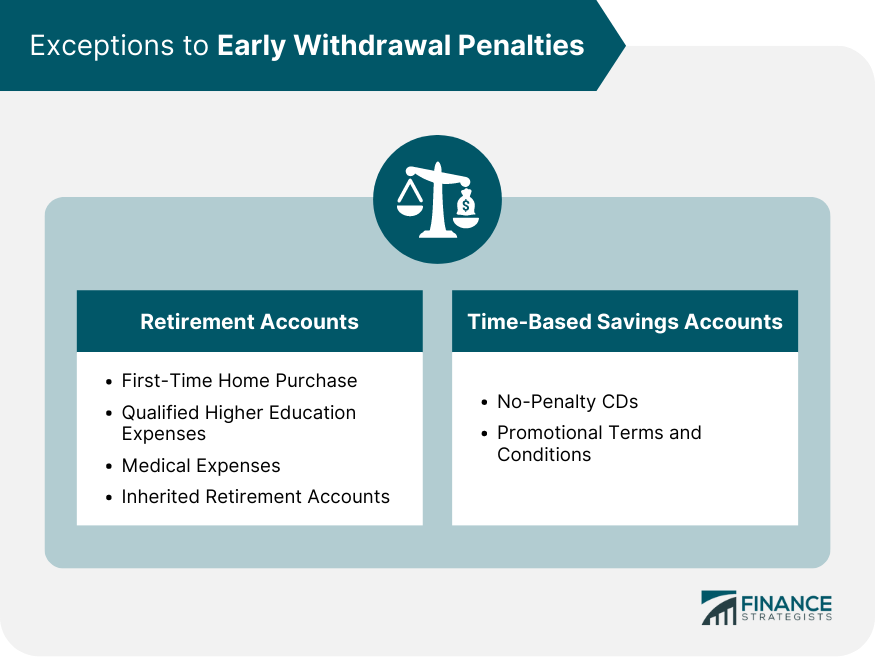

Exceptions to the Penalty

While the 10% penalty is generally applicable, there are some exceptions. These exceptions are specified by the IRS and may include situations such as qualifying medical expenses, disability, or a qualified domestic relations order (QDRO) issued in a divorce.

Common Exceptions to the 10% Penalty:

- Unreimbursed Medical Expenses: Withdrawals may be penalty-free to the extent they exceed 7.5% of your adjusted gross income (AGI).

- Disability: If you become disabled and unable to work, withdrawals may be exempt from the penalty.

- Qualified Domestic Relations Order (QDRO): A QDRO, issued as part of a divorce, can allow penalty-free withdrawals.

- Death: If you die, your beneficiaries can withdraw money from your 401(k) without penalty.

- IRS Levy: If the IRS levies your 401(k) to pay unpaid taxes, the withdrawal may be exempt from the penalty.

It's crucial to carefully review the specific requirements for each exception. Consult with a tax professional to determine if you qualify.

Hardship Withdrawals: A Closer Look

Previously, 401(k) plans allowed hardship withdrawals for various reasons. However, regulations have changed.

Under current rules, 401(k) hardship withdrawals are generally only permitted for immediate and heavy financial needs. These needs may include certain medical expenses, costs related to the purchase of a primary residence, or tuition expenses.

Even if a hardship withdrawal is permitted, it's still subject to income tax. And, it is usually subject to the 10% early withdrawal penalty if you're under 59 ½.

Loans vs. Withdrawals

Consider the alternative of a 401(k) loan before resorting to an early withdrawal. A 401(k) loan allows you to borrow money from your retirement account and repay it with interest, avoiding the immediate tax implications and penalties of a withdrawal.

However, if you leave your job or fail to repay the loan according to the agreed-upon schedule, the outstanding balance may be treated as a distribution, subject to taxes and penalties. Always consider the long term impact on your retirement.

Impact on Retirement Savings

The most significant impact of an early 401(k) withdrawal is the reduction of your future retirement savings. Withdrawing funds early not only incurs penalties and taxes, but it also disrupts the potential for long-term growth through compounding.

Fidelity Investments, for instance, has conducted studies showing the significant impact of early withdrawals on retirement readiness. Even seemingly small withdrawals can have a substantial impact on the long-term growth of your retirement nest egg.

Seeking Professional Advice

Navigating the complexities of 401(k) withdrawals requires careful consideration. It is always advisable to consult with a qualified financial advisor or tax professional before making any decisions. A professional can assess your individual circumstances and provide personalized guidance.

Ultimately, understanding the penalties and tax implications associated with early 401(k) withdrawals can help you protect your retirement savings and make informed financial decisions. Careful planning is essential for a secure retirement.

_Early_Withdrawal_Penalty_Exceptions.png?width=4800&height=2180&name=401(k)_Early_Withdrawal_Penalty_Exceptions.png)