Accounting Softwares For Small Business

In the demanding world of small business, survival often hinges on meticulous financial management. From tracking every penny to projecting future growth, the challenge is immense, and the stakes are undeniably high.

Many businesses still grapple with outdated spreadsheets or even manual ledgers, a risky proposition that can lead to errors, missed opportunities, and ultimately, business failure. The right accounting software can be a lifeline, offering streamlined processes and valuable insights.

This article delves into the world of accounting software designed specifically for small businesses, exploring the range of options, key features, and the critical role these tools play in fostering financial health and sustainable growth.

The Nut Graf: Empowering Small Businesses with Technology

Accounting software is no longer a luxury but a necessity for small businesses. These platforms automate crucial tasks like bookkeeping, invoicing, expense tracking, and financial reporting, saving time and reducing the risk of human error. Choosing the right software, however, requires careful consideration of a business's specific needs, budget, and technical expertise. The potential benefits – improved efficiency, better financial visibility, and enhanced decision-making – are well worth the investment.

Key Features and Functionality

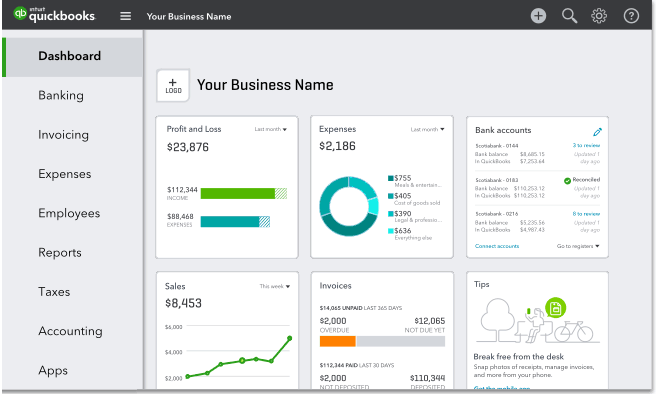

Modern accounting software offers a wealth of features beyond basic bookkeeping. Cloud-based solutions, in particular, provide anytime, anywhere access and facilitate collaboration.

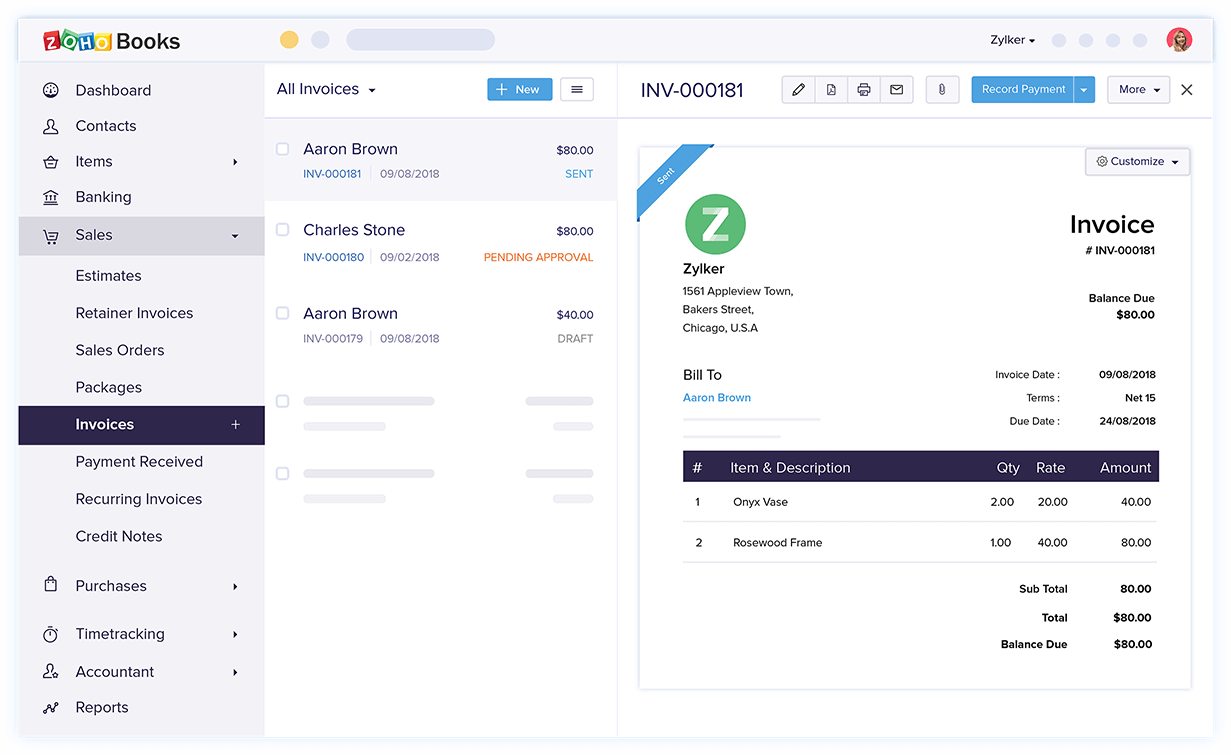

Core functionalities often include: Invoicing and billing; Expense tracking; Bank reconciliation; Financial reporting (balance sheets, income statements, cash flow statements); Payroll processing; Inventory management and Tax preparation.

Many platforms also offer integrations with other business tools, such as CRM (Customer Relationship Management) systems, e-commerce platforms, and payment gateways, creating a seamless flow of data across different departments.

Popular Software Options for Small Businesses

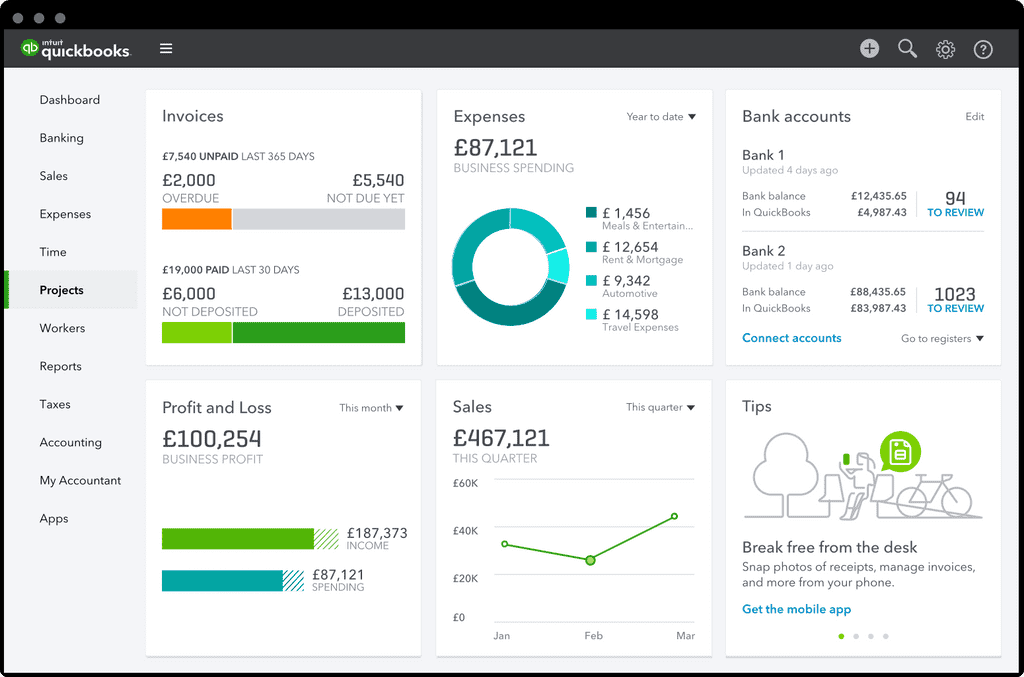

The market is saturated with accounting software, each with its own strengths and weaknesses. Popular options include QuickBooks Online, Xero, Zoho Books, and FreshBooks.

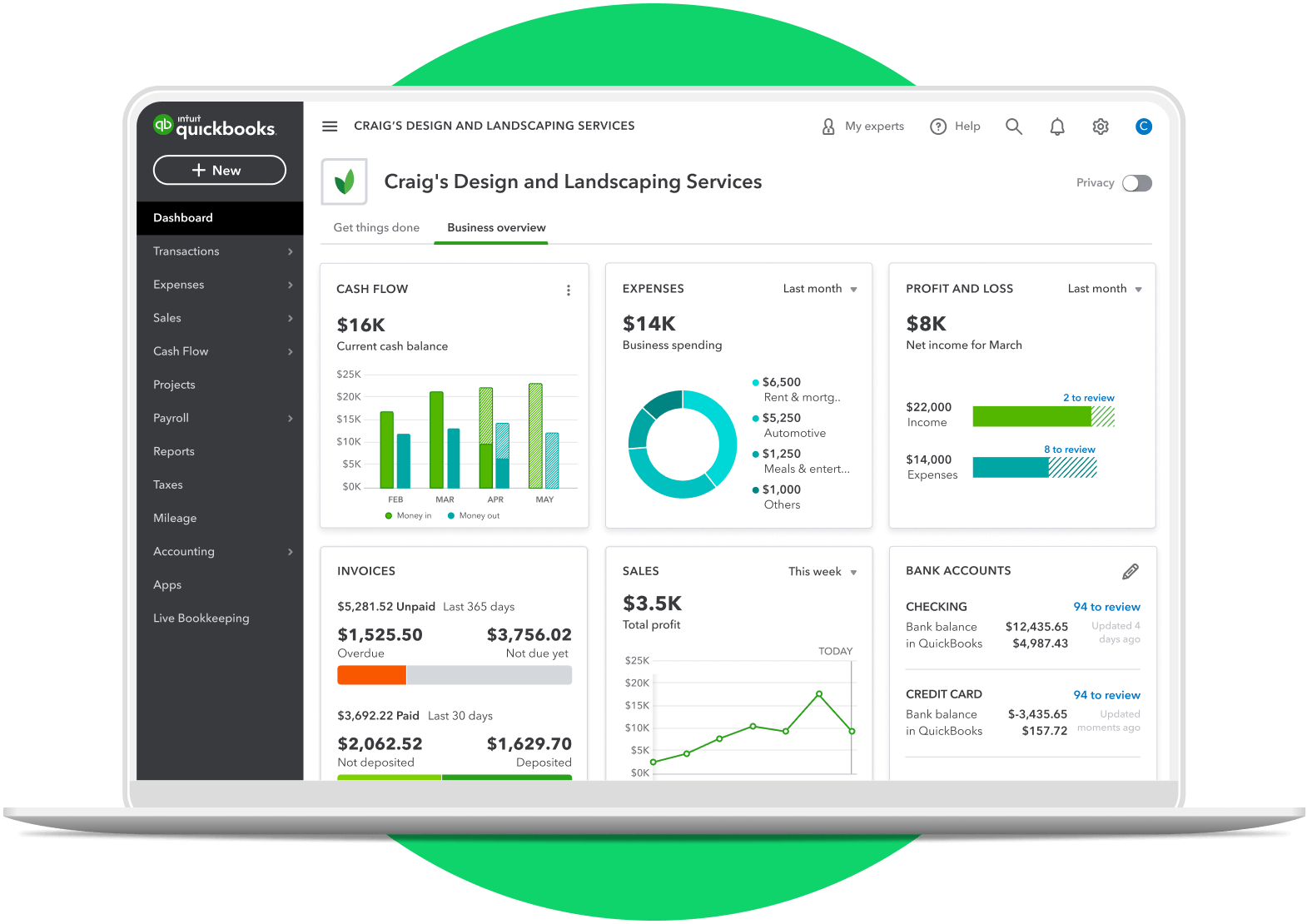

QuickBooks Online is a widely used platform, known for its comprehensive feature set and scalability. Xero is another strong contender, offering a user-friendly interface and robust reporting capabilities.

Zoho Books stands out for its affordability and integration with the broader Zoho ecosystem. FreshBooks, on the other hand, is specifically designed for freelancers and service-based businesses.

Choosing the Right Software: A Tailored Approach

Selecting the right accounting software is not a one-size-fits-all process. Businesses need to carefully evaluate their specific requirements and priorities.

Factors to consider include: Budget (subscription fees, implementation costs, training); Business size and complexity; Industry-specific needs; Integration requirements; Ease of use and support. A thorough needs assessment and trial period are essential before making a final decision.

Consider scaling capabilities. Will the software support your business as it grows? "Choosing software is more than just feature comparisons; it is about how the software will fit with current workflows," said Anita Thompson, a small business consultant from Thompson & Associates.

The Cloud vs. On-Premise Debate

While cloud-based accounting software has become increasingly popular, some businesses still prefer on-premise solutions. Cloud-based software offers advantages such as accessibility, automatic updates, and lower upfront costs.

On-premise software, on the other hand, provides greater control over data security and customization. The choice depends on a business's specific risk tolerance, IT infrastructure, and budget constraints.

Increasingly, cloud solutions are winning out due to improved security protocols and ease of use, according to a recent report from the Small Business Administration.

Beyond Automation: Gaining Valuable Insights

Accounting software is not just about automating routine tasks; it's also about generating valuable insights that can drive better business decisions. Powerful reporting features allow businesses to track key performance indicators (KPIs), identify trends, and pinpoint areas for improvement.

By analyzing financial data, businesses can optimize pricing strategies, manage cash flow more effectively, and make informed investment decisions. The software empowers business owners to take control of their finances and make data-driven decisions.

The Future of Accounting Software

The future of accounting software is likely to be shaped by trends such as artificial intelligence (AI) and machine learning (ML). AI-powered tools can automate tasks such as data entry, fraud detection, and financial forecasting.

ML algorithms can analyze vast amounts of data to identify patterns and provide personalized insights. The integration of these technologies will further enhance the efficiency and effectiveness of accounting software, empowering small businesses to compete in an increasingly complex and competitive marketplace. Automation will only increase according to Deloitte's 2024 Tech Trends report.

Conclusion: Investing in Financial Health

Investing in the right accounting software is a strategic move for any small business. By streamlining processes, improving financial visibility, and providing valuable insights, these tools can help businesses thrive in today's challenging environment. The key is to carefully assess your needs, explore the available options, and choose a solution that aligns with your business goals. Remember that financial health is the foundation of sustainable growth.