Capital One Quicksilver Card Vs Capital One Platinum

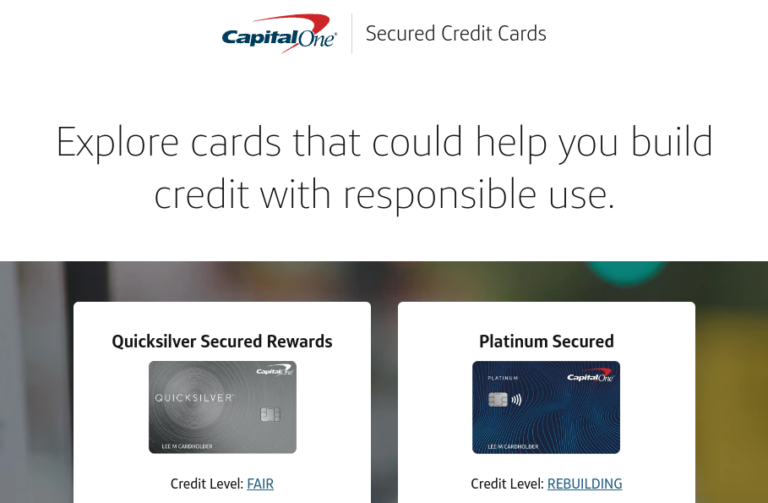

Credit card users face a crucial decision: Capital One Quicksilver or Capital One Platinum? Understanding the nuances is vital for maximizing benefits and minimizing costs.

This guide breaks down the key differences between these two popular cards, helping you choose the one that best aligns with your financial goals and spending habits.

Rewards and Benefits

The Capital One Quicksilver card offers a straightforward rewards structure: 1.5% cash back on every purchase, every day. There are no rotating categories or minimum spending requirements to worry about.

The Capital One Platinum card, however, does not offer rewards. Its primary focus is on building or improving credit.

APR and Fees

APR (Annual Percentage Rate) varies for both cards depending on creditworthiness. The Quicksilver card generally offers a range, while the Platinum card's APR might be similar but is often less of a concern for those focused on balance transfers or emergency use with prompt repayment.

Neither card charges an annual fee. This makes them both attractive options for users looking to avoid additional costs.

Credit Score Requirements

Quicksilver typically requires good to excellent credit for approval. This means a FICO score of 670 or higher is generally needed.

Platinum is geared toward those with fair to good credit. Applicants with a FICO score in the 620-699 range may find this card easier to obtain.

Who Should Choose Quicksilver?

If you have good credit and want to earn consistent rewards on all purchases, the Quicksilver card is a solid choice. The flat-rate cash back simplifies tracking earnings.

This is ideal for individuals who value simplicity and don't want to juggle multiple reward categories.

Who Should Choose Platinum?

The Platinum card is designed for individuals aiming to build or rebuild their credit. It provides access to a credit line without the temptation of rewards spending, encouraging responsible use.

This option is suitable for those who might carry a balance and need a tool to improve their credit score over time.

Additional Perks

Both cards offer standard Capital One benefits like fraud protection and 24/7 customer service. They also may offer access to Capital One Entertainment.

Capital One also monitors your account for suspicious activity, providing an extra layer of security.

Important Considerations

Before applying, review your credit report to understand your credit standing. This will help determine which card you're more likely to be approved for.

Carefully consider your spending habits and financial goals. Are you prioritizing rewards or credit building?

Next Steps

Visit the Capital One website to compare the cards side-by-side and review the latest terms and conditions. Pay close attention to the APRs and any potential fees.

Choose the card that best aligns with your needs and apply online. Responsible card use is key to maximizing benefits and maintaining a healthy credit score.

![Capital One Quicksilver Card Vs Capital One Platinum Capital One Platinum Card vs. Quicksilver Card [2025]](https://upgradedpoints.com/wp-content/uploads/2023/05/Capital-One-Platinum-vs-Capital-One-Quicksilver-One-Upgraded-Points-1.jpg)

![Capital One Quicksilver Card Vs Capital One Platinum Capital One Platinum Card vs. Quicksilver Card [2025]](https://upgradedpoints.com/wp-content/uploads/2020/10/Capital-One-Platinum.png)