Where Are Unrealized Gains And Losses From Investment Securities Displayed

The world of finance is filled with complex accounting rules, and understanding where to find unrealized gains and losses from investment securities is crucial for investors, analysts, and anyone interpreting financial statements. Misinterpreting these figures can lead to skewed perceptions of a company's financial health, impacting investment decisions and overall market confidence.

This article delves into the specific locations within financial statements where unrealized gains and losses on investment securities are disclosed, navigating the intricacies of accounting standards and reporting practices. It aims to provide a clear understanding of how these gains and losses are presented, their impact on financial performance, and the ongoing evolution of their reporting requirements.

Understanding Unrealized Gains and Losses

Unrealized gains and losses, often referred to as "paper profits" or "paper losses," represent the change in the market value of an investment security that an entity holds, but has not yet sold. These gains or losses are considered unrealized because they haven't been "realized" through a sale transaction.

For example, if a company purchases stock for $100 and its market value increases to $120, the company has an unrealized gain of $20. Conversely, if the market value drops to $80, the company has an unrealized loss of $20.

Where to Find Unrealized Gains and Losses: A Detailed Look

The Balance Sheet

Investment securities themselves are generally listed on the balance sheet as assets. The carrying value of these securities, and how unrealized gains and losses are reflected, depends on their classification under accounting standards such as U.S. GAAP (Generally Accepted Accounting Principles) or IFRS (International Financial Reporting Standards).

Under both GAAP and IFRS, investment securities are typically classified into three categories: Held-to-maturity, Available-for-sale, and Trading securities. Each category has a different accounting treatment.

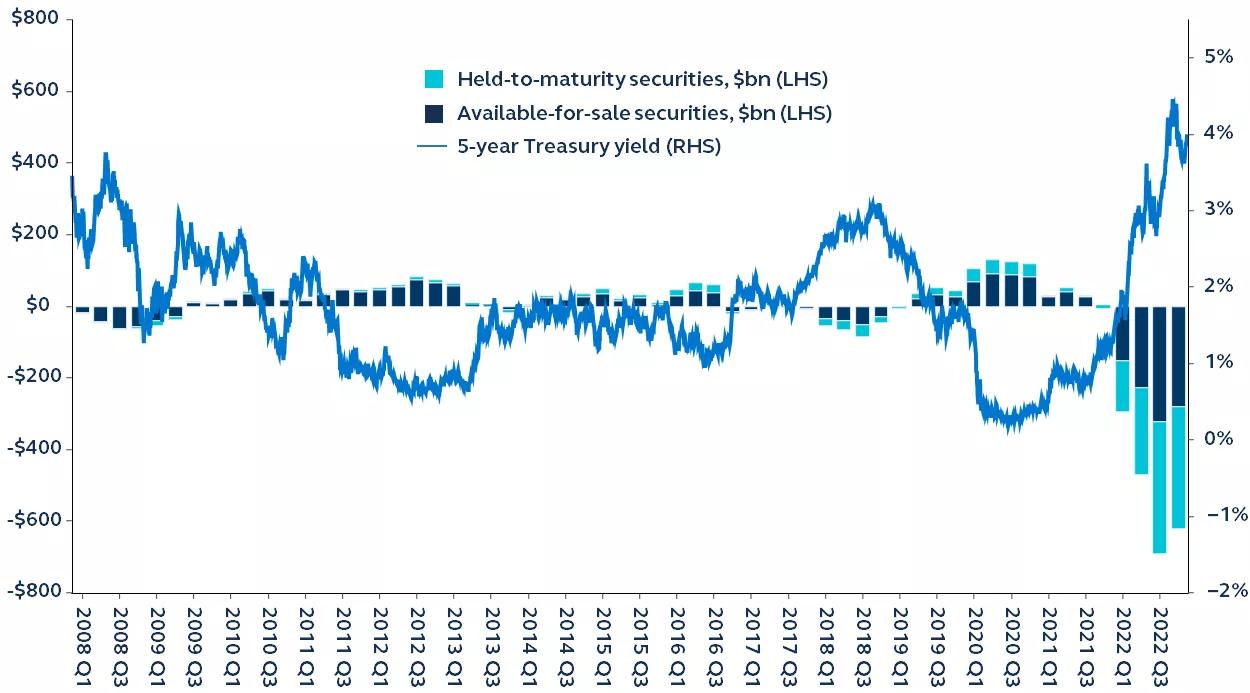

Held-to-maturity securities are debt securities that the company has the intent and ability to hold until maturity. These are typically carried at amortized cost, and unrealized gains and losses are generally not recognized.

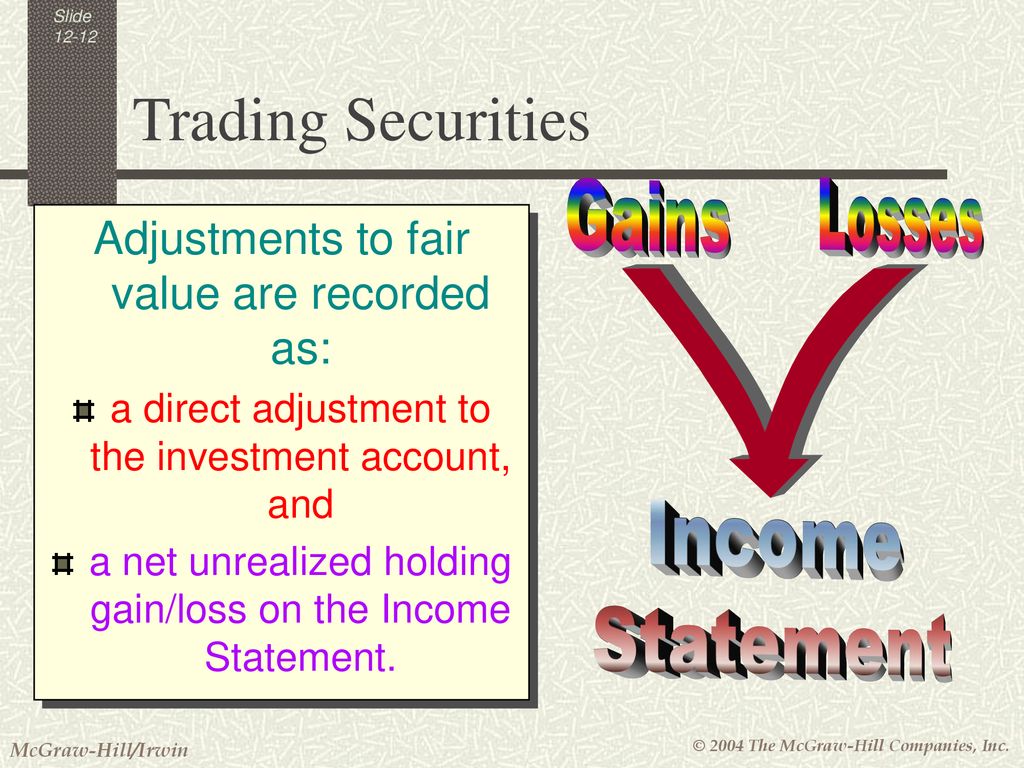

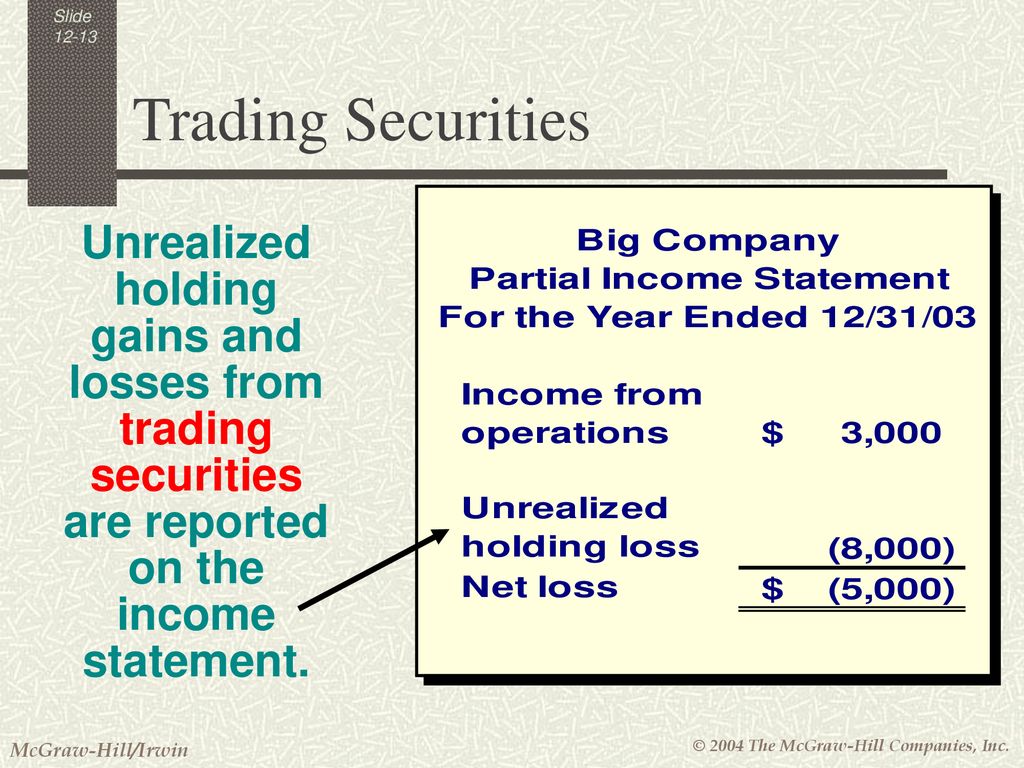

Trading securities are bought and held primarily for the purpose of selling them in the near term. Unrealized gains and losses on trading securities are recognized in the income statement in the period in which they occur. This means that fluctuations in the market value of these securities directly impact a company's reported profit or loss.

Available-for-sale securities are those that are not classified as either held-to-maturity or trading securities. Under U.S. GAAP, unrealized gains and losses on available-for-sale securities are typically reported as a component of other comprehensive income (OCI), which is presented separately from net income.

The Income Statement and Other Comprehensive Income (OCI)

As mentioned earlier, unrealized gains and losses on trading securities are reported directly in the income statement. This can significantly impact a company's net income, especially for firms that actively trade securities.

Under U.S. GAAP, Other Comprehensive Income (OCI) is a separate section of the financial statements where certain gains and losses are recorded that are not included in net income. Unrealized gains and losses on available-for-sale securities are typically found here, net of any related tax effects.

Accumulated Other Comprehensive Income (AOCI) is a component of equity on the balance sheet. It represents the cumulative amount of OCI items over time, including the accumulated unrealized gains and losses on available-for-sale securities. When these securities are sold, the unrealized gain or loss is "recycled" from AOCI to the income statement.

The Statement of Cash Flows

Unrealized gains and losses themselves do not directly impact the statement of cash flows because they are non-cash items. However, the purchase and sale of investment securities, which ultimately realize these gains and losses, are reported as cash flows.

The classification of these cash flows depends on the nature of the investment. Purchases and sales of trading securities are typically classified as operating activities, while purchases and sales of available-for-sale and held-to-maturity securities are usually classified as investing activities.

Footnote Disclosures

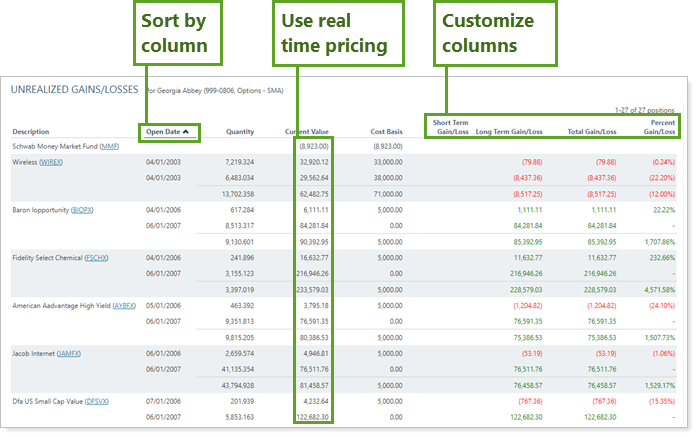

Footnote disclosures are an essential part of financial statements, providing additional information and context to the numbers presented. Companies are required to disclose significant accounting policies related to investment securities, including the methods used to determine fair value and the classification of securities.

The footnotes will also provide details about the gross unrealized gains and losses on investment securities, broken down by security type and other relevant categories. These disclosures are crucial for understanding the nature and extent of a company's exposure to market fluctuations.

Changes and Evolution in Reporting Standards

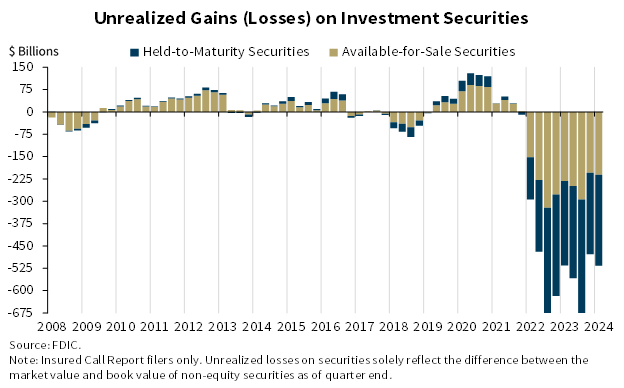

Accounting standards are not static; they are continually evolving to reflect changes in the business environment and to improve the quality and comparability of financial reporting. Recent changes to accounting standards have impacted the reporting of unrealized gains and losses, and further changes are anticipated in the future.

For example, the Financial Accounting Standards Board (FASB) has issued guidance on the measurement of credit losses on financial instruments, which can impact the carrying value of debt securities and the recognition of related unrealized losses.

Conclusion

Understanding where to find unrealized gains and losses from investment securities is critical for accurately assessing a company's financial position and performance. These gains and losses are primarily reported on the balance sheet (through the carrying value of the securities and AOCI), the income statement (for trading securities), and in footnote disclosures.

Keeping abreast of evolving accounting standards and reporting practices is essential for investors and analysts to make informed decisions. By carefully analyzing the financial statements and related disclosures, stakeholders can gain a deeper understanding of the impact of market fluctuations on a company's financial health and future prospects.

.jpg)

.jpg)

.jpg)

.jpg)

![Where Are Unrealized Gains And Losses From Investment Securities Displayed Unrealized gains (losses) on investment securities.[10] | Download](https://www.researchgate.net/publication/376131429/figure/fig2/AS:11431281209086216@1701633286787/Unrealized-gains-losses-on-investment-securities10.png)

.jpg)