Accounting Systems For Small Businesses

For small business owners, navigating the world of finance can feel like sailing uncharted waters. Selecting the right accounting system is crucial, not only for compliance but also for informed decision-making and sustainable growth. The market offers a dizzying array of options, from simple spreadsheets to sophisticated cloud-based platforms.

Choosing an appropriate accounting system is a pivotal decision for any small business. This choice affects everything from tax compliance and cash flow management to long-term strategic planning. Understanding the nuances of available systems is therefore paramount for entrepreneurs seeking financial stability and growth.

The Landscape of Accounting Systems

The accounting systems market is diverse, catering to various business needs and budgets. Options range from basic manual systems to sophisticated, automated software solutions. Small businesses need to carefully assess their requirements before making a decision.

Manual systems, often involving spreadsheets and paper records, are the most basic. While cost-effective initially, they are prone to errors and lack scalability. Many small businesses use cloud based system such as QuickBooks, Xero and Zoho Books.

Cloud-Based Accounting Software

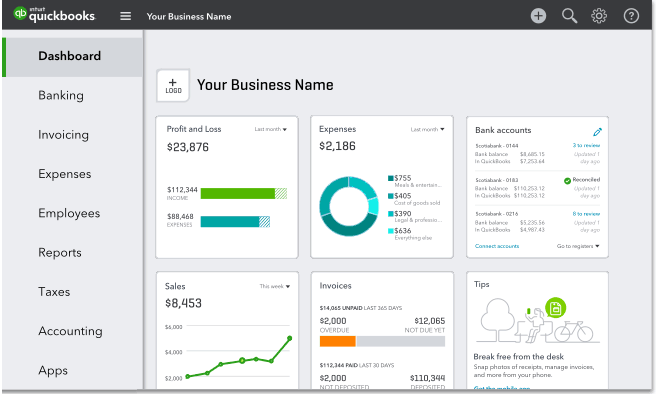

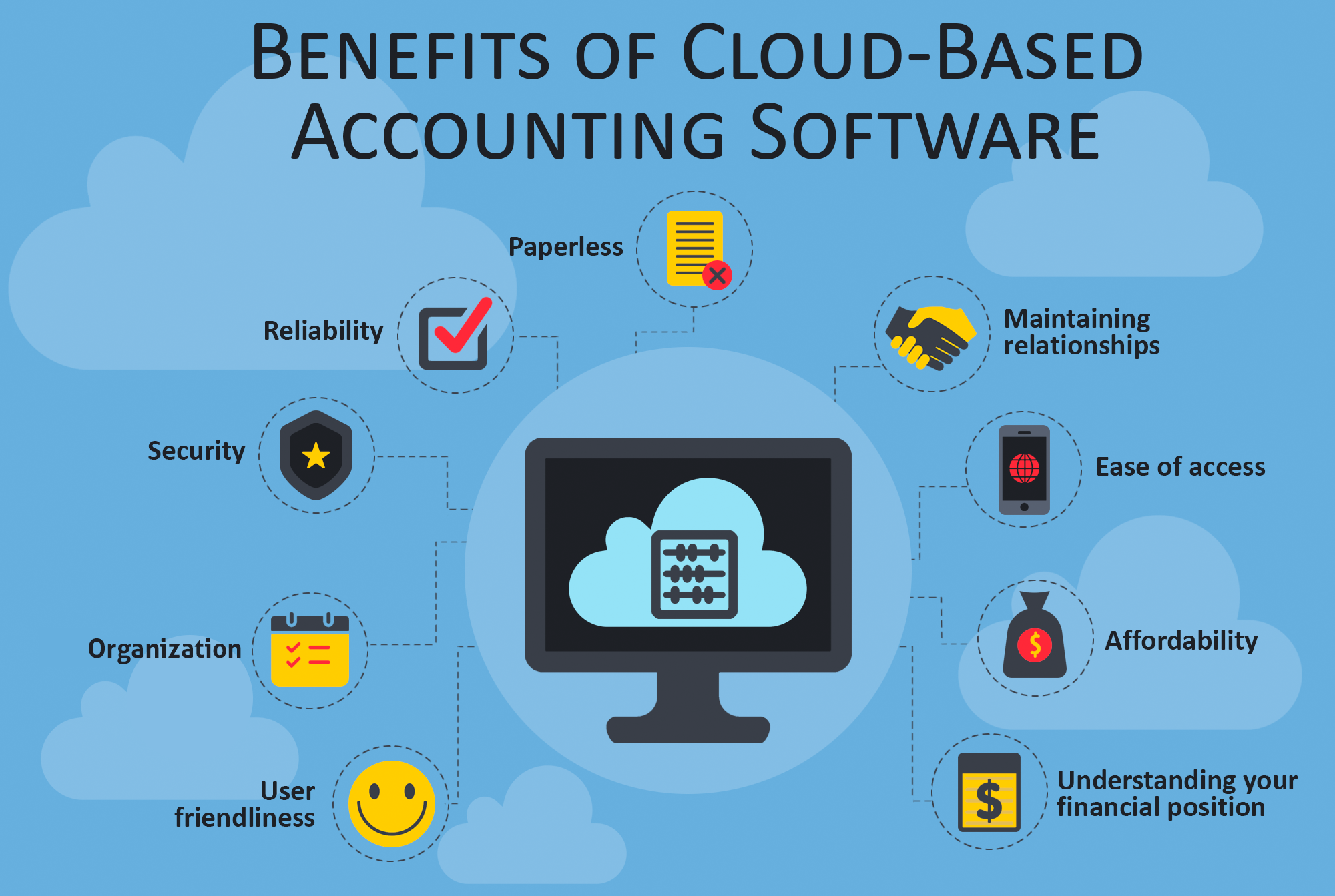

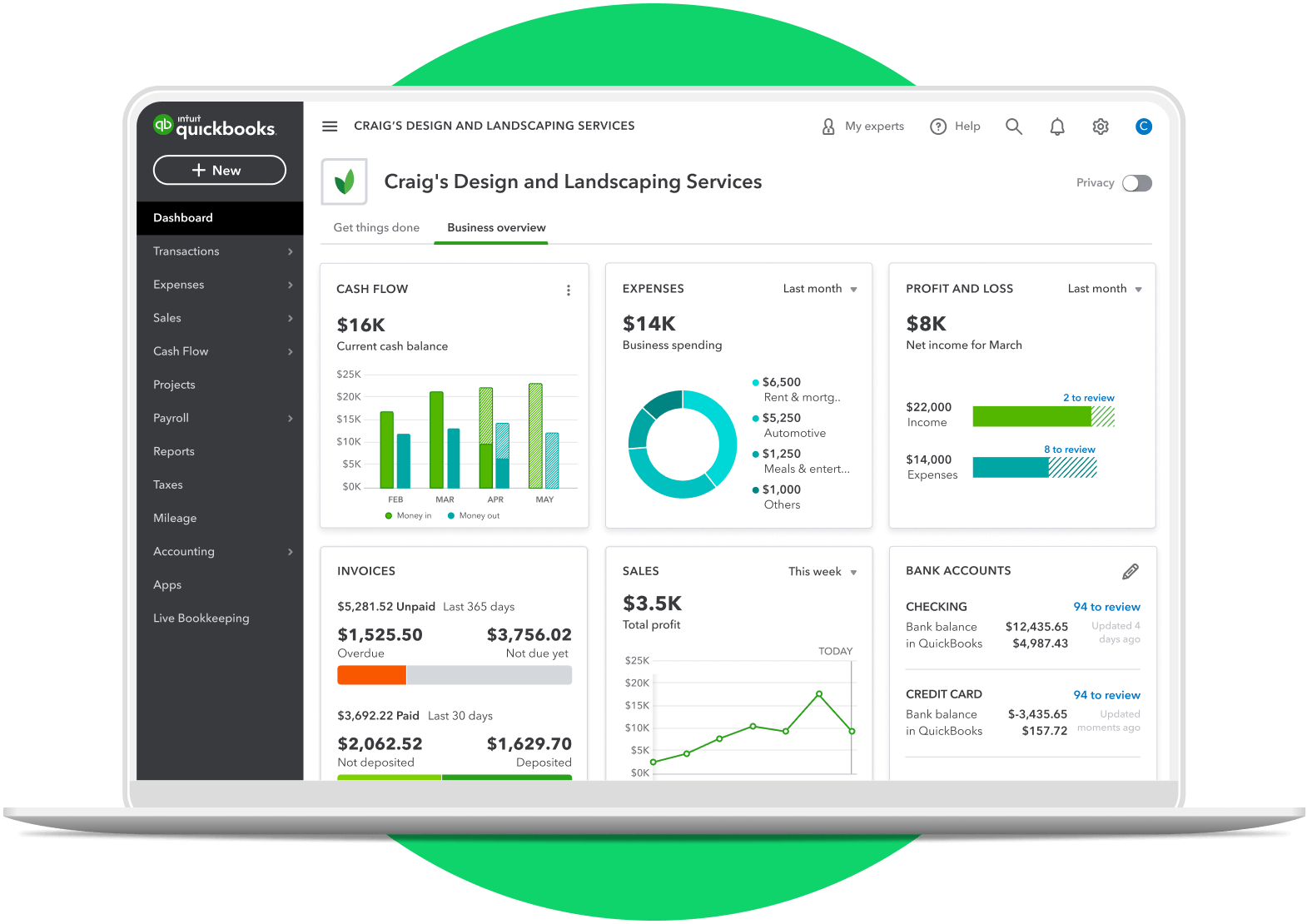

Cloud-based solutions like QuickBooks Online, Xero, and Zoho Books have gained immense popularity. These platforms offer accessibility from anywhere with an internet connection, automatic data backups, and real-time financial insights. The features are often subscription-based and tailored for small and medium sized businesses.

According to a report by Statista, the cloud accounting market is projected to reach $6.1 billion by 2024. This shows the increasing adoption of these platforms due to their convenience and efficiency.

Desktop Accounting Software

Traditional desktop accounting software, such as QuickBooks Desktop, is installed directly on a computer. While offering more control over data storage, these systems require manual backups and often lack the real-time collaboration features of cloud-based options.

Key Considerations for Selection

Selecting the right accounting system is not a one-size-fits-all process. Several factors must be considered, including the business size, industry, budget, and technical expertise of the staff. A thorough assessment of these elements will guide the selection process.

Scalability is crucial. The chosen system should accommodate future growth and increased transaction volumes. Integration capabilities with other business tools, such as CRM and inventory management systems, are also important.

Cost is always a consideration, but it's essential to look beyond the initial price tag. Consider the long-term costs, including training, support, and potential upgrades. A poorly chosen system can lead to hidden expenses and inefficiencies.

Impact on Small Businesses

Implementing an effective accounting system can have a transformative impact on small businesses. Accurate financial data enables better decision-making, improves cash flow management, and facilitates compliance with tax regulations.

Proper accounting allows businesses to track their income and expenses meticulously. This also leads to better financial planning and resource allocation. Having real-time financial data helps businesses identify trends, manage costs, and forecast future performance.

One local bakery owner, Sarah Miller, shared her experience. "Switching to a cloud-based accounting system has been a game-changer. I can now track my sales and expenses in real-time, make informed decisions about inventory, and save time on bookkeeping."

Future Trends

The accounting technology landscape is constantly evolving. Artificial intelligence (AI) and machine learning (ML) are increasingly being integrated into accounting software, automating tasks and providing more sophisticated analytics. Businesses also need to understand about blockchain.

Blockchain technology is also emerging as a potential disruptor, offering enhanced security and transparency in financial transactions. As these technologies mature, they are likely to become more accessible to small businesses.

Small businesses that embrace these advancements will be well-positioned to compete in the digital age. They can gain a competitive edge, streamline operations, and drive sustainable growth.