Accumulated Depreciation Is A Liability Or Asset

Imagine walking into a bustling antique shop, the air thick with the scent of aged wood and forgotten stories. Each item, from the grandfather clock ticking softly in the corner to the chipped porcelain dolls gazing from the shelves, bears the mark of time. Their prices reflect not just their rarity, but also the wear and tear they've endured, a tangible representation of depreciation.

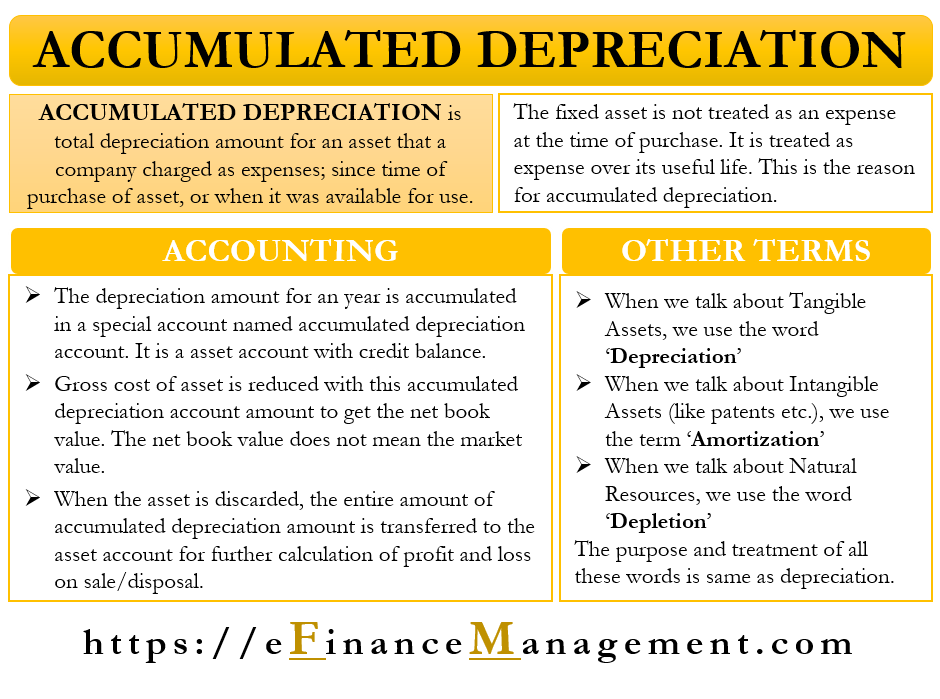

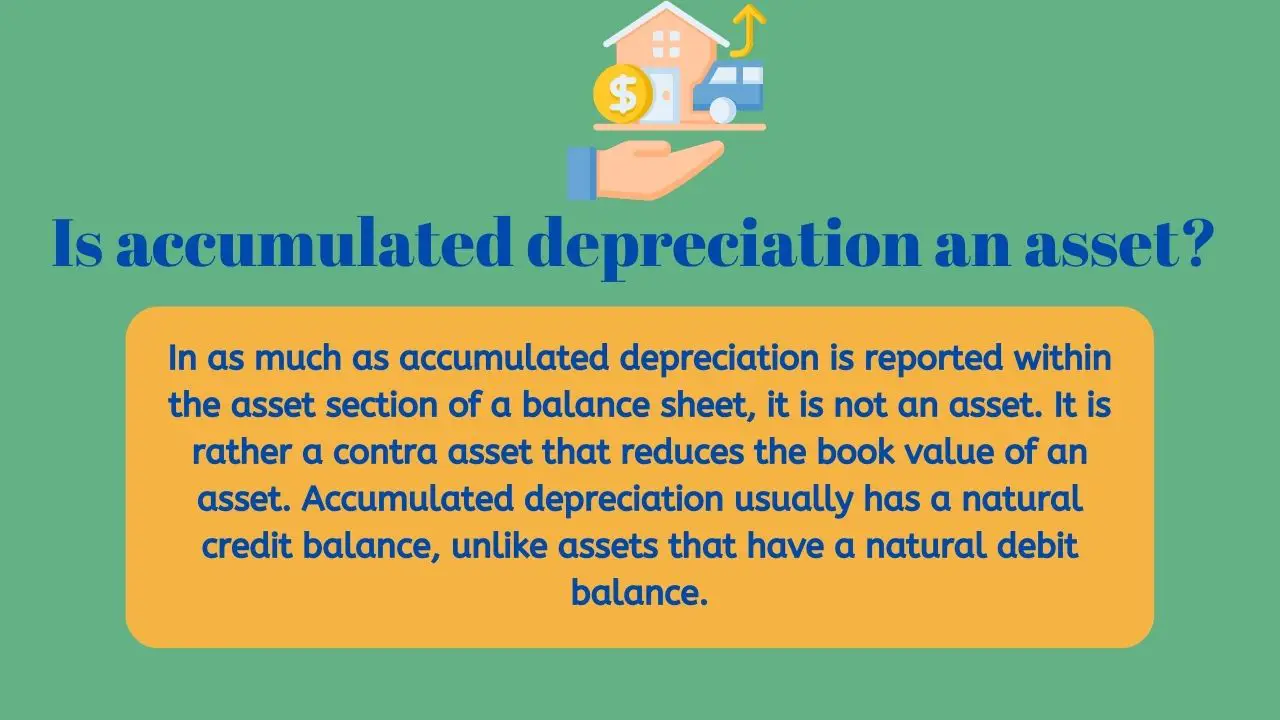

The question of whether accumulated depreciation is a liability or an asset often stirs debate in the accounting world. It's a crucial concept that impacts how a company's financial health is perceived, influencing investment decisions and overall business strategy. Ultimately, it is a contra-asset account, reducing the book value of an asset and reflecting the portion of its cost that has been expensed over its useful life.

Understanding Depreciation

Depreciation, at its core, is the systematic allocation of the cost of a tangible asset over its useful life. Think of a delivery truck purchased by a bakery. That truck isn't just a single-day expense; it's an investment that will hopefully serve the bakery for years, delivering cakes and pastries to eager customers.

Instead of expensing the entire cost of the truck upfront, depreciation allows the bakery to spread the expense over the years the truck is in service. This provides a more accurate picture of the bakery's profitability each year, matching the cost of the asset with the revenue it helps generate.

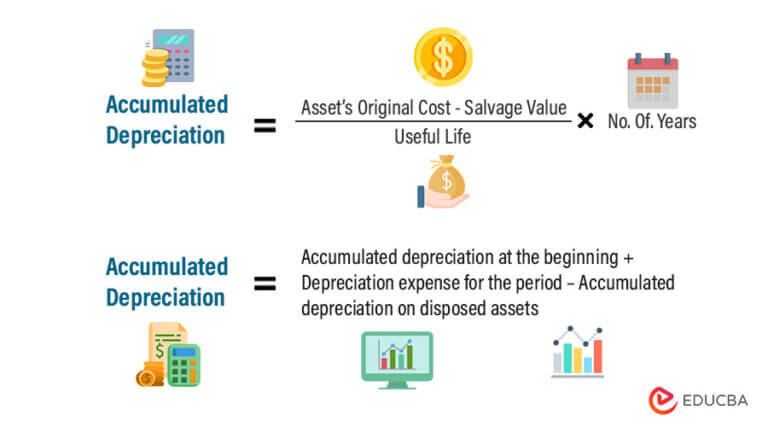

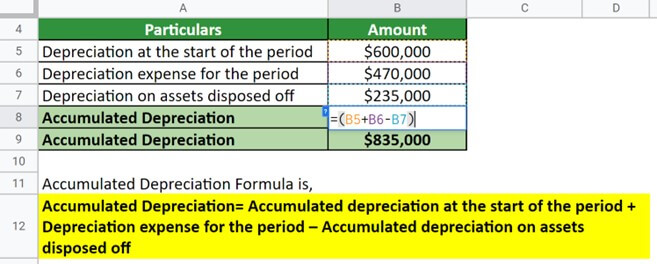

Accumulated depreciation is the total amount of depreciation that has been recognized on an asset since it was put into service. It's like a running tally of the asset's wear and tear, a cumulative record of its declining value.

The Contra-Asset Perspective

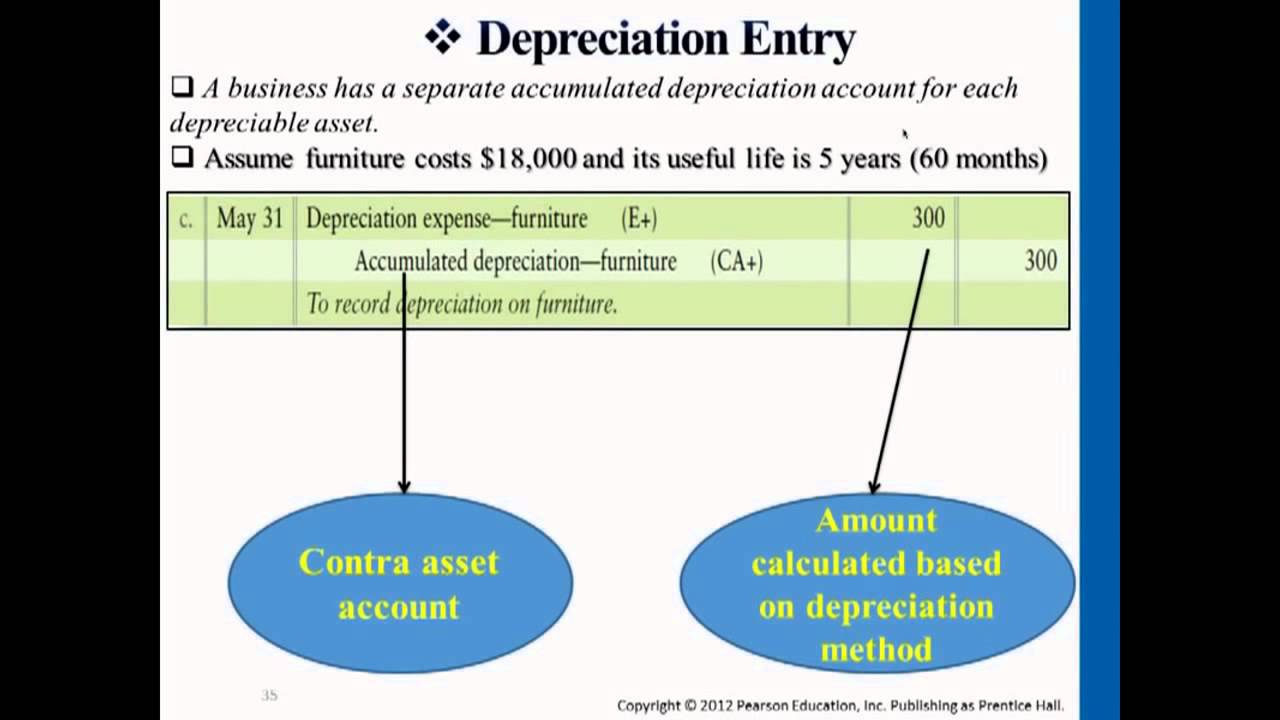

So, why is accumulated depreciation classified as a contra-asset? A contra-asset account has a credit balance, which reduces the debit balance of a related asset account. In this case, it reduces the book value of the asset on the balance sheet.

Consider that delivery truck again. Let's say the bakery purchased it for $50,000 and expects it to last for five years. If they use straight-line depreciation, they'll depreciate it by $10,000 per year. After three years, the accumulated depreciation would be $30,000.

The truck's book value, the value listed on the balance sheet, would be $20,000 ($50,000 original cost minus $30,000 accumulated depreciation). The accumulated depreciation effectively shows how much of the truck's original cost has already been expensed.

The International Financial Reporting Standards (IFRS) and Generally Accepted Accounting Principles (GAAP) both support this treatment of accumulated depreciation as a contra-asset. They aim to provide a true and fair view of a company's financial position.

Why Not a Liability?

The common confusion arises because depreciation *seems* like it represents a future obligation, perhaps a cost to replace the asset. However, that's not quite accurate.

A liability is a present obligation to transfer assets or provide services to another entity in the future. For example, a bank loan is a liability because the company is obligated to repay the loan with interest.

Accumulated depreciation doesn't represent a present obligation. It's simply an allocation of the cost of a past investment. There's no external party to whom the company owes something because of depreciation.

Think of it this way: depreciating the truck doesn't mean the bakery owes someone $10,000 each year. It just means they're recognizing the expense of using the truck over time. It is an accounting practice to provide a more accurate view of a company's financials, not an obligation.

The Impact on Financial Statements

The treatment of accumulated depreciation significantly impacts a company's financial statements. It affects the balance sheet by reducing the reported value of assets and influences the income statement by recording depreciation expense.

A company with a high level of accumulated depreciation might appear to have fewer assets on its balance sheet. However, this isn't necessarily a bad thing. It could simply mean the company has been using its assets for a long time and has been properly accounting for their wear and tear.

Potential investors and creditors use this information, combined with other financial metrics, to assess the company’s overall financial health and stability. It's a piece of the puzzle, not the entire picture.

Real-World Examples

Consider a manufacturing company that invests heavily in machinery. Over time, that machinery will depreciate. The accumulated depreciation on those machines will reduce their book value on the company's balance sheet. This helps paint a more accurate picture of the factory's assets.

Or take an airline company with a fleet of airplanes. These planes are valuable assets, but they also depreciate significantly over their lifespan. The airline must carefully track the accumulated depreciation on each plane to accurately reflect its financial position.

According to data from the U.S. Bureau of Economic Analysis (BEA), businesses consistently allocate substantial resources to depreciation each year, demonstrating its widespread impact across various industries. This underscores the importance of understanding how accumulated depreciation is treated in financial accounting.

The Importance of Accuracy

Accurate depreciation accounting is essential for sound financial reporting. It ensures that financial statements provide a true and fair view of a company's financial position and performance.

Misrepresenting depreciation can have serious consequences. It can mislead investors, distort financial ratios, and even lead to legal issues. Transparency and adherence to accounting standards are paramount.

Furthermore, companies must consistently apply depreciation methods to avoid any misleading reporting. Consistency ensures comparability of financial statements across different periods.

The Bigger Picture

So, accumulated depreciation isn't a liability. It's a contra-asset, a critical component of sound financial accounting. It reflects the allocation of an asset's cost over its useful life, providing a more accurate picture of a company's financial health.

By understanding this distinction, investors, creditors, and business owners can make more informed decisions. They can better assess a company's financial position, evaluate its performance, and plan for the future.

In the end, understanding accumulated depreciation is not just about accounting; it's about gaining a deeper understanding of how businesses operate and create value over time. It is about seeing beyond the surface numbers and appreciating the story they tell about the lifecycle of an asset.

:max_bytes(150000):strip_icc()/dotdash_Final_Why_is_Accumulated_Depreciation_a_Credit_Balance_Jul_2020-01-34c67ae5f6a54883ba5a5947ba50f139.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Why_is_Accumulated_Depreciation_a_Credit_Balance_Jul_2020-02-b230b73e49c3406ba7b944172f09a624.jpg)