Acfe Report To The Nations 2024

The global cost of fraud continues to bleed businesses dry, a silent pandemic eroding profits and trust. The Association of Certified Fraud Examiners (ACFE)'s 2024 Report to the Nations paints a stark picture, revealing not just the prevalence of occupational fraud, but also the evolving tactics employed by perpetrators and the increasingly sophisticated methods needed to combat them.

This year's report, analyzing 2,550 cases of occupational fraud investigated between January 2022 and September 2023, serves as a critical resource for organizations seeking to understand and mitigate their fraud risk. The findings highlight key trends in fraud schemes, victim characteristics, detection methods, and the financial impact of fraudulent activities, providing invaluable insights for bolstering internal controls and fraud prevention strategies. The report underscores the urgent need for proactive measures and a commitment to ethical conduct at all levels of an organization.

Key Findings and Trends

The median loss caused by occupational fraud in the studied cases was $145,000. While this figure remains significant, it's crucial to understand the nuances behind the numbers. The report categorizes fraud schemes into three primary types: asset misappropriation, financial statement fraud, and corruption.

Asset misappropriation, the most common type of fraud, occurred in 86% of cases, but resulted in the lowest median loss of $100,000. This category includes schemes such as theft of cash, inventory, and other assets. While individually less damaging, the sheer frequency of these schemes makes them a persistent threat.

Financial statement fraud, though the least frequent (9% of cases), inflicted the highest median loss at a staggering $544,000. These schemes involve intentional misrepresentation of financial data to deceive stakeholders. The complexity and scale of financial statement fraud make it particularly difficult to detect and prosecute.

Corruption schemes, including bribery, conflicts of interest, and extortion, accounted for 24% of cases and resulted in a median loss of $200,000. These schemes often involve collusion between employees and external parties, making them challenging to uncover through traditional auditing methods.

Impact of Anti-Fraud Controls

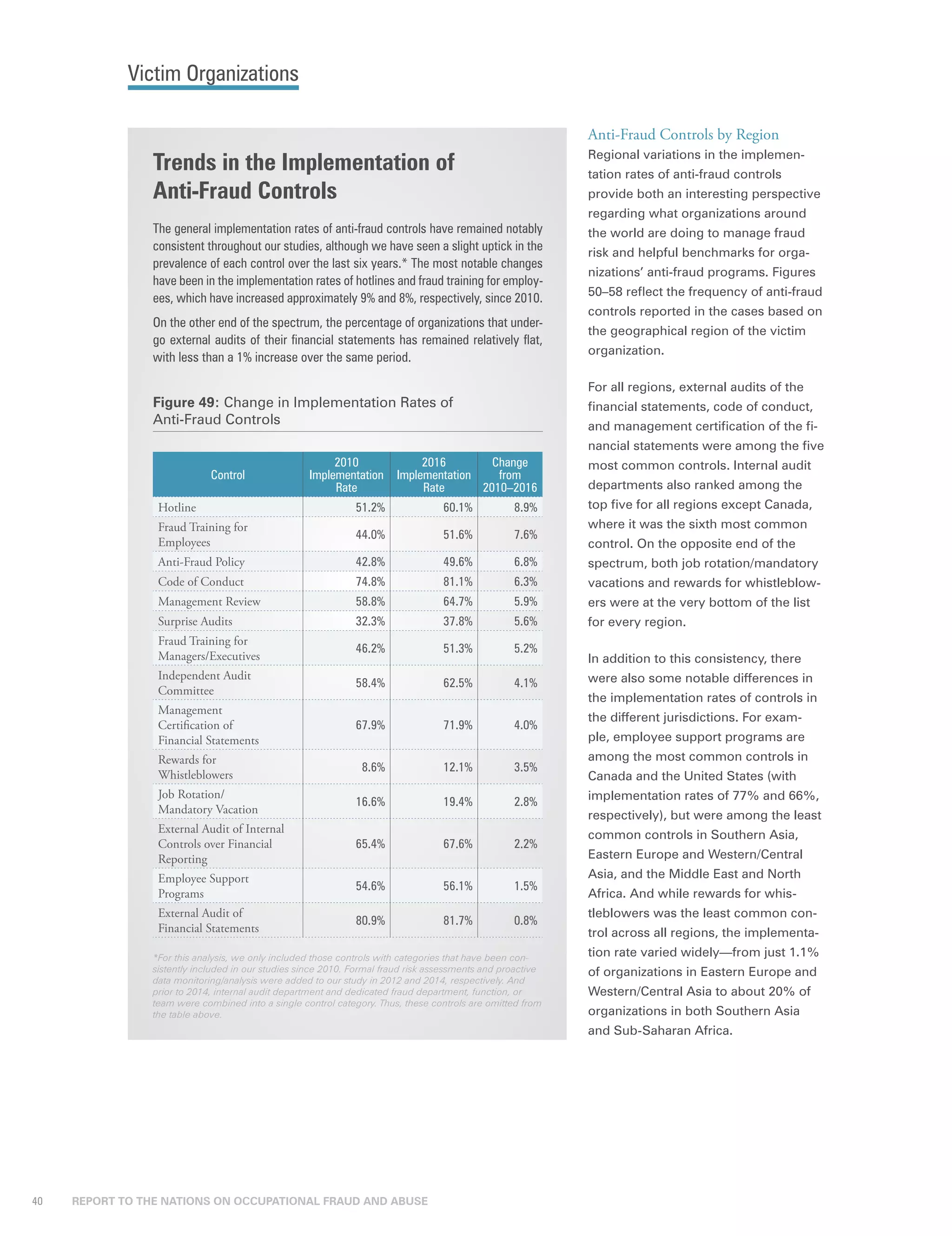

The Report to the Nations emphasizes the critical role of anti-fraud controls in mitigating the risk and impact of occupational fraud. Organizations with robust internal controls experienced significantly lower losses and faster detection times.

Specifically, the presence of proactive data monitoring and analysis was associated with a median loss of $80,000, considerably lower than the $200,000 median loss in organizations lacking such controls. A hotline, another commonly recommended control, was associated with a 50% reduction in the median loss.

Internal audit functions, ethics training programs, and management review processes also demonstrated a positive impact on fraud prevention and detection. The report underscores that a layered approach, combining multiple anti-fraud controls, provides the most effective defense.

Perpetrator Characteristics and Victim Organizations

Understanding the characteristics of fraudsters is crucial for developing targeted prevention strategies. The Report to the Nations provides insights into the profiles of individuals who commit occupational fraud.

Employees with higher levels of authority tend to cause greater losses. Owners/executives accounted for only 23% of cases but caused a median loss of $350,000, significantly higher than losses caused by managers ($150,000) or employees ($60,000).

The longer a perpetrator remains with an organization, the greater the potential for fraud. Employees who had been with their organizations for more than five years caused a median loss of $200,000, compared to $80,000 for those with less than a year of tenure. This highlights the importance of ongoing monitoring and vigilance, even with trusted employees.

Small businesses are disproportionately affected by occupational fraud, often lacking the resources and expertise to implement effective anti-fraud controls. Organizations with fewer than 100 employees suffered a median loss of $150,000, representing a greater percentage of their revenue compared to larger organizations.

Detection Methods and Reporting Mechanisms

How fraud is detected plays a significant role in limiting the financial damage and bringing perpetrators to justice. The Report to the Nations reveals that tips remain the most common method of initial fraud detection.

Tips accounted for 43% of fraud detections, emphasizing the importance of creating a culture where employees feel safe and encouraged to report suspicious activity. Hotlines and whistleblower policies are crucial components of an effective tip reporting system.

Internal audit was the second most common detection method (15%), followed by management review (12%). By accident accounted for 7% of fraud detections, indicating room for improvements in proactive fraud detection mechanisms.

The Future of Fraud Prevention

The landscape of fraud is constantly evolving, driven by technological advancements and changing business practices. Organizations must adapt their fraud prevention strategies to address emerging threats.

The increasing use of technology in fraud schemes, including cyber fraud and data breaches, requires organizations to invest in cybersecurity measures and data analytics capabilities. Artificial intelligence (AI) and machine learning can play a significant role in detecting anomalies and identifying suspicious patterns of activity.

Furthermore, a strong ethical culture and a commitment to integrity are essential for preventing fraud. Organizations must foster a culture where ethical behavior is valued and rewarded, and where employees are empowered to speak up against wrongdoing.

The ACFE's 2024 Report to the Nations is a call to action for organizations to prioritize fraud prevention and invest in robust internal controls. By understanding the latest trends in occupational fraud and implementing effective mitigation strategies, organizations can protect their assets, preserve their reputation, and foster a culture of integrity.