All Of The Following Are Payroll Liabilities Except

The intricacies of payroll management are often a source of confusion for businesses, especially when it comes to distinguishing between payroll liabilities and other financial obligations. A misstep in this area can lead to significant financial penalties and legal complications, highlighting the critical importance of accurate accounting and compliance. Understanding what constitutes a payroll liability – and, equally important, what doesn't – is fundamental to sound financial management.

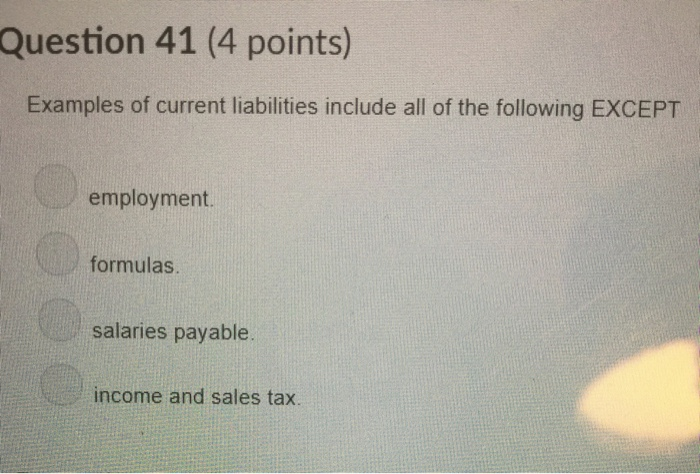

This article delves into the often-murky waters of payroll liabilities, clearly defining what they are, providing concrete examples, and, most importantly, clarifying what falls outside this category. Specifically, we will address the question, "All of the following are payroll liabilities except...?", equipping businesses with the knowledge to navigate payroll complexities effectively and avoid costly errors.

Understanding Payroll Liabilities

A payroll liability represents an amount a business owes to its employees or to government agencies as a result of its payroll obligations. These liabilities accrue as employees earn wages, and they must be accurately calculated and remitted on time to avoid penalties.

Payroll liabilities are not just limited to wages. They encompass a broader range of deductions and employer contributions.

These are often categorized into employee deductions and employer obligations.

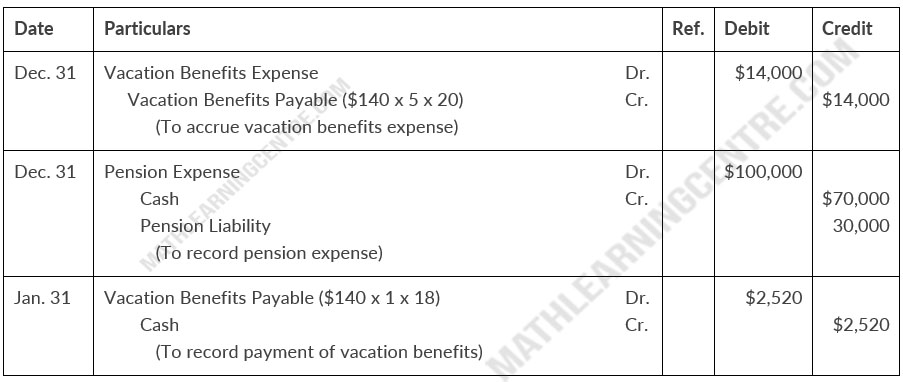

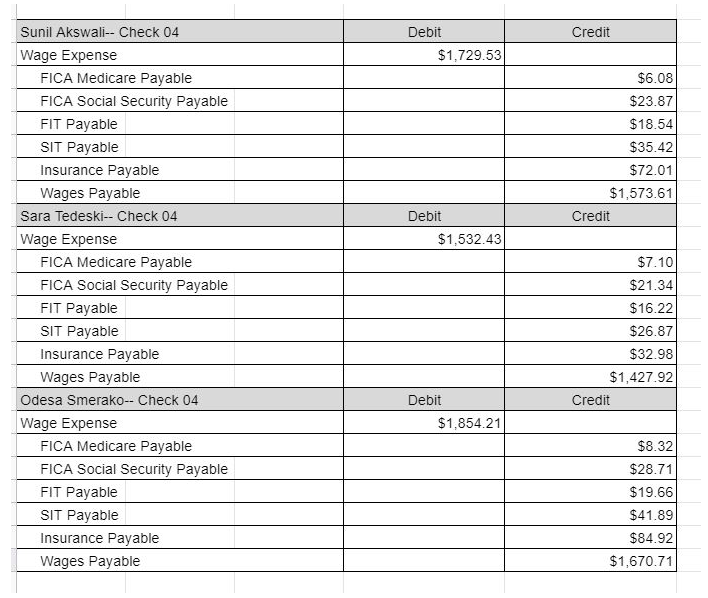

Employee Deductions

Employee deductions are amounts withheld from an employee's gross pay. These deductions are held in trust by the employer and remitted to the appropriate agency.

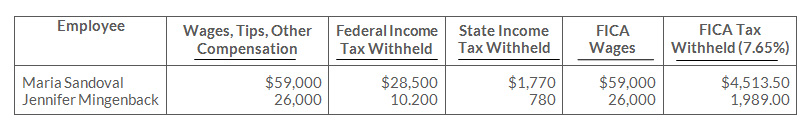

Common examples include federal income tax, state income tax (where applicable), Social Security tax (FICA), Medicare tax (also part of FICA), and employee contributions to retirement plans (like 401(k)s) and health insurance premiums.

The employer acts as an intermediary, collecting these funds on behalf of the government or benefit providers.

Employer Obligations

Employer obligations are taxes and contributions that the employer is legally required to pay based on their employees' wages. These are in addition to the employee's gross pay.

Examples include the employer's share of Social Security and Medicare taxes (matching the employee's contribution), federal unemployment tax (FUTA), and state unemployment tax (SUTA). Employer contributions to employee benefits, such as health insurance or retirement plans, also fall under this category.

These obligations represent a direct cost to the employer, calculated as a percentage of employee wages.

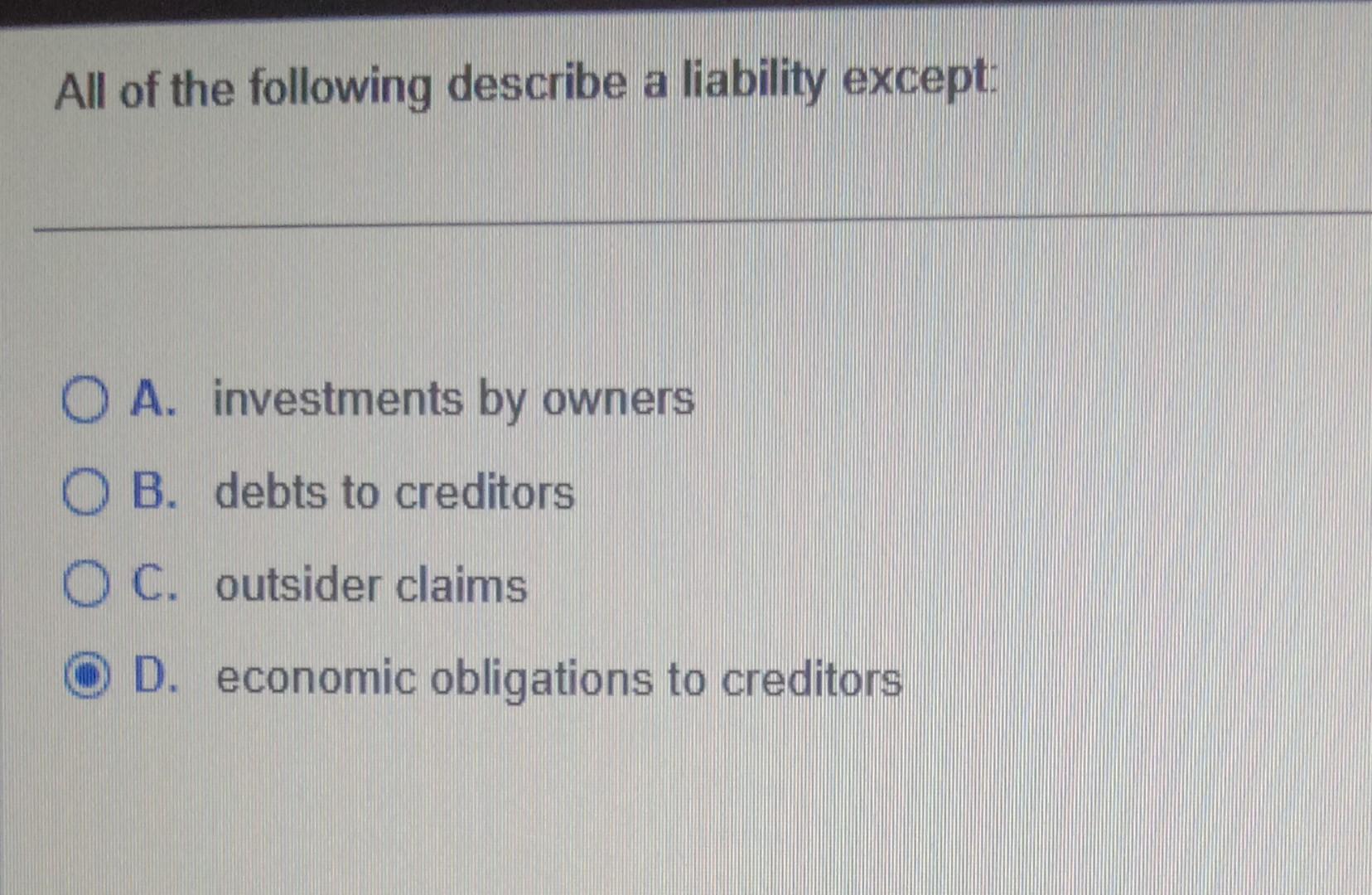

What is *Not* a Payroll Liability?

While many expenses are directly linked to payroll, some expenses are not considered payroll liabilities. These are usually operational expenses that are indirectly related to employee compensation but do not represent amounts owed to employees or the government based on payroll calculations.

Distinguishing these from true payroll liabilities is crucial for accurate financial reporting and budgeting.

Here are some examples of items that are not typically classified as payroll liabilities:

- Office Supplies: These are general business expenses needed for day-to-day operations. Although employees use these supplies, they aren't directly related to payroll calculations.

- Rent or Mortgage Payments: The cost of office space, while essential, is an operational expense, not a payroll-related obligation.

- Utilities: Electricity, water, and internet are necessary for business operations but are not derived from payroll calculations.

- Advertising and Marketing Expenses: These costs are incurred to promote the business and are unrelated to employee compensation or tax obligations.

- Workers' Compensation Insurance Premiums: While related to employees, the payment itself, before it's calculated and allocated, is simply an operating expense. Once calculated and assigned to a specific payroll period, it becomes a payroll liability.

- Employee Training Costs: Expenses related to employee development and training programs are operational expenses, not payroll liabilities.

The key differentiator is whether the expense is a direct result of payroll calculations and owed to employees or the government.

Common Misconceptions

One common misconception is confusing workers' compensation insurance premiums with payroll liabilities. The insurance premium itself, until specifically calculated and allocated to a payroll period, is an operating expense. The *amount due* for workers' compensation based on the current payroll *is* a liability.

Another area of confusion arises with employee benefits. While employer contributions to health insurance and retirement plans are payroll liabilities, administrative fees associated with these benefits are often treated as separate operational expenses.

Careful review of expense classifications and consultation with accounting professionals can help prevent these misunderstandings.

Best Practices for Managing Payroll Liabilities

Accurate record-keeping is paramount for effective payroll liability management. Maintain detailed records of all payroll calculations, deductions, and remittances.

Utilize payroll software or engage a payroll service provider to automate calculations and ensure compliance with tax regulations. Regularly reconcile payroll records with bank statements and general ledger accounts to identify and correct any discrepancies.

Staying updated on changes in tax laws and regulations is also crucial to avoid penalties and maintain compliance.

The Future of Payroll Liabilities

The landscape of payroll liabilities is constantly evolving due to changes in tax laws, employment regulations, and the increasing complexity of employee benefits. The rise of remote work and the gig economy further complicate payroll management, as businesses must navigate varying state and local tax laws for employees located in different jurisdictions.

Automation and artificial intelligence are playing an increasingly important role in streamlining payroll processes and reducing the risk of errors. Businesses are adopting cloud-based payroll solutions that offer real-time data access and automated tax updates.

As the workforce becomes more diverse and geographically dispersed, businesses must invest in robust payroll systems and seek expert guidance to effectively manage their payroll liabilities and maintain compliance in an ever-changing regulatory environment. Adapting to these changes is key to long-term financial stability and success.