How Much Money Should You Put In Stocks

The allure of the stock market, with its potential for substantial returns, often clashes with the inherent risks involved. For both seasoned investors and newcomers alike, a crucial question looms: How much money should one allocate to stocks? The answer, unfortunately, isn't a simple numerical value, but rather a tailored strategy shaped by individual circumstances, financial goals, and risk tolerance.

This article delves into the complexities of stock allocation, providing a framework for readers to assess their own financial situation and make informed decisions. We'll explore different approaches, consider expert opinions, and examine the factors that influence the ideal percentage of your portfolio that should be invested in the stock market.

Understanding Your Financial Landscape

Before diving into specific allocation strategies, it's paramount to understand your current financial situation. This involves evaluating several key factors.

Age is a significant determinant. Younger investors, with a longer time horizon, generally have more leeway to tolerate market volatility and can allocate a larger percentage to stocks. Older investors, closer to retirement, may prefer a more conservative approach, emphasizing capital preservation.

Risk Tolerance is another critical factor. Are you comfortable with the possibility of short-term losses in exchange for potentially higher long-term gains? A low risk tolerance suggests a smaller stock allocation, while a higher risk tolerance allows for a larger one.

Financial Goals must be clearly defined. Are you saving for retirement, a down payment on a house, or a child's education? The timeline and required return for each goal will influence your stock allocation strategy.

The Role of Time Horizon

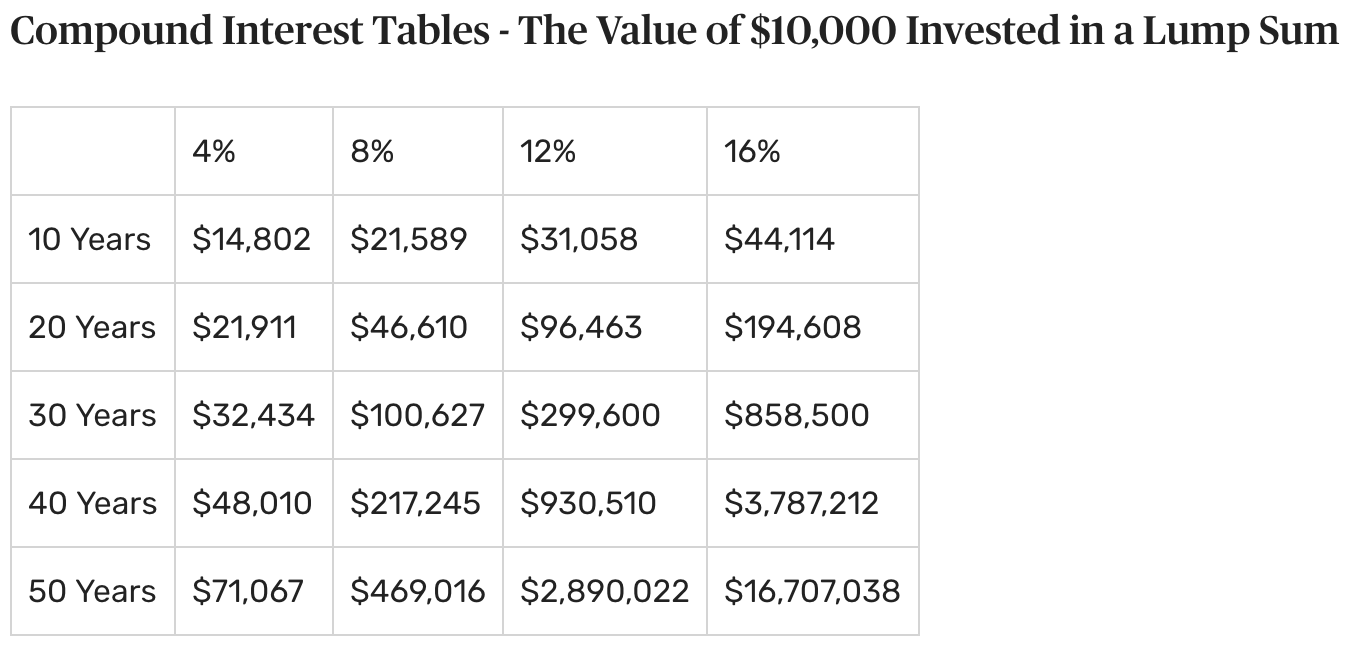

The length of time you have to invest plays a crucial role in determining your stock allocation. A longer time horizon allows you to weather market downturns and potentially benefit from long-term growth.

For instance, a 25-year-old saving for retirement in 40 years can afford to take on more risk, allocating a higher percentage to stocks. Conversely, a 60-year-old nearing retirement may opt for a more conservative allocation to protect their accumulated savings.

Historical data shows that stocks have generally outperformed other asset classes over long periods. However, past performance is not indicative of future results.

Different Allocation Strategies

Several common strategies can guide your stock allocation decisions. Each approach has its own merits and drawbacks, depending on your individual circumstances.

The "100 Minus Your Age" Rule: This simple rule suggests subtracting your age from 100 to determine the percentage of your portfolio that should be allocated to stocks. For example, a 30-year-old would allocate 70% to stocks and 30% to bonds.

This rule provides a basic starting point, but it doesn't account for individual risk tolerance or financial goals. It's a good rule of thumb, but it shouldn't be the sole basis for your investment decisions.

Risk-Based Allocation: This approach involves assessing your risk tolerance through questionnaires and interviews, then allocating your portfolio accordingly. A conservative portfolio might allocate 30-50% to stocks, while an aggressive portfolio could allocate 80-100%.

Risk-based allocation offers a more personalized approach, but it relies on accurate self-assessment of risk tolerance. It also requires ongoing monitoring and adjustments to maintain the desired risk level.

Goal-Based Allocation: This strategy focuses on allocating assets based on the specific requirements of your financial goals. For example, a long-term retirement goal might warrant a higher stock allocation, while a short-term goal like a down payment on a house might require a more conservative approach.

Goal-based allocation ensures that your investments are aligned with your financial objectives. However, it can be more complex to implement, requiring careful planning and monitoring of each goal's progress.

Seeking Professional Advice

Navigating the complexities of stock allocation can be challenging. Consulting a qualified financial advisor can provide valuable insights and personalized guidance.

A financial advisor can help you assess your financial situation, determine your risk tolerance, and develop a tailored investment strategy. They can also provide ongoing monitoring and adjustments to ensure your portfolio remains aligned with your goals.

The cost of professional advice should be considered, but the potential benefits of a well-designed investment strategy can outweigh the fees.

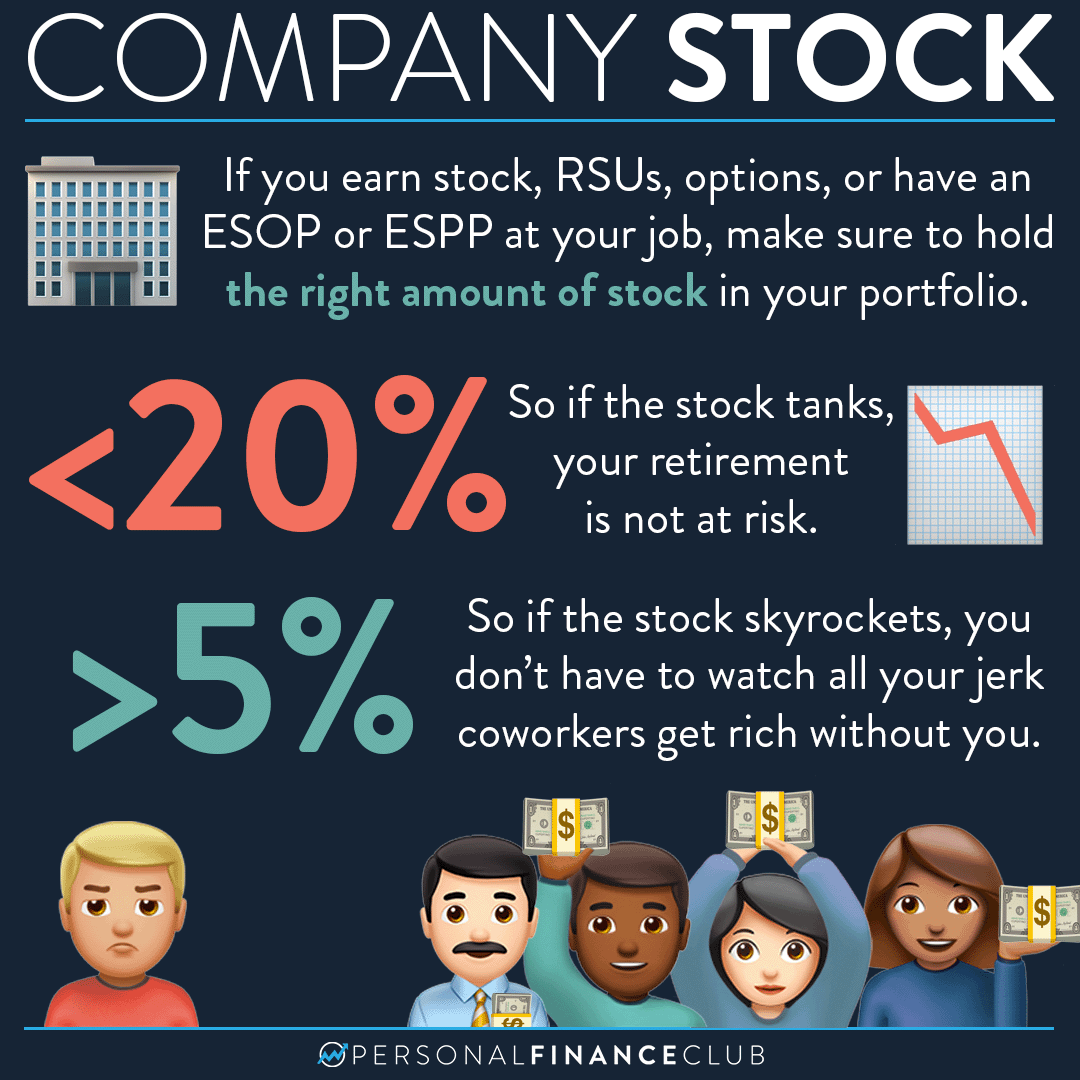

The Importance of Diversification

Regardless of your chosen allocation strategy, diversification is crucial. Spreading your investments across different asset classes, industries, and geographic regions can help mitigate risk.

Diversification doesn't guarantee profits or prevent losses, but it can reduce the impact of any single investment on your overall portfolio. Consider investing in a mix of stocks, bonds, real estate, and other asset classes.

Low-cost index funds and exchange-traded funds (ETFs) provide a convenient and affordable way to diversify your stock portfolio.

Looking Ahead: Adjusting Your Strategy

Stock allocation is not a one-time decision. Your financial situation, goals, and risk tolerance will evolve over time, requiring periodic adjustments to your investment strategy.

Regularly review your portfolio and rebalance your asset allocation to maintain your desired risk level. Consider rebalancing annually or when significant market changes occur.

Staying informed about market trends and economic conditions is also essential. However, avoid making impulsive decisions based on short-term market fluctuations. A long-term perspective is crucial for successful stock investing.