Ada Swing Trade Setup April 2025

Whispers are circulating among crypto traders: Is April 2025 shaping up for a potential swing trade setup for Cardano (ADA)? The promise of protocol upgrades, coupled with broader market trends, has ignited speculation about a profitable window for savvy investors. But lurking beneath the surface are cautionary tales of volatility and unforeseen market corrections that could quickly derail even the most carefully planned strategy.

This article examines the potential ADA swing trade setup in April 2025. We delve into the technical indicators, fundamental catalysts, and risk factors that could influence ADA's price movement. Our goal is to provide a balanced, data-driven analysis to help investors make informed decisions, acknowledging both the opportunities and the inherent uncertainties in the cryptocurrency market.

Technical Analysis: A Mixed Bag

Technical analysis provides the first layer of insight into potential trading opportunities. Examining ADA's historical price action, trading volumes, and key support and resistance levels is crucial for identifying potential entry and exit points.

Currently, analysis suggests several possibilities, none without their caveats. Some analysts point to a potential bullish divergence on the Relative Strength Index (RSI) as a precursor to a price increase. This would indicate that while the price has been falling, the RSI is showing increasing buying pressure, suggesting a potential reversal.

Conversely, Moving Averages (MAs) may tell a different story. A death cross – where the 50-day MA crosses below the 200-day MA – could indicate bearish momentum. Investors need to carefully weigh these conflicting signals.

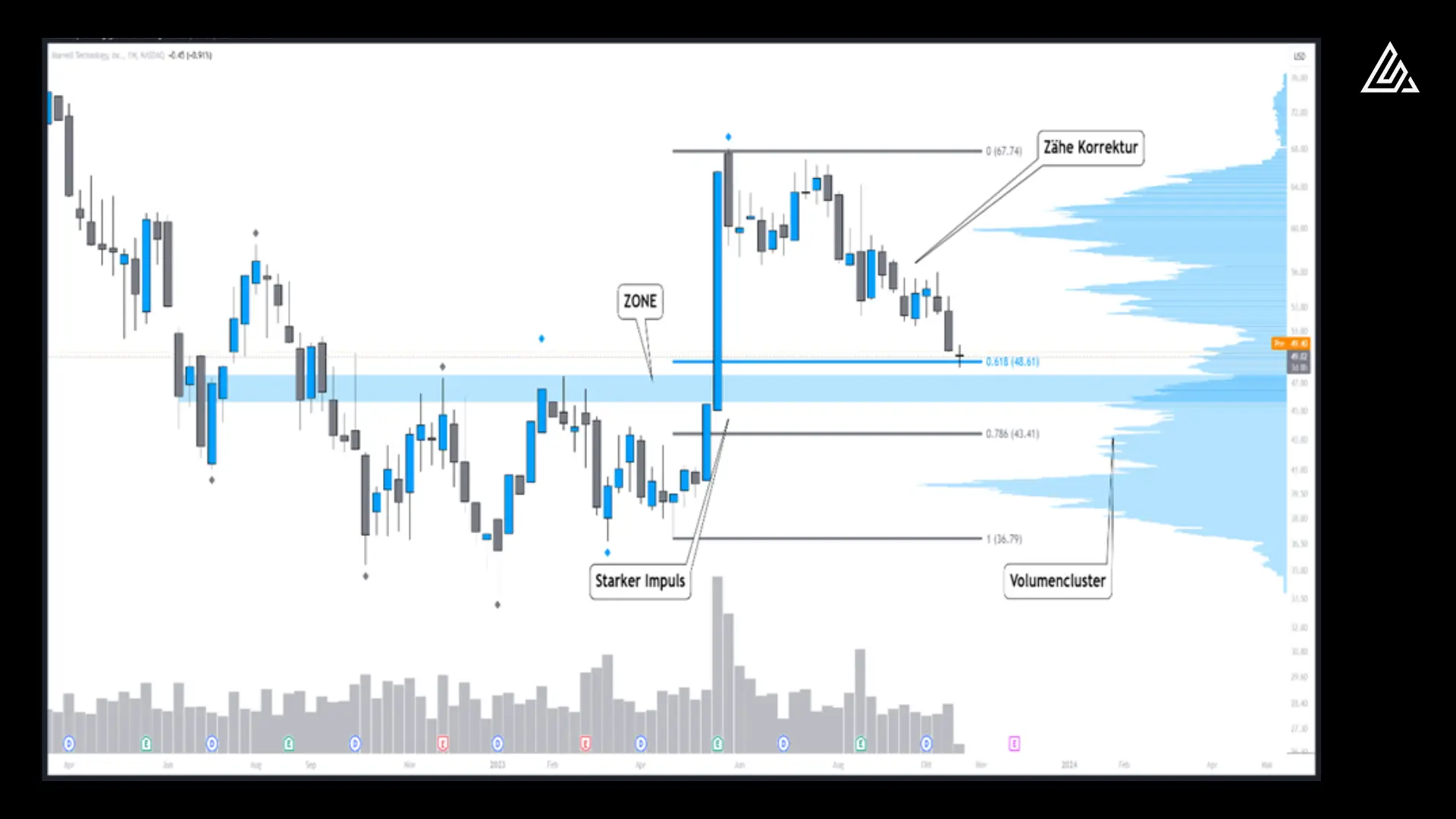

Key Support and Resistance Levels

Identifying key support and resistance levels is paramount for swing trading. Support levels act as a price floor, where buying pressure is expected to outweigh selling pressure. Resistance levels represent a price ceiling, where selling pressure is likely to increase.

Analyzing past price data, we can identify potential support around $0.50 and resistance near $0.80. Breaking through these levels would likely trigger further price movement in the respective direction.

Fundamental Catalysts: Protocol Upgrades and Ecosystem Growth

Beyond technical indicators, fundamental factors play a crucial role in driving ADA's price. Protocol upgrades, ecosystem growth, and broader adoption can all positively influence investor sentiment and demand.

The ongoing development of the Cardano ecosystem is a primary focus. Anticipated advancements in smart contract functionality, scaling solutions, and decentralized finance (DeFi) applications could attract new users and developers to the platform.

Specifically, if the Hydra scaling solution shows significant traction, it could dramatically improve transaction speeds and lower fees. Hydra's successful implementation could make Cardano more competitive with other blockchains like Ethereum and Solana.

Ecosystem Expansion and Adoption

Increased adoption of ADA for real-world applications is another key factor. The launch of new decentralized applications (dApps) and partnerships with traditional businesses could demonstrate the utility of the Cardano blockchain and drive demand for ADA.

We are closely monitoring the progress of projects building on Cardano, such as those in the decentralized identity and supply chain management spaces. These ventures could significantly increase ADA's use case.

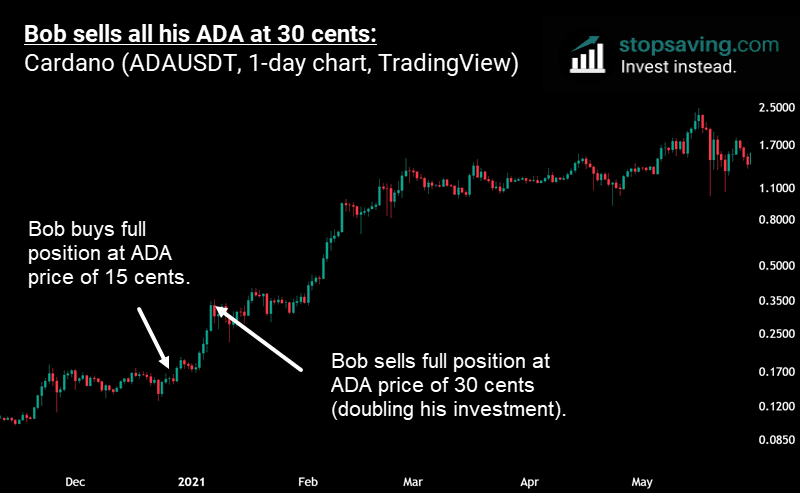

Risk Factors: Market Volatility and Regulatory Uncertainty

While the potential upside of an ADA swing trade setup is enticing, it's crucial to acknowledge the inherent risks. The cryptocurrency market is known for its volatility, and unforeseen events can quickly erase profits.

Regulatory uncertainty remains a significant concern for the entire crypto space. Government actions, such as stricter regulations or outright bans, could negatively impact ADA's price and overall market sentiment. Investors should closely follow regulatory developments in key jurisdictions, including the United States and the European Union.

Furthermore, broader macroeconomic factors, such as rising interest rates or a global recession, could impact the demand for risky assets like cryptocurrencies. These are factors which are outside of the direct control of the Cardano team.

Competition and Technological Disruption

The cryptocurrency market is highly competitive, with numerous projects vying for market share. New blockchain platforms with superior technology or innovative features could challenge Cardano's position and impact ADA's price.

The ongoing evolution of blockchain technology means that any project, no matter how advanced, must constantly adapt to remain competitive. Investors must stay abreast of developments in the space and assess how they might affect ADA's long-term prospects.

Expert Opinions and Perspectives

To gain a comprehensive understanding of the potential ADA swing trade setup, we consulted with several crypto analysts and industry experts. Their perspectives provide valuable insights into the current market dynamics and future outlook for Cardano.

"ADA has the potential for significant growth in 2025, but investors need to be prepared for volatility," says Sarah Chen, a crypto analyst at Blockchain Insights. "Focus on risk management and don't overextend your positions."

Another perspective comes from David Lee, a DeFi developer working on the Cardano ecosystem: "Successful implementation of key upgrades will be crucial for ADA's price. Keep a close eye on the progress of Hydra and other scaling solutions."

Conclusion: Proceed with Caution and Diligence

The potential ADA swing trade setup in April 2025 presents both opportunities and risks. Technical indicators offer a mixed picture, while fundamental catalysts hinge on successful protocol upgrades and ecosystem growth. Market volatility and regulatory uncertainty remain significant concerns.

Investors should conduct thorough research, develop a well-defined trading strategy, and manage risk appropriately. This is not financial advice. Investing in cryptocurrencies is inherently risky, and investors could lose their entire investment.

By carefully weighing the potential rewards against the inherent uncertainties, investors can make informed decisions about participating in the ADA market. Monitoring technical indicators, closely following project developments, and staying abreast of market trends are all crucial elements of a successful trading strategy.