What Stocks Are Motley Fool Recommending

Imagine settling into your favorite armchair, a steaming mug warming your hands, the soft glow of the screen illuminating your face. The market's aflutter, and you're seeking some sound investment advice. You're wondering, as many do: What nuggets of wisdom is The Motley Fool sharing this week? What stocks are they quietly, or not so quietly, pointing towards as having long-term potential?

The Motley Fool, a well-regarded investment advisory service, regularly updates its recommendations across its various platforms. While specific stock picks fluctuate based on market conditions and internal analysis, they generally favor companies exhibiting strong growth potential, innovative business models, and solid financials. Understanding their philosophy can help investors interpret their recommendations.

Understanding The Motley Fool's Approach

The Motley Fool isn’t about chasing fleeting trends or quick profits. Their investment philosophy, honed over decades, leans heavily towards a long-term, buy-and-hold strategy. They advocate for investing in well-researched companies with the potential for sustained growth over years, not just quarters.

Central to their approach is identifying companies disrupting existing industries or creating entirely new ones. They look for strong leadership teams, a competitive advantage, and a business model that can scale effectively.

Recent Recommendations and Trends

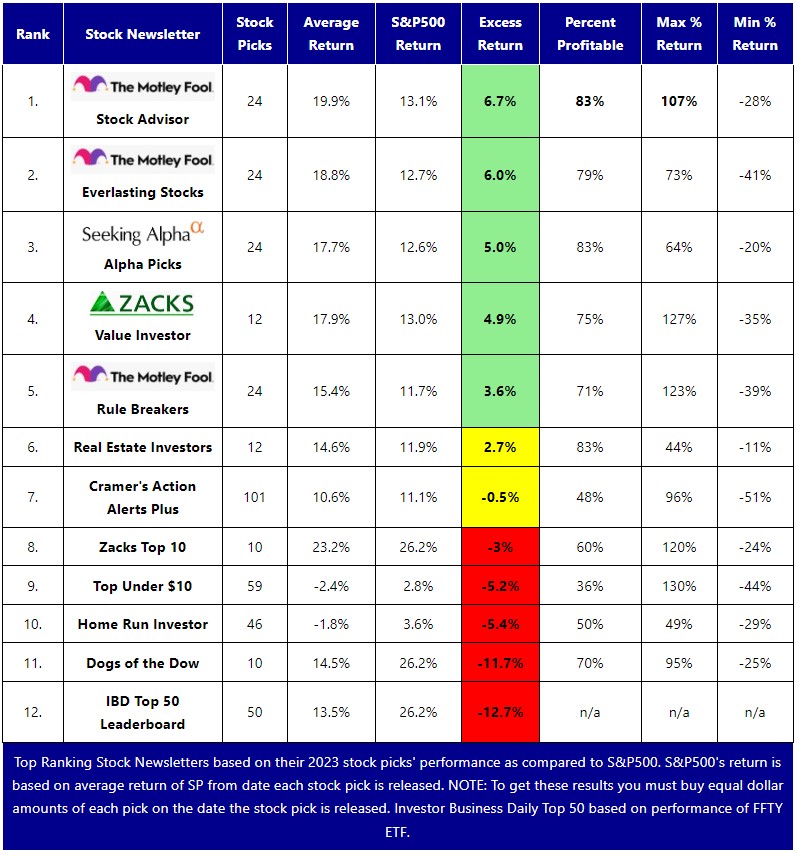

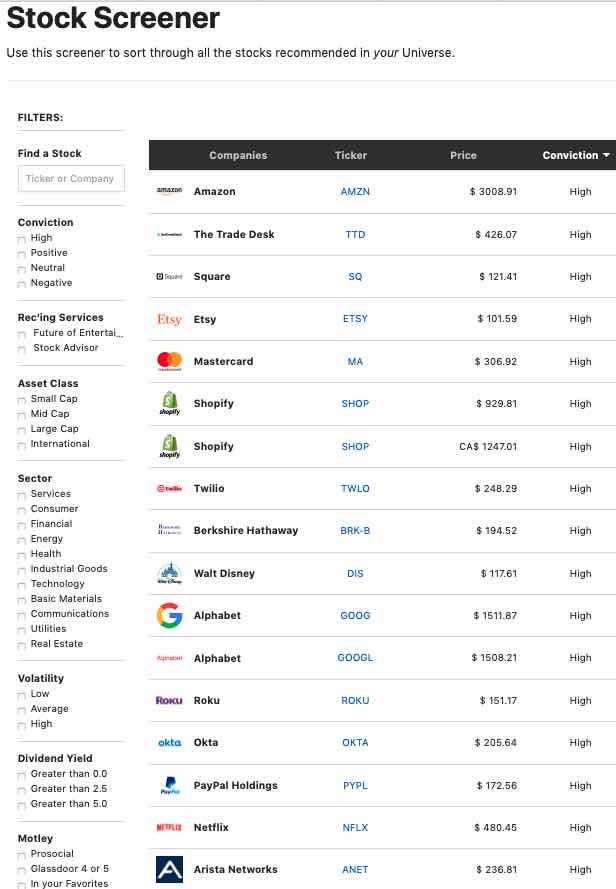

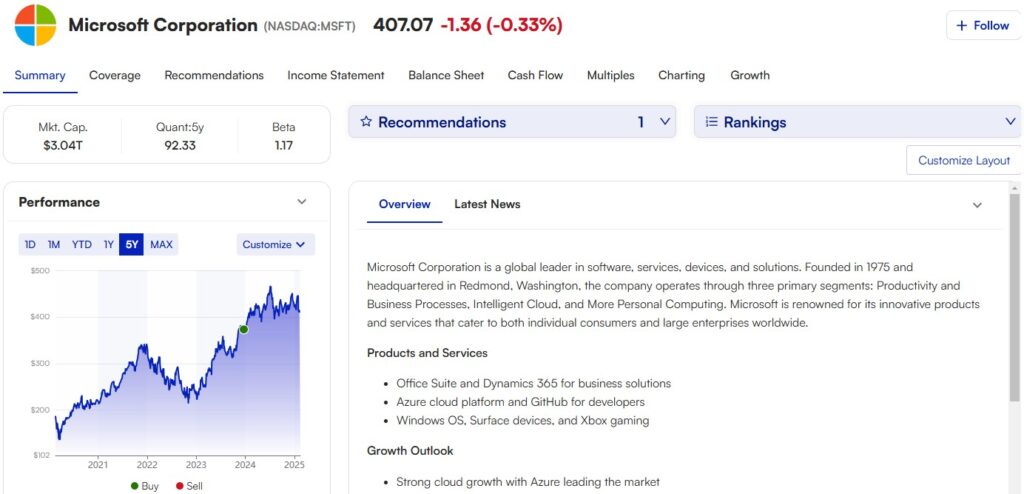

While specific recommendations vary between their Stock Advisor and Rule Breakers services, a few recurring themes and companies often surface. Companies in the technology sector, especially those involved in cloud computing, cybersecurity, and artificial intelligence, frequently appear.

The e-commerce sector remains a consistent area of interest, with companies demonstrating innovative fulfillment models and strong customer loyalty. Furthermore, companies focusing on renewable energy and sustainable practices are increasingly gaining attention, reflecting a growing awareness of environmental responsibility among investors.

It is important to consult The Motley Fool's website and specific subscription services for the most up-to-date and detailed recommendations. Remember that past performance doesn't guarantee future results.

Examples of Previously Recommended Stocks

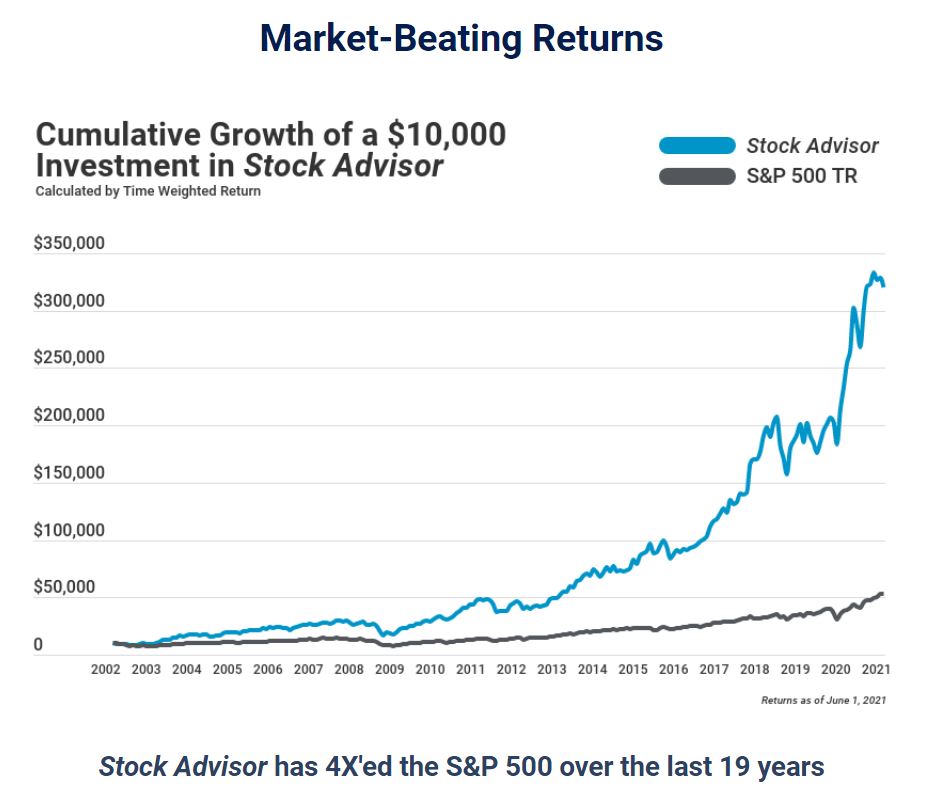

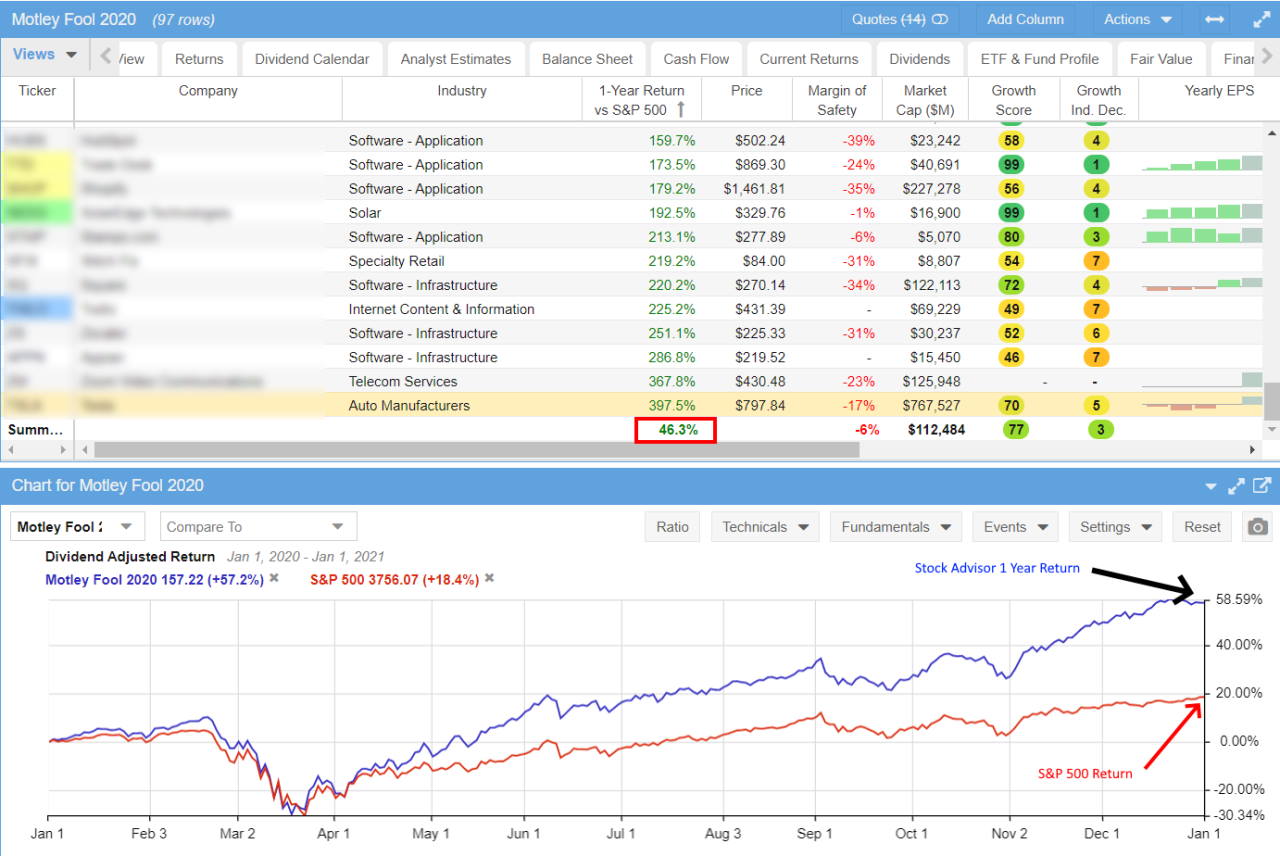

Over the years, The Motley Fool has highlighted companies that have gone on to deliver impressive returns for their subscribers. While these past successes shouldn't be interpreted as guarantees, they illustrate the potential of their research-driven approach.

Examples of well-known companies previously recommended include Amazon, Netflix, and Tesla. Their recommendations are based on an in-depth analysis of the company's financials, management team, and competitive landscape.

It is crucial to note that every investment carries inherent risks, and even the most well-researched stock can underperform. Investors should carefully consider their own risk tolerance and financial goals before making any investment decisions.

How to Interpret The Motley Fool's Advice

Simply mirroring The Motley Fool's picks blindly isn't the optimal strategy. Instead, use their recommendations as a starting point for your own research.

Delve into the company's financials, understand its business model, and assess its competitive position. Consider whether the stock aligns with your overall investment strategy and risk tolerance.

Consider the Fool's rationale behind the recommendation. Understanding their thought process empowers you to make more informed decisions and learn from their expertise.

Ultimately, successful investing involves continuous learning and adapting to market dynamics. The Motley Fool provides valuable insights and research, but it's up to each individual investor to make informed choices.

As you close your investment platforms, remember that the journey of wealth-building is a marathon, not a sprint. By combining The Motley Fool's recommendations with your own diligent research and a long-term perspective, you can pave the way for a more secure financial future. So, keep learning, stay informed, and invest wisely.