Which Of The Following Will Increase Basis For Depreciation

The question of what increases the basis for depreciation is a cornerstone of tax law, impacting businesses of all sizes. Misunderstanding this concept can lead to significant financial repercussions, including overpayment of taxes or, more seriously, facing penalties for underreporting.

Navigating the intricacies of depreciation and its basis requires a thorough understanding of relevant tax codes and regulations. This article delves into the specific elements that contribute to an increased basis for depreciation, offering clarity for businesses seeking to optimize their tax strategies and maintain compliance.

Understanding the Basis for Depreciation: The Nut Graf

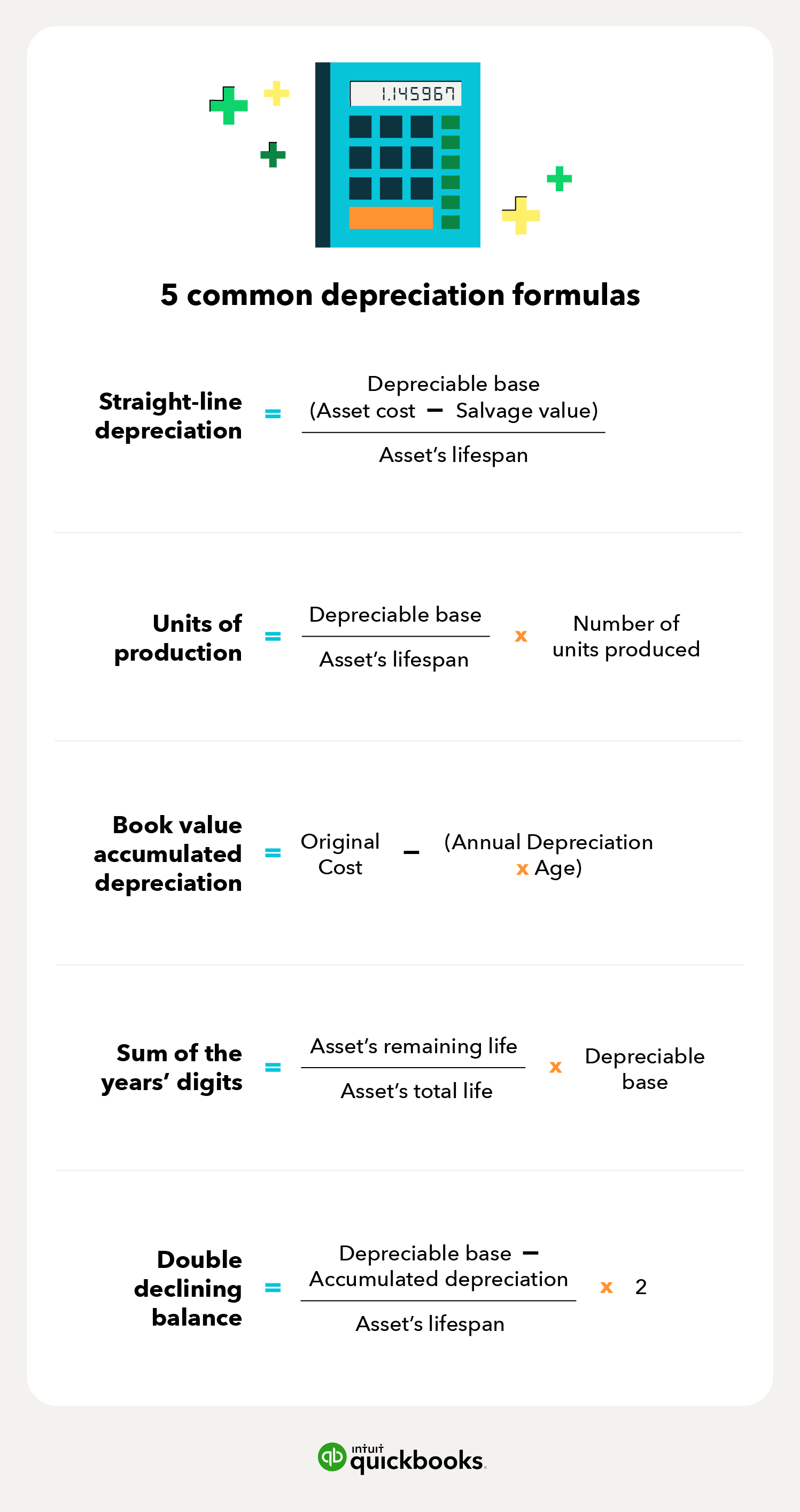

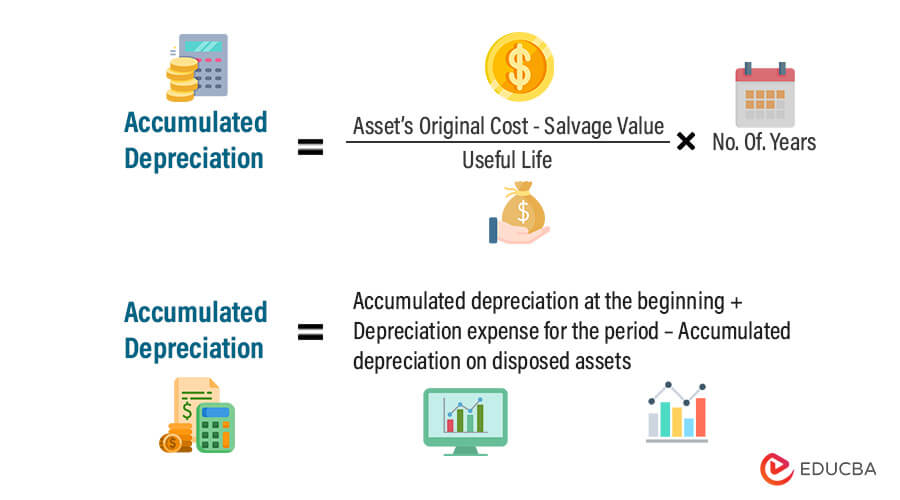

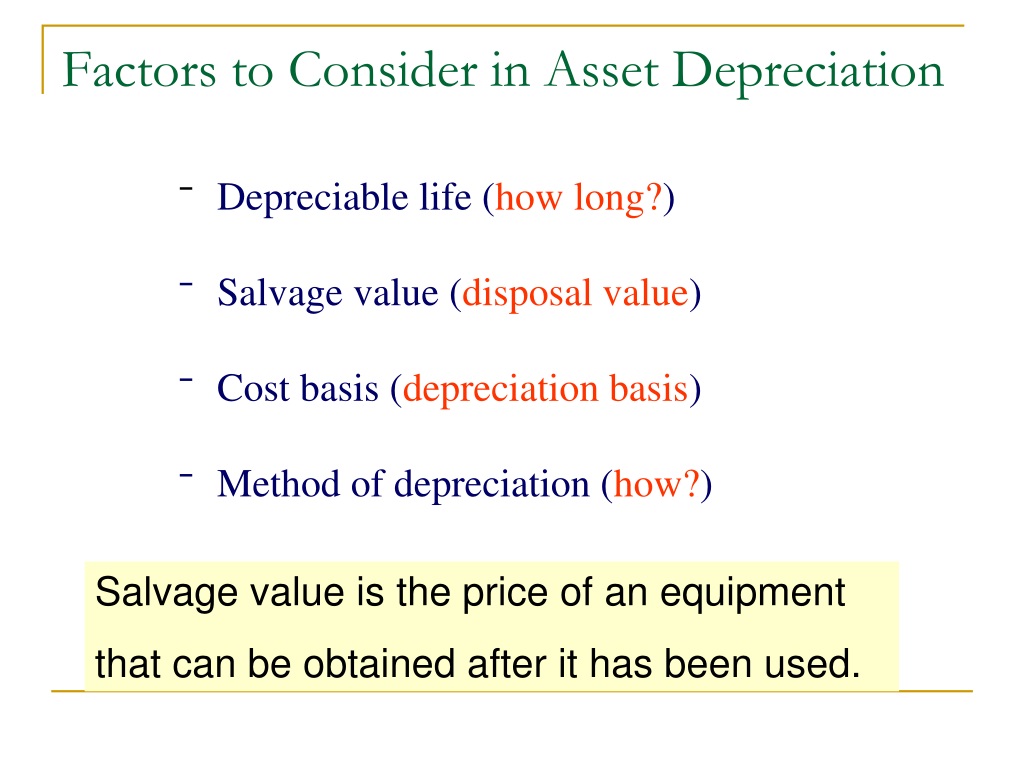

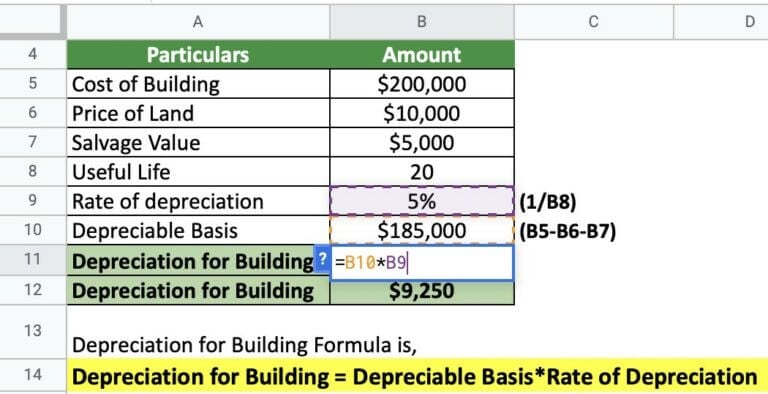

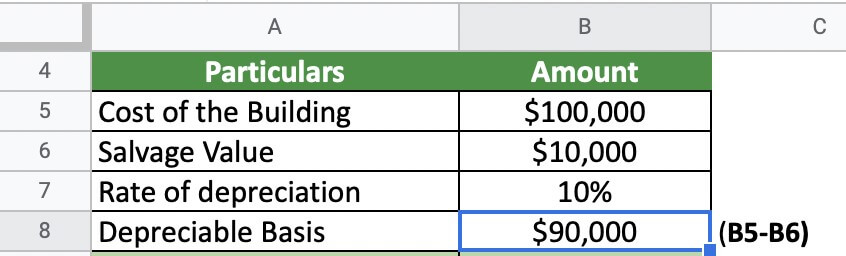

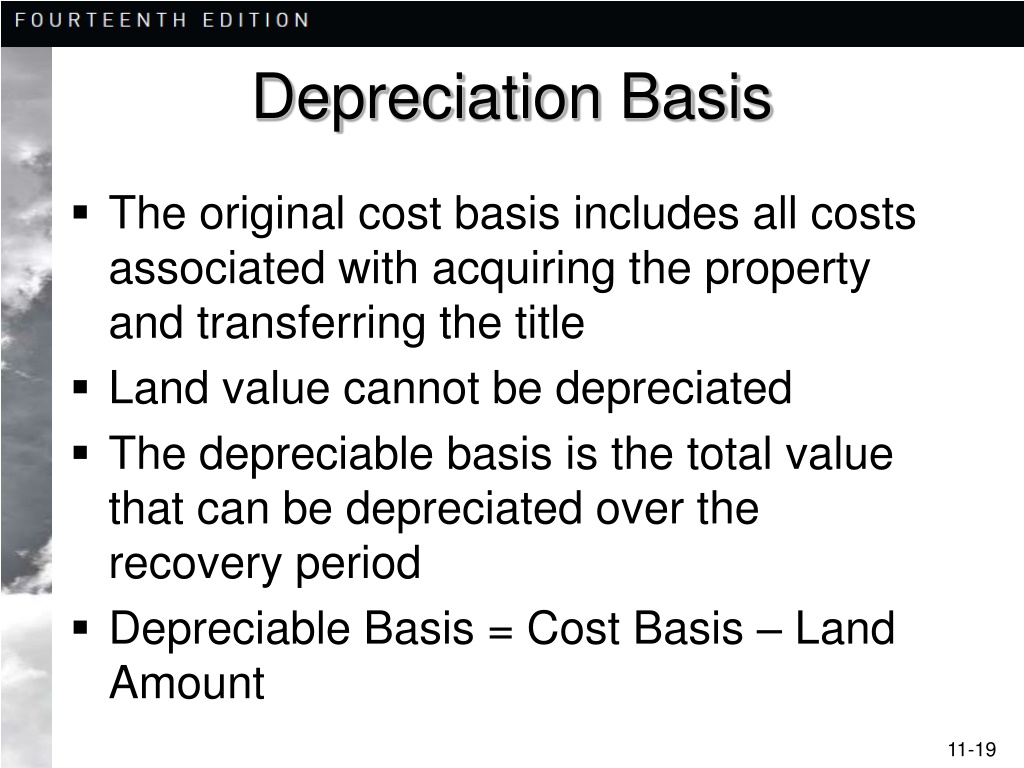

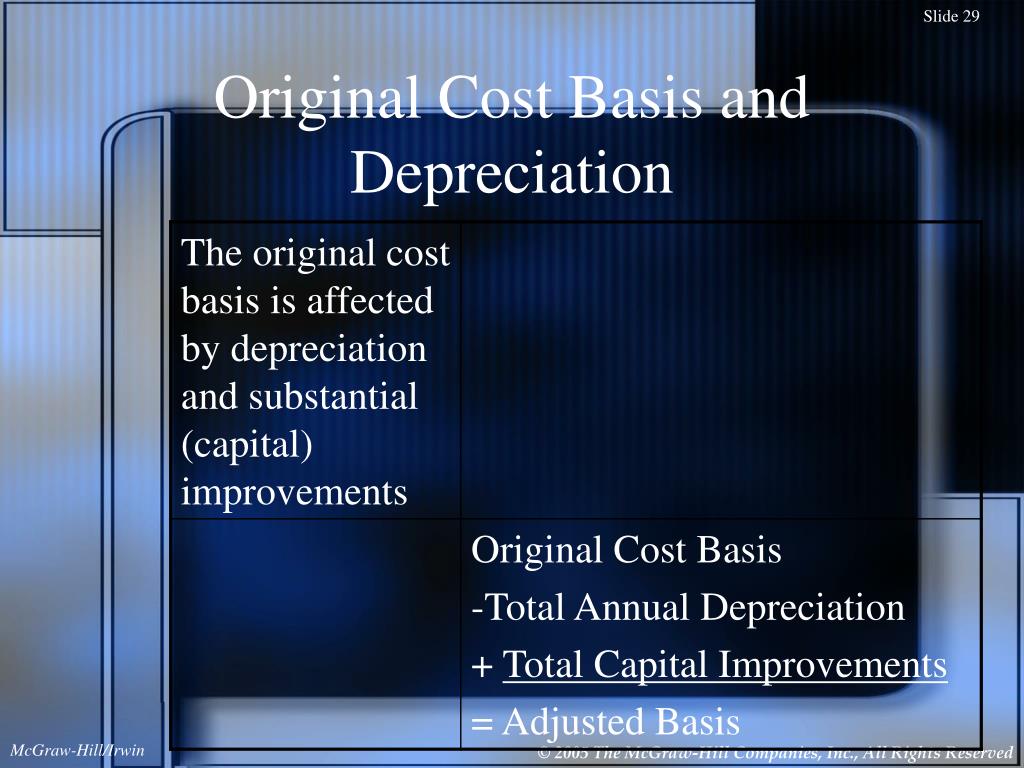

The basis for depreciation represents the amount a business can recover through depreciation deductions over an asset's useful life. Generally, it starts with the asset's cost but can be influenced by various factors that either increase or decrease it.

Specifically, items like improvements made to the asset after its purchase, certain legal fees, and even sales tax can all contribute to an increase in the depreciable basis. Conversely, deductions like the Section 179 deduction or claiming bonus depreciation would reduce the basis.

Cost of Acquisition: The Initial Foundation

The most fundamental element of the depreciable basis is the cost of acquiring the asset. This encompasses the purchase price negotiated with the seller.

Beyond the sticker price, the cost includes expenses directly related to acquiring and placing the asset into service. For example, transportation charges incurred to move equipment to its designated location.

Installation fees, which include labor and materials required to set up and make the asset operational, are also added to the basis. Consulting the IRS Publication 946, How to Depreciate Property, provides further guidance.

Capital Improvements: Enhancing the Asset's Value

Capital improvements are expenditures that add to the asset's value, prolong its useful life, or adapt it to a new or different use. These are not deductible as current expenses but are added to the asset's basis.

Consider a manufacturing facility: if a new, energy-efficient cooling system is installed, this qualifies as a capital improvement. Similarly, if a building undergoes significant structural modifications, such as adding a new wing, it increases the basis for depreciation.

The key distinction lies in whether the expenditure repairs or merely maintains the asset versus genuinely enhances it. Routine maintenance is typically expensed, while enhancements become part of the depreciable basis.

Certain Legal and Professional Fees

Certain legal and professional fees directly related to the acquisition or preparation of an asset for its intended use can increase the basis. These are often overlooked but are crucial considerations.

For example, if a business incurs legal fees to obtain a clear title for a property or to resolve zoning issues, these fees are added to the asset's basis. Engineering fees for designing a specialized piece of equipment are also included.

However, fees for general business advice or tax planning, even if indirectly related to the asset, are usually not included in the asset's basis, they are typically deductible business expenses.

Sales Tax and Other Incidental Costs

Sales tax paid on the purchase of an asset is another component that increases the depreciable basis. This is a straightforward addition that reflects the total cost to the business.

Other incidental costs may include excise taxes or fees for inspections required before the asset can be used. These small costs, when aggregated, can contribute significantly to the overall depreciable basis.

Accurate record-keeping of all acquisition-related expenses is essential to ensure the correct depreciation calculation. Retain all receipts and invoices to support your deductions.

Impact of Section 179 Deduction and Bonus Depreciation

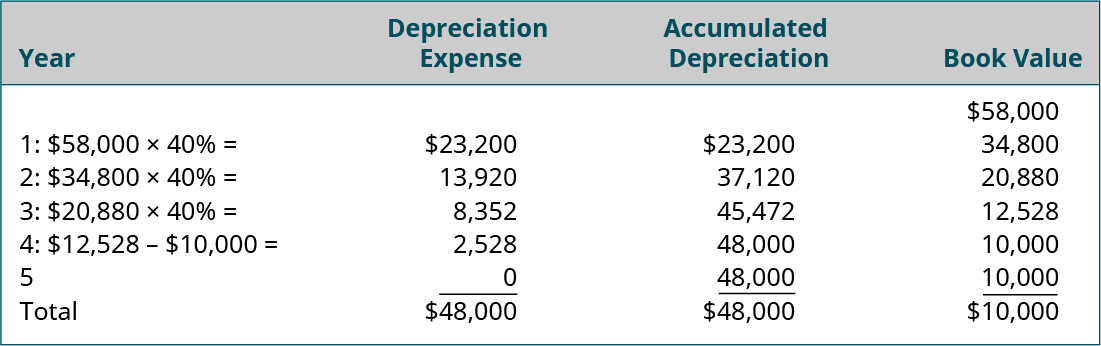

It's crucial to understand that while the elements above increase the basis, certain deductions immediately reduce it. The Section 179 deduction allows businesses to deduct the full purchase price of qualifying assets in the year they are placed in service, up to a certain limit.

Similarly, bonus depreciation allows for an additional first-year depreciation deduction, further reducing the basis. These deductions are beneficial in the short term but result in a lower depreciable basis for subsequent years.

Careful planning is needed to determine whether to utilize these deductions or opt for regular depreciation to maximize long-term tax benefits. The choice depends on the company's current and projected tax situation.

Examples in Practice

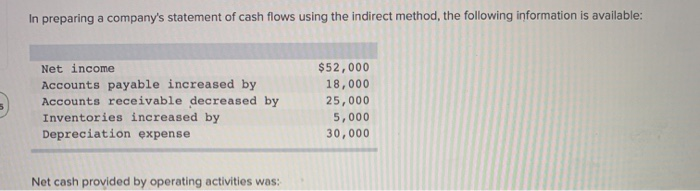

Imagine a bakery purchases a new industrial oven for $50,000. They pay $2,000 for shipping, $3,000 for installation, and $500 in sales tax.

The bakery's depreciable basis is $50,000 (oven) + $2,000 (shipping) + $3,000 (installation) + $500 (sales tax) = $55,500. If the bakery chooses to take the Section 179 deduction of $25,000 (hypothetically), the remaining basis for regular depreciation would be $30,500.

Another example: a construction company buys a used bulldozer for $75,000. They spend $10,000 on rebuilding the engine and $5,000 on reinforcing the chassis. This is a capital improvement and would increase the asset's basis.

Future Considerations and the Changing Tax Landscape

Tax laws are subject to change, and businesses must stay abreast of new regulations affecting depreciation. Congress can alter depreciation methods, rates, or eligibility requirements for deductions like Section 179 and bonus depreciation.

Staying informed through professional tax advisors and resources like the IRS website is crucial. Failing to adapt to these changes can lead to errors in tax filings and potential penalties.

Moreover, businesses should consider the long-term implications of depreciation choices on their overall tax strategy. Understanding the interplay between depreciation, deductions, and credits can result in significant tax savings over time.