Is Inuvo A Good Stock To Buy

Imagine a bustling digital marketplace, humming with the energy of countless interactions. Algorithms whisper in the background, connecting consumers with precisely what they're seeking. In the center of it all, stands a company striving to refine this complex dance, promising advertisers a more effective way to reach their target audiences. That company is Inuvo, Inc. (INUV), and its stock is capturing attention in a market constantly seeking the next disruptive innovation.

The core question swirling around Inuvo is simple, yet loaded with potential: Is INUV a good stock to buy? This isn’t a straightforward yes or no. It demands a closer look at the company’s business model, financial health, growth prospects, and the inherent risks of investing in a small-cap, technology-driven enterprise.

Inuvo: A Deep Dive

Founded in 1987, Inuvo has evolved significantly over the years. It now operates primarily in the realm of artificial intelligence (AI) driven marketing technology. Their flagship platform, IntentKey, analyzes online user behavior to predict consumer intent.

This technology allows advertisers to deliver more relevant ads to potential customers. The core of Inuvo's value proposition lies in its ability to improve ad performance and ROI compared to traditional methods.

The IntentKey Advantage

IntentKey distinguishes itself through its focus on understanding why a consumer is online, not just what they are doing. By analyzing vast amounts of data, IntentKey attempts to decipher the underlying motivations behind searches and browsing activity.

This deeper understanding allows Inuvo to serve ads that are more likely to resonate with users, thus increasing engagement and conversion rates for advertisers. The AI is constantly learning and adapting, promising ever-improving performance over time.

Financial Performance and Challenges

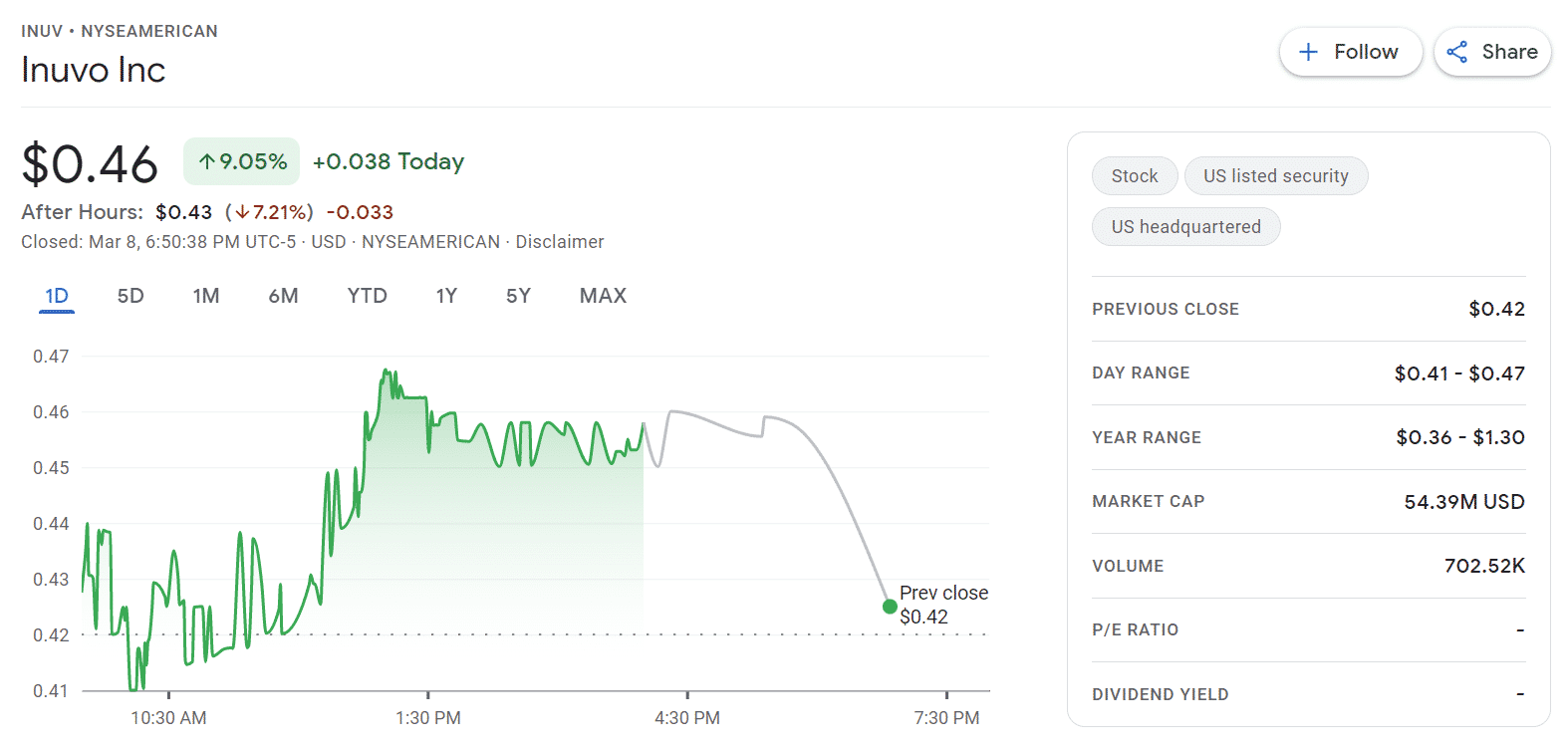

Analyzing Inuvo's financial performance is crucial for any potential investor. Revenue growth is a key indicator, reflecting the demand for Inuvo's services and its ability to attract and retain clients.

Historically, Inuvo's revenue has experienced fluctuations. Examining recent quarterly and annual reports will provide the most up-to-date picture of the company’s financial trajectory and identify any emerging trends.

Profitability is another critical factor. Like many growth-oriented technology companies, Inuvo has faced challenges in achieving consistent profitability. Investors need to assess whether the company's investments in research and development are likely to translate into future profits.

Cash flow is also vital. A healthy cash flow indicates the company's ability to fund its operations, invest in growth initiatives, and weather potential economic downturns. Strong cash flow is generally a positive sign for a company's long-term sustainability.

Debt levels are also a consideration. High debt can increase financial risk and limit a company's flexibility. Investors should evaluate Inuvo's debt-to-equity ratio and its ability to service its debt obligations.

Market Opportunities and Competition

The digital advertising market is vast and growing. This presents significant opportunities for companies like Inuvo that can offer innovative solutions to improve ad performance.

However, the market is also highly competitive. Inuvo faces competition from larger, well-established players like Google and Facebook, as well as from other emerging ad tech companies.

Inuvo’s success hinges on its ability to differentiate itself from the competition. Its IntentKey technology and focus on understanding consumer intent could provide a competitive edge.

Management Team and Strategy

The quality of a company's management team is a key determinant of its success. Investors should research the experience and track record of Inuvo's leadership.

A clear and well-articulated strategy is also essential. Inuvo's management team must have a plan for navigating the competitive landscape, scaling the business, and achieving profitability.

Their investor relations materials and public statements can offer insights into the company’s strategic priorities and long-term vision. Pay attention to their communication style and commitment to transparency.

Potential Risks and Rewards

Investing in Inuvo, like any stock, involves both potential risks and rewards. The potential rewards include the possibility of significant capital appreciation if the company's technology gains widespread adoption and its financial performance improves.

However, there are also risks to consider. These include the risk of technological obsolescence, increased competition, and the challenges of scaling a small-cap company. Small-cap stocks can also be more volatile than large-cap stocks.

The digital advertising landscape is constantly evolving. A sudden shift in technology or consumer behavior could negatively impact Inuvo's business.

Analyst Ratings and Market Sentiment

Pay attention to what financial analysts are saying about Inuvo. Analyst ratings and price targets can provide valuable insights into market sentiment and expectations for the company's future performance.

However, it's important to remember that analyst ratings are not always accurate. Investors should conduct their own research and not rely solely on analyst opinions.

Market sentiment can also influence stock prices. News articles, social media discussions, and investor forums can provide a sense of how investors are feeling about Inuvo.

Making an Informed Decision

Ultimately, the decision of whether or not to invest in Inuvo is a personal one. It should be based on your individual investment goals, risk tolerance, and financial situation.

Before investing, carefully review Inuvo's financial statements, read independent research reports, and consider the company's competitive landscape.

Consider consulting with a financial advisor who can help you assess the risks and rewards of investing in Inuvo and determine whether it aligns with your overall investment strategy.

Due diligence is paramount. Don't let hype or speculation influence your decision-making process. Make informed choices based on facts and analysis.

A Final Thought

Inuvo represents a compelling narrative in the evolving digital advertising space. The promise of AI-driven intent analysis offers a glimpse into the future of marketing, but the path to profitability and market dominance is rarely smooth.

Whether Inuvo is a "good" stock to buy depends entirely on your perspective. For the risk-tolerant investor seeking high-growth potential, Inuvo might present an intriguing opportunity.

However, for those seeking stability and proven profitability, a more established company might be a better fit. The key is to understand the risks, assess the potential rewards, and make a decision that aligns with your individual investment goals. The digital marketplace is a dynamic and unforgiving arena, but with careful research and a measured approach, investors can navigate its complexities and potentially reap significant rewards.