Adverse Selection In A Public Stock Company Occurs When

Investors are facing increased risk as adverse selection is impacting public stock valuations. This hidden threat occurs when one party in a transaction has more information than the other, creating imbalances that can lead to significant financial losses.

Adverse selection in public stock companies surfaces when insiders exploit information asymmetry to the detriment of outside investors. This article explores the mechanics of this problem and its potential ramifications for the market.

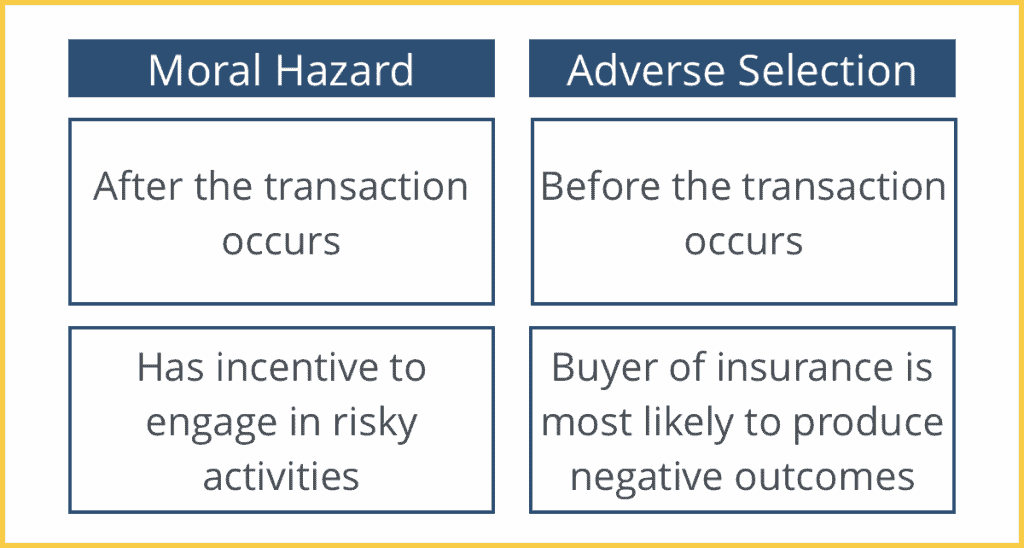

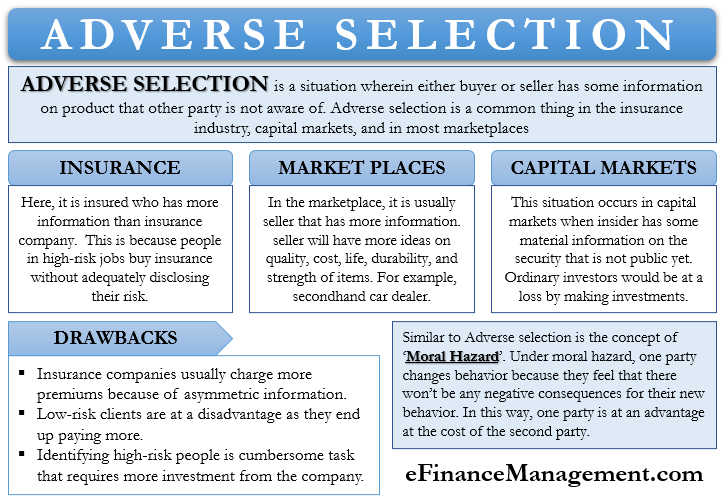

What is Adverse Selection?

Adverse selection happens when informed parties, like company executives or major shareholders, use non-public information to trade stocks. This gives them an unfair advantage over ordinary investors who lack the same insight.

Essentially, those with superior information are more likely to engage in trades that benefit them, potentially at the expense of others.

Common Scenarios

One prominent scenario occurs during initial public offerings (IPOs). Companies might strategically time their IPOs when they know their prospects are less favorable than perceived by the market.

For example, a tech company nearing obsolescence might rush to go public, offloading shares before the decline becomes widely known.

Another instance involves insider trading. Executives aware of upcoming bad news, such as a product recall or a significant earnings miss, might sell their shares before the information becomes public.

The Role of Information Asymmetry

Information asymmetry is the bedrock of adverse selection. When corporate insiders possess private knowledge about a company's financial health, future plans, or regulatory hurdles, they can use this advantage to make profitable trades.

Outside investors, relying on public reports and market analysis, are often unaware of these hidden realities. This disparity in information creates a playing field tilted in favor of the informed party.

Impact on Investors

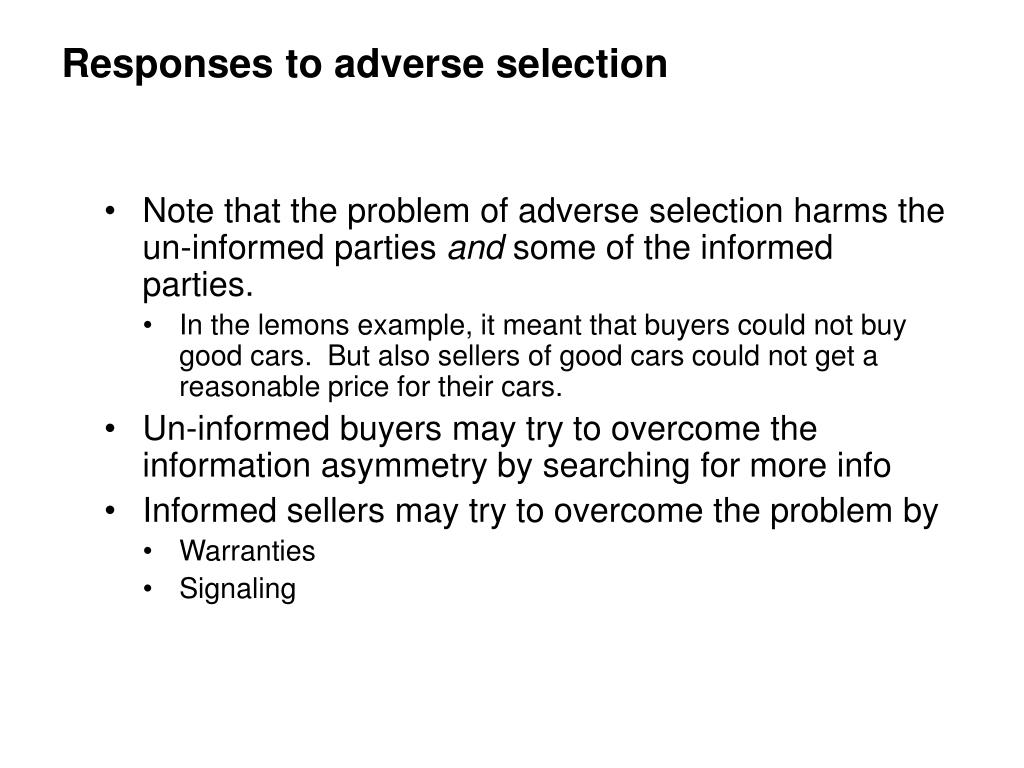

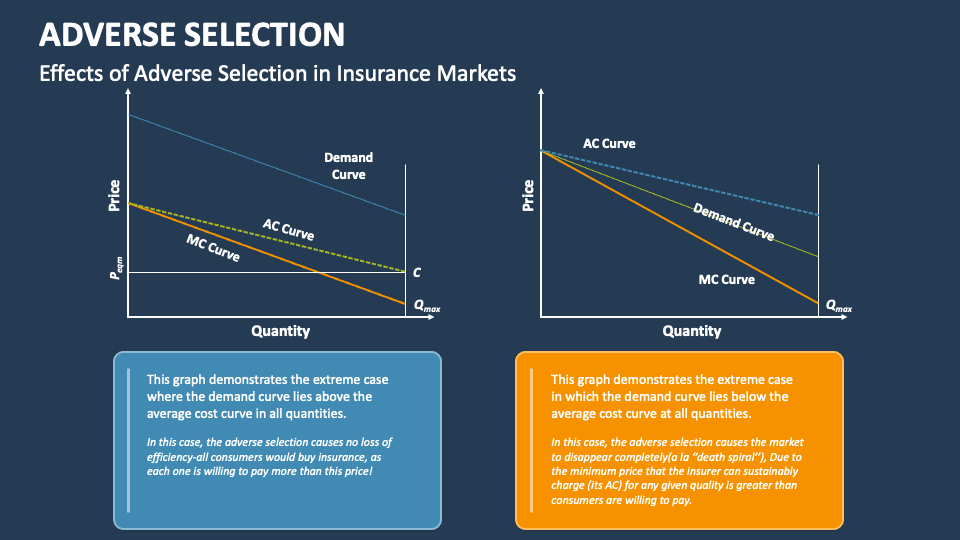

Adverse selection can erode investor confidence and market integrity. Investors who consistently find themselves on the losing end of trades due to hidden information may withdraw from the market.

This decreased participation can reduce market liquidity and efficiency, making it harder for companies to raise capital.

Furthermore, it can lead to mispricing of assets, where stocks are valued higher or lower than their true worth, leading to bubbles and crashes.

Regulatory Measures

To combat adverse selection, regulatory bodies like the Securities and Exchange Commission (SEC) enforce strict rules against insider trading and require companies to disclose material information promptly.

Regulations mandate transparent financial reporting and penalize individuals or entities engaged in illicit information-based trading.

The effectiveness of these measures varies, and sophisticated strategies can sometimes circumvent regulatory oversight. Still, they remain a critical line of defense.

Case Studies

Consider the case of Enron. Prior to its collapse, company executives allegedly misrepresented the company's financial condition and engaged in insider trading, selling off their shares while encouraging employees and investors to hold onto theirs.

More recently, investigations into suspicious trading activity before major corporate announcements have highlighted the ongoing prevalence of potential adverse selection issues.

Mitigation Strategies for Investors

Investors can reduce their exposure to adverse selection by diversifying their portfolios and investing in well-regulated companies with strong corporate governance.

Conducting thorough due diligence and relying on independent financial analysis can provide added protection.

Staying informed about market trends and regulatory changes is also crucial for detecting potentially problematic situations.

The Future Landscape

As technology advances, new challenges emerge in combating adverse selection. The increasing speed and complexity of financial markets can make it harder to detect and prosecute insider trading.

Furthermore, the rise of alternative data and sophisticated trading algorithms poses new risks, requiring regulators to adapt and refine their enforcement strategies.

Conclusion

Adverse selection remains a significant threat in public stock companies, impacting investor confidence and market efficiency. The SEC continues its monitoring and enforcement activities, with several ongoing investigations related to suspicious trading patterns. Investors must remain vigilant and informed to navigate this complex landscape and mitigate their risks. Further announcements are expected in the coming months regarding enhanced regulatory measures.