Air Products & Chemicals Investor Relations

Air Products' stock faces pressure as investors react to adjusted earnings guidance below expectations, triggering immediate market adjustments. The company now anticipates adjusted earnings per share between $12.20 and $12.50, a revision causing concern among shareholders and analysts.

This article provides a concise overview of the recent developments impacting Air Products' investor relations, focusing on the revised earnings guidance and its implications for the company's stock performance and future outlook.

Revised Earnings Guidance Impacts Market Sentiment

Air Products (Air Products & Chemicals, Inc.), a leading industrial gases company, announced an adjustment to its full-year adjusted earnings per share (EPS) guidance.

The revised guidance now projects adjusted EPS between $12.20 and $12.50, a change from previous projections.

This announcement has directly influenced investor sentiment and market activity surrounding the company's stock.

Immediate Market Reaction

Following the release of the updated guidance, Air Products' stock experienced notable fluctuations.

Investors are closely monitoring the situation as the market digests the implications of the revised earnings outlook.

The stock performance reflects a combination of investor reactions and analyst evaluations.

Key Factors Influencing the Revision

While the official statement pointed to "ongoing macroeconomic uncertainty," analysts suggest several contributing factors.

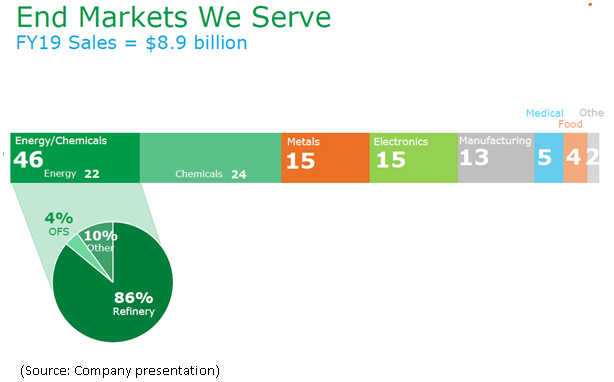

These include potentially lower-than-anticipated demand in specific sectors and the impact of fluctuating energy costs on production expenses.

Supply chain complexities, though lessening, may also contribute to the revised outlook.

Analyst Perspectives

Analysts at major financial institutions are actively reassessing their ratings and price targets for Air Products.

These adjustments reflect the need to account for the revised earnings guidance and its potential long-term effects.

Early reports indicate a cautious approach, with some analysts lowering their short-term expectations.

Investor Relations Communication

Air Products' Investor Relations team has been actively communicating with shareholders and analysts.

They are providing detailed explanations of the factors driving the revised guidance and outlining the company's strategies for mitigating the impact.

Transparency and timely communication are crucial during periods of market volatility.

Company Statement

Air Products released an official statement acknowledging the revised guidance.

The statement emphasized the company's commitment to long-term value creation and its focus on executing key strategic initiatives.

The company reaffirms its commitment to operational efficiency and strategic investments.

Financial Performance Overview

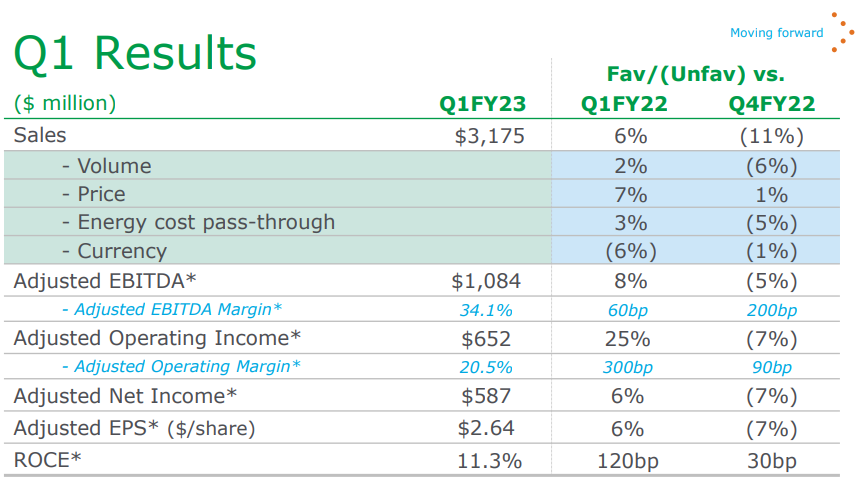

While the revised guidance impacts full-year projections, Air Products' previous financial performance remains a key indicator.

The company's historical revenue growth and profitability margins are factors investors continue to evaluate.

Previous quarterly reports provide insight into the company's operational strengths and areas for improvement.

Looking Ahead

Air Products' management team will likely address investor concerns during upcoming earnings calls and investor conferences.

These events offer opportunities for detailed discussions about the company's performance and future plans.

The focus will be on outlining strategies to navigate the current economic environment and achieve long-term growth targets.

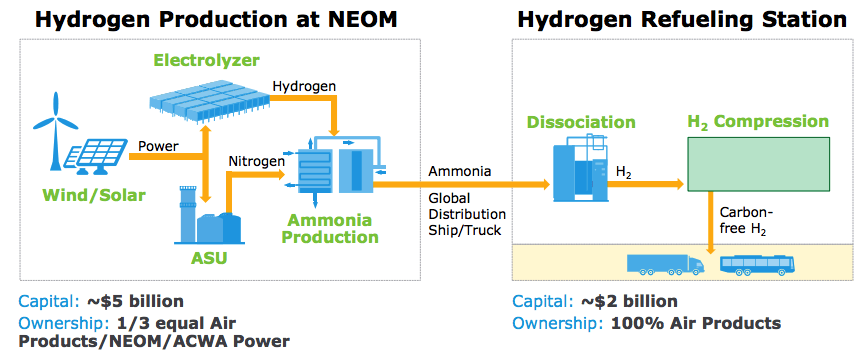

Impact on Strategic Projects

The revised earnings guidance may influence the timeline or scope of some of Air Products' strategic projects.

Careful evaluation of capital expenditures and project prioritization will be necessary to maintain financial stability.

The company remains committed to its core business segments and exploring new growth opportunities.

Next Steps and Ongoing Developments

Investors are advised to monitor Air Products' upcoming earnings releases and investor presentations for further updates.

Analyst reports and market news will provide additional insights into the company's performance and prospects.

The situation remains dynamic, and ongoing developments will continue to shape investor sentiment and the company's stock performance.