Alabama Income Tax Form 40 2024

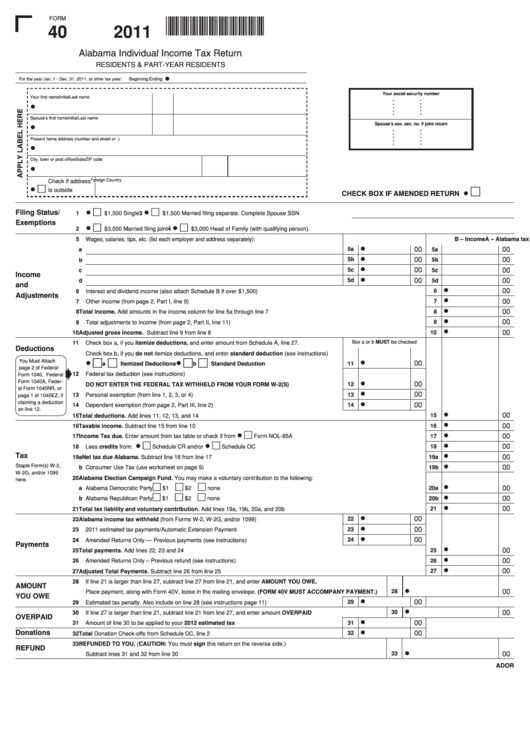

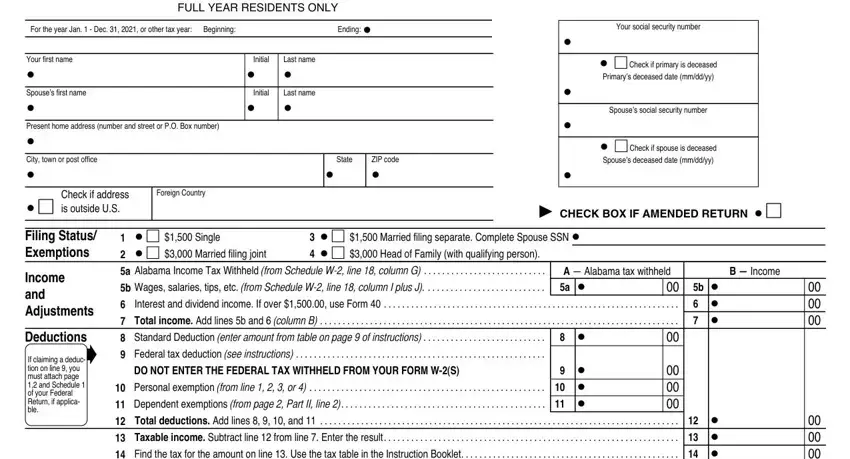

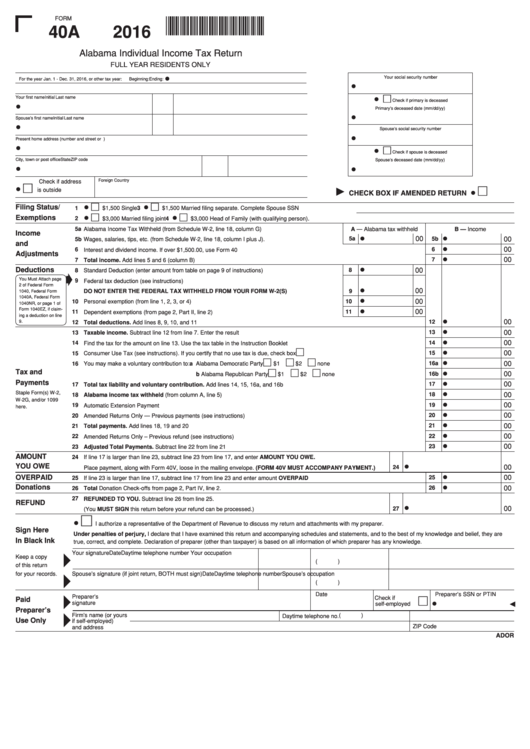

Alabama residents are gearing up for the 2024 tax season, and with it comes the annual review of Form 40, the state's income tax return. Understanding the changes, deadlines, and available credits is crucial for Alabamians to ensure accurate filing and avoid potential penalties. This article breaks down what taxpayers need to know about Form 40 for the current tax year.

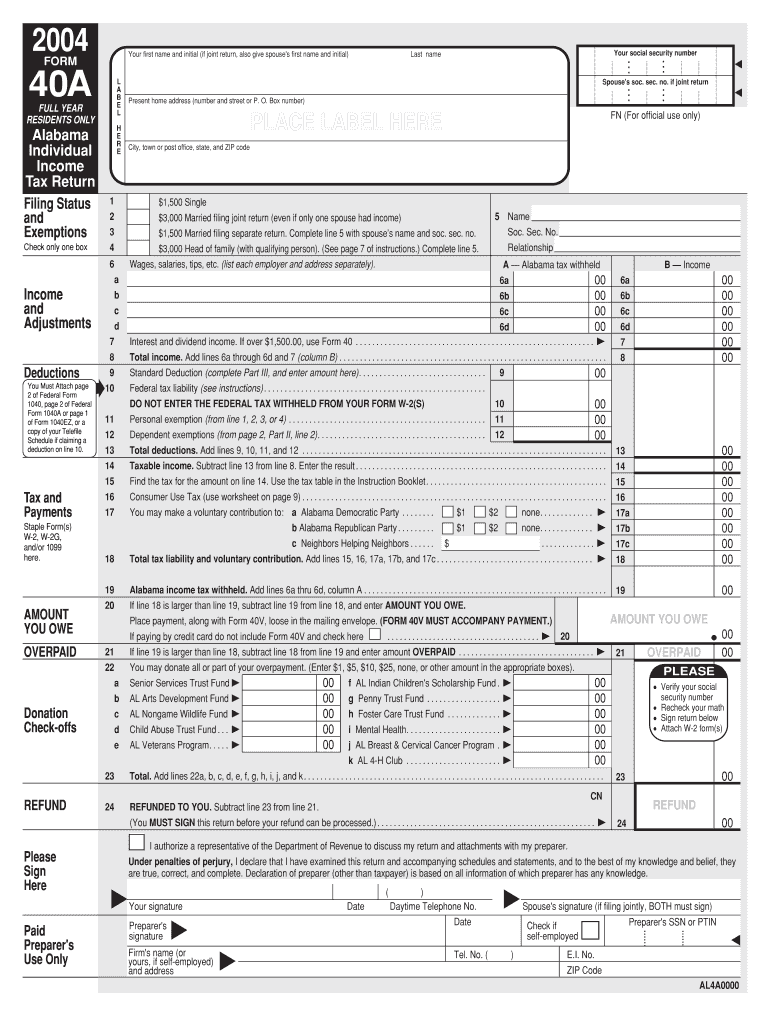

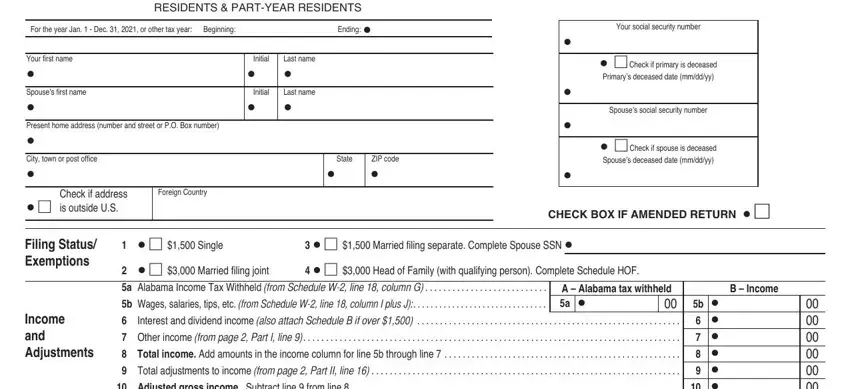

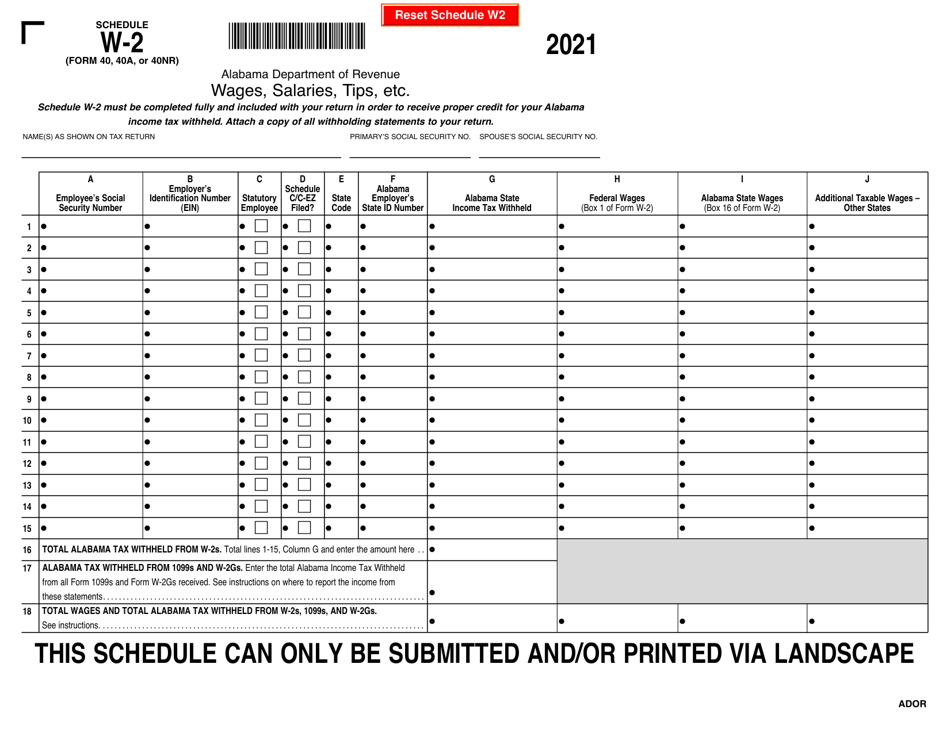

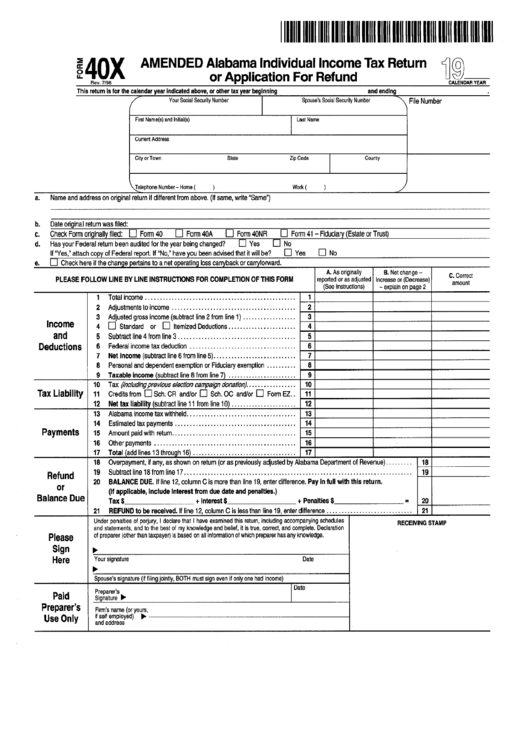

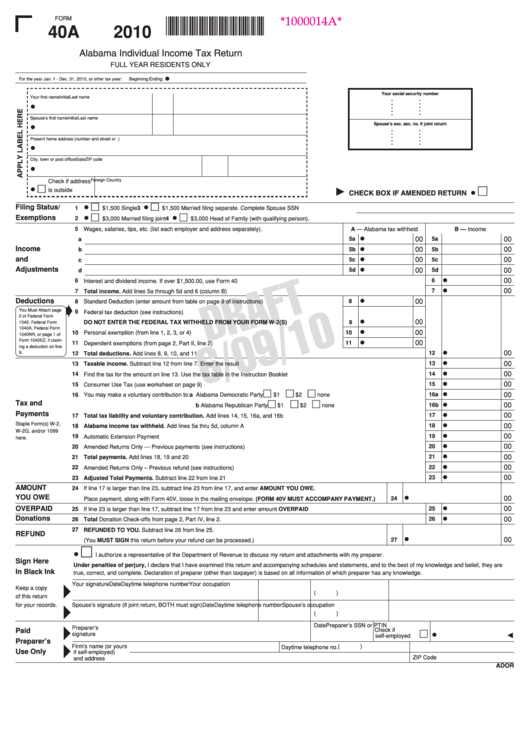

Form 40 is the primary document used by Alabama residents to report their income, deductions, and credits to the Alabama Department of Revenue. Accurate and timely filing is essential for compliance with state tax laws, ensuring that individuals pay the correct amount of tax owed. This article will explore key aspects of the form, offering guidance for a smooth filing process.

Key Deadlines and Filing Information

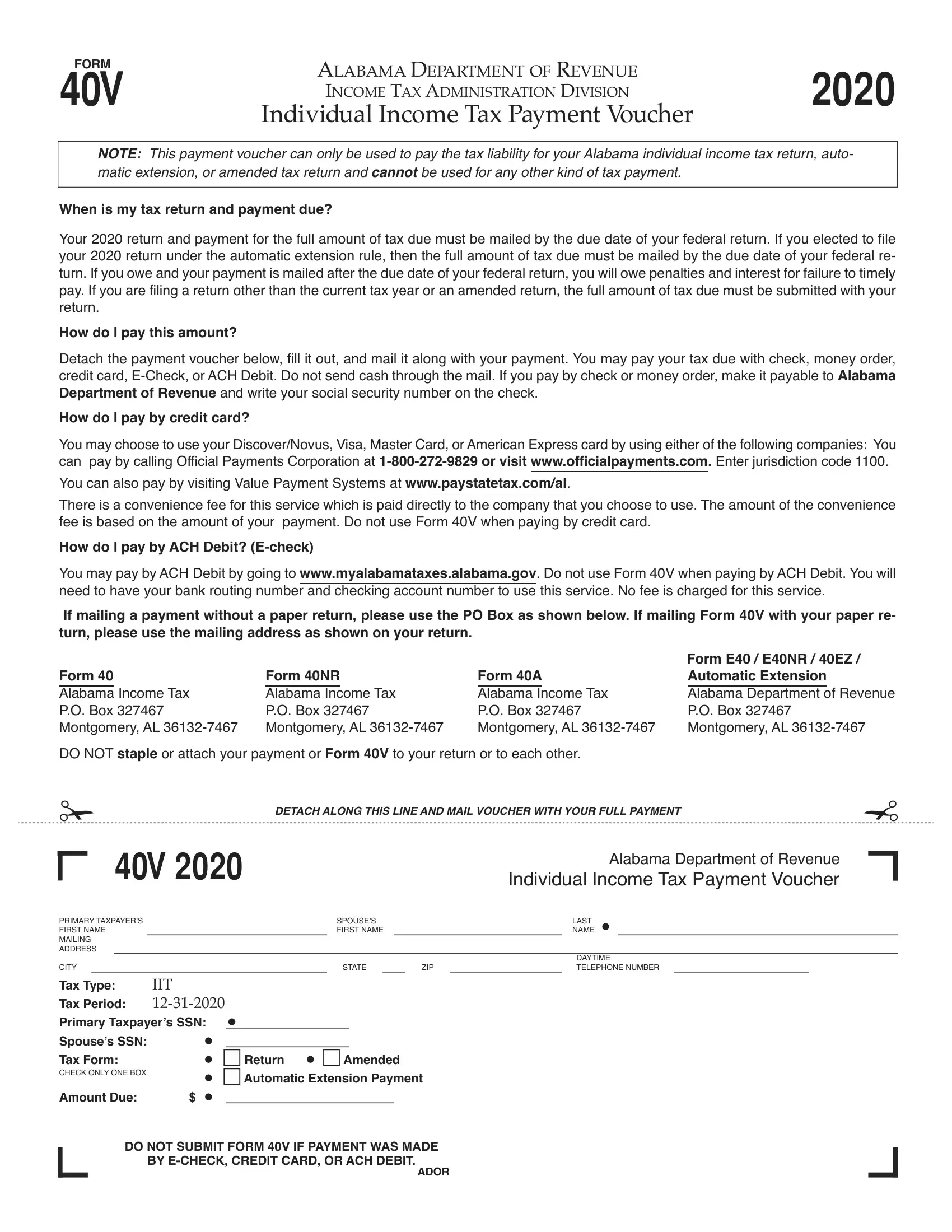

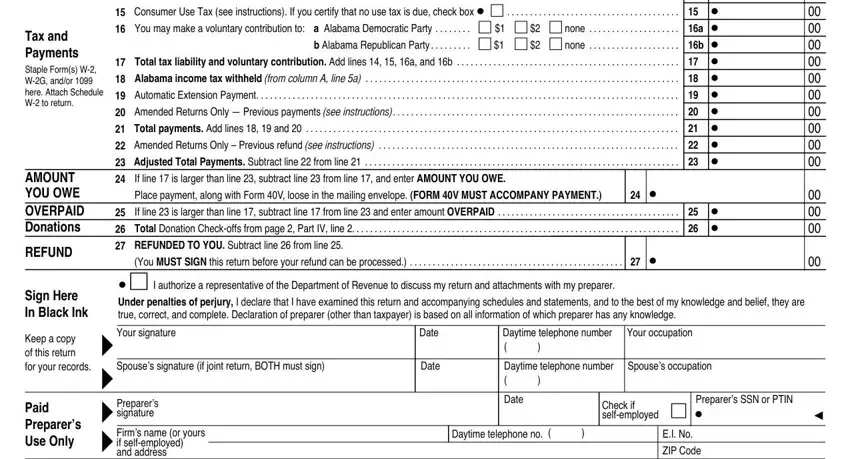

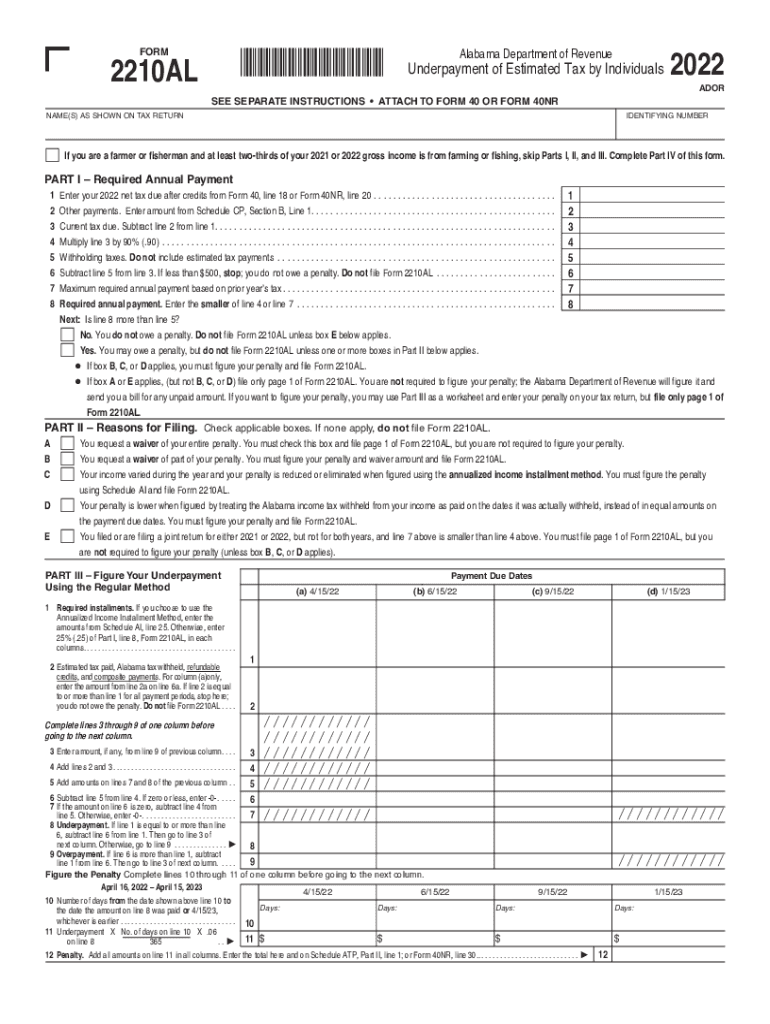

The deadline for filing Alabama income tax returns, including Form 40, typically aligns with the federal deadline, which is April 15th in most years. For 2024, since April 15th falls on a Monday, taxpayers are expected to adhere to this date. Failure to file by the deadline can result in penalties and interest charges.

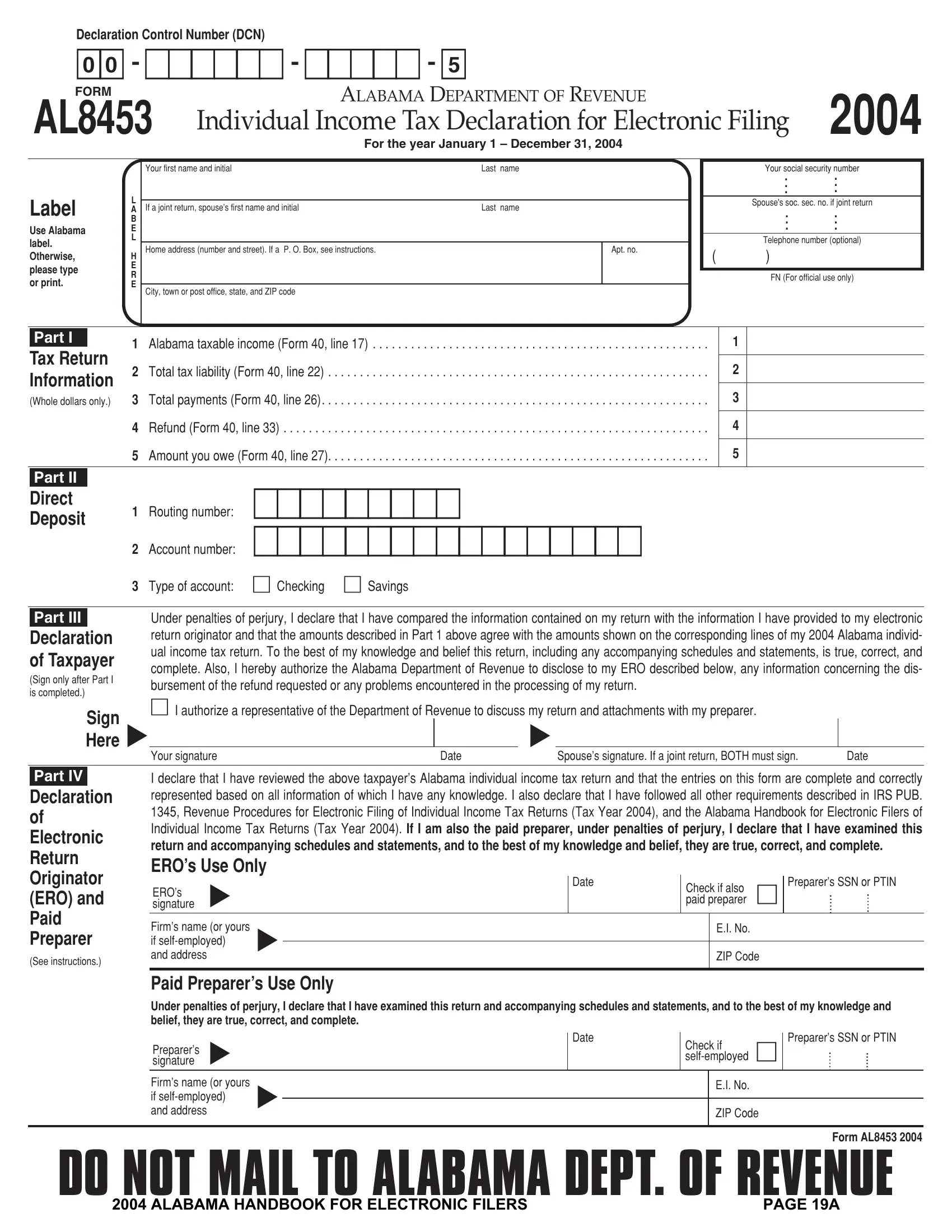

Taxpayers have several options for filing their Alabama income tax return. They can file electronically through the My Alabama Taxes (MAT) portal, which is the state's online filing system. Alternatively, they can download Form 40 from the Alabama Department of Revenue's website, complete it, and mail it to the designated address.

Electronic filing is generally recommended for its speed and accuracy, often providing quicker refunds. It also reduces the risk of errors associated with manual data entry. Paper filing, however, remains an option for those who prefer it.

Changes and Updates to Form 40 for 2024

Each year, the Alabama Department of Revenue may implement changes to Form 40 based on legislative updates or clarifications of existing tax laws. Taxpayers need to be aware of these changes to ensure they are using the correct form and following the proper procedures.

One significant change that could affect taxpayers is adjustments to income tax brackets. These brackets determine the tax rate applied to different levels of income, and any changes can impact the overall tax liability of individuals. Stay informed to avoid overpaying or underpaying your taxes.

Furthermore, there may be updates to deductions and credits available to Alabama residents. Changes to eligibility requirements or amounts could affect the amount of tax owed or the refund received. Keep reading to understand more about the deductions and credits available.

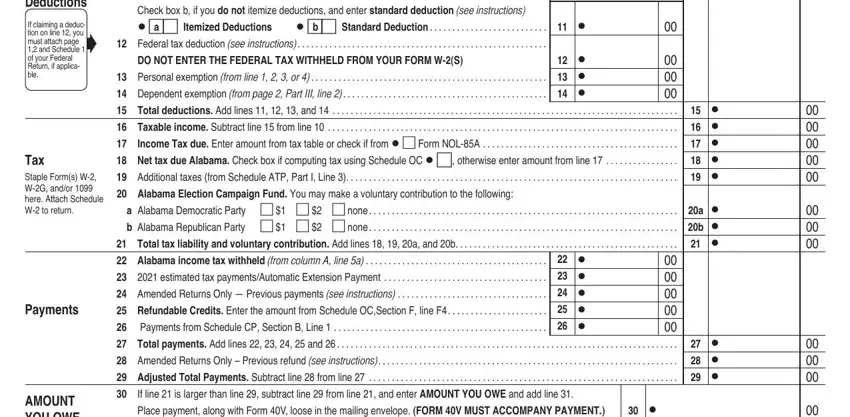

Understanding Deductions and Credits

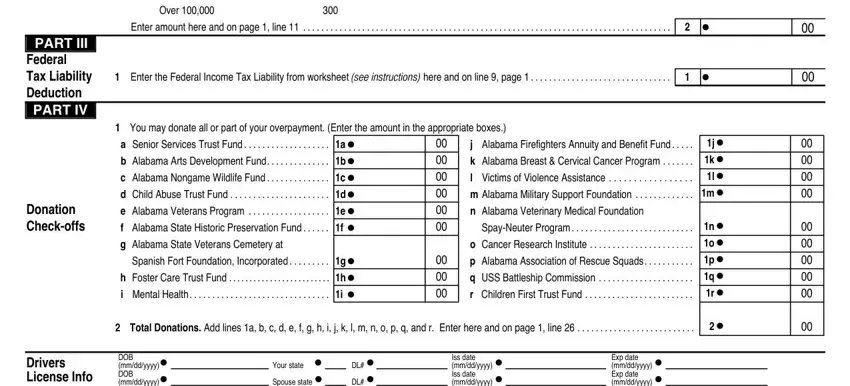

Deductions and credits are essential components of Form 40, as they can significantly reduce a taxpayer's overall tax liability. Deductions reduce the amount of income subject to tax, while credits directly reduce the amount of tax owed.

Some common deductions available to Alabama residents include the standard deduction, which is a fixed amount that taxpayers can claim regardless of their actual expenses. Those who itemize, detailing specific expenses, may claim a larger deduction by listing qualifying expenses like home mortgage interest, property taxes, and charitable donations.

Several credits may be available, such as the Child and Dependent Care Credit, which helps offset the cost of childcare expenses, and the Elderly or Disabled Taxpayer Credit, for qualifying individuals. Detailed information about eligibility requirements and credit amounts can be found on the Alabama Department of Revenue's website.

Important Note: Tax laws can be complex, and it is recommended to consult with a qualified tax professional or refer to the Alabama Department of Revenue's official resources for personalized guidance.

Impact on Alabama Residents

The accuracy and completeness of Form 40 filings directly impact the financial well-being of Alabama residents. Errors or omissions can lead to penalties, interest charges, or delays in receiving refunds. Careful attention to detail is therefore crucial.

For instance, missing out on eligible deductions or credits can result in overpaying taxes, reducing the amount of money available for household expenses or investments. In contrast, claiming deductions or credits without proper documentation can trigger an audit and potential penalties.

Furthermore, the revenue generated through income taxes is a vital source of funding for state government services, including education, healthcare, and infrastructure. Accurate reporting ensures that the state has the resources to provide these essential services to its citizens.

Seeking Assistance and Resources

The Alabama Department of Revenue provides numerous resources to assist taxpayers with filing Form 40. The department's website offers detailed instructions, publications, and frequently asked questions (FAQs) to address common inquiries.

Taxpayers can also contact the department's customer service representatives by phone or email for assistance with specific questions or concerns. These representatives can provide clarification on tax laws, filing procedures, and eligibility requirements for deductions and credits.

Additionally, free tax preparation services may be available to low-income individuals, seniors, and individuals with disabilities through programs like the Volunteer Income Tax Assistance (VITA) program. These services offer free tax help from IRS-certified volunteers.

Remember that the Alabama Department of Revenue website is the best source for all information, forms, and regulations: revenue.alabama.gov. Utilize this valuable resource and seek professional help if needed.

By staying informed about the changes to Form 40, understanding available deductions and credits, and utilizing available resources, Alabama residents can navigate the 2024 tax season with confidence. Accurate and timely filing is essential for compliance and financial well-being. Don't delay, start gathering your information today!