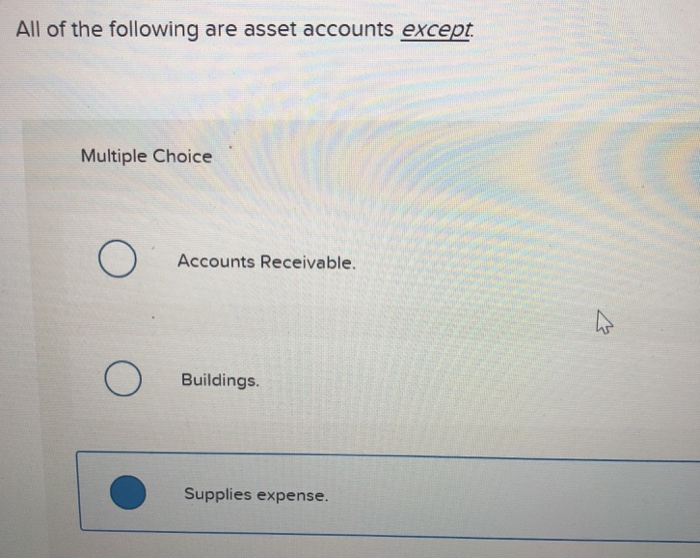

All Of The Following Are Classified As Fixed Assets Except

The seemingly straightforward question, "All Of The Following Are Classified As Fixed Assets Except," often trips up both seasoned finance professionals and students alike, revealing a deeper complexity within accounting principles. The correct identification hinges on a nuanced understanding of what constitutes a fixed asset and the subtle differences between various asset types.

This article delves into the intricacies of fixed asset classification, exploring the common misconceptions and providing a comprehensive guide to accurately distinguishing fixed assets from other asset categories.

Understanding Fixed Assets: The Core Principles

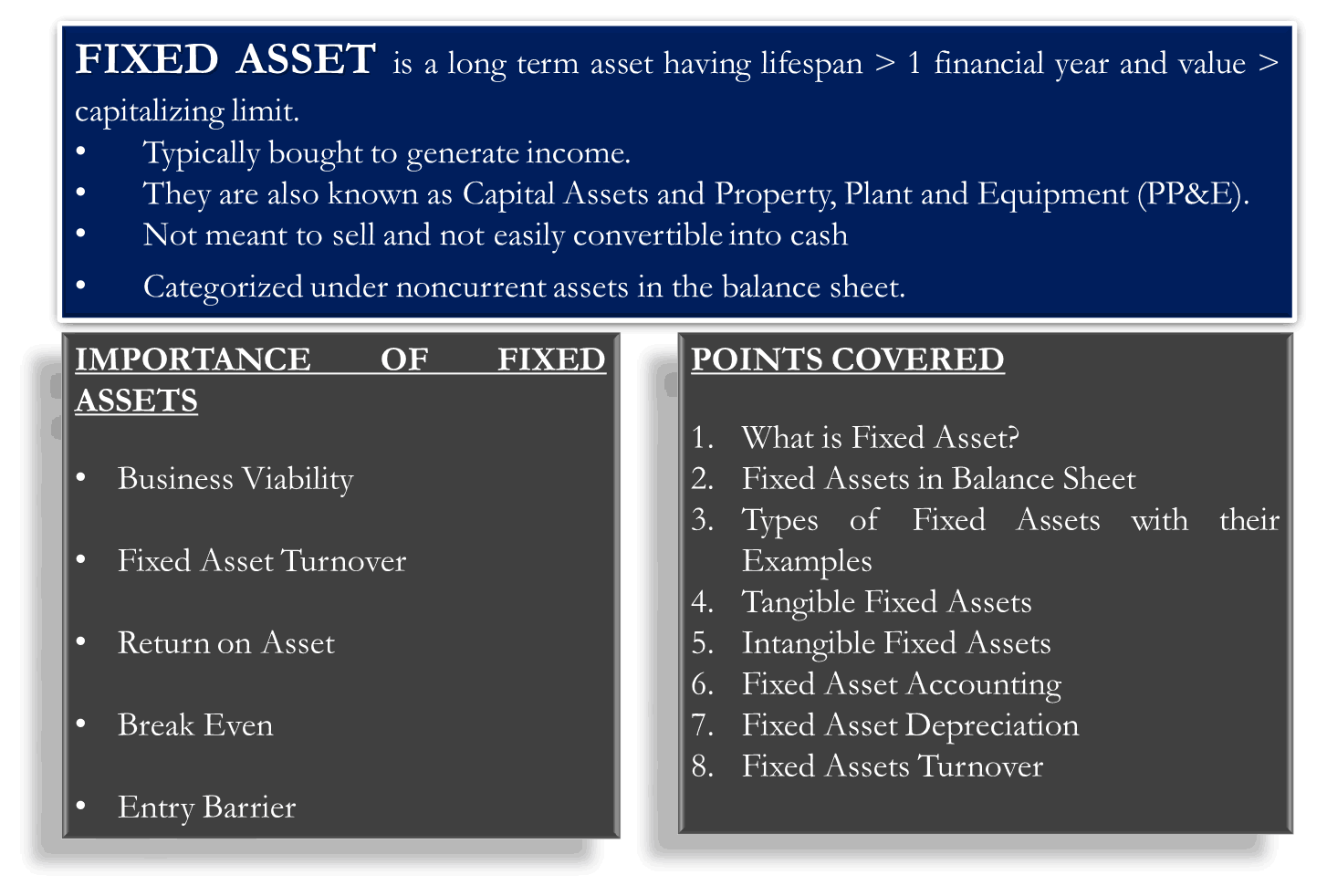

Fixed assets, also known as property, plant, and equipment (PP&E), are long-term tangible assets that a company owns and uses to generate income. These assets are not intended for sale in the ordinary course of business and have a useful life exceeding one year.

They are essential for a company's operations, representing a significant investment in its productive capacity.

Key Characteristics of Fixed Assets

Several characteristics define fixed assets. Firstly, they are tangible, meaning they have a physical presence.

Secondly, they are used in the company's operations, contributing directly or indirectly to the production of goods or services. Finally, fixed assets are expected to provide benefits for more than one accounting period.

Common Examples of Fixed Assets

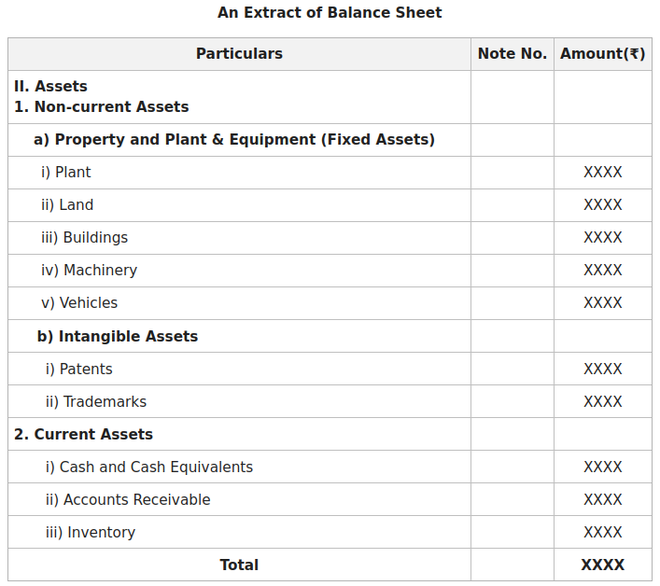

Common examples of fixed assets include land, buildings, machinery, equipment, furniture, and vehicles. These assets are typically recorded on the balance sheet at their historical cost, less accumulated depreciation.

Depreciation reflects the systematic allocation of the asset's cost over its useful life.

Distinguishing Fixed Assets from Other Asset Categories

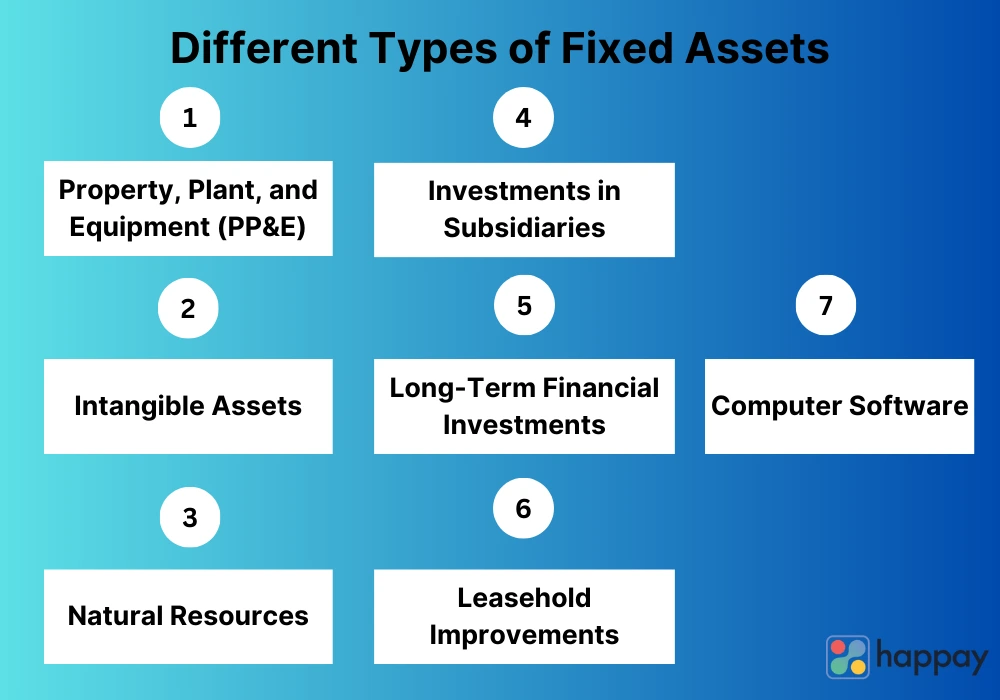

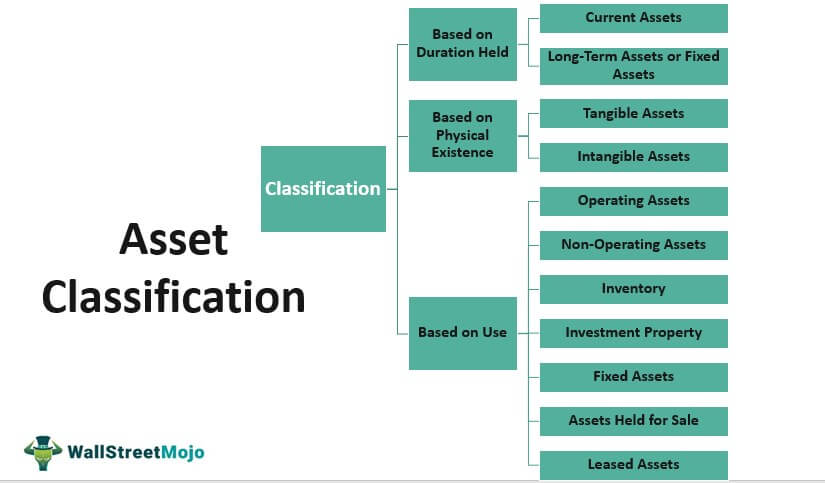

The challenge arises when differentiating fixed assets from other asset categories, such as current assets, intangible assets, and investments. Each category has distinct characteristics and accounting treatments.

Fixed Assets vs. Current Assets

Current assets are assets that are expected to be converted into cash, sold, or consumed within one year or the operating cycle, whichever is longer. Examples include cash, accounts receivable, inventory, and prepaid expenses.

The key difference lies in the timeframe: fixed assets have a longer lifespan and are not intended for quick conversion into cash, unlike current assets.

Fixed Assets vs. Intangible Assets

Intangible assets lack physical substance but represent valuable rights or privileges. Examples include patents, trademarks, copyrights, and goodwill.

While both fixed assets and intangible assets are long-term, the key distinction is their tangibility. Fixed assets are physical, whereas intangible assets are not.

Fixed Assets vs. Investments

Investments represent assets held by a company for capital appreciation or income generation, but not necessarily for use in its operations. These can include stocks, bonds, and real estate held for investment purposes.

The primary distinction is the intended use. Fixed assets are used in the business operations, while investments are held for financial gain.

The Tricky Cases: When Classification Becomes Complex

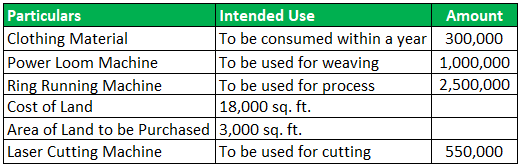

Certain scenarios can blur the lines between asset categories, requiring careful consideration. For example, land held for future development might be classified as an investment rather than a fixed asset.

Similarly, equipment held for resale would be considered inventory, a current asset, not a fixed asset. Context is crucial.

Inventory vs. Fixed Assets: A Common Point of Confusion

Inventory consists of goods held for sale in the ordinary course of business. Determining if an item is inventory or a fixed asset depends on the company's intention.

A car dealer classifies cars as inventory, while a taxi company classifies them as fixed assets.

Impact of Misclassification

Incorrectly classifying assets can have significant consequences for a company's financial statements. It can distort key financial ratios, such as the debt-to-asset ratio and the return on assets.

It can also impact depreciation expense, affecting net income and taxable income. Moreover, misclassification can mislead investors and creditors about a company's financial health.

Navigating the Nuances: Best Practices for Asset Classification

Accurate asset classification requires a thorough understanding of accounting principles and a careful assessment of the asset's characteristics and intended use. Companies should establish clear policies and procedures for asset classification, and regularly review these policies to ensure they remain relevant.

Consulting with a qualified accountant is also recommended, especially in complex cases. Regular auditing is essential.

The Future of Asset Classification

As businesses become more complex and technology evolves, asset classification may become even more challenging. The rise of digital assets, such as cryptocurrencies and NFTs, presents new questions about their classification. Are they intangible assets, investments, or something else entirely?

The accounting standards will need to adapt to address these emerging asset classes.

Ultimately, a deep understanding of the core principles of asset classification, coupled with sound judgment and professional guidance, is essential for accurate financial reporting and informed decision-making.

:max_bytes(150000):strip_icc()/fixedasset-edit-3fa5166c806b4897921df1a7dbcb5826.jpg)