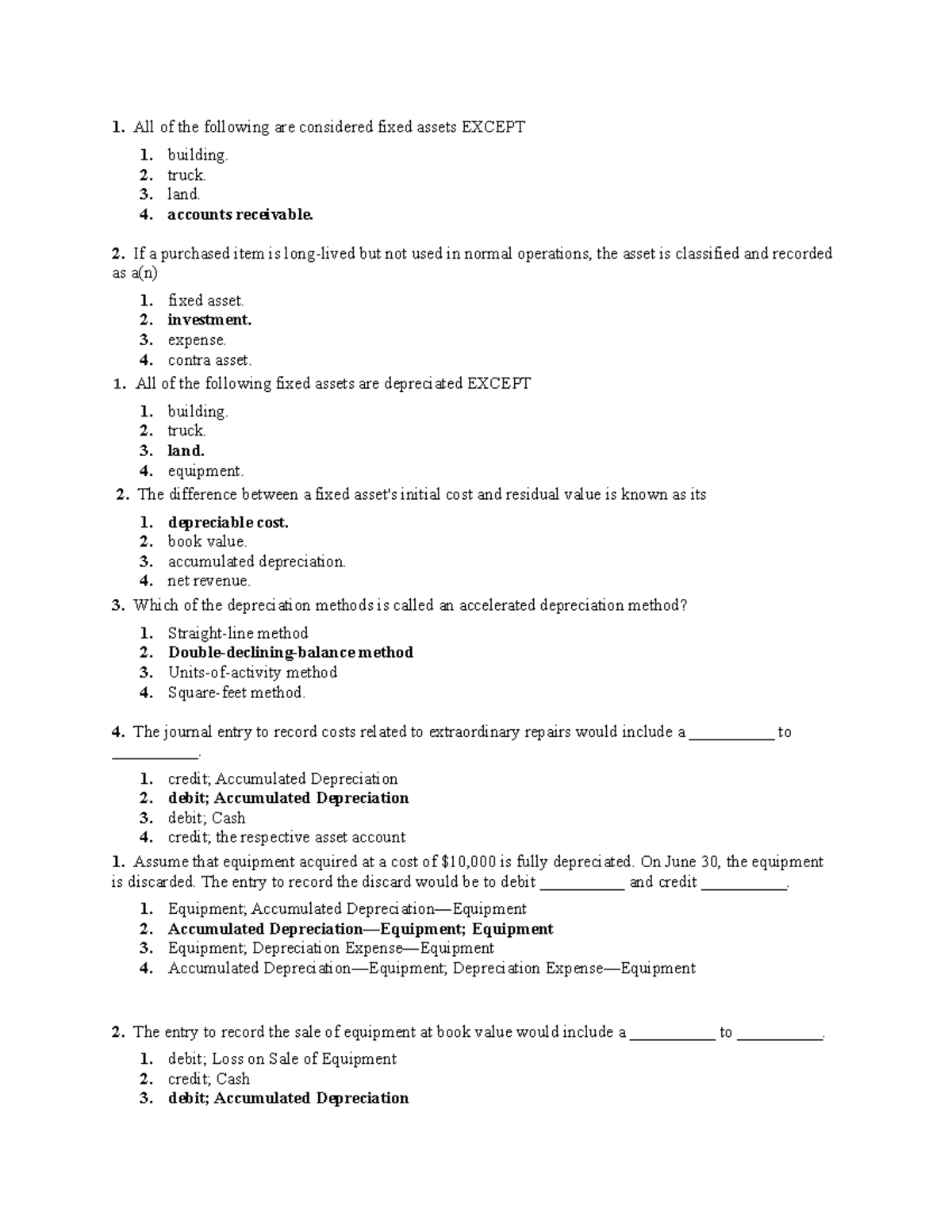

All Of The Following Are Considered Fixed Assets Except

The proper categorization of assets is a cornerstone of sound financial accounting, yet confusion often arises concerning which items qualify as fixed assets. Understanding the distinction between fixed and other types of assets is crucial for accurate financial reporting and informed decision-making.

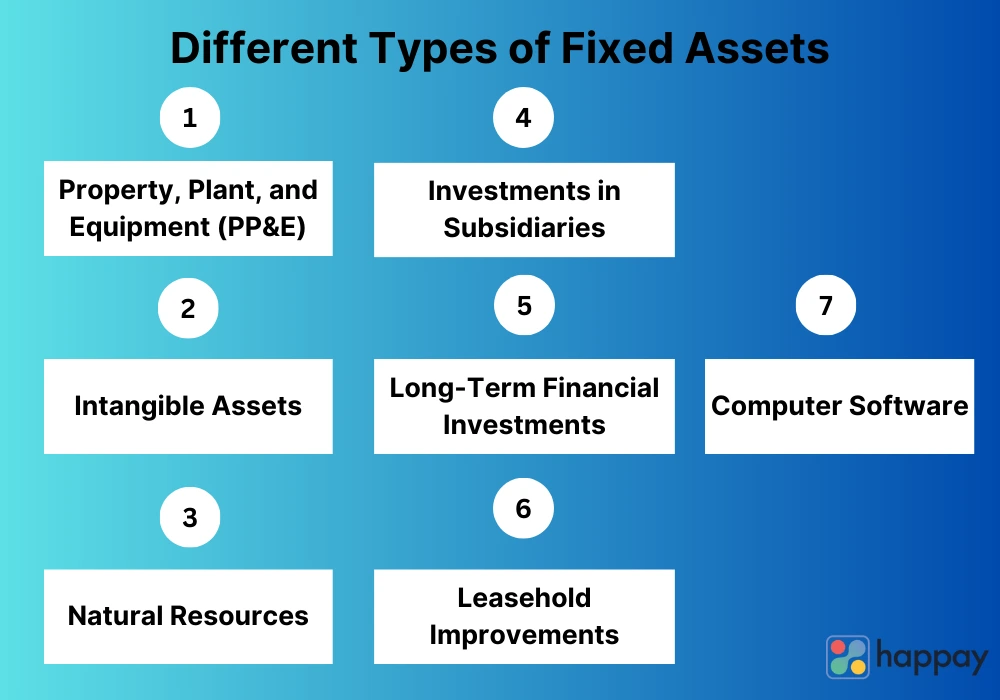

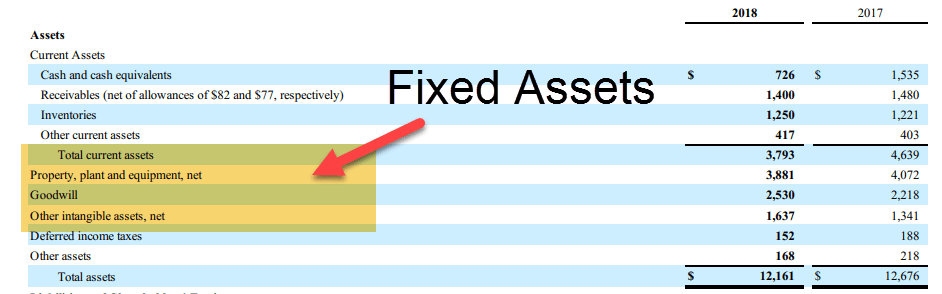

This article clarifies the nature of fixed assets, also known as property, plant, and equipment (PP&E), and identifies items that do not fall within this category. Proper classification impacts a company's balance sheet, income statement, and ultimately, its perceived financial health.

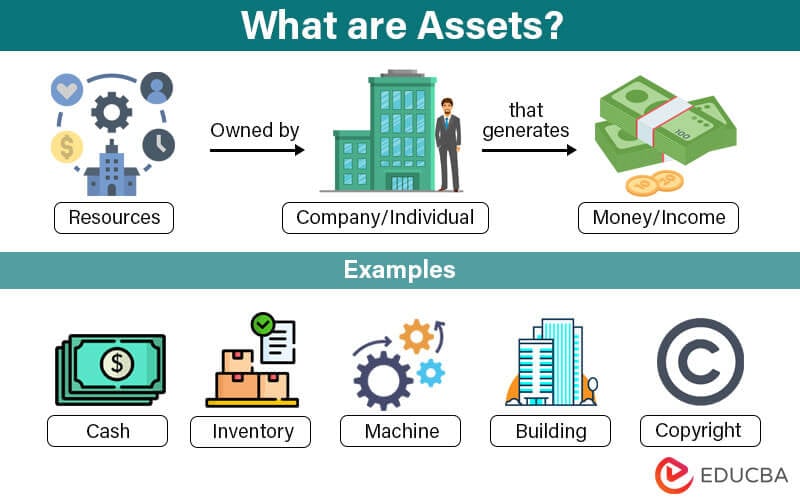

What Are Fixed Assets?

Fixed assets are tangible items a company owns and uses to generate income, possessing a useful life of more than one year. They are not intended for sale in the ordinary course of business. These assets are generally illiquid, meaning they cannot be quickly converted into cash.

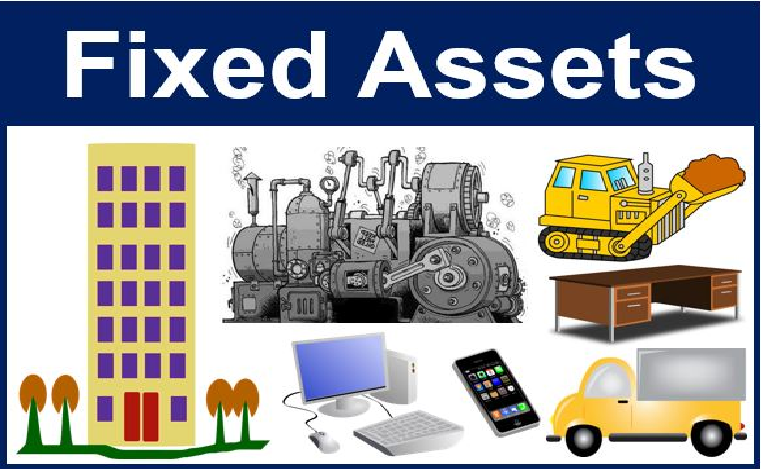

Examples of fixed assets include land, buildings, machinery, equipment, furniture, and vehicles. These items are essential for a company's long-term operations and contribute to its revenue-generating capacity.

Key Characteristics of Fixed Assets:

To be classified as a fixed asset, an item must meet several criteria.

First, it must be tangible; it needs to have a physical presence that can be seen and touched. Secondly, the asset must be expected to benefit the company for more than one accounting period, often several years.

Finally, the asset must be used in the company's operations and not held for resale to customers.

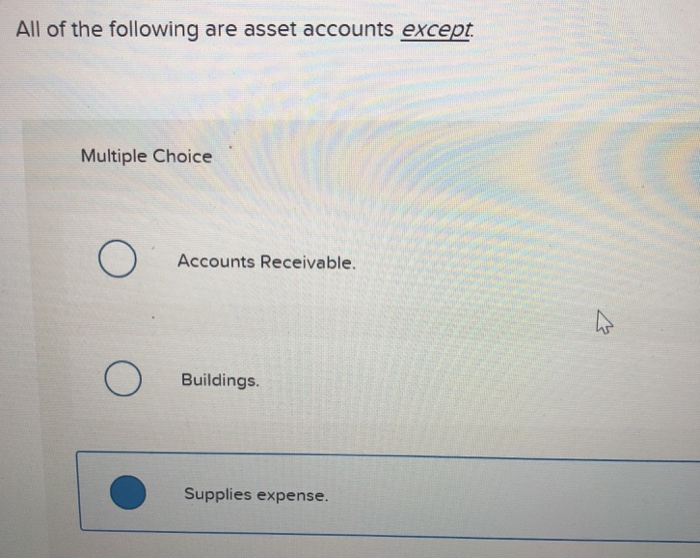

What Is NOT Considered a Fixed Asset?

Several types of assets are frequently mistaken for fixed assets, but their characteristics exclude them from this category.

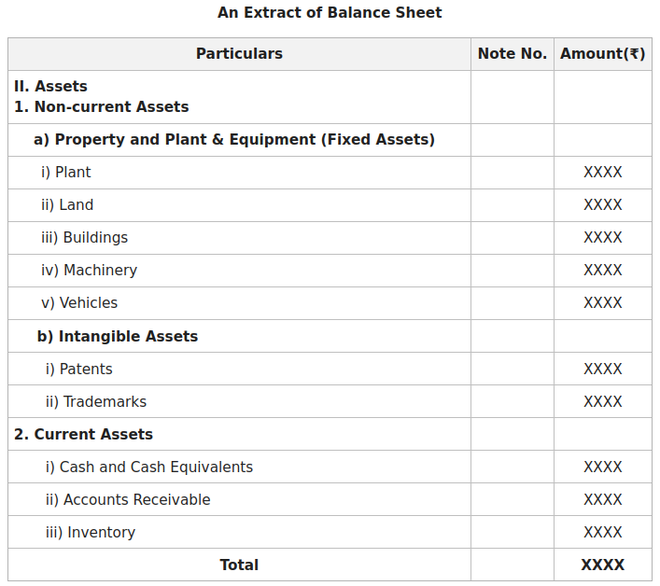

These include current assets, intangible assets, and certain types of investments.

Current Assets:

Current assets are items a company expects to convert into cash, sell, or consume within one year or the normal operating cycle, whichever is longer. Cash, accounts receivable, and inventory fall into this classification.

Unlike fixed assets, current assets are highly liquid. Inventory, while a tangible asset, is specifically held for sale and is therefore not classified as a fixed asset.

For example, a car dealership considers the cars on its lot as inventory, a current asset, while the building the dealership operates from is a fixed asset.

Intangible Assets:

Intangible assets lack physical substance but represent valuable rights or privileges. These assets include patents, trademarks, copyrights, and goodwill.

Even though they can provide long-term benefits, their lack of tangible form differentiates them from fixed assets. Intangible assets are subject to amortization rather than depreciation, reflecting the consumption of their value over time.

Investments:

Certain types of investments are also not considered fixed assets. These include short-term investments like stocks and bonds held for trading purposes.

While long-term investments in other companies can sometimes be categorized as fixed assets under specific circumstances (e.g., significant influence), they are typically classified separately on the balance sheet. The key difference lies in the purpose of holding the asset.

Impact on Financial Statements

The correct classification of assets significantly impacts a company's financial statements. Fixed assets are recorded on the balance sheet at their historical cost less accumulated depreciation.

Depreciation is the systematic allocation of the cost of a fixed asset over its useful life. This expense reduces the company's net income over time.

Misclassifying an item as a fixed asset can overstate the company's asset value and understate expenses in the short term, potentially misleading investors and creditors. Conversely, incorrect classification as a current asset may understate long-term earning potential.

Real-World Example

Consider a manufacturing company that purchases a new robotic arm for its production line. This robotic arm, with a useful life exceeding one year and used directly in the production process, would be classified as a fixed asset.

However, if the company also buys raw materials to be used in production, these raw materials would be classified as inventory, a current asset, due to their intended sale to customers as finished goods.

Similarly, the company's brand name, although extremely valuable, would be classified as an intangible asset, not a fixed asset, as it lacks physical form.

Conclusion

In summary, while land, buildings, machinery, and equipment are all considered fixed assets, items like inventory, cash, accounts receivable, and intangible assets such as patents and trademarks are not. Correctly identifying and classifying assets is essential for maintaining accurate and transparent financial records.

Accurate financial reporting allows stakeholders to make informed decisions about a company's financial health and future prospects. A solid grasp of fixed asset definitions and proper classification methodologies is crucial for accountants, financial analysts, and business managers alike.

:max_bytes(150000):strip_icc()/fixedasset-edit-3fa5166c806b4897921df1a7dbcb5826.jpg)