All Of The Following Are Manufacturing Costs Except:

Imagine walking through a bustling factory, the rhythmic hum of machinery a constant backdrop. Sparks fly as welders join metal, the air thick with the scent of oil and hot steel. Workers, clad in protective gear, move with purpose, transforming raw materials into finished goods. But behind the scenes, a critical process unfolds—cost accounting—determining the true price of creation.

At the heart of manufacturing lies the imperative to understand and manage costs. This article delves into the fundamental components of manufacturing costs, clarifying what's included and, crucially, what's not. Specifically, we'll explore the common question: "All of the following are manufacturing costs except:". We aim to provide a clear and accessible understanding of this vital accounting concept.

Understanding Manufacturing Costs

Manufacturing costs are the expenses a company incurs to convert raw materials into finished goods. They are the lifeblood of any production-based business. Accurately tracking and analyzing these costs is essential for profitability, pricing decisions, and overall financial health.

The Three Pillars: Direct Materials, Direct Labor, and Manufacturing Overhead

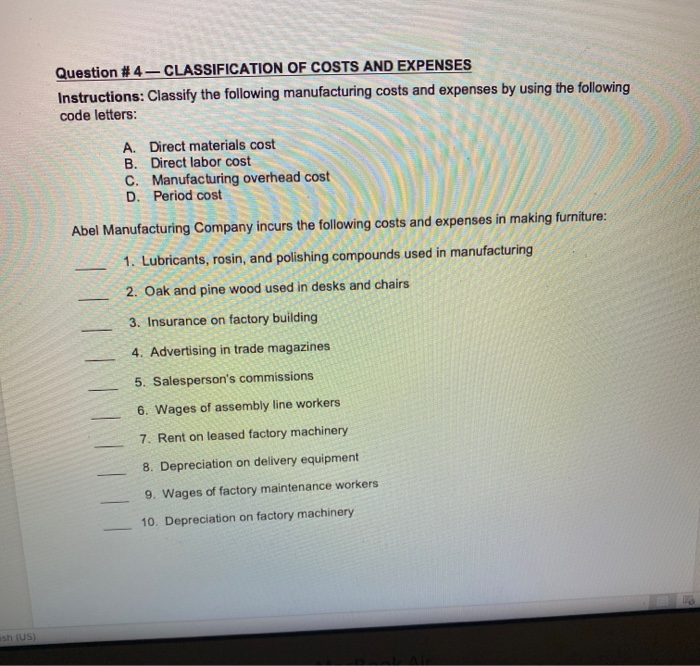

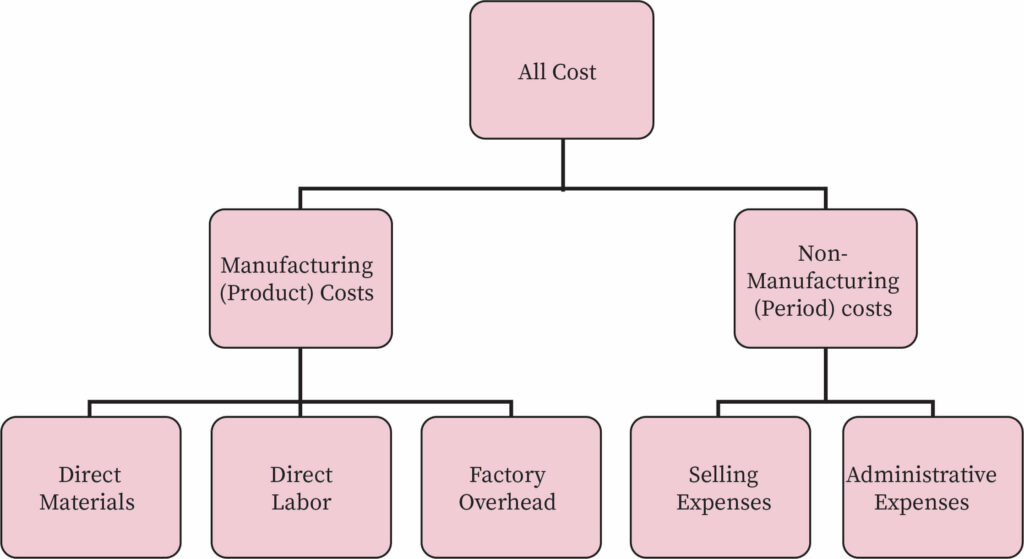

Manufacturing costs are traditionally categorized into three primary components: direct materials, direct labor, and manufacturing overhead. Understanding each of these is critical to identifying what falls outside the realm of production expenses.

Direct Materials are the raw materials that become an integral part of the finished product. These are the materials that can be directly traced to the final item. Examples include the steel used in car manufacturing, the fabric in clothing, or the wood in furniture.

Direct Labor encompasses the wages and benefits paid to workers who are directly involved in the production process. This includes employees who operate machinery, assemble components, or perform other hands-on tasks. The key here is that their work directly contributes to creating the product.

Manufacturing Overhead is a catch-all category that includes all manufacturing costs except direct materials and direct labor. It consists of a wide array of indirect costs necessary to support the production process.

Examples of manufacturing overhead include factory rent, utilities (electricity, gas, water) for the factory, depreciation on factory equipment, factory insurance, salaries of factory supervisors, and indirect materials (e.g., cleaning supplies, lubricants for machines). Think of it as everything needed to keep the factory running smoothly, aside from the specific materials and labor directly building the product.

What Isn't a Manufacturing Cost?

Now that we've established what is included, let's focus on what is not. Understanding these exclusions is crucial for accurate financial reporting and decision-making.

Selling, General, and Administrative (SG&A) Expenses are the primary expenses that fall outside the manufacturing cost umbrella. These are costs associated with running the business but are not directly tied to the production process.

Selling expenses include costs related to marketing, sales, and distribution. Examples include advertising costs, sales commissions, shipping expenses for finished goods, and salaries of sales personnel.

General and administrative expenses encompass the costs of managing the company as a whole. This includes executive salaries, accounting and legal fees, office rent, insurance for administrative buildings, and other costs associated with running the overall business operations.

Interest Expense is another expense that is typically not considered a manufacturing cost. Interest is the cost of borrowing money. While it may be related to financing the business, it is not directly linked to the production process itself.

Research and Development (R&D) Expenses are incurred in the process of creating new products or improving existing ones. While innovation is vital, these costs are generally treated separately from manufacturing costs.

To further illustrate, imagine a company that makes bicycles. The cost of the steel used to build the frames (direct materials), the wages of the workers who assemble the bikes (direct labor), and the electricity used to power the factory (manufacturing overhead) are all manufacturing costs. However, the salaries of the sales team, the cost of advertising campaigns, and the rent for the corporate office are not manufacturing costs.

Why It Matters

The accurate classification of costs is essential for several reasons. First, it impacts the cost of goods sold (COGS), a key figure on the income statement. Misclassifying costs can distort the COGS, leading to inaccurate profit calculations.

Secondly, it influences pricing decisions. A clear understanding of manufacturing costs allows companies to set prices that cover their expenses and generate a profit. Underestimating manufacturing costs can lead to underpricing, while overestimating can lead to being uncompetitive.

Thirdly, it supports inventory valuation. Manufacturing costs are used to value the inventory of finished goods, work-in-progress, and raw materials on the balance sheet. Accurate inventory valuation is essential for financial reporting and tax purposes.

According to the Institute of Management Accountants (IMA), "Effective cost management is critical for organizational success in today's competitive business environment." This reinforces the importance of understanding and accurately classifying manufacturing costs.

Real-World Implications

Consider a small craft brewery. The cost of the barley and hops (direct materials), the brewers' wages (direct labor), and the cost of maintaining the brewing equipment (manufacturing overhead) are all manufacturing costs. However, the marketing manager's salary, the cost of advertising on social media, and the rent for the tasting room are not.

For a large automotive manufacturer, the steel, plastic, and glass used in the cars (direct materials), the assembly line workers' wages (direct labor), and the depreciation on the robotic welding equipment (manufacturing overhead) are all manufacturing costs. The CEO's salary, the cost of legal services, and the cost of building a new corporate headquarters are not.

Conclusion: Beyond the Factory Walls

Understanding manufacturing costs extends beyond the factory floor. It's a fundamental concept that influences financial reporting, pricing strategies, and overall business profitability. By correctly identifying and classifying these costs, businesses can make informed decisions and navigate the complexities of the modern manufacturing landscape.

So, when faced with the question "All of the following are manufacturing costs except:", remember the core components: direct materials, direct labor, and manufacturing overhead. Anything outside of those directly linked to the production process, such as SG&A expenses, interest, or R&D, typically falls into a different category, impacting the overall financial picture in its own unique way.

+Direct+Materials..jpg)