All Of The Following Are Money Market Instruments Except

The intricacies of the money market, a vital component of the global financial system, often present a challenge even to seasoned investors. Recent discussions among financial analysts have centered on clarifying which instruments qualify as money market tools and which fall outside this definition, prompting a renewed focus on understanding the nuances of short-term debt instruments.

This article aims to dissect the composition of the money market, identify its key instruments, and pinpoint which financial products are frequently misconstrued as belonging to this category. Understanding these distinctions is critical for investors, businesses, and policymakers alike to navigate the complexities of short-term financing and investment options.

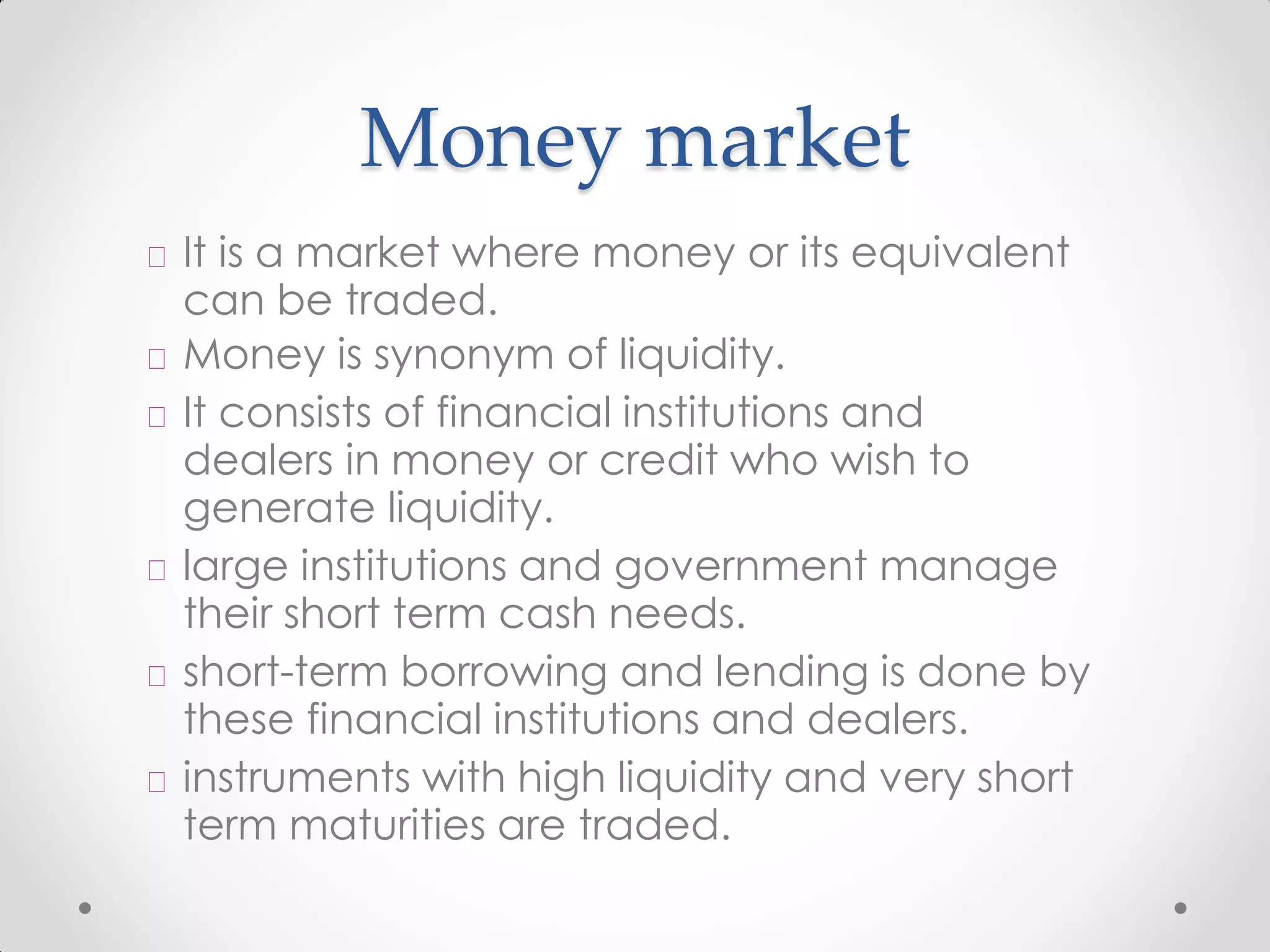

What Constitutes a Money Market Instrument?

Money market instruments are characterized by their short-term maturity, typically less than a year, and high liquidity. They are designed to be low-risk investments, providing a safe haven for funds seeking temporary parking.

Key characteristics include a maturity of one year or less, a high degree of liquidity, and relatively low credit risk. These features ensure the principal investment remains secure and accessible.

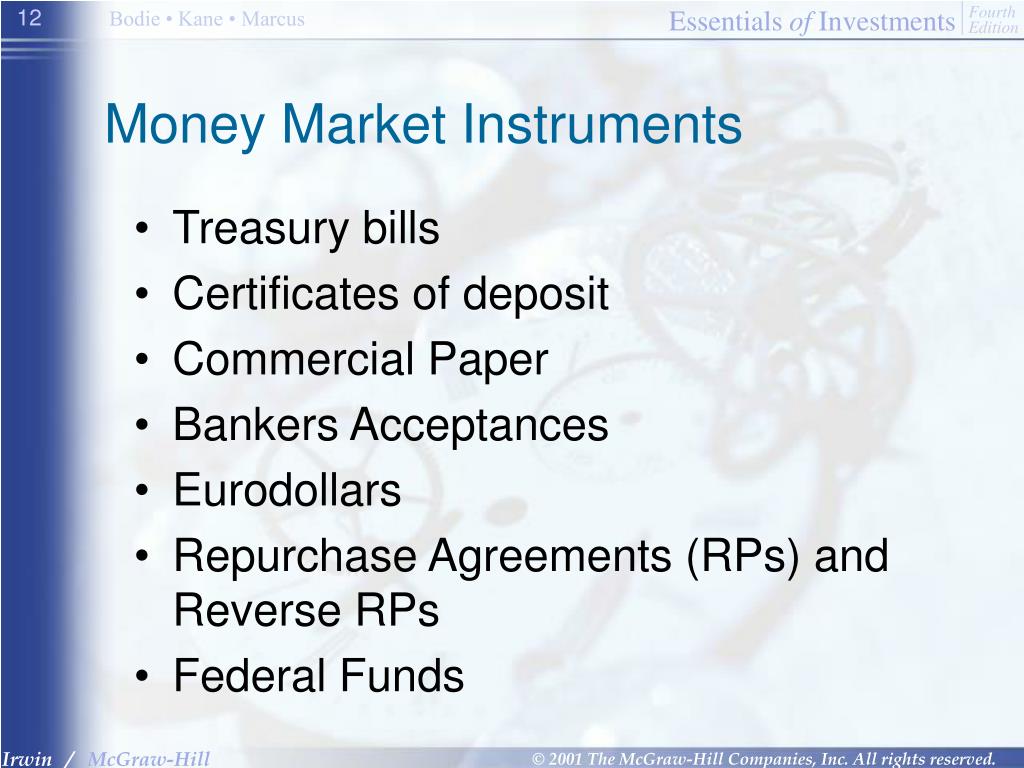

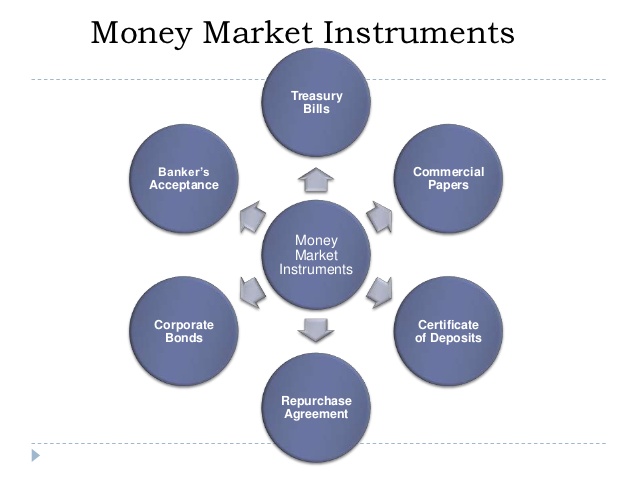

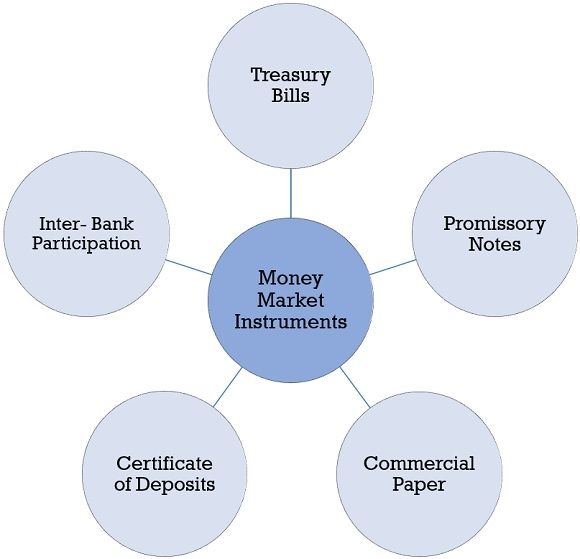

Common Money Market Instruments

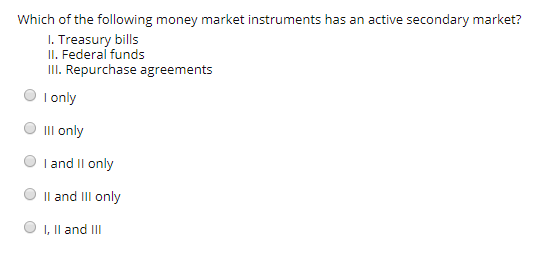

Several instruments are commonly traded within the money market. These include Treasury Bills, Commercial Paper, Certificates of Deposit (CDs), and Repurchase Agreements (Repos).

Treasury Bills are short-term debt obligations issued by a government, typically with maturities ranging from a few days to 52 weeks. They are considered risk-free due to the backing of the issuing government.

Commercial Paper represents unsecured, short-term debt issued by corporations to finance immediate needs. Its creditworthiness depends on the financial health of the issuing company.

Certificates of Deposit (CDs) are time deposits offered by banks, providing a fixed interest rate for a specified period. Early withdrawals may incur penalties.

Repurchase Agreements (Repos) involve the sale of securities with an agreement to repurchase them at a later date and higher price. This effectively creates a short-term, collateralized loan.

Identifying Instruments Outside the Money Market

While the above instruments are core to the money market, many other financial products are frequently confused as belonging to this category. One prominent example is long-term corporate bonds.

Long-term corporate bonds, with maturities exceeding one year (often spanning several decades), do not fit the money market's short-term nature. They are categorized as part of the capital market rather than the money market.

Unlike the low-risk profile of money market instruments, long-term bonds carry greater risks related to interest rate fluctuations and the issuing company's long-term financial stability.

The Significance of Accurate Classification

Correctly classifying financial instruments is crucial for several reasons. It impacts investment strategies, risk management, and regulatory oversight.

For investors, understanding the differences helps in allocating assets according to their risk tolerance and investment horizons. Misclassifying an instrument could lead to unexpected losses or missed opportunities.

For businesses, it affects the choice of financing options. Short-term needs are best met with money market instruments, while long-term investments require capital market financing.

"Clear distinctions between money market and capital market instruments are essential for maintaining financial stability," said Dr. Anya Sharma, a financial economist at the Institute for Economic Research. "Misunderstandings can create systemic risks and market inefficiencies."

The Broader Impact

The proper functioning of the money market is integral to the overall health of the economy. It provides essential liquidity for businesses and governments, facilitating daily operations.

Money market instruments enable companies to manage their short-term cash flows, ensuring they can meet payroll obligations and other immediate expenses. Governments rely on them to fund short-term budgetary needs.

When the money market operates efficiently, businesses can invest and expand, promoting economic growth. Disruptions can lead to a credit crunch and hinder economic activity.

Conclusion

In conclusion, while various financial instruments are involved in short-term finance, a select few, such as Treasury Bills, Commercial Paper, CDs, and Repos, constitute the core of the money market. Distinguishing these from other financial products, such as long-term corporate bonds, is essential for informed investment decisions, effective risk management, and overall financial stability. Continual education and vigilance in understanding the nuances of the financial markets are vital for all participants.

.jpg)