What Is A Dp3 Insurance Policy

For homeowners seeking insurance coverage beyond the standard protections of a typical homeowner's policy, a DP3 insurance policy offers a potential solution. But what exactly does a DP3 policy cover, and who should consider it?

This type of policy, often referred to as a dwelling fire policy, is specifically designed for properties that are not occupied as a primary residence. Understanding its coverage, limitations, and suitability is crucial for making informed insurance decisions.

Understanding DP3 Insurance

The "DP" in DP3 stands for Dwelling Property, highlighting that the focus is on insuring the physical structure of a dwelling.

Unlike standard homeowner's insurance, which often includes coverage for personal belongings, liability, and additional living expenses, DP3 policies primarily address the dwelling itself. These policies are especially useful for landlords or those who own vacation homes.

Key Features and Coverage

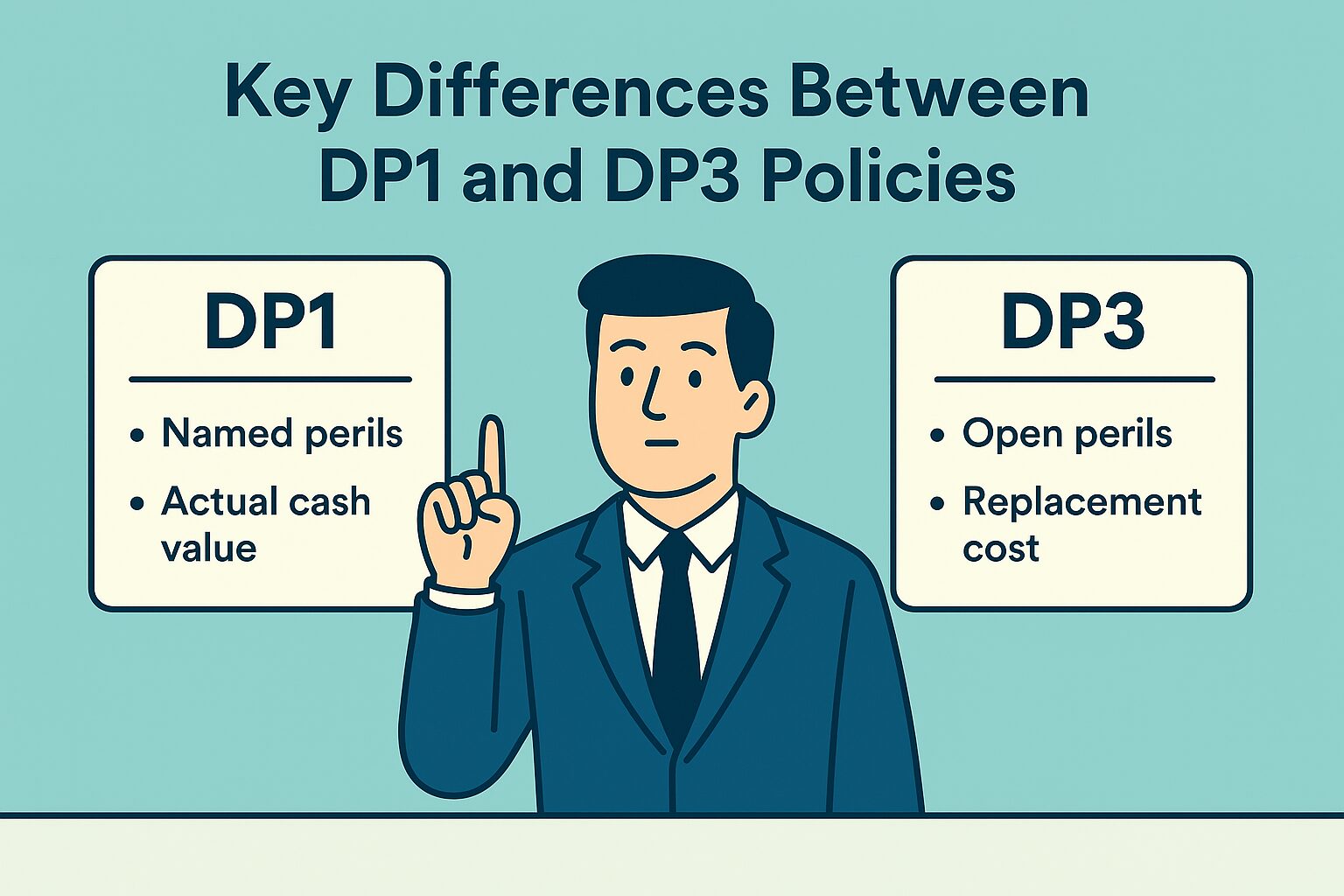

DP3 policies provide coverage on an "all-risk" or "open perils" basis, meaning that they cover all causes of loss unless specifically excluded in the policy.

This is a broader level of coverage compared to DP1 or DP2 policies, which typically cover only named perils, like fire, wind, and hail. This means you are covered unless a specific exclusion applies.

The typical structure for the policy includes coverage for:

- Dwelling: Covers the physical structure of the home, including walls, roof, and attached structures.

- Other Structures: Covers detached structures like garages, sheds, and fences.

- Fair Rental Value: If the property is a rental and becomes uninhabitable due to a covered loss, this coverage reimburses the owner for lost rental income.

Common Exclusions

While DP3 policies offer broad coverage, certain exclusions are standard. These exclusions usually include:

- Earth Movement: Damage caused by earthquakes, landslides, and sinkholes.

- Water Damage: Certain types of water damage, such as flooding or sewer backup, are often excluded, requiring separate flood insurance policies.

- Neglect: Damage resulting from the homeowner's failure to maintain the property.

- Intentional Acts: Damage caused intentionally by the homeowner.

- War: Damage resulting from acts of war.

Who Needs a DP3 Policy?

DP3 policies are most commonly used in situations where the property is not the owner's primary residence. Several types of property owners should consider DP3 insurance:

- Landlords: For rental properties, DP3 policies offer protection against damage to the physical structure, while a separate landlord liability policy can cover liability concerns.

- Owners of Vacation Homes: For seasonal or vacation homes, where the property is vacant for extended periods, a DP3 policy can provide coverage against covered perils.

- Owners of Inherited Properties: If you've inherited a property that you don't intend to occupy immediately, a DP3 policy can protect the dwelling until you decide its future.

- Homes Under Renovation: A DP3 policy may be a suitable option while your primary residence is undergoing significant renovations that render it temporarily uninhabitable.

DP3 vs. Other Dwelling Fire Policies

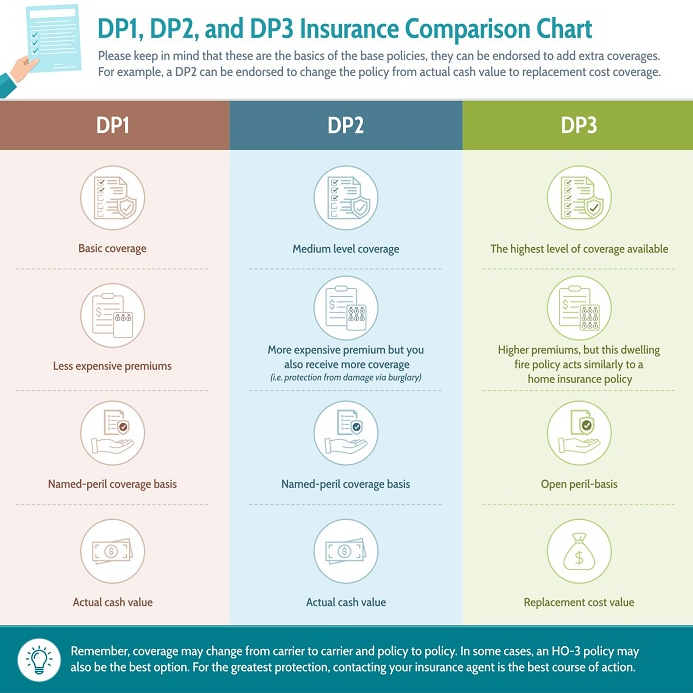

DP3 is not the only dwelling fire policy option. DP1 and DP2 policies also exist, offering varying levels of coverage. DP1 is the most basic and typically only covers named perils on an actual cash value basis.

DP2 is a step up, offering coverage for more named perils, and is often offered on a replacement cost basis. DP3 provides the broadest coverage since it is open perils, unless specifically excluded.

"The choice between DP1, DP2, and DP3 depends on the level of risk you're comfortable with and your budget. DP3 offers the most comprehensive protection but also comes with a higher premium," - says John Smith, a licensed insurance broker.

Cost and Considerations

The cost of a DP3 policy varies based on several factors, including the location of the property, its value, the coverage limits, and the deductible amount. Generally, DP3 policies are more expensive than DP1 or DP2 policies due to their broader coverage.

It's important to compare quotes from multiple insurance providers to find the best coverage at the most competitive price. Working with an independent insurance agent can help you understand your options and select the right policy.

Also, carefully review the policy's exclusions to understand what is not covered. Consider purchasing supplemental insurance, such as flood insurance, if needed.

The Impact of DP3 Insurance

DP3 insurance plays a critical role in protecting property owners from financial losses due to unforeseen events. By providing comprehensive coverage for the dwelling structure, DP3 policies offer peace of mind to landlords and owners of non-primary residences.

It ensures properties can be repaired or rebuilt after a covered loss. This is particularly significant in areas prone to natural disasters or where rental properties are essential for local housing.

The availability of DP3 insurance supports a stable rental market and protects investments in vacation and inherited properties.

Conclusion

A DP3 insurance policy is a valuable tool for protecting non-primary residences. Its broad, all-risk coverage offers comprehensive protection against a wide range of perils.

While it's essential to understand the policy's exclusions and compare it with other dwelling fire policies, DP3 insurance can provide peace of mind and financial security for landlords, vacation home owners, and those with inherited properties. Consider consulting with an insurance professional to determine if a DP3 policy is the right choice for your specific needs.

.png)

.jpg)