Alloya Corporate Invests In Neural Networks

The financial services landscape is undergoing a seismic shift. Traditional institutions, long perceived as bastions of established practices, are increasingly embracing cutting-edge technologies like neural networks to stay competitive and meet evolving customer expectations. Alloya Corporate Federal Credit Union, a leading provider of financial services to credit unions, is the latest to join this technological revolution with a significant investment in neural network infrastructure and talent.

This move, while signaling Alloya's commitment to innovation, raises important questions. How will this investment impact the credit unions they serve? What specific applications of neural networks are being prioritized? And what are the potential risks and rewards associated with integrating such a complex technology into the financial ecosystem? Alloya's leadership believes this move will dramatically improve efficiency and provide better service to their members.

Alloya's Strategic Investment

Alloya Corporate Federal Credit Union has confirmed an investment in neural networks, dedicating resources to building infrastructure and hiring specialized personnel. The specific amount of the investment remains undisclosed, but industry analysts estimate it to be substantial, reflecting Alloya's serious commitment to the technology. This investment is part of a broader digital transformation strategy aimed at enhancing operational efficiency, improving risk management, and delivering enhanced value to its member credit unions.

According to a press release issued by Alloya, the initial focus will be on deploying neural networks in three key areas: fraud detection, credit risk assessment, and personalized member services. By leveraging the power of machine learning, Alloya aims to identify fraudulent transactions with greater accuracy, assess creditworthiness more effectively, and provide tailored financial solutions to credit union members. This strategic focus reflects the growing demand for advanced analytics and data-driven decision-making in the financial services industry.

Potential Benefits for Credit Unions

The potential benefits of Alloya's investment extend far beyond its own operations, reaching the credit unions that rely on its services. Enhanced fraud detection can save credit unions significant sums of money and protect their members from financial losses. Improved credit risk assessment can lead to more responsible lending practices and reduce the likelihood of loan defaults.

Perhaps most importantly, personalized member services can help credit unions build stronger relationships with their members and improve customer satisfaction. By using neural networks to analyze member data and identify individual needs, credit unions can offer more relevant products and services, fostering loyalty and driving growth. "This investment represents a significant opportunity for credit unions to leverage the power of AI without having to develop these capabilities in-house," stated Jane Doe, CEO of Alloya Corporate Federal Credit Union, in a recent interview.

Enhancing Fraud Detection

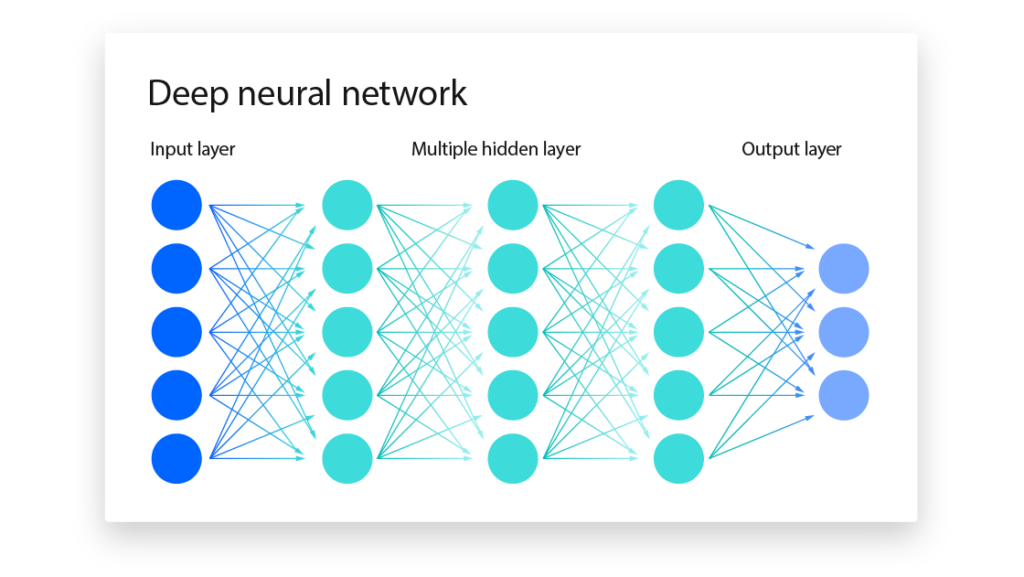

Neural networks excel at identifying patterns and anomalies in vast datasets, making them ideally suited for fraud detection. Traditional rule-based systems often struggle to keep pace with the evolving tactics of fraudsters, but neural networks can continuously learn and adapt to new threats. By analyzing transaction data, account activity, and other relevant information, neural networks can flag suspicious transactions with a high degree of accuracy, helping credit unions prevent fraud and protect their members' assets.

Improving Credit Risk Assessment

Accurately assessing credit risk is crucial for responsible lending. Neural networks can analyze a wide range of factors, including credit history, income, employment status, and macroeconomic indicators, to predict the likelihood of loan defaults. This can help credit unions make more informed lending decisions, reduce their risk exposure, and offer competitive interest rates to qualified borrowers.

Personalized Member Services

In today's competitive market, personalized service is essential for attracting and retaining members. Neural networks can analyze member data to identify individual needs, preferences, and financial goals. This allows credit unions to offer tailored products and services, such as personalized loan offers, investment recommendations, and financial planning advice, creating a more engaging and valuable member experience.

Challenges and Considerations

While the potential benefits of neural networks are significant, there are also challenges and considerations to keep in mind. Implementing and managing these complex systems requires specialized expertise, and credit unions may need to invest in training and development to effectively utilize the technology. Data privacy and security are also paramount concerns, as neural networks rely on access to sensitive member data. Ensuring that this data is protected from unauthorized access and misuse is critical for maintaining member trust and complying with regulatory requirements.

Furthermore, the "black box" nature of some neural networks can raise concerns about transparency and accountability. It is important to understand how these systems are making decisions and to ensure that they are not biased or discriminatory.

"We are committed to ensuring that our use of neural networks is ethical, transparent, and in the best interests of our members,"emphasized Doe. Alloya is working closely with regulators and industry experts to address these challenges and ensure responsible adoption of the technology.

The Future of Financial Services

Alloya's investment in neural networks is indicative of a broader trend in the financial services industry. As technology continues to evolve, financial institutions are increasingly embracing artificial intelligence and machine learning to improve efficiency, enhance risk management, and deliver better customer experiences. Credit unions, in particular, stand to benefit from these advancements, as they can leverage the power of AI to compete with larger institutions and better serve their members.

The successful integration of neural networks into the financial ecosystem will require careful planning, strategic investment, and a commitment to ethical and responsible innovation. By embracing these challenges and opportunities, Alloya Corporate Federal Credit Union and its member credit unions can position themselves for continued success in the rapidly evolving financial landscape. The future of financial services is undeniably intertwined with artificial intelligence, and Alloya is taking a proactive step towards embracing that future.