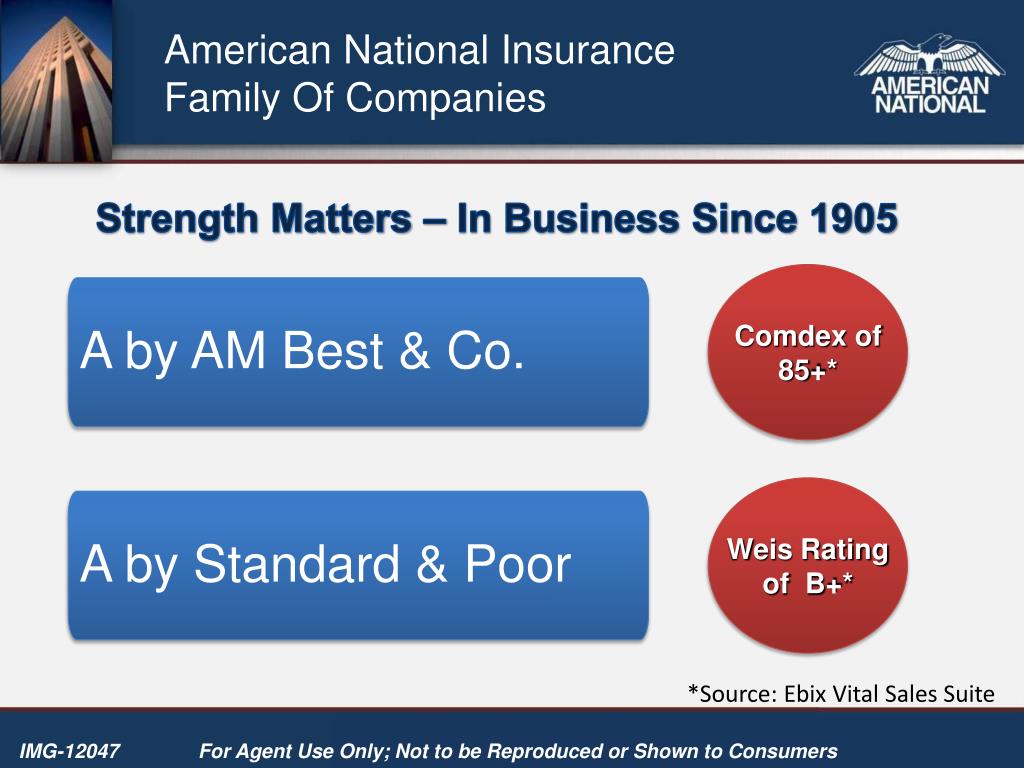

American National Insurance Am Best Rating

Imagine a seasoned sailor navigating through a storm, relying on a trusted compass to guide them safely to shore. In the world of insurance, where financial stability is paramount, an Am Best rating serves as that reliable compass, guiding policyholders and investors alike. For American National Insurance Company (ANICO), maintaining a strong rating is more than just a badge of honor; it's a testament to its enduring commitment to financial strength and security.

This article delves into the significance of ANICO's Am Best rating, exploring its implications for policyholders, the company's historical performance, and its strategic approach to maintaining financial robustness. Understanding this rating provides valuable insights into the company's ability to meet its obligations and promises to its customers.

Understanding the Am Best Rating

Am Best is a leading credit rating agency specializing in the insurance industry. They provide in-depth assessments of insurance companies' financial strength, operating performance, and business profile.

These ratings are crucial for policyholders, investors, and industry stakeholders, offering an independent and objective evaluation of an insurer's ability to pay claims and honor its financial commitments.

A high Am Best rating typically indicates a financially stable and well-managed company.

The Rating Scale

Am Best's rating scale ranges from A++ (Superior) to F (In Liquidation). The ratings are divided into secure and vulnerable categories.

Secure ratings range from A++ to B++, indicating a strong ability to meet ongoing obligations. Vulnerable ratings, ranging from B+ to F, suggest varying degrees of financial weakness.

Each rating level reflects Am Best's opinion on an insurer's ability to meet its financial obligations.

American National Insurance Company: A Legacy of Strength

Founded in 1905, American National Insurance Company has a long and storied history of providing insurance and financial services. Headquartered in Galveston, Texas, ANICO has grown into a diversified financial services provider.

Over the decades, the company has built a reputation for financial strength and stability. This commitment to long-term financial health is at the core of ANICO's operational philosophy.

Their history reflects a consistent pursuit of excellence and security for their policyholders.

Significance of ANICO's Am Best Rating

ANICO has consistently maintained a strong Am Best rating. This rating serves as a crucial indicator of the company's financial health and ability to meet its obligations to policyholders.

A high rating means policyholders can be confident in ANICO's ability to pay claims and provide long-term security. It's a reflection of diligent financial management and strategic planning.

This strong rating also attracts investors and partners, enhancing ANICO's market position.

Factors Influencing the Rating

Am Best's rating process is comprehensive, taking into account various quantitative and qualitative factors. Key factors include a company’s balance sheet strength, operating performance, and business profile.

Balance sheet strength assesses an insurer's capital adequacy, reserves, and liquidity. Strong capital reserves are essential for absorbing unexpected losses and ensuring the company can meet its obligations.

Operating performance evaluates profitability, efficiency, and underwriting results. A track record of consistent profitability strengthens an insurer’s financial position.

The business profile analyzes an insurer's market position, diversification, and management expertise. A diverse portfolio and experienced management team can contribute to a higher rating.

ANICO's Strategies for Maintaining Financial Strength

ANICO employs several strategies to maintain its financial strength and, consequently, its strong Am Best rating. Prudent underwriting practices are central to ANICO’s approach.

They carefully assess risk and price their policies appropriately. Conservative investment strategies also play a key role, prioritizing long-term growth and stability over short-term gains.

Effective risk management is another cornerstone, identifying and mitigating potential threats to the company's financial health. Furthermore, ANICO is committed to maintaining a strong capital base.

The Impact on Policyholders

For policyholders, ANICO's strong Am Best rating translates directly into peace of mind. It assures them that the company is financially sound and capable of fulfilling its promises.

Knowing that their insurer is highly rated can provide significant comfort, especially during times of uncertainty. It reinforces the reliability and trustworthiness of ANICO as a long-term partner.

This trust is particularly important for life insurance, annuities, and other financial products that extend over many years.

Am Best Rating vs. Other Ratings

While Am Best is a leading rating agency for the insurance industry, other agencies like Standard & Poor's and Moody's also provide financial strength ratings. Each agency has its own methodologies and rating scales.

It's important to consider multiple ratings when evaluating an insurer's financial health. Comparing ratings from different agencies can provide a more comprehensive view.

However, Am Best's focus specifically on the insurance industry makes its ratings particularly relevant for assessing insurers.

Looking Ahead

Maintaining a strong Am Best rating requires continuous effort and adaptation. ANICO must navigate an evolving landscape, including changing regulations, economic conditions, and technological advancements.

By staying proactive and implementing sound financial strategies, ANICO can sustain its strong rating and continue to provide security to its policyholders. The insurance industry is dynamic, requiring constant vigilance.

ANICO's commitment to financial strength positions it well for future success.

"We are committed to maintaining the highest standards of financial strength and service to our policyholders," said a representative from American National Insurance Company.

This dedication reflects ANICO's core values and commitment to its customers.

Conclusion

ANICO's Am Best rating is more than just a letter grade; it's a symbol of the company's unwavering commitment to financial strength and security. It's a reflection of decades of prudent management, strategic planning, and a deep understanding of the insurance industry.

For policyholders, this rating offers invaluable peace of mind, assuring them that American National Insurance Company is a reliable and trustworthy partner. As ANICO continues to navigate the complexities of the financial world, its dedication to maintaining a strong financial foundation will undoubtedly remain a cornerstone of its success, providing a safe harbor for those who entrust their future to them.

:max_bytes(150000):strip_icc()/American_National_Recirc-afa3cfab6e4047909136720c908cb396.jpg)